What are the limits and fees of the Nexo Card

In this article:

- Nexo Card fees and limits overview

- ATM withdrawal fees

- Foreign exchange (FX) fees

- Transaction limits

- Managing spending limits and allowed transactions

- How can I check my transaction volume and limits

- Important notes

1. Nexo Card fees and limits overview

Below is an overview of the fees associated with the Nexo Card:

- There are no monthly, annual, or inactivity fees.

- You get a monthly limit of free ATM withdrawals. Fees are charged only if you exceed this limit.

- All foreign exchange (FX) transactions are subject to fees.

By default, per-transaction, daily, and monthly limits apply to your Nexo Card usage. However, with the Spending Controls feature, you can set custom limits based on your preferences and spending habits.

Additionally, you can choose which transaction types are allowed, giving you greater control over how and where your card is used.

2. ATM withdrawal fees

If you exceed the free monthly ATM withdrawal limit for your Loyalty Tier, a 2% fee, with a minimum charge of €1.99 or £1.99, will be applied to each subsequent ATM withdrawal.

| Loyalty tier | Free ATM withdrawals per month |

| Base | €200 / £180 |

| Silver | €400 / £360 |

| Gold | €1,000 / £900 |

| Platinum | €2,000 / £1,800 |

The free monthly ATM withdrawal limit resets on the first day of each month at 00:00 CET.

Note: Fee amounts are subject to rounding based on general rounding rules (to their nearest hundredth). For example, ATM withdrawal fee amounts of $3.004 and lower will be rounded down to $3.00, and amounts ranging from $3.005 to $3.009 will be rounded up to $3.01.

3. Foreign exchange (FX) fees

FX transactions are those where the Local Currency (the merchant’s currency) differs from your Card Currency (EUR or GBP). In such cases, the transaction amount denominated in the Local Currency has to be converted into your Card Currency.

All FX conversions are subject to a 0.2% or 2% fee, depending on the Local Currency. FX transactions made on weekends are subject to an additional 0.5% fee.

| EEA/UK/CH currencies | Other currencies | |

| FX fee |

0.2% | 2% |

| Weekend FX fee* | +0.5% | +0.5% |

* Weekend fees apply:

- From Friday 21:00 UTC to Sunday 22:00 UTC (second Sunday of March till first Sunday of November)

- From Friday 22:00 UTC to Sunday 23:00 UTC (first Sunday of November till second Sunday of March)

Note: Fee amounts are subject to rounding based on general rounding rules (to their nearest hundredth). For example, FX fee amounts of $0.004 and lower will be rounded down to $0.00, and amounts ranging from $0.005 to $0.009 will be rounded up to $0.01.

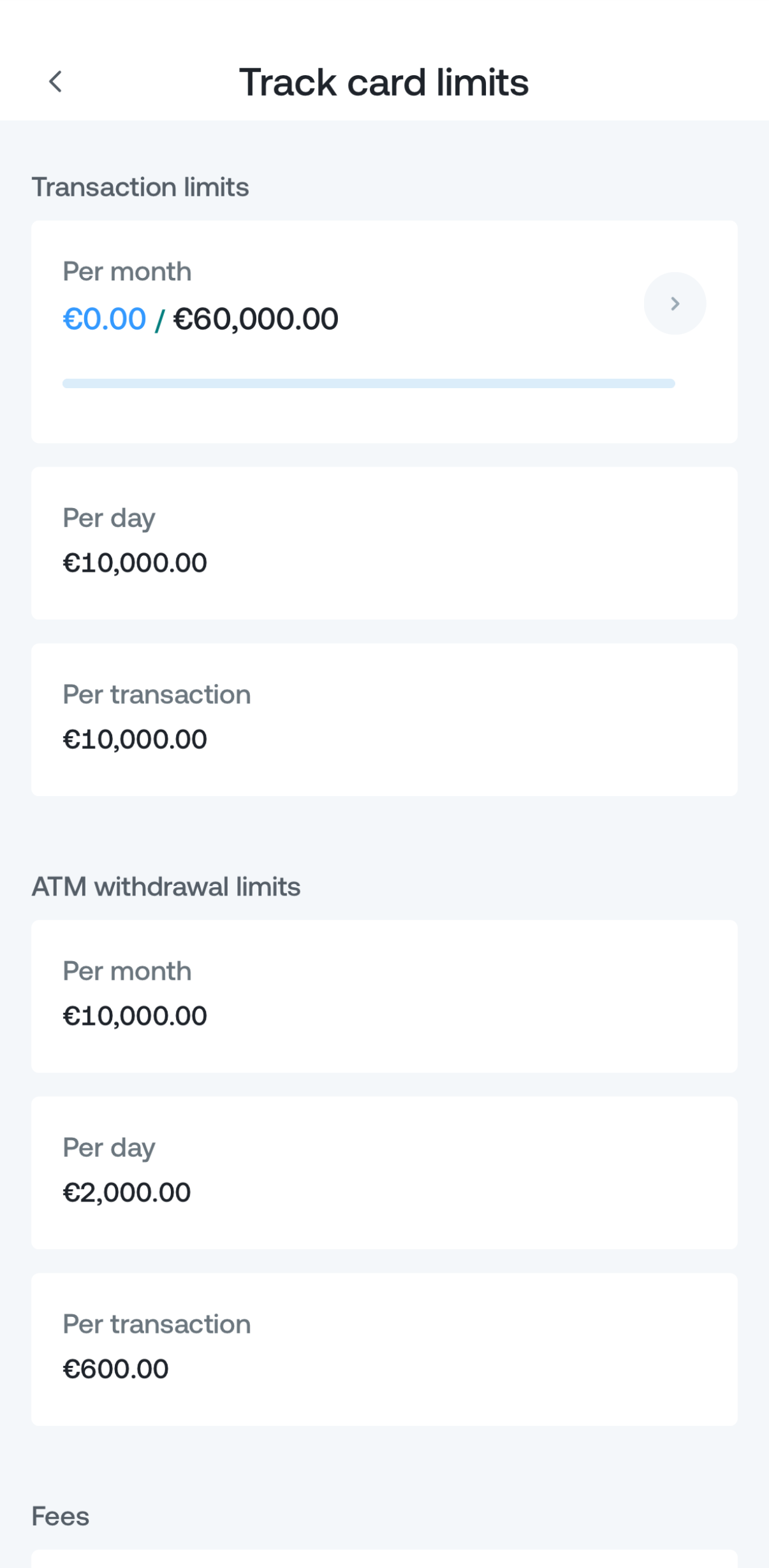

4. Nexo Card transaction limits

The following limits apply to Nexo Card transactions by default:

| Purchases |

ATM withdrawals | |

| Per transaction |

€10,000 / £9,000 | €600 / £540 |

| Daily | €10,000 / £9,000 |

€2,000 / £1,800 |

| Monthly | €60,000 / £54,000 | €10,000 / £9,000 |

The transaction limits above are reset on a rolling basis.

5. Managing spending limits and allowed transactions

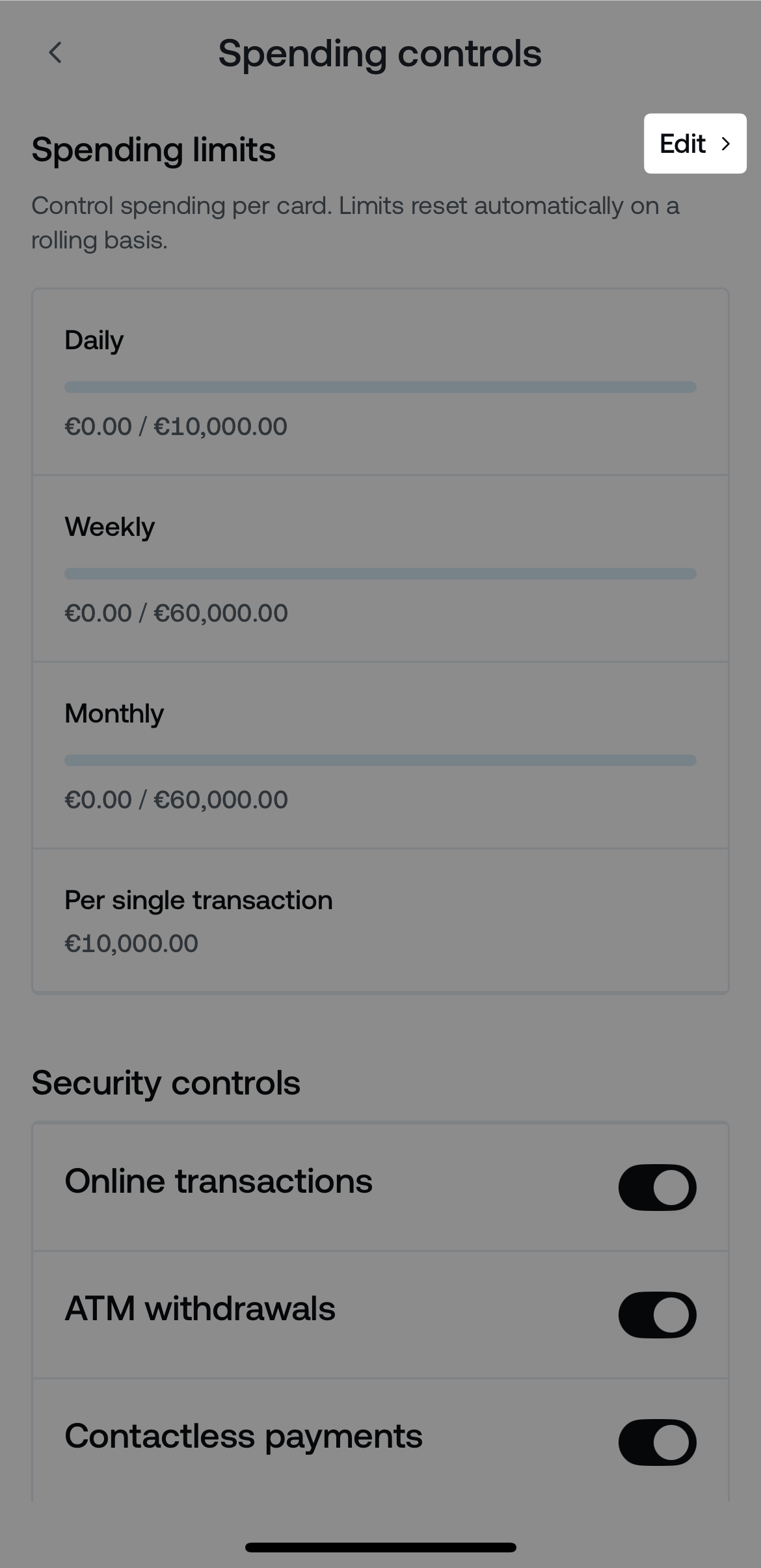

The Nexo Card’s Spending Controls feature allows you to set custom daily, weekly, and monthly spending limits, as well as a limit per single transaction. You can also choose which transaction types are permitted (online transactions, ATM withdrawals, contactless payments, and mobile wallet payments).

This gives you greater control over your card usage and helps you handle your spending with confidence.

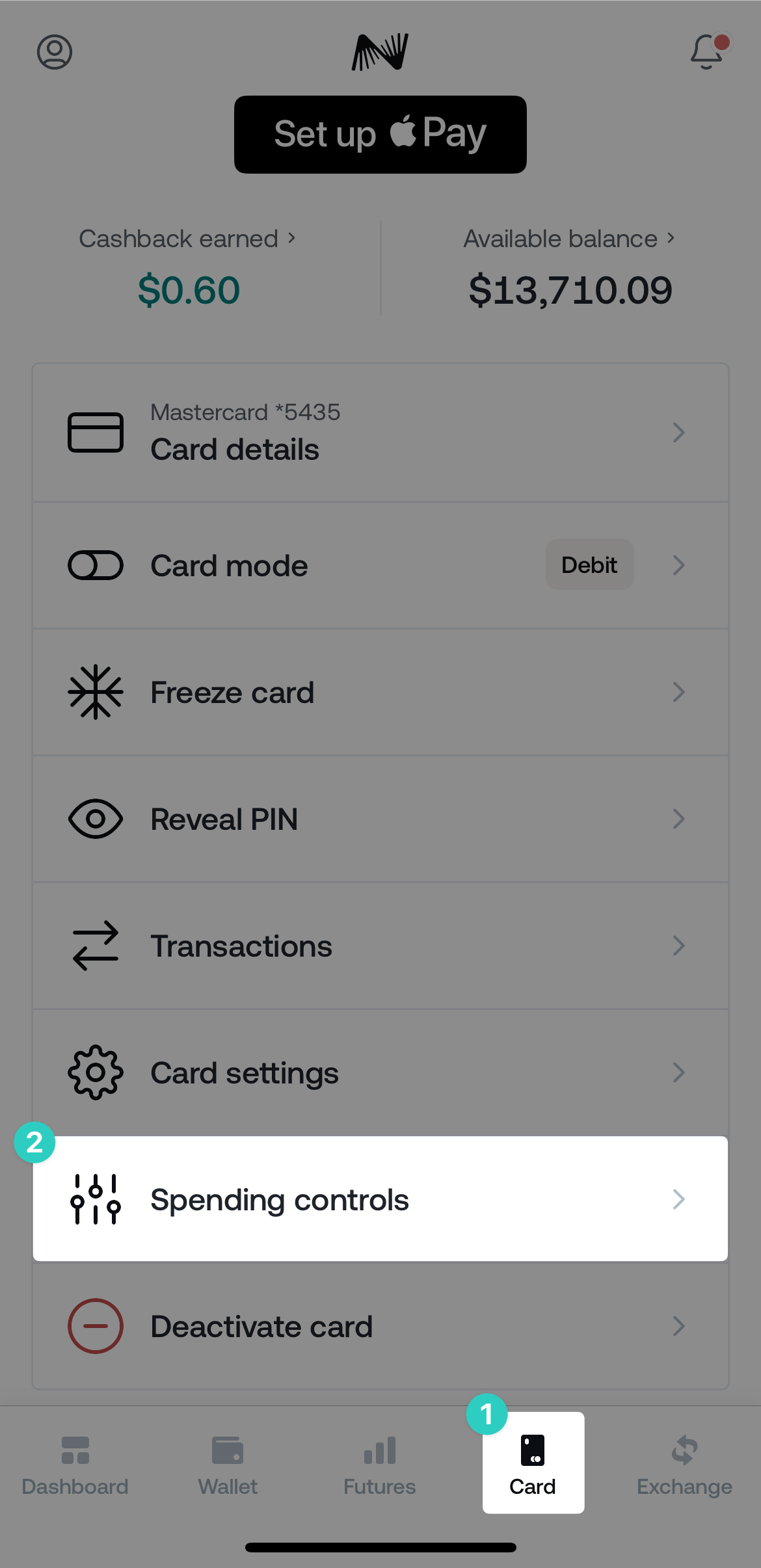

To manage your Nexo Card spending, open the Card tab in the Nexo app and tap Spending controls under the card you wish to customize.

Important: If you have both a virtual and a physical Nexo Card, you’ll need to configure spending controls separately, as settings are applied per card.

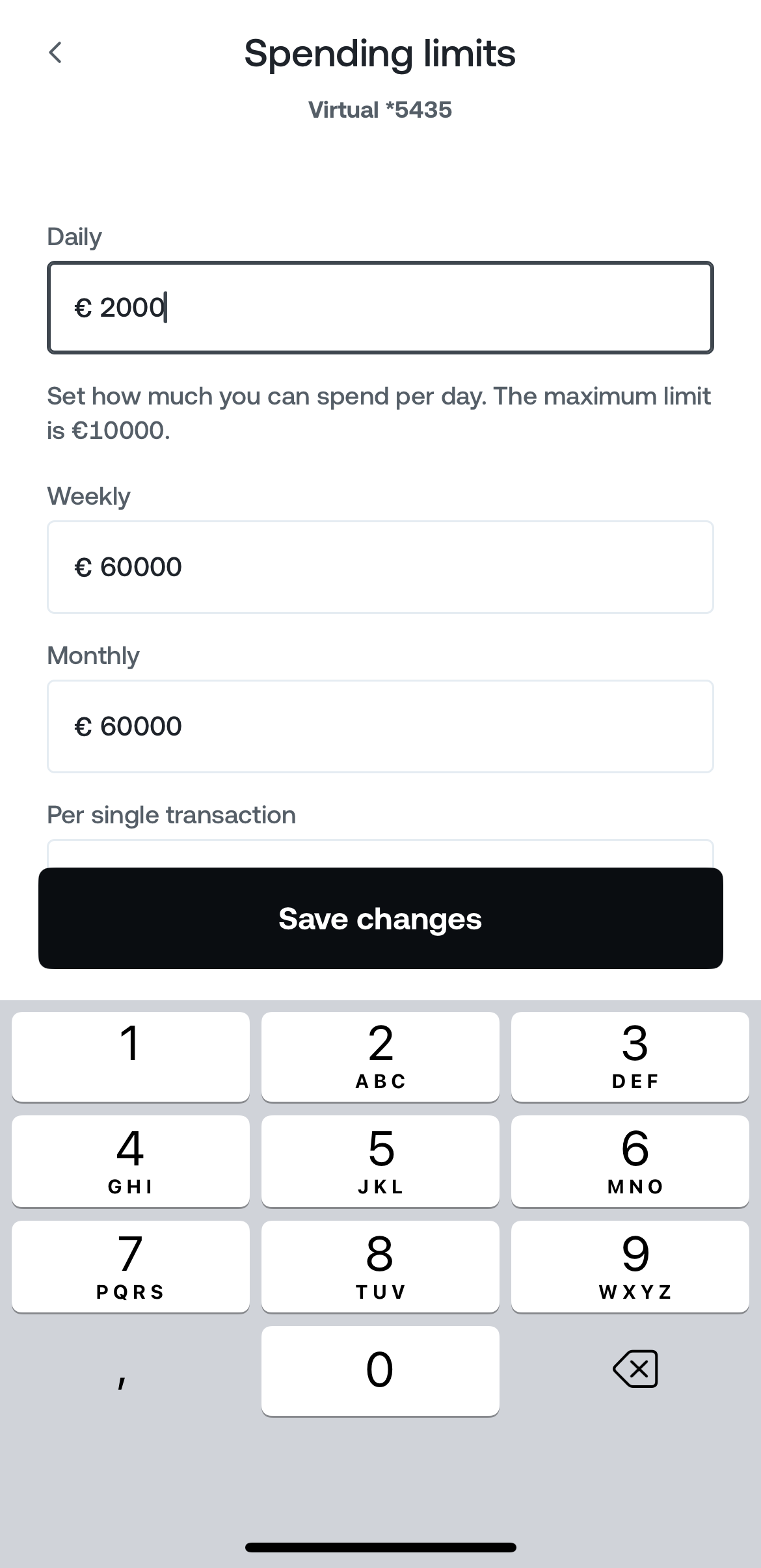

How to set custom limits

Tap the Edit button next to the Spending limits section. You can define daily, weekly, and monthly limits, as well as a limit per single transaction.

Note: The limits must follow a logical order — the per-transaction limit must be lower than or equal to the daily limit, the daily limit lower than or equal to the weekly, and the weekly lower than or equal to the monthly.

To revert to default values, tap Reset limits.

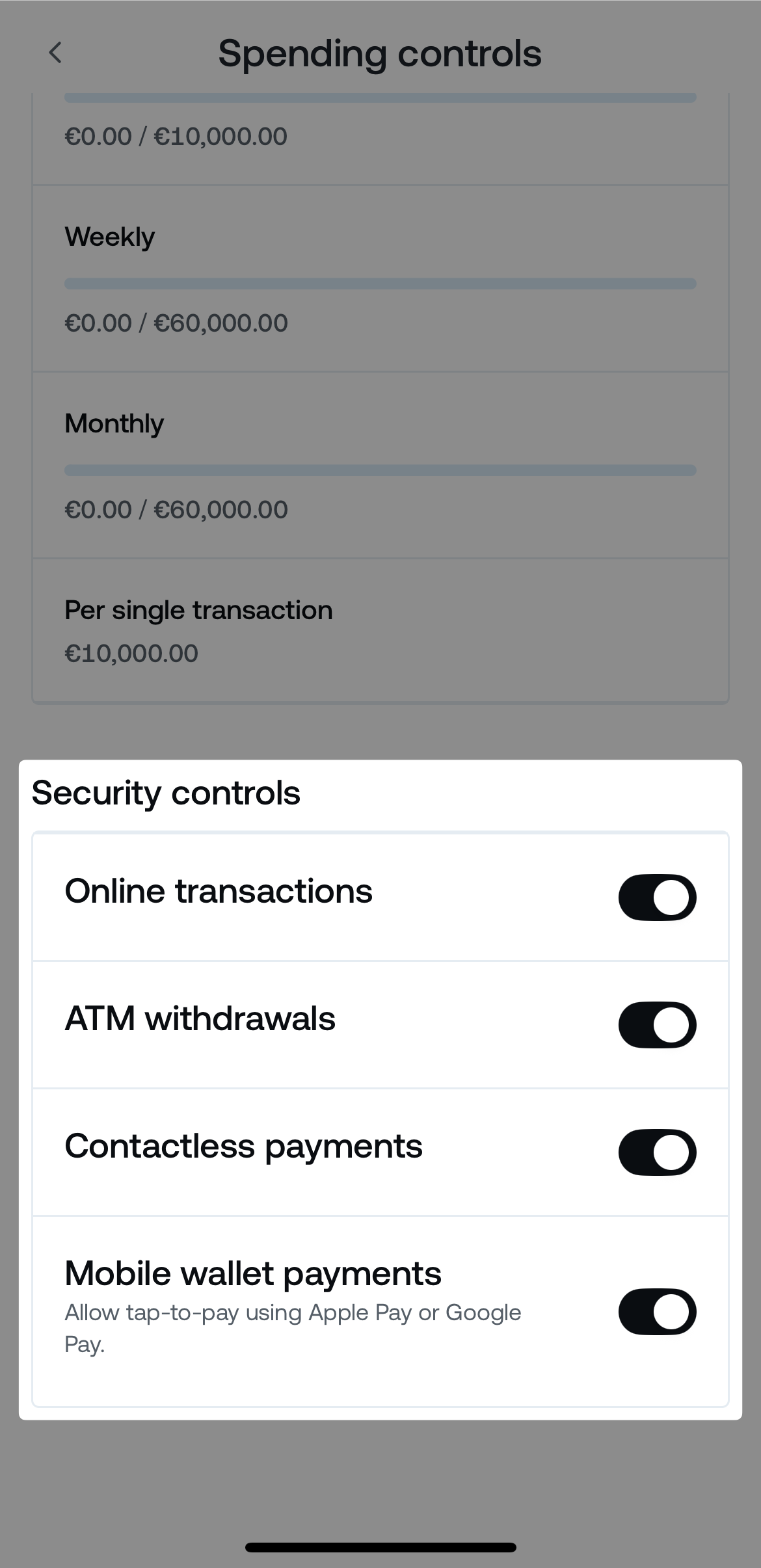

How to control which transaction types are allowed

Use the toggles in the Security controls section to enable or disable specific transaction types.

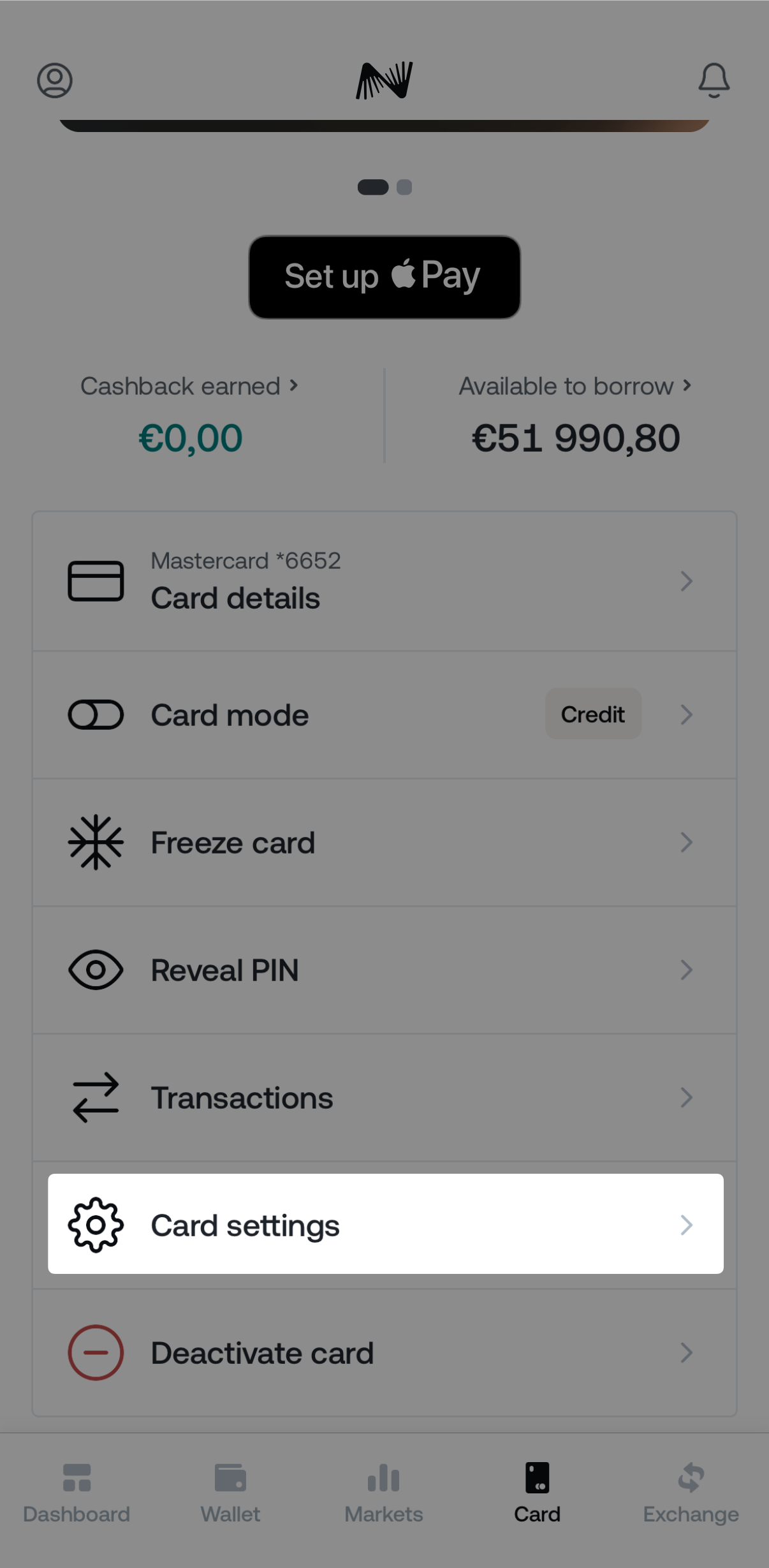

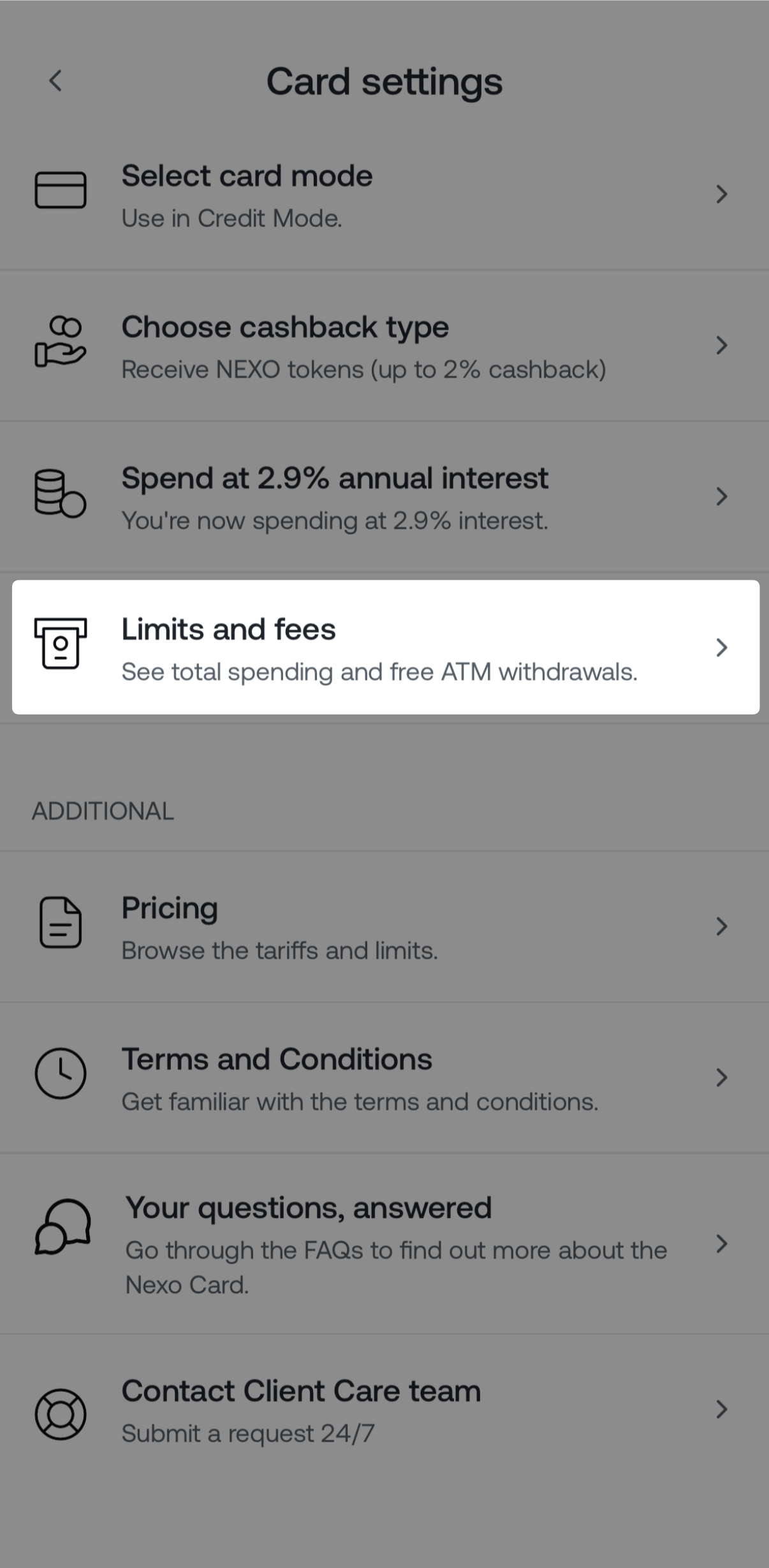

6. How can I check my transaction volume and limits

1. Open the Nexo app and go to the Card tab.

2. Tap Card Settings.

3. Select Track Card Limits.

6. Important notes

- Please note that Nexo may update these fees and limits at any time, at Nexo’s discretion.

What are the limits and fees of the Nexo Card?

Fees

Both the physical and virtual Nexo Cards have no monthly, annual or inactivity fees.

How many free ATM withdrawals am I allowed per month?

Depending on your Loyalty tier, you can enjoy up to 10 free withdrawals:

- Basic: 1 free withdrawal

- Silver: 3 free withdrawals

- Gold: 5 free withdrawals

- Platinum: 10 free withdrawals

Once you run out of free withdrawals, you’ll be charged only €1.99 / £1.99 per additional withdrawal until your monthly limit resets again.

Are there any foreign transaction fees?

Depending on your Loyalty tier, you can enjoy up to €20,000 / £20,000 in free foreign transactions:

- Basic: No FX fees for up to €3,000 / £3,000 per month

- Silver: No FX fees for up to €5,000 / £5,000 per month

- Gold: No FX fees for up to €10,000 / £10,000 per month

- Platinum: No FX fees for up to €20,000 / £20,000 per month

Once you reach your currency exchange limit, you’ll be charged a 0.5% fee on foreign transactions until your monthly limit resets again.

Limits

Transaction limits:

- Monthly: up to €60,000 / £54,000

- Daily: up to €10,000 / £9,000

- Per single transaction: up to €10,000 / £9,000

ATM withdrawal limits:

- Monthly: up to €10,000 / £9,000

- Daily: up to €2,000 / £1,800

- Per single withdrawal: up to €600 / £540

You can also monitor your transaction volume and limits from the Nexo App by following these simple steps:

1. Open the Nexo App and log in.

2. Navigate to the “Card” tab.

3. Tap on the “Card Settings” option.

4. Select “Limits and Fees“.

5. You can tap on the different limits to see individual usage for each.

Important: Please note that we may update these fees and limits at any time and with immediate effect, at our sole discretion.