Dual Investment – Explained

In this article:

1. What is Dual Investment

2. What are the benefits of the Dual Investment product

3. What do I need for Dual Investment trading

4. Key concepts

5. Dual Investment – Buy low and sell high strategies

6. How do I subscribe to a Dual Investment strategy

7. FAQ

1. What is Dual Investment

Dual Investment is a product that allows you to buy or sell a chosen crypto asset at a predetermined price at a specific point in the future.

Better yet, you will be earning enhanced daily yield on your holdings while you wait for your strategy to be executed.

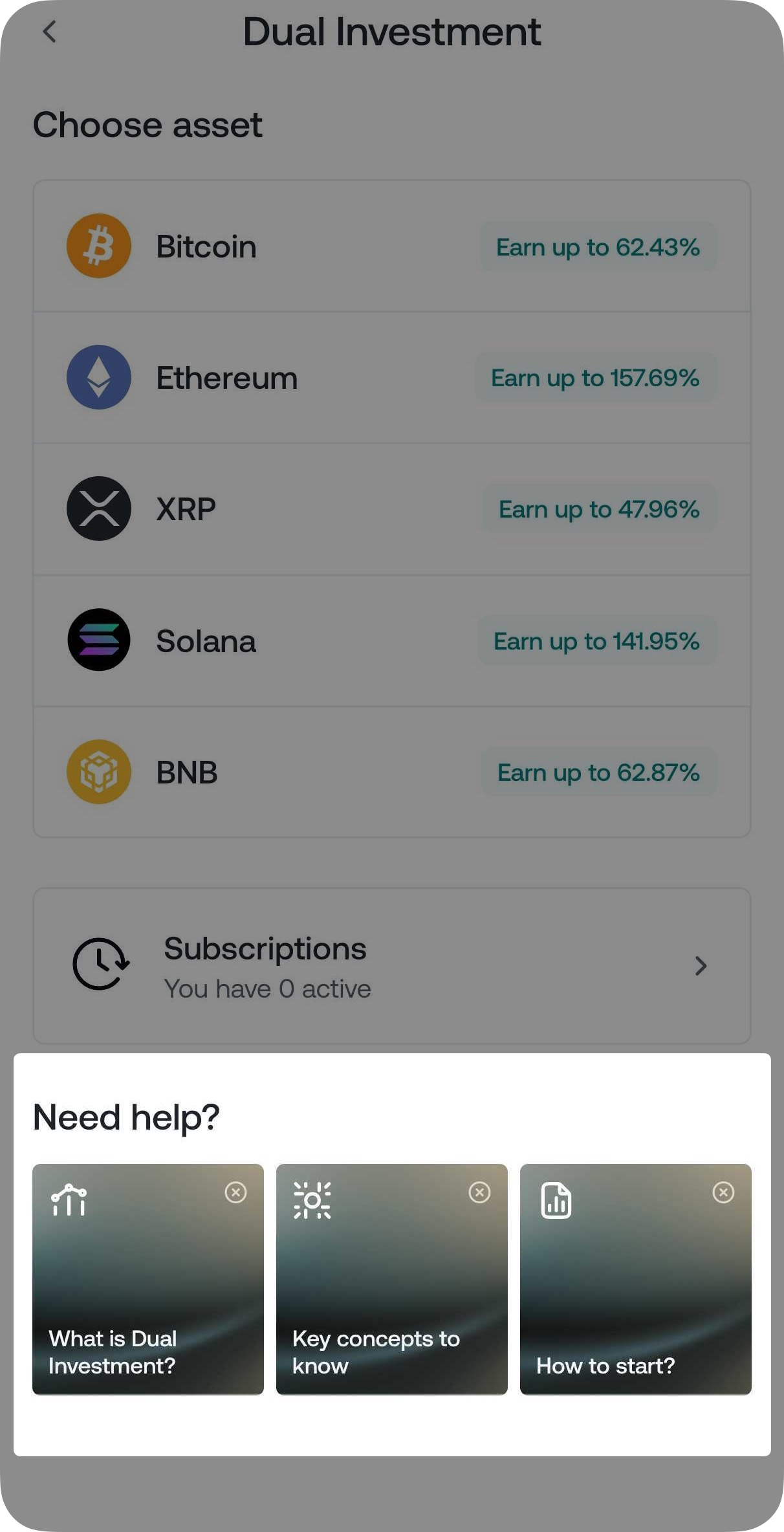

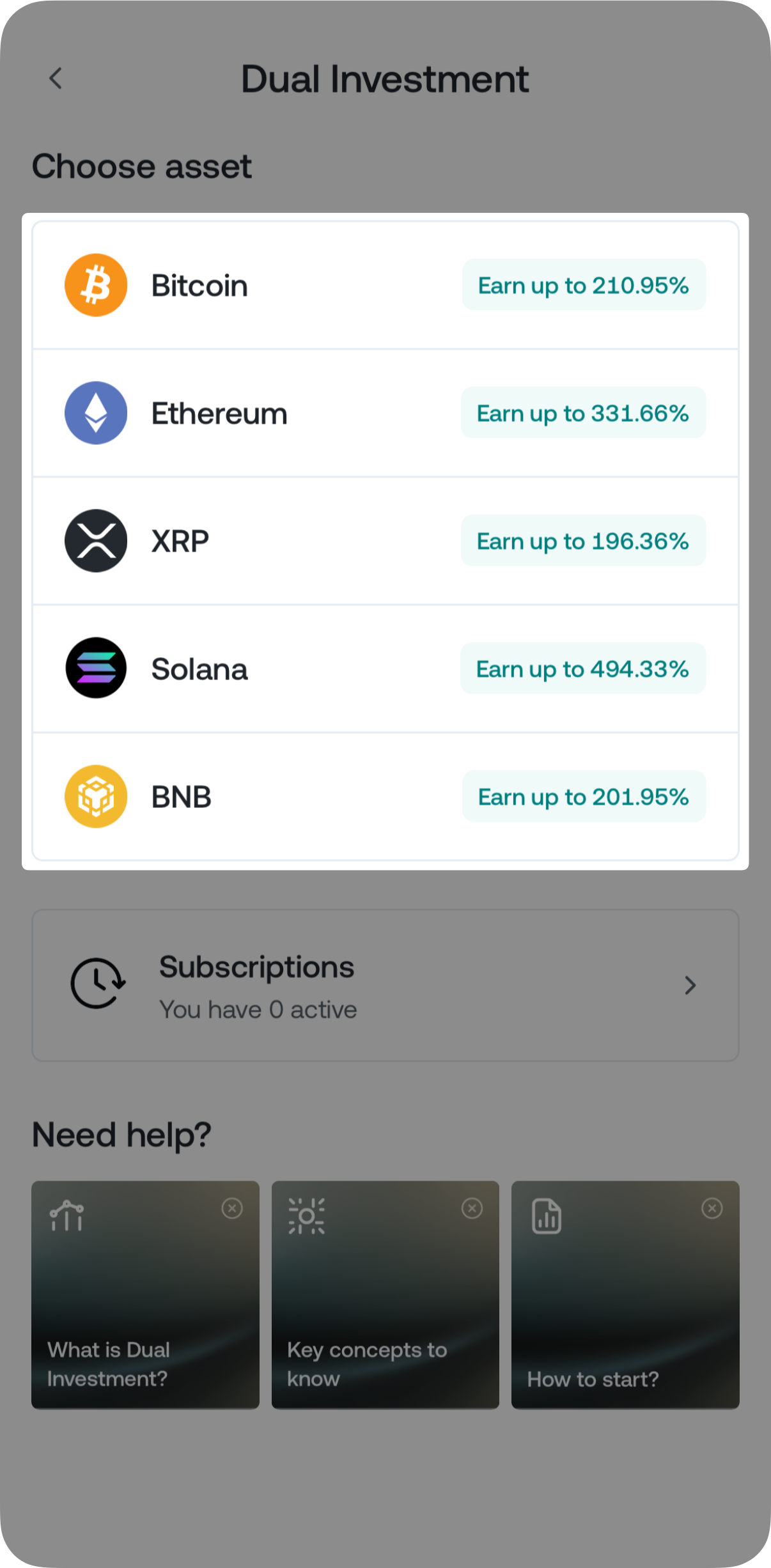

You can base your trading strategy — buy low or sell high — around BTC, ETH, XRP, SOL, or BNB and choose your desired subscription based on the available Target Price, Settlement Date, and Interest Rate.

Depending on your strategy, the selected asset will be either bought or sold with USDT* or USDC under the chosen conditions.

*Residents of EEA countries cannot subscribe to Dual Investment strategies involving USDT. Any active subscriptions will not be affected and will continue until maturity.

2. What are the benefits of the Dual Investment product

- Buy low or sell high: Choose the strategy that best fits your market expectations, buy or sell at a desired price, and benefit from price movement in any direction.

- Enjoy enhanced earnings: Earn at higher interest rates, regardless of market volatility and your Loyalty Tier.

- Learn, plan, and profit: Discover the Dual Investment key concepts and strategies with Nexo’s $1-friendly interface and project your potential returns upfront to achieve your goals.

3. What do I need for Dual Investment trading

Depending on your country of residence, you may be required to complete an introductory 5-question quiz as a preliminary step before you can get started with Dual Investment.

💡Tip: Before you start, Nexo recommends reviewing the product details through the help section in the Savings Hub>Dual Investment.

This information is also available in the Knowledge Center on the Nexo app and Nexo’s $1 platform.

You will need to have one of the supported assets available in your Savings Wallet to begin trading:

- For the sell high strategy: You will need at least 0.01 BTC, 0.2 ETH, 1,000 XRP, 10 SOL, or 1 BNB.

- For the buy low strategy: You will need a specific amount of USDT or USDC that depends on your Target Price.

4. Key concepts

Target Price

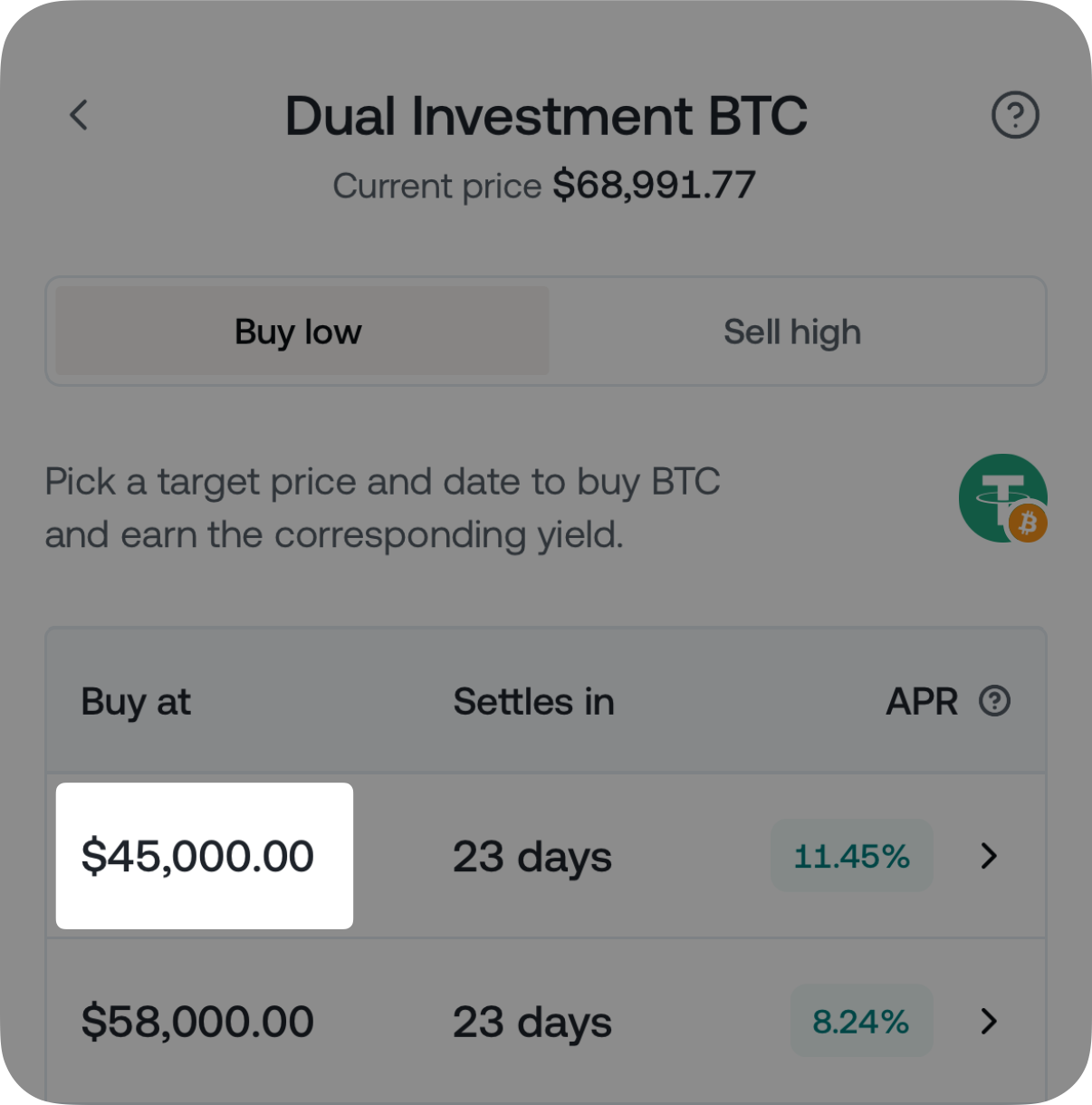

Each trading strategy offers an array of predetermined prices (listed under Buy at and Sell at) that you can choose from when buying or selling your assets. The price you select from the list is referred to as the Target Price.

The outcome of your strategy will depend on whether your Target Price is met at the Settlement Date.

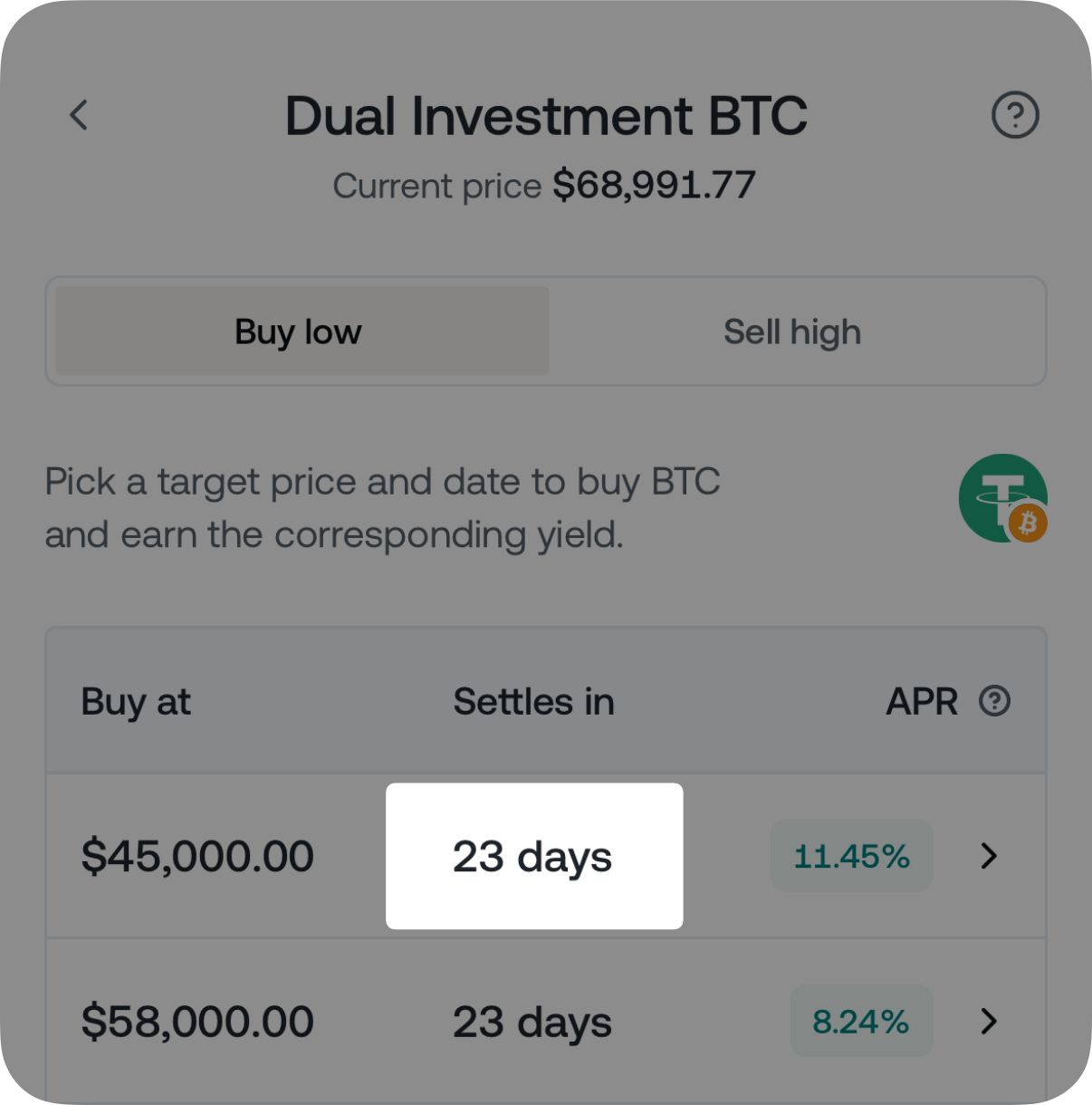

Settlement Date

The Settlement Date is the specific day when your assets are bought or sold, provided the predetermined Target Price is achieved.

Your trading strategy concludes on this date, and you will receive your assets along with the accrued interest.

For Dual Investment subscriptions, the settlement occurs at 08:00 AM UTC on the Settlement Date.

You can find the Settlement Date displayed next to the Target Price under the Settles in column.

⚠️ Important: Once you subscribe to a strategy, the USDT, USDC, BTC, ETH, XRP, SOL, or BNB will be locked, i.e., you will not be able to access these funds until the Settlement Date.

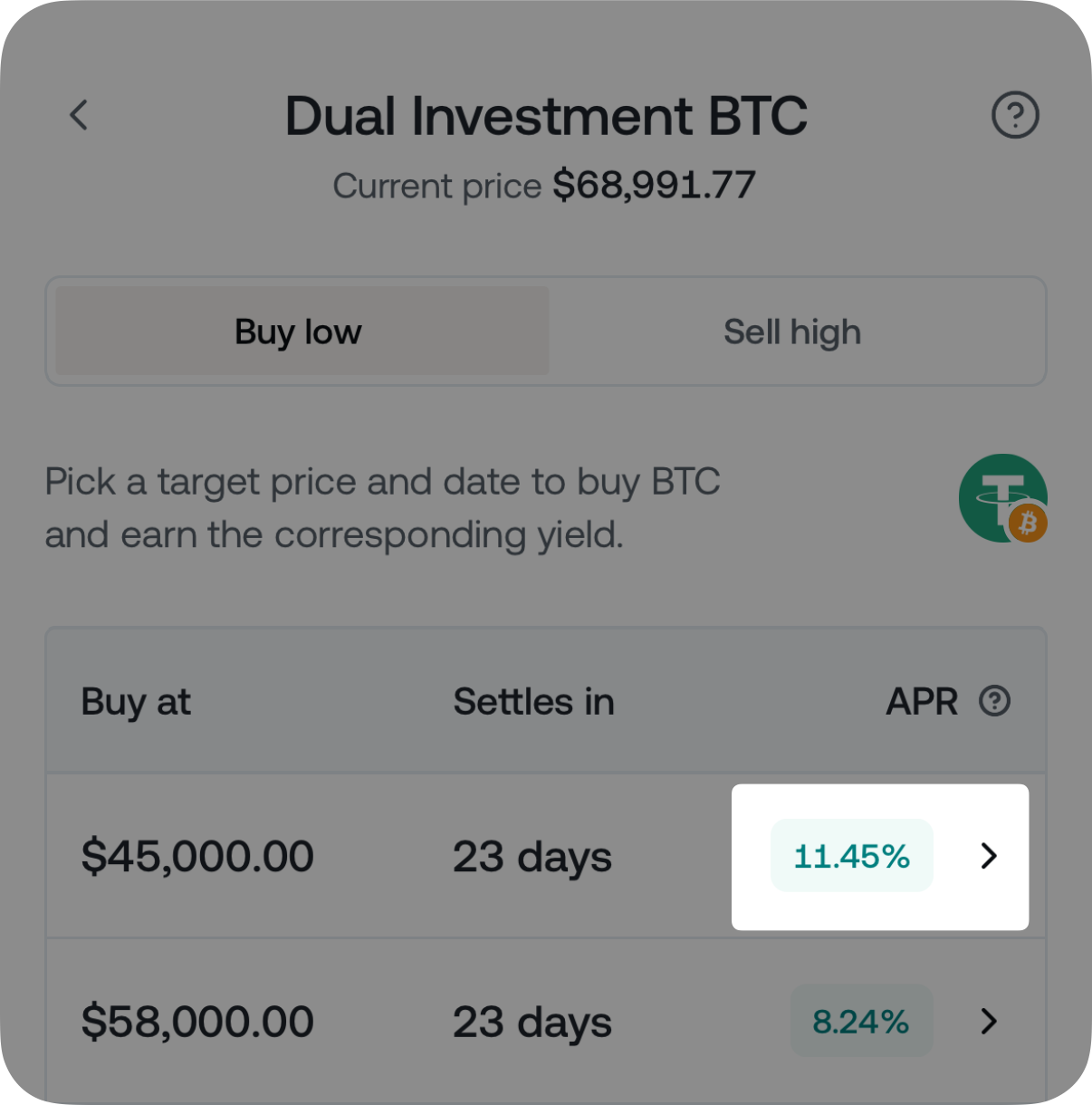

Interest

While waiting for your strategy to end on the Settlement Date, you will be earning daily interest.

The interest rate differs depending on the strategy and is displayed under Interest as an annual percentage, or % per year.

ℹ️ Note: The total interest earned for the duration of your subscription will be paid out at the Settlement Date, regardless of whether the Target Price is met.

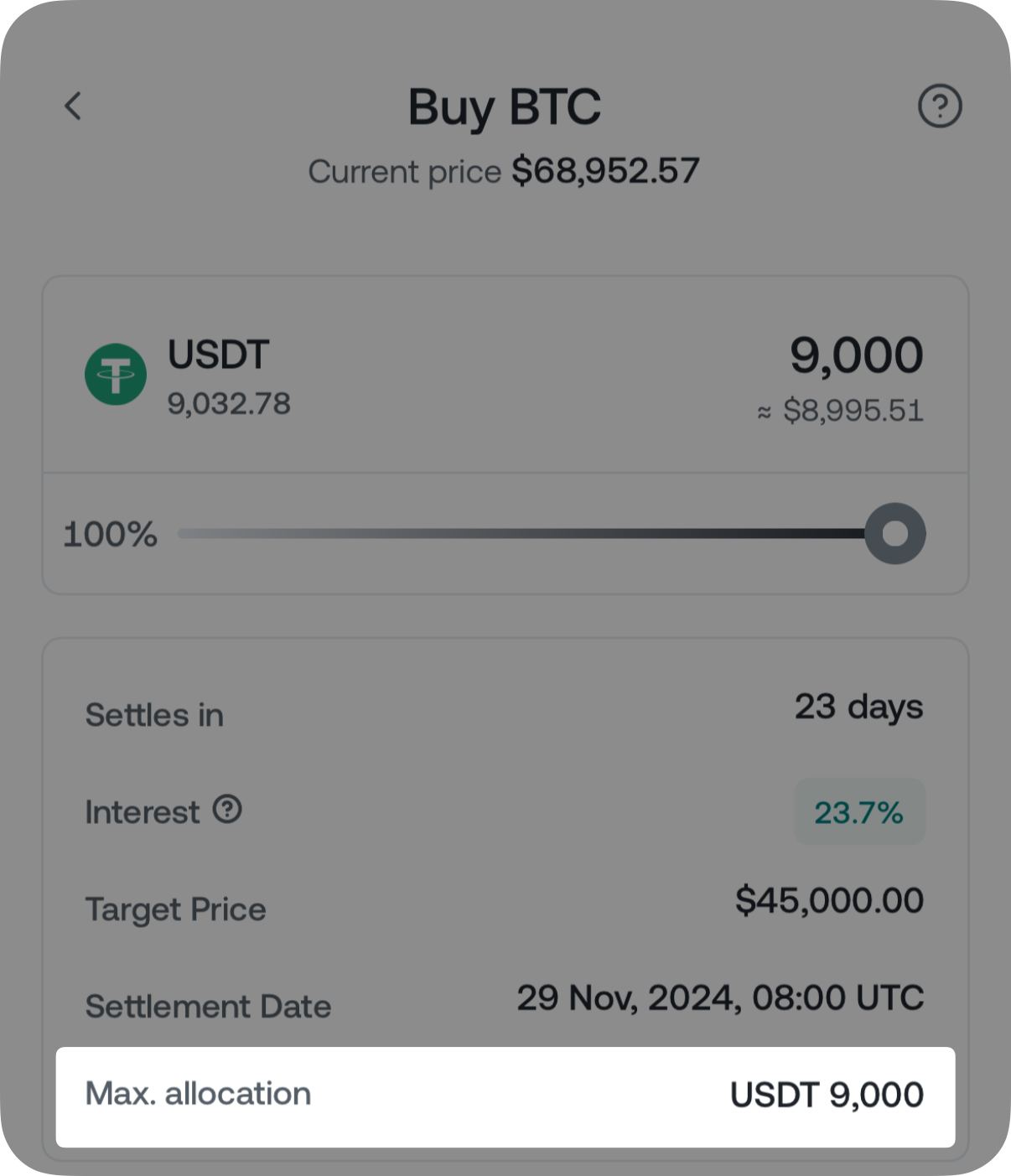

Max. Allocation

This is the maximum volume Nexo’s $1 base can subscribe to for each pair.

The Max. Allocation amount is shared among all Nexo users, meaning that once the quota is filled, it will make the Dual Investment option for that pair at that particular Target Price unavailable.

Example: If the Max. Allocation for BTC at 20,000 USDT is 153,945 USDT, all Nexo users collectively can subscribe to buy up to 153,945 USDT worth of BTC at that price.

5. Dual Investment – Buy low and sell high strategies

Buy low vs. sell high strategies

The buy low strategy offers you a chance to buy a crypto asset of your choice (BTC, ETH, XRP, SOL, or BNB) with USDT or USDC at a predetermined Target Price on a specific Settlement Date in the future.

In this strategy, the Target Price will be lower than the current market price of the selected crypto asset.

The trade will be executed if the market price at the time of settlement is equal to or lower than the Target Price.

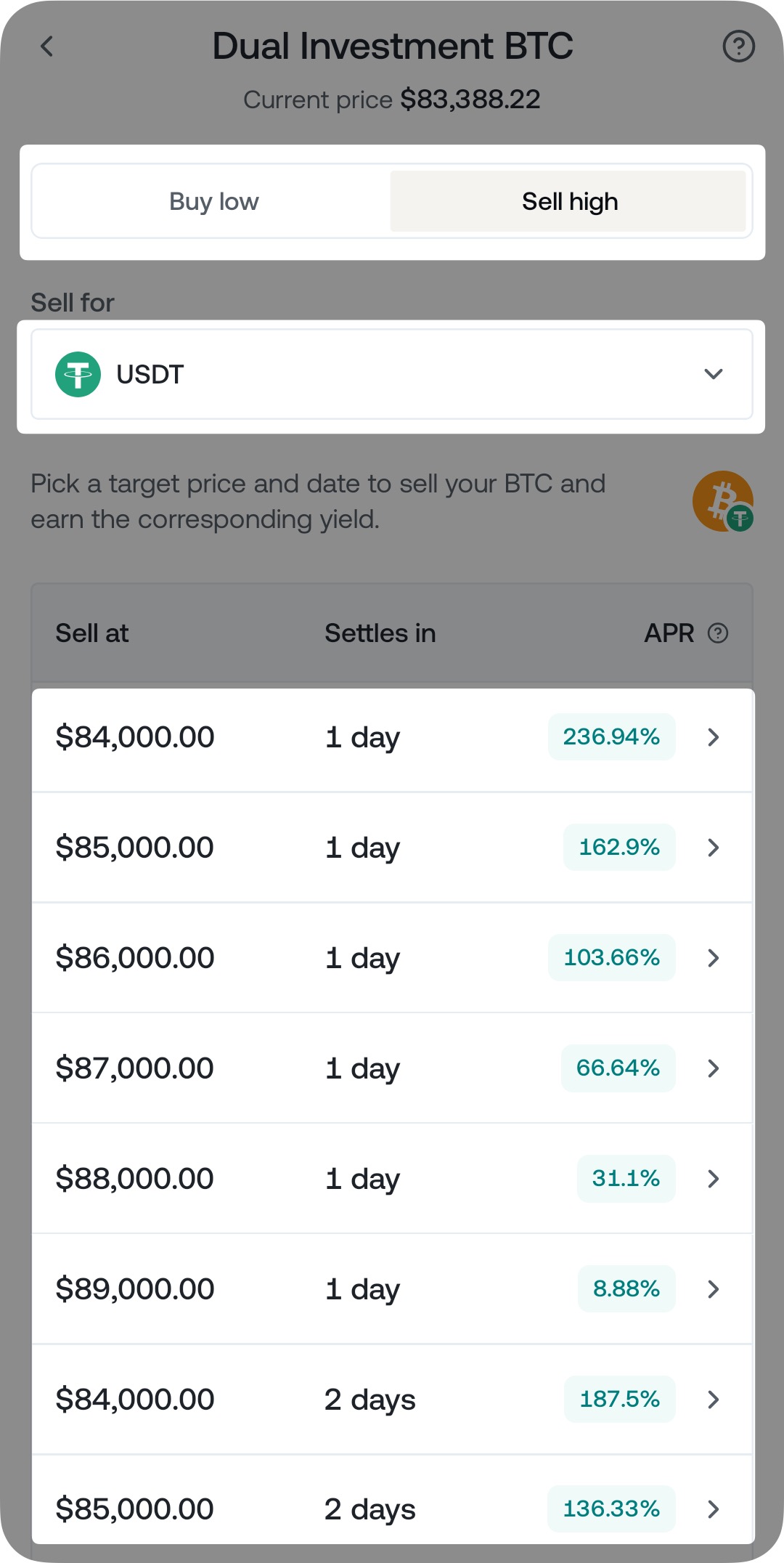

On the other hand, the sell high strategy offers you a chance to sell your existing crypto (BTC, ETH, XRP, SOL, or BNB) for USDT or USDC at a predetermined Target Price on a specific Settlement Date in the future.

In this strategy, the Target Price will be higher than the current market price of the selected crypto asset.

The trade will be executed if the market price at the time of settlement is equal to or higher than the Target Price.

Further points to consider:

- Assets in a Dual Investment subscription:

- Earn interest per the Dual Investment subscription conditions. In other words, if you have assets in a Dual Investment subscription, you will not receive Flexible Savings interest on them from the Earn Product, and those assets cannot be locked in Fixed-term Savings.

- Cannot be transferred to Nexo Pro.

- Cannot be exchanged or withdrawn before the Settlement Date of the Dual Investment subscription.

- Cannot be used as collateral on the Nexo platform. In other words, they will not count toward your LTV, and you cannot take out loans with them.

- Will not be automatically transferred to the Credit Line Wallet if the Automatic Collateral Transfer feature is enabled.

- Cannot be utilized for automatic loan repayments.

- The annual interest rates for the Dual Investment strategies are not determined by your Loyalty Tier.

- The Dual Investment interest will be paid out in the output currency, regardless if the Interest Payout in NEXO Tokens feature is enabled or if your Loyalty Tier is different on the Settlement Date.

- Trades executed as part of a Dual Investment subscription are not subject to crypto cashback.

Detailed Buy Low and Sell High examples are available in the next section.

Buy low – Examples

Consider the following setup:

- Current market price of BTC: 1 BTC = 38,000 USD.

- You have 19,000 USDT (equivalent to ~0.5 BTC at the current market price of 1 BTC = 38,000 USD).

- Dual Investment Subscription Amount: 19,000 USDT (equivalent to ~0.5 BTC at the current market price of 1 BTC = 38,000 USD).

- Target Price: 1 BTC = 34,000 USD.

- Settlement Date: 14 days from now.

- Annual interest rate: 10%.

Outcome 1: The Target Price is met

When the Target Price is met in the buy low strategy, it means that the price of the selected crypto asset (BTC, ETH, XRP, SOL, or BNB) on the Settlement Date is equal to or lower than the Target Price.

Let us review each of these scenarios in detail.

Scenario A: The price of BTC is equal to the Target Price

In this case, the price of BTC is equal to 34,000 USD at the time of settlement (on the 14th day); therefore, the USDT to BTC trade will be executed. As a result, you will receive:

-

- Output amount: ~0.5588 BTC (calculated as the Subscription Amount divided by the Target Price: 19,000 / 34,000 = ~0.5588 BTC).

- Interest: 14-day interest on the Subscription Amount at the annual interest rate of 10% paid out in the output currency (BTC).

The following formula can be used to calculate the approximate interest amount you will receive (note that this amount has to be converted to the output currency using the Target Price):

-

- Interest = (Subscription Amount x Annual Interest Rate% x Number of days until Settlement) / 365.

In this specific case:

-

- Interest = (19,000 USDT x 10% x 14) / 365.

- Interest = 26,600 / 365.

- Interest = ~72.88 USDT in BTC (or 72.88 / 34,000 = ~0.00214353 BTC).

Scenario B: The price of BTC is lower than the Target Price

In this case, the price of BTC is lower than 34,000 USD (for instance, 28,000 USD) at the time of settlement (on the 14th day).

However, the USDT to BTC trade will still be executed at the initial Target Price of 34,000 USD per 1 BTC. As a result, you will receive:

-

- Output amount: ~0.5588 BTC (calculated as the Subscription Amount divided by the Target Price: 19,000 / 34,000 = ~0.5588 BTC).

- Interest: 14-day interest on the Subscription Amount at the annual interest rate of 10% paid out in the output currency (BTC).

The following formula can be used to calculate the approximate interest amount you will receive (note that this amount has to be converted to the output currency using the Target Price):

-

- Interest = (Subscription Amount x Annual Interest Rate% x Number of days until Settlement) / 365.

In this specific case:

-

- Interest = (19,000 USDT x 10% x 14) / 365.

- Interest = 26,600 / 365.

- Interest = ~72.88 USDT in BTC (or 72.88 / 34,000 = ~0.00214353 BTC).

Outcome 2: The Target Price is not met

When the Target Price is not met in the buy low strategy, it means that the price of the selected crypto asset (BTC, ETH, XRP, SOL, or BNB) on the Settlement Date is higher than the Target Price.

The price of BTC is higher than the Target Price

In this case, the price of BTC is higher than 34,000 USD at the time of settlement (on the 14th day); therefore, the USDT to BTC trade will not be executed. As a result, you will receive:

-

- Output amount: 19,000 USDT (same as the initial subscription amount).

- Interest: 14-day interest on the Subscription Amount at the annual interest rate of 10% paid out in the output currency (USDT).

The following formula can be used to calculate the approximate interest amount you will receive:

-

- Interest = (Subscription Amount x Annual Interest Rate% x Number of days until Settlement) / 365.

In this specific case:

-

- Interest = (19,000 x 10% x 14) / 365.

- Interest = 26,600 / 365.

- Interest = ~72.88 USDT.

Sell high – Examples

Consider the following setup:

- Current market price of BTC: 1 BTC = 36,000 USD.

- You have 0.2 BTC (equivalent to ~7,200 USDT at the current market price of 1 BTC = 36,000 USD).

- Dual Investment Subscription Amount: 0.2 BTC (equivalent to ~7,200 USDT at the current market price of 1 BTC = 36,000 USD).

- Target Price: 1 BTC = 40,000 USD.

- Settlement Date: 7 days from now.

- Annual interest rate: 11%.

Outcome 1: The Target Price is met

When the Target Price is met in the sell high strategy, it means that the price of the selected crypto asset (BTC, ETH, XRP, SOL, or BNB) on the Settlement Date is equal to or higher than the Target Price. Let us review each of these scenarios in detail.

Scenario A: The price of BTC is equal to the Target Price

In this case, the price of BTC is equal to 40,000 USD at the time of settlement (on the 7th day); therefore, the BTC to USDT trade will be executed. As a result, you will receive:

-

- Output amount: 8,000 USDT (calculated as the Subscription Amount divided by the Target Price: 0.2 x 40,000 = 8,000 USDT).

- Interest: 7-day interest on the Subscription Amount at the annual interest rate of 11% paid out in the output currency (USDT).

The following formula can be used to calculate the approximate interest amount you will receive (note that this amount has to be converted to the output currency using the Target Price):

-

- Interest = (Subscription Amount x Annual Interest Rate% x Number of days until Settlement) / 365.

In this specific case:

-

- Interest = (0.2 BTC x 11% x 7) / 365.

- Interest = 0.154 / 365.

- Interest = ~0.000422 BTC in USDT (or 0.000422 x 40,000 USDT = ~16.88 USDT).

Scenario B: The price of BTC is higher than the Target Price

In this case, the price of BTC is higher than 40,000 USD (for instance, 50,000 USD) at the time of settlement (on the 7th day).

However, the BTC to USDT trade will still be executed at the initial Target Price of 40,000 USDT per 1 BTC. As a result, you will receive:

-

- Output amount: 8,000 USDT (calculated as the Subscription Amount divided by the Target Price: 0.2 x 40,000 = 8,000 USDT).

- Interest: 7-day interest on the Subscription Amount at the annual interest rate of 11% paid out in the output currency (USDT).

The following formula can be used to calculate the approximate interest amount you will receive (note that this amount has to be converted to the output currency using the Target Price):

-

- Interest = (Subscription Amount x Annual Interest Rate% x Number of days until Settlement) / 365.

In this specific case:

-

- Interest = (0.2 BTC x 11% x 7) / 365.

- Interest = 0.154 / 365.

- Interest = ~0.000422 BTC in USDT (or 0.000422 x 40,000 USDT = ~16.88 USDT).

Outcome 2: The Target Price is not met

When the Target Price is not met in the sell high strategy, it means that the price of the selected crypto asset (BTC, ETH, XRP, SOL, or BNB) on the Settlement Date is lower than the Target Price.

The price of BTC is lower than the Target Price

In this case, the price of BTC is lower than 40,000 USD at the time of settlement (on the 7th day); therefore, the BTC to USDT trade will not be executed. As a result, you will receive:

-

- Output amount: 0.2 BTC (same as the initial subscription amount).

- Interest: 7-day interest on the Subscription Amount at the annual interest rate of 11% paid out in the output currency (BTC).

The following formula can be used to calculate the approximate interest amount you will receive:

-

- Interest = (Subscription Amount x Annual Interest Rate% x Number of days until Settlement) / 365.

In this specific case:

-

- Interest = (0.2 BTC x 11% x 7) / 365.

- Interest = 0.154 / 365.

- Interest = ~0.000422 BTC.

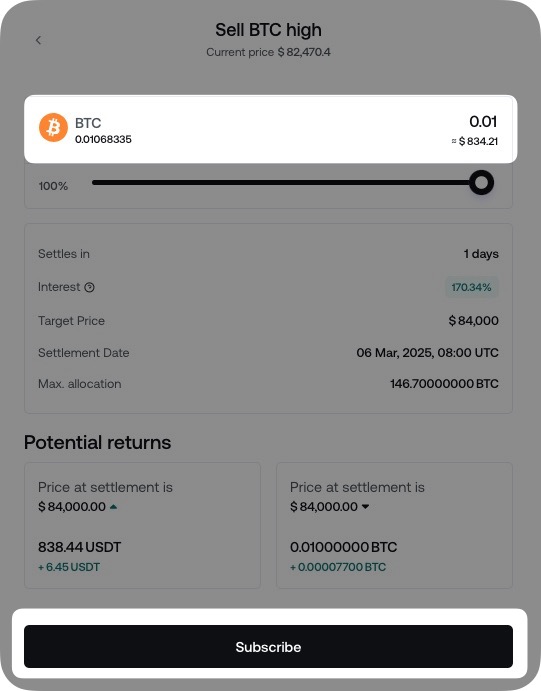

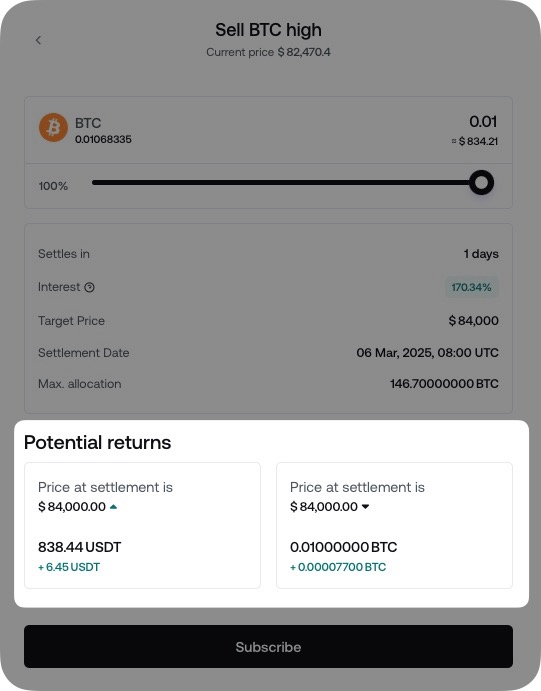

6. How do I subscribe to a Dual Investment strategy

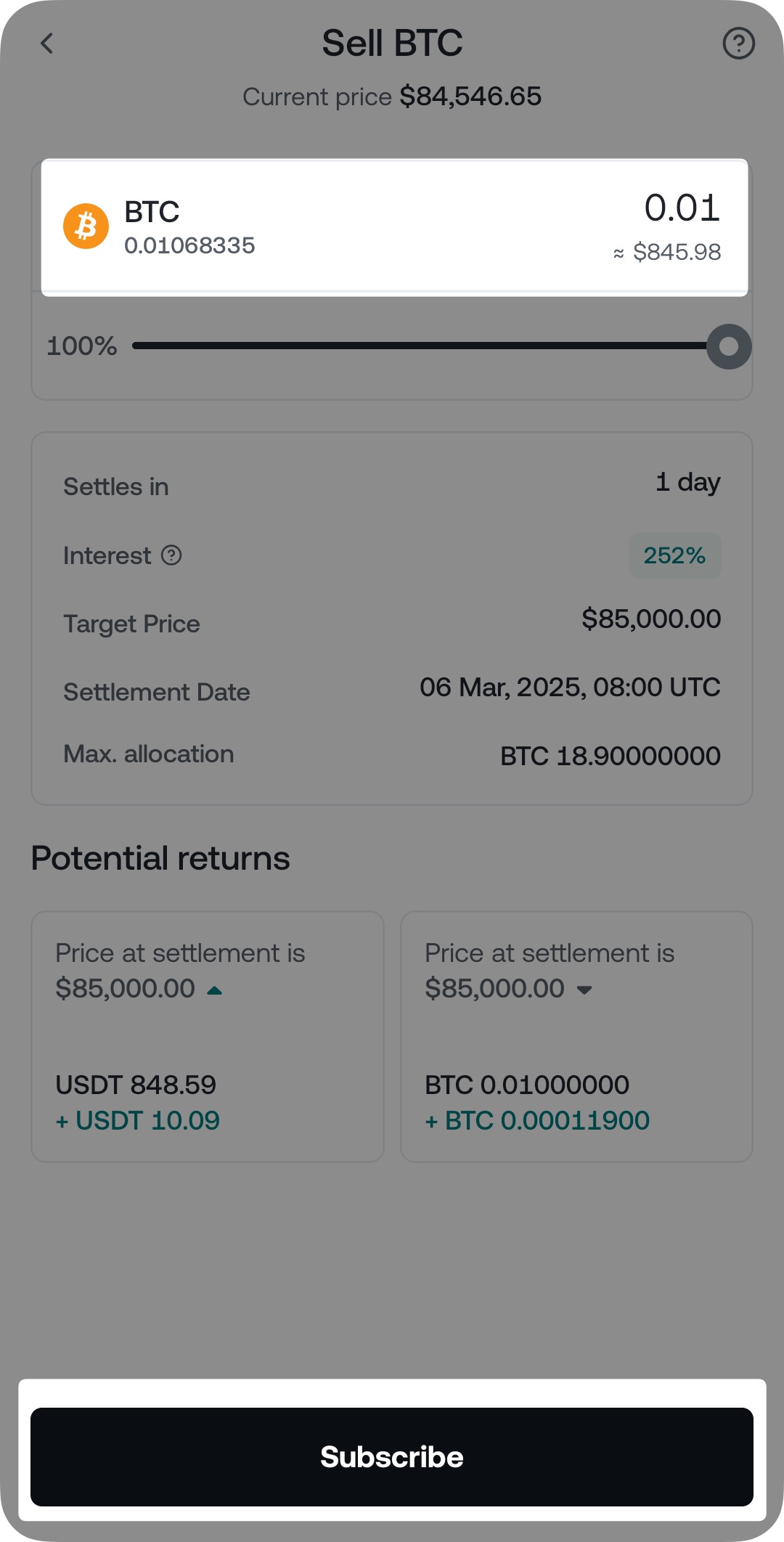

On the Nexo app

1. Log in to your account on the Nexo app.

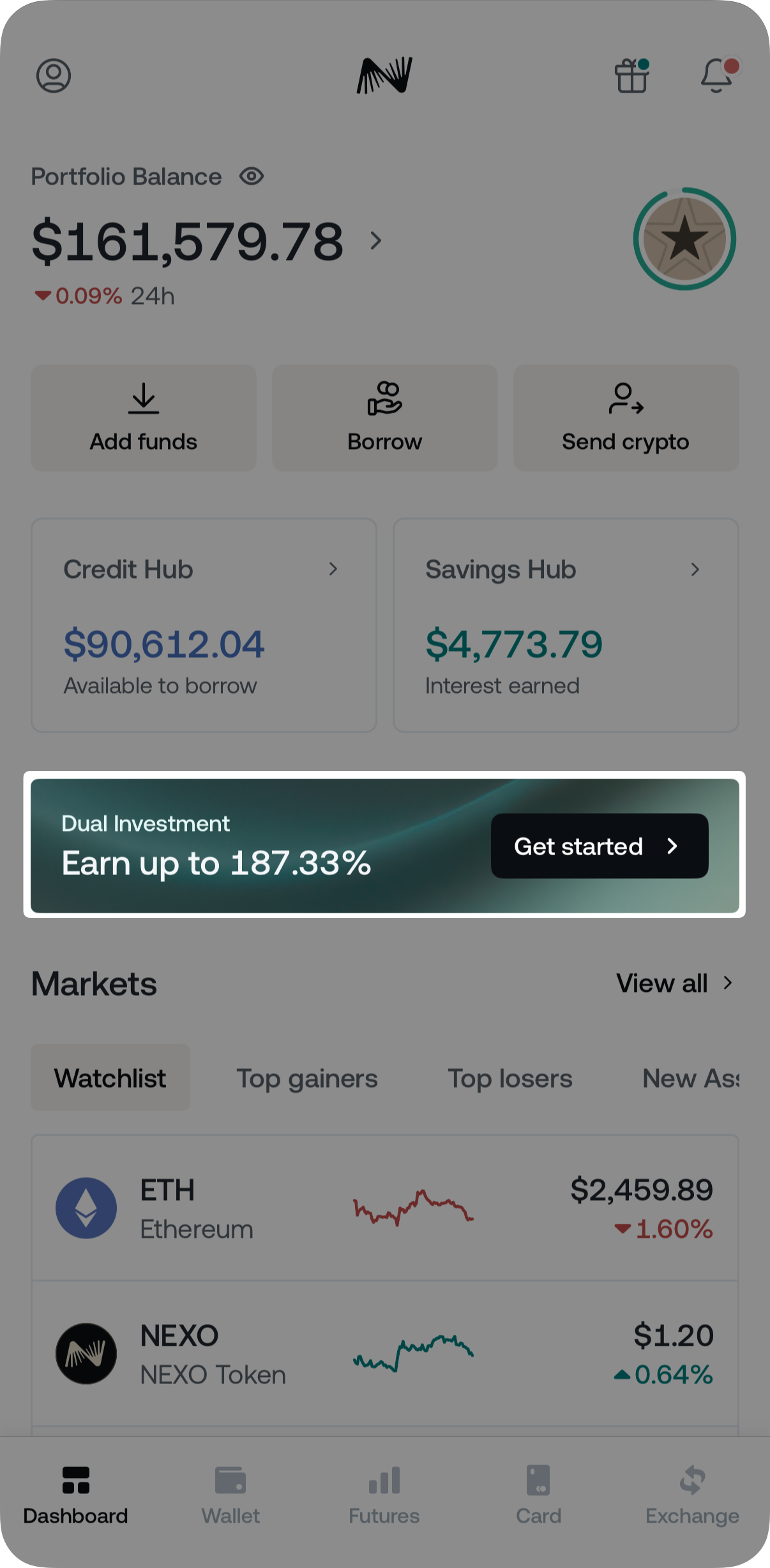

2. On your Dashboard, tap Get started on the Dual Investment banner.

3. Choose the asset that you want to buy/sell (BTC, ETH, XRP, SOL, or BNB).

4. Pick your strategy (buy low or sell high), select the Buy with or Sell for currency (USDT* or USDC), and select one of the available subscriptions.

*The option to choose USDT is unavailable to residents of EEA countries.

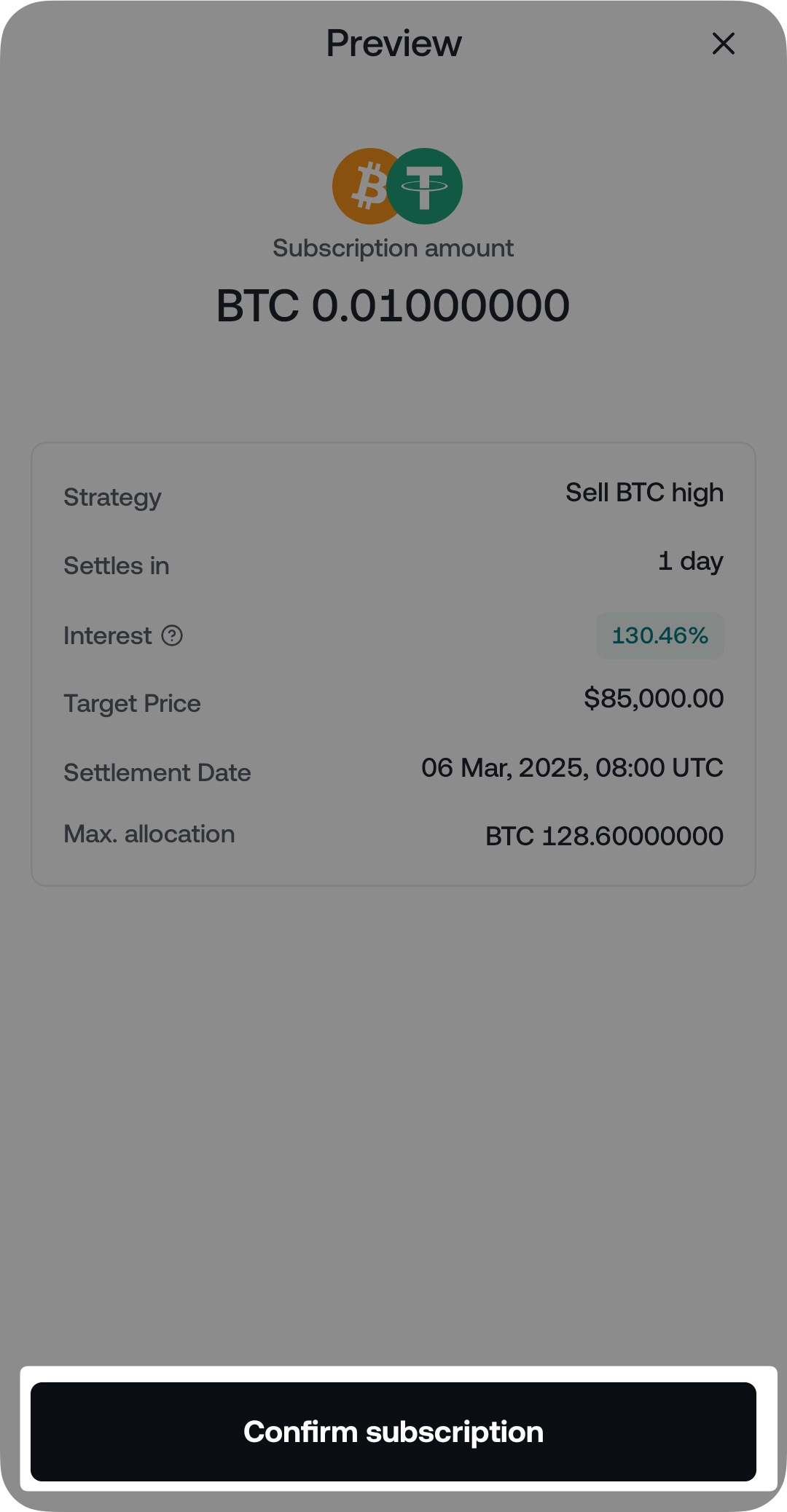

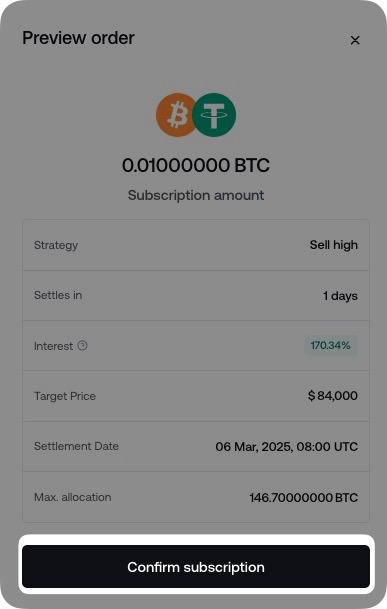

5. Choose the amount you want to subscribe with and tap Subscribe.

6. Once you have reviewed your subscription details, tap Confirm Subscription.

Congratulations! You have successfully created a Dual Investment subscription.

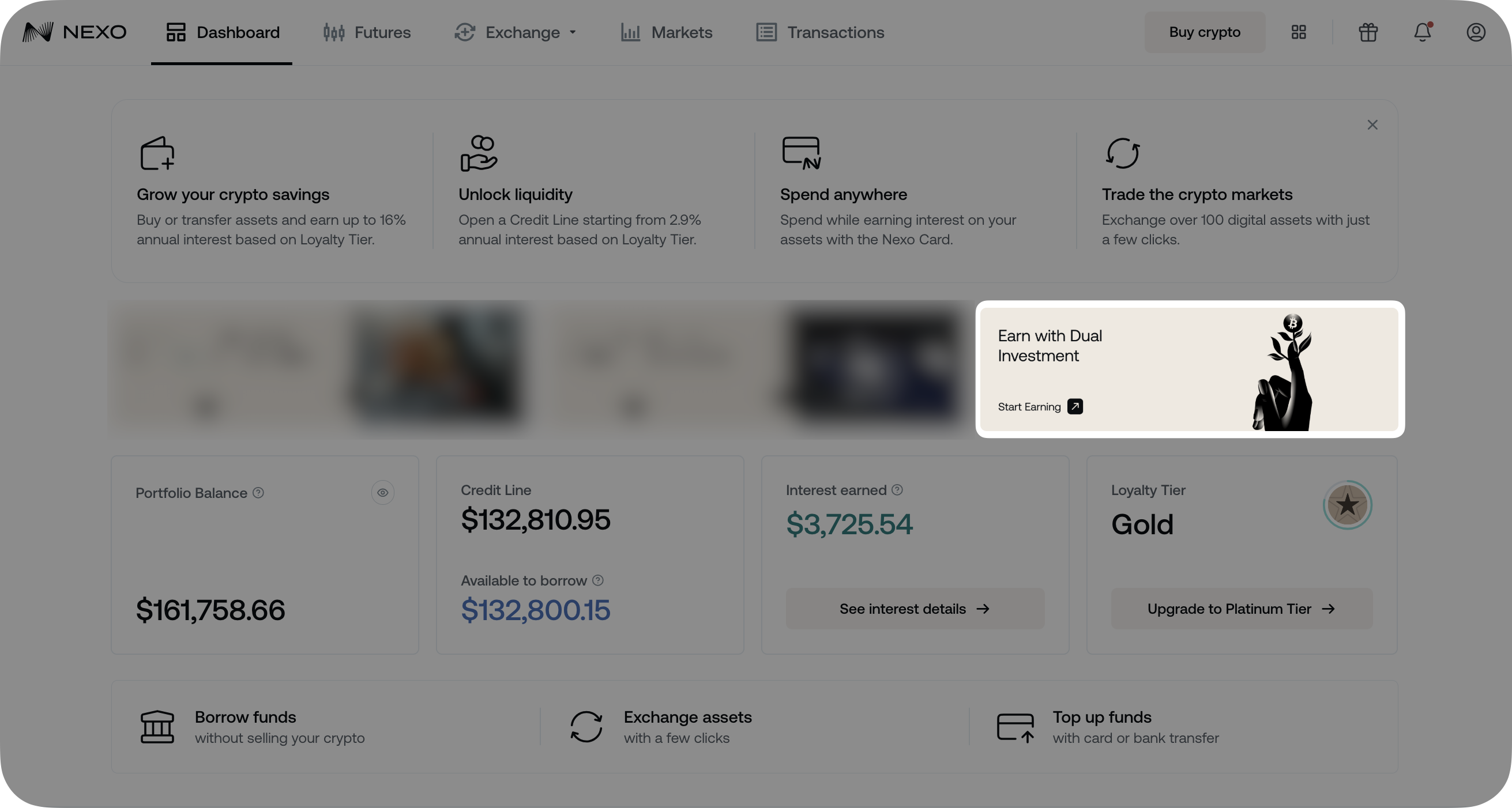

On the web platform

1. Log in to your account

2. On your Dashboard, click the Earn with Dual Investment button located right above your Loyalty tier.

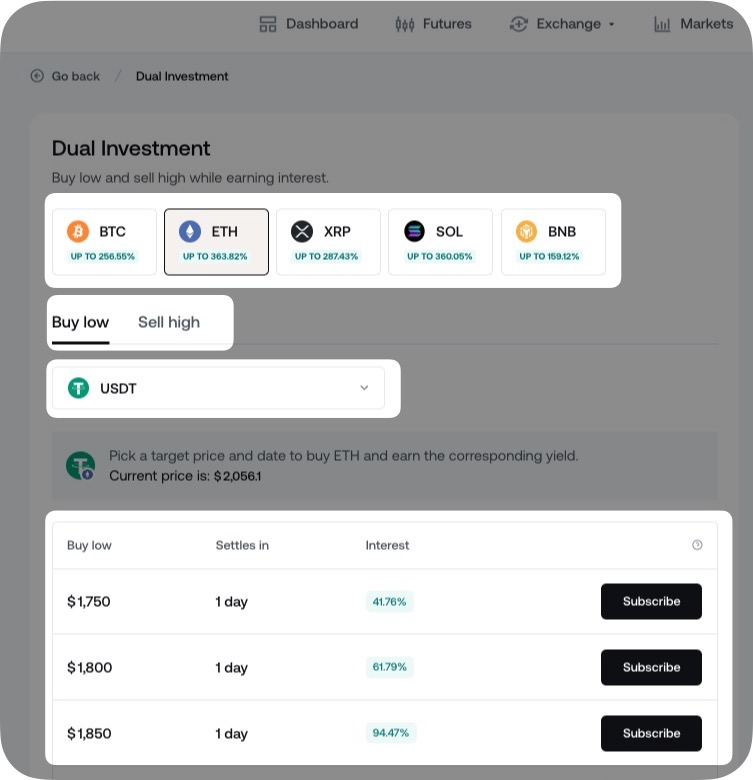

3. Choose the asset that you want to buy/sell (BTC, ETH, XRP, SOL, or BNB), and the Buy with or Sell for currency (USDT* or USDC). Pick your strategy (buy low or sell high) and select one of the available subscriptions.

*The option to choose USDT is unavailable to residents of EEA countries.

4. Choose the amount you want to subscribe with and click Subscribe.

5. Once you have reviewed your subscription details, click Confirm Subscription.

Congratulations! You have successfully created a Dual Investment subscription.

7. FAQ

- Q: What is the minimum amount I can subscribe with for a BTC strategy?

- A: For BTC pairs, the minimum subscription value is 0.01 BTC.

-

-

- Subscription amounts up to 0.1 BTC: You can adjust the amount by 0.01 units up to 0.1 BTC (e.g. 0.02, 0.03, …, 0.09, up to 0.1 BTC).

- Subscription amounts above 0.1 BTC: For each value above 0.1 BTC, you can adjust the amount by 0.1 units (e.g. 0.2, 0.3, 0.4, etc.).

-

To conclude, your subscription amount can be 0.02 BTC, 0.03 BTC, 0.1 BTC, 0.2 BTC, 1.5 BTC, or 10 BTC, but not 0.011 BTC, 0.15 BTC, 1.543 BTC, or 10.001 BTC.

- Q: What is the minimum amount I can subscribe with for an ETH strategy?

- A: For ETH pairs, the minimum subscription value is 0.2 ETH.

-

-

- Subscription amounts up to 1 ETH: You can adjust the amount by 0.2 units up to 1 ETH (e.g. 0.2, 0.4, 0.6, 0.8, up to 1 ETH).

- Subscription amounts above 1 ETH: For each value above 1 ETH, you can adjust the amount by 1 unit (e.g. 2, 3, 4, etc.).

-

To conclude, your subscription amount can be 0.2 ETH, 0.4 ETH, 2 ETH, 3 ETH, or 10 ETH, but not 2.2 ETH or 7.1 ETH.

- Q: What is the minimum amount I can subscribe with for an XRP, SOL, or a BNB strategy?

- A: The minimum subscription value is 1,000 XRP, 10 SOL, or 1 BNB, respectively.

- Subscription amounts above 1,000 XRP: You can adjust the amount by 1,000 units (e.g. 2,000, 3,000, 4,000, etc.).

- Subscription amounts above 10 SOL: You can adjust the amount by 10 units (e.g. 20, 30, 40, etc.).

- Subscription amounts above 1 BNB: You can adjust the amount by 1 unit (e.g. 2, 3, 4, etc.).

- A: The minimum subscription value is 1,000 XRP, 10 SOL, or 1 BNB, respectively.

- Q: How can I project my potential returns?

- A: Check the Potential Returns section (located under the trade details when placing a Dual Investment subscription).

- Q: Can I cancel or modify an active Dual Investment subscription?

- A: No, once your subscription is set up, you cannot cancel or modify it.

- Q: Can I use assets placed in a Dual Investment subscription?

- A: No, they will remain locked until the Settlement Date. This means you cannot:

- Exchange or withdraw these assets.

- Transfer them to Nexo Pro.

- Transfer them to the Credit Line Wallet.

- Use them for loan repayment.

- A: No, they will remain locked until the Settlement Date. This means you cannot:

- Q: Where can I view my active and past Dual Investments?

- A: On the Nexo app, go to the Savings Hub in your Dashboard tab, tap Earn with Dual Investment>Investments, and select Active or Past subscriptions. Tap the filter icon to filter your subscriptions.

On the Web platform, go to your Dashboard>Dual Investment>select Active or Past subscriptions. Click See all to view or filter your subscriptions.

- A: On the Nexo app, go to the Savings Hub in your Dashboard tab, tap Earn with Dual Investment>Investments, and select Active or Past subscriptions. Tap the filter icon to filter your subscriptions.

- Q: Can I filter my subscriptions?

- A: You can conveniently filter your subscriptions by strategy (sell high or buy low) and asset (BTC, ETH, XRP, SOL, or BNB). Your previous subscriptions can also be filtered by settlement status (Exercised or Not exercised).

8. Important notes

- The Dual Investment product is unavailable for clients residing in Australia, the United Kingdom, and some countries in the EEA.

- The content and examples presented in this article are only for general information and educational purposes, without warranty of any kind. It should not be interpreted as financial advice nor as a recommendation to purchase any specific asset. You are advised to trade responsibly.