Wealth Vaults – explained

In this article:

2. Key features of Wealth Vaults

7. Platform access and limitations

8. Portfolio impact and eligibility

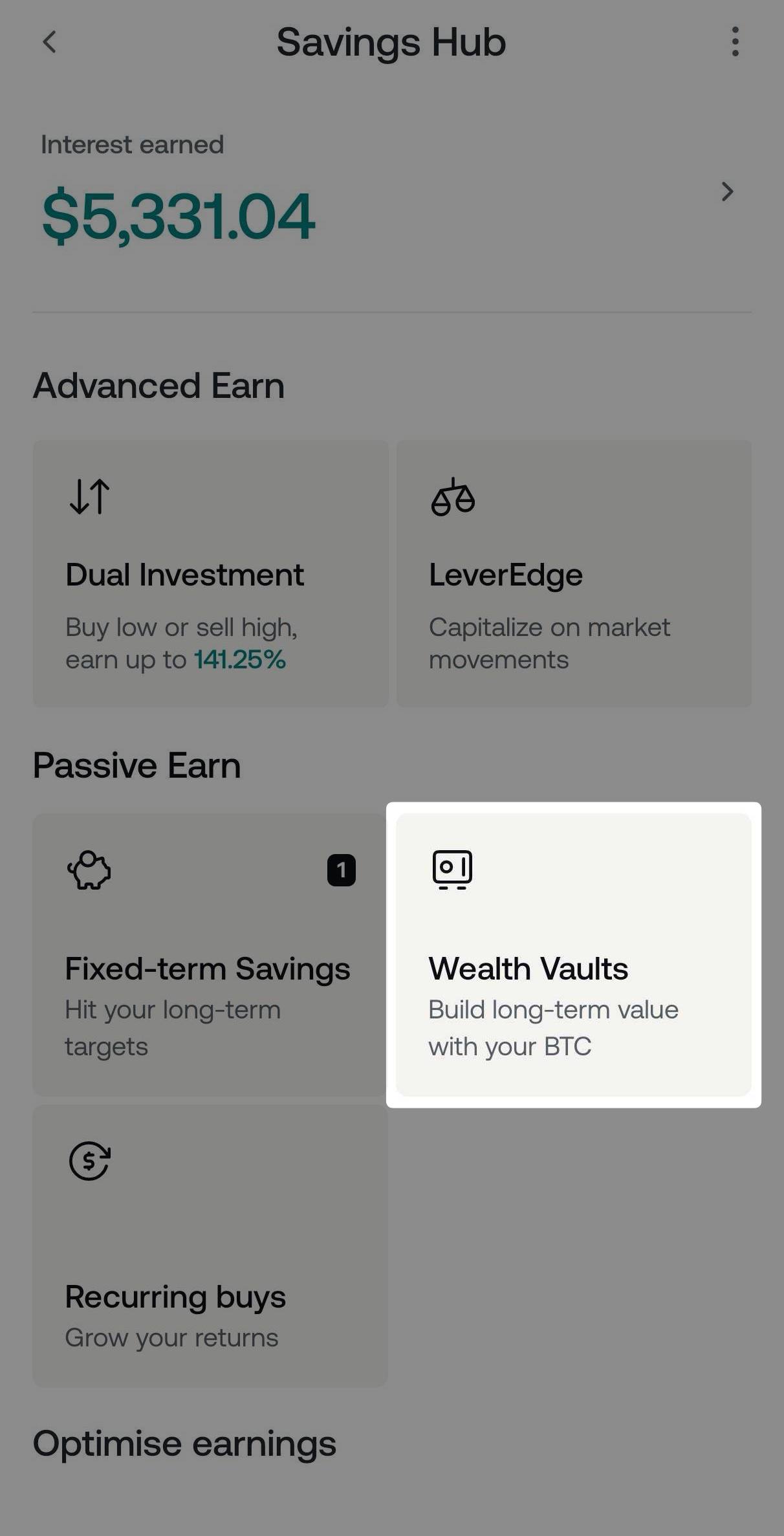

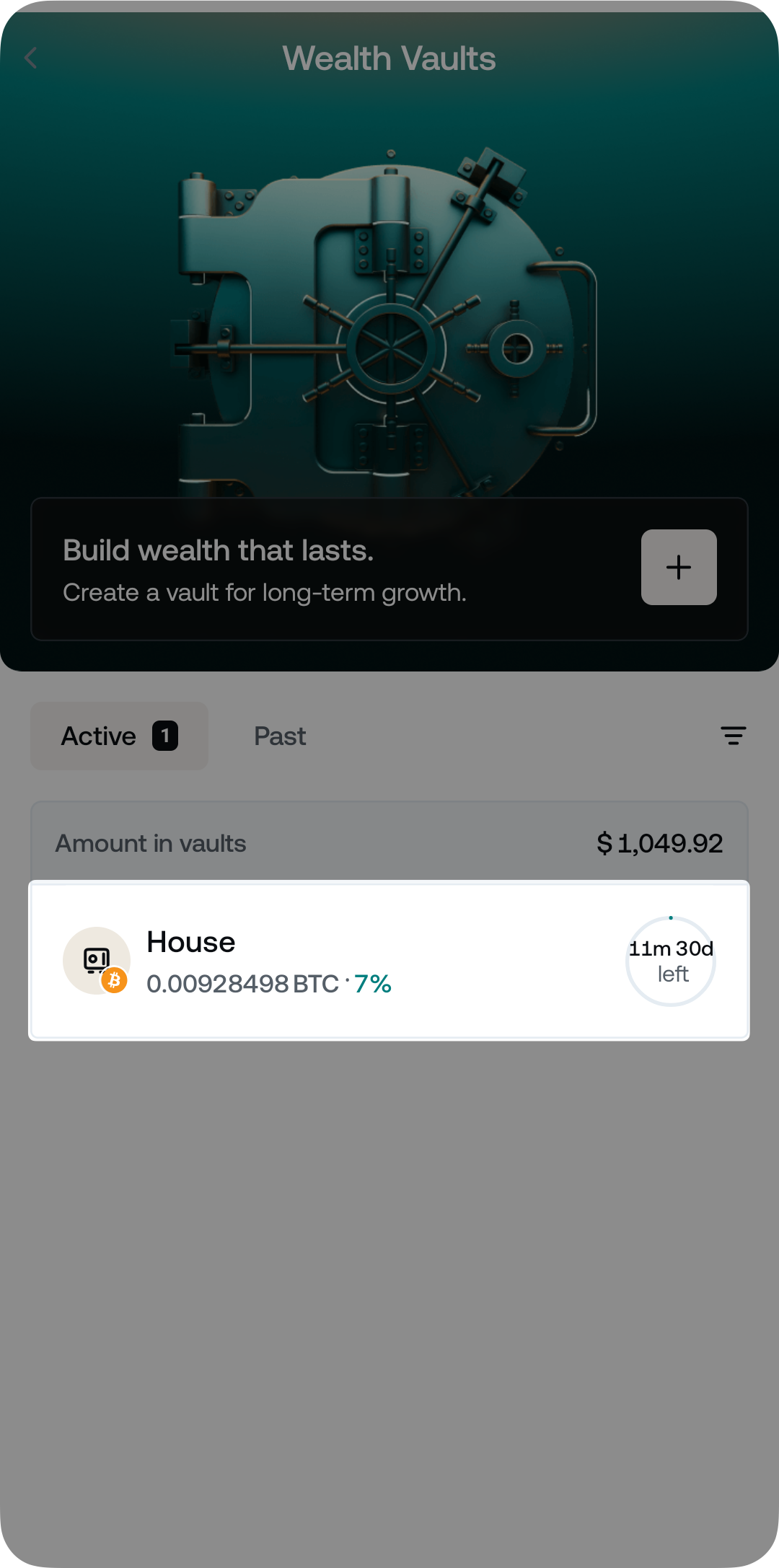

1. What is Wealth Vaults

Wealth Vaults is a long-term savings feature that allows you to earn interest on BTC for a fixed duration between 1 and 20 years. Vaults are ideal for users with long-term goals, such as retirement planning or preserving generational wealth.

Once you create a vault, it holds your BTC until maturity, with interest accumulated over the entire period and paid out at the end. You can personalize each vault with a name and an icon.

2. Key features of Wealth Vaults

- Available only for BTC

- Term range: 1–20 years

- Minimum amount to create a vault: ,000 (in BTC equivalent)

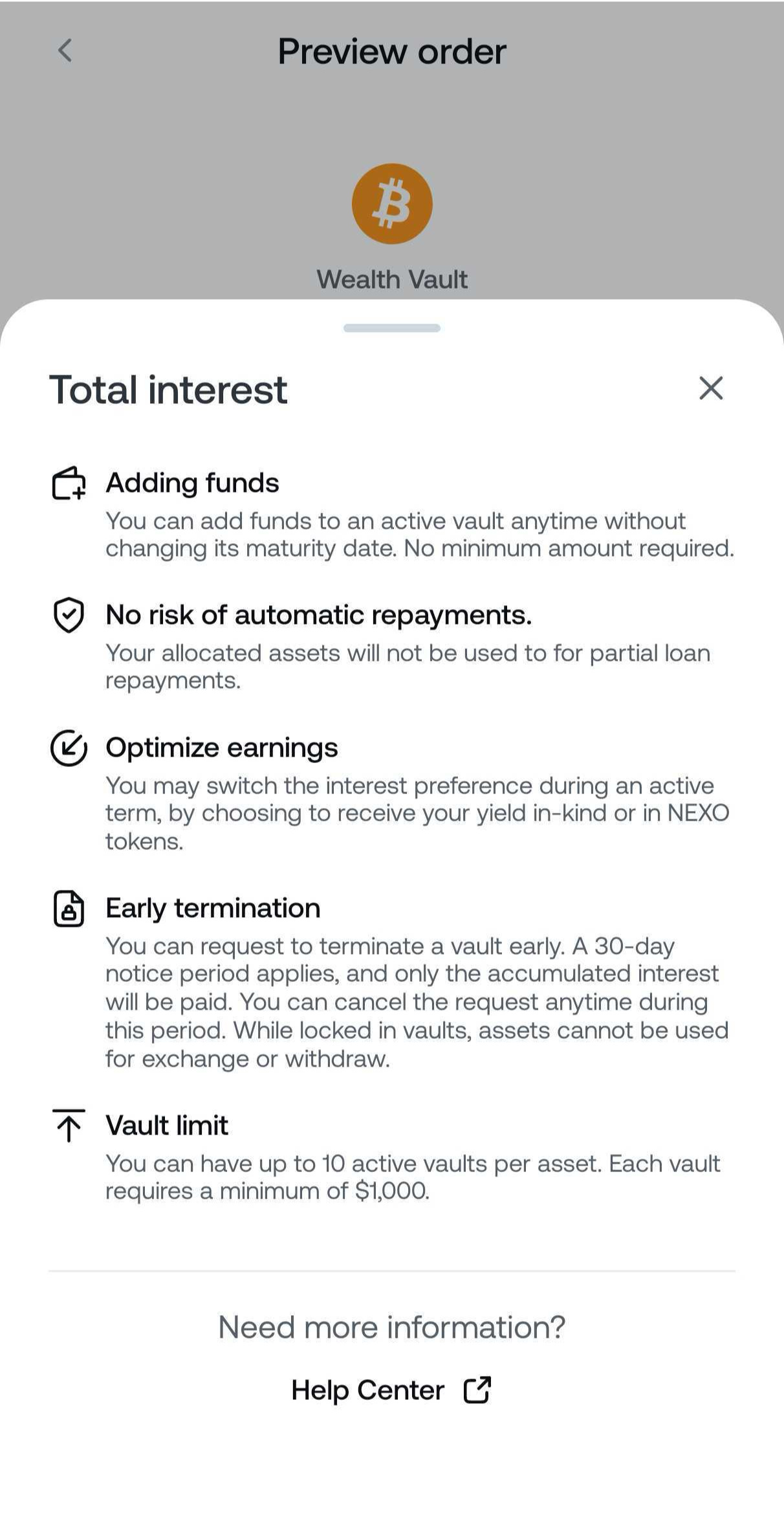

- Top-ups: Add BTC to your existing vault at any time (no minimum)

- Earn type: In BTC or in NEXO, depending on your global Earn Preference

- Interest payout: At maturity only

- Interest notifications: Reflected daily as Vault interest in the Interest Earned notification

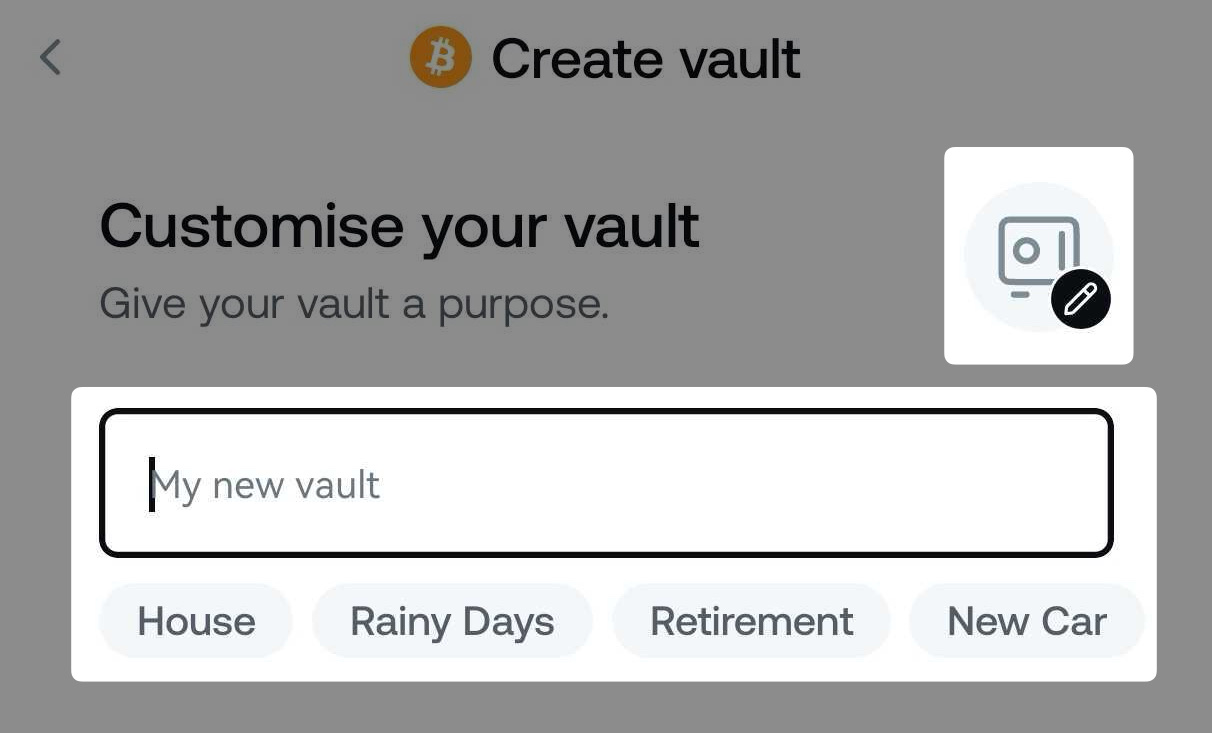

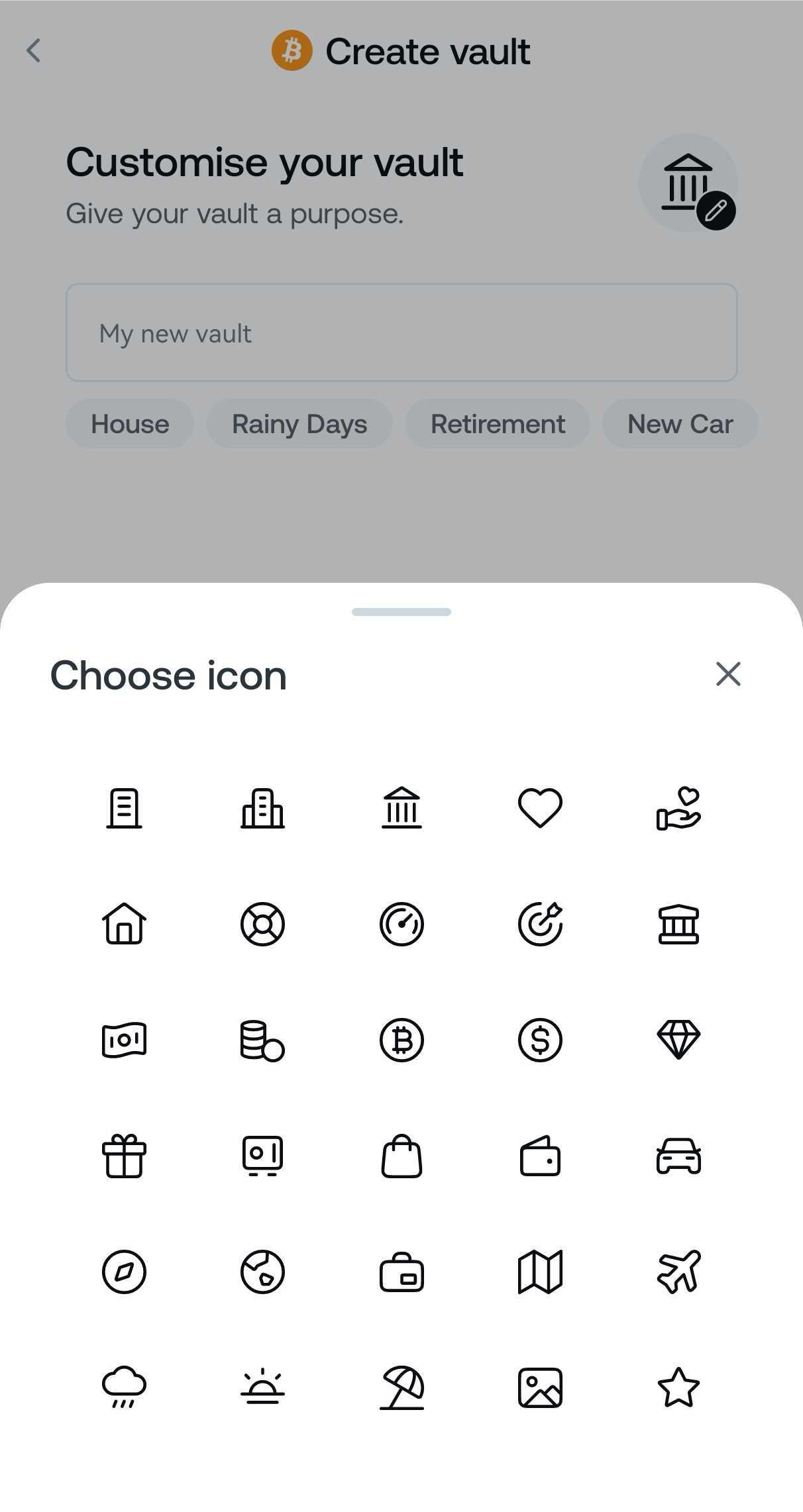

- Vault customization: Set a name and choose an icon from a predefined gallery

- Number of vaults: Up to 10

3. Interest structure

Vaults use the same calculation model as Fixed-term Savings:

- Flexible Savings rate – Based on your Loyalty Tier (between 3% and 4% for BTC)

- Vault bonus – 1% for BTC

- Earn in NEXO bonus – up to 2% (applied to all vaults when Interest payout in NEXO Tokens is enabled)

Interest is accrued daily based on the total BTC balance in the Vault, but is distributed only upon maturity.

4. How to create a vault

To create a vault, make sure you have the Nexo app version 5.26.0 or later installed. This feature is currently not available for setup via the web platform.

Steps:

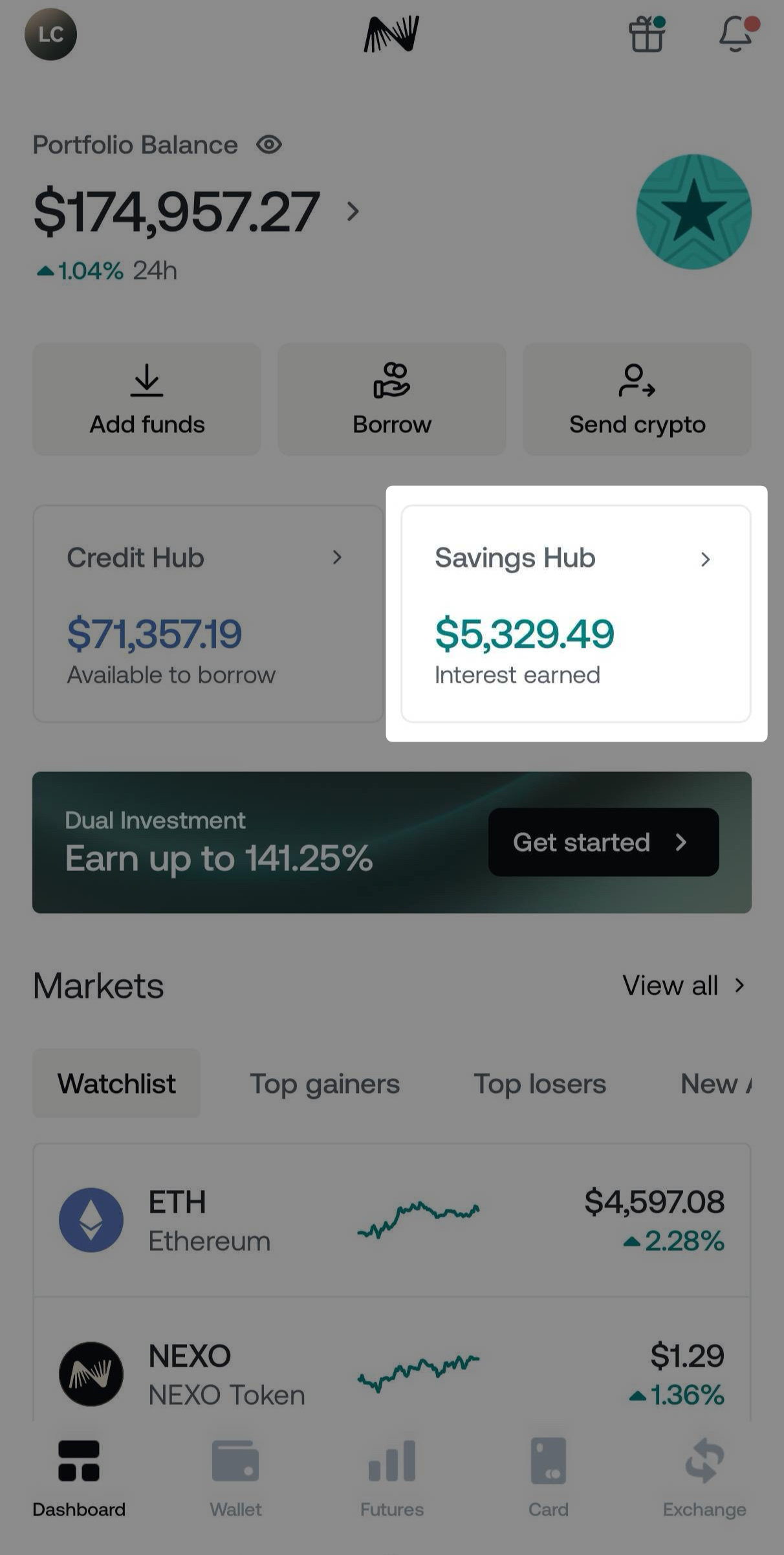

1. Open the Nexo app.

2. Go to your Savings Hub.

3. Tap Wealth Vaults.

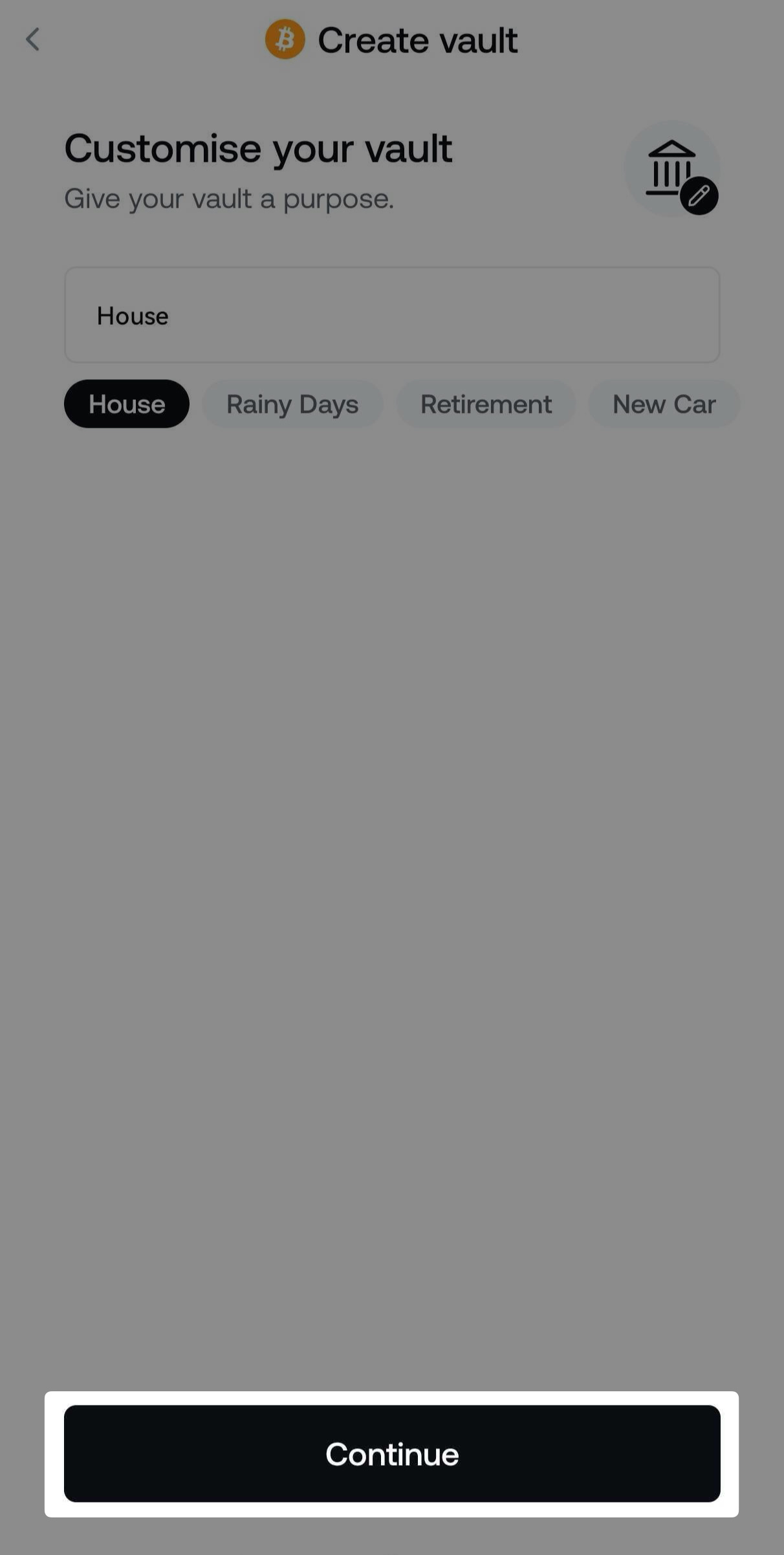

4. Give your vault a name: pick a preset name or type one yourself.

5. Optionally, choose an icon for your vault.

6. Tap Continue.

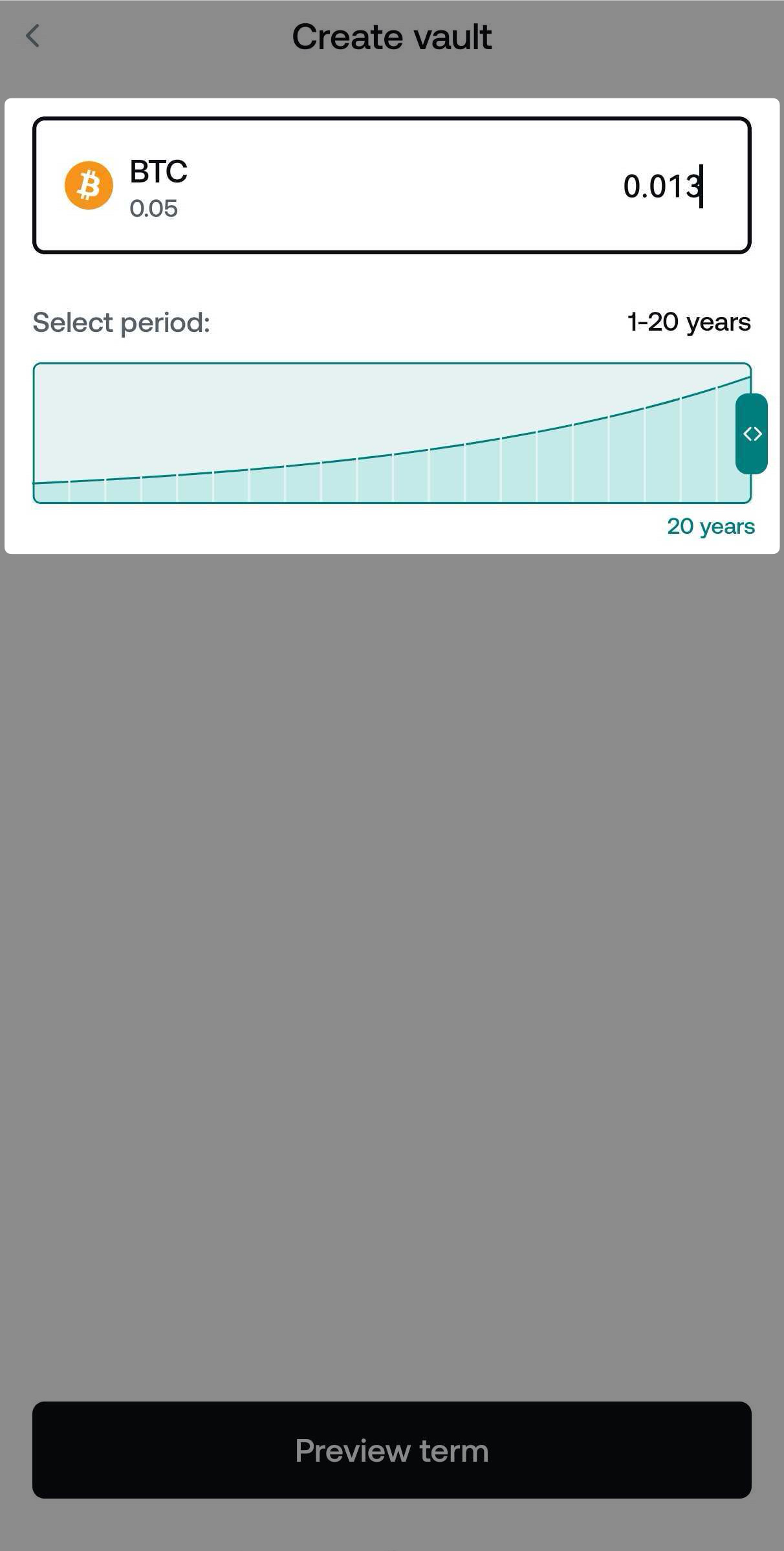

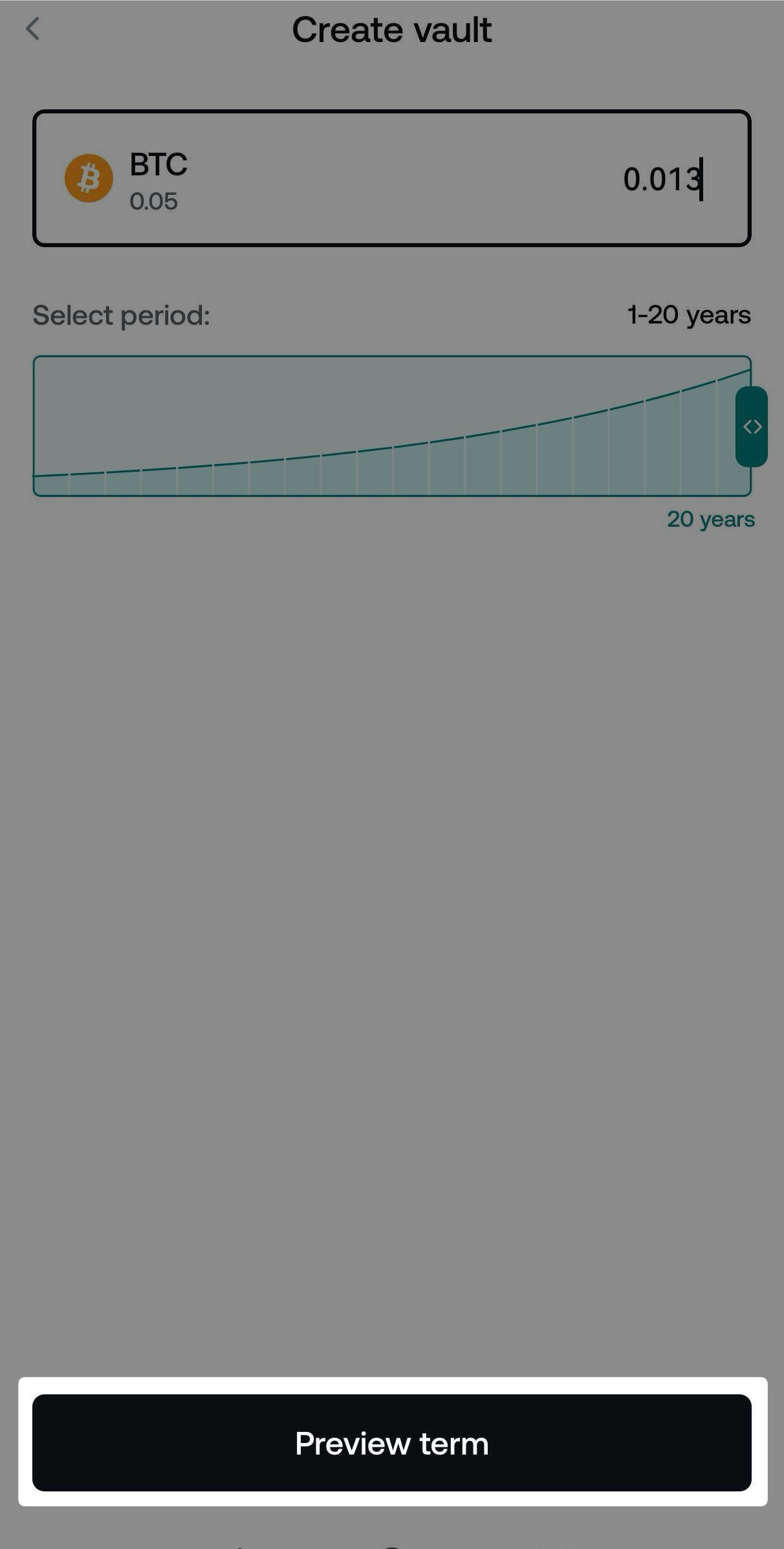

7. Enter the desired amount of BTC (minimum ,000 equivalent) and select the duration using the slider.

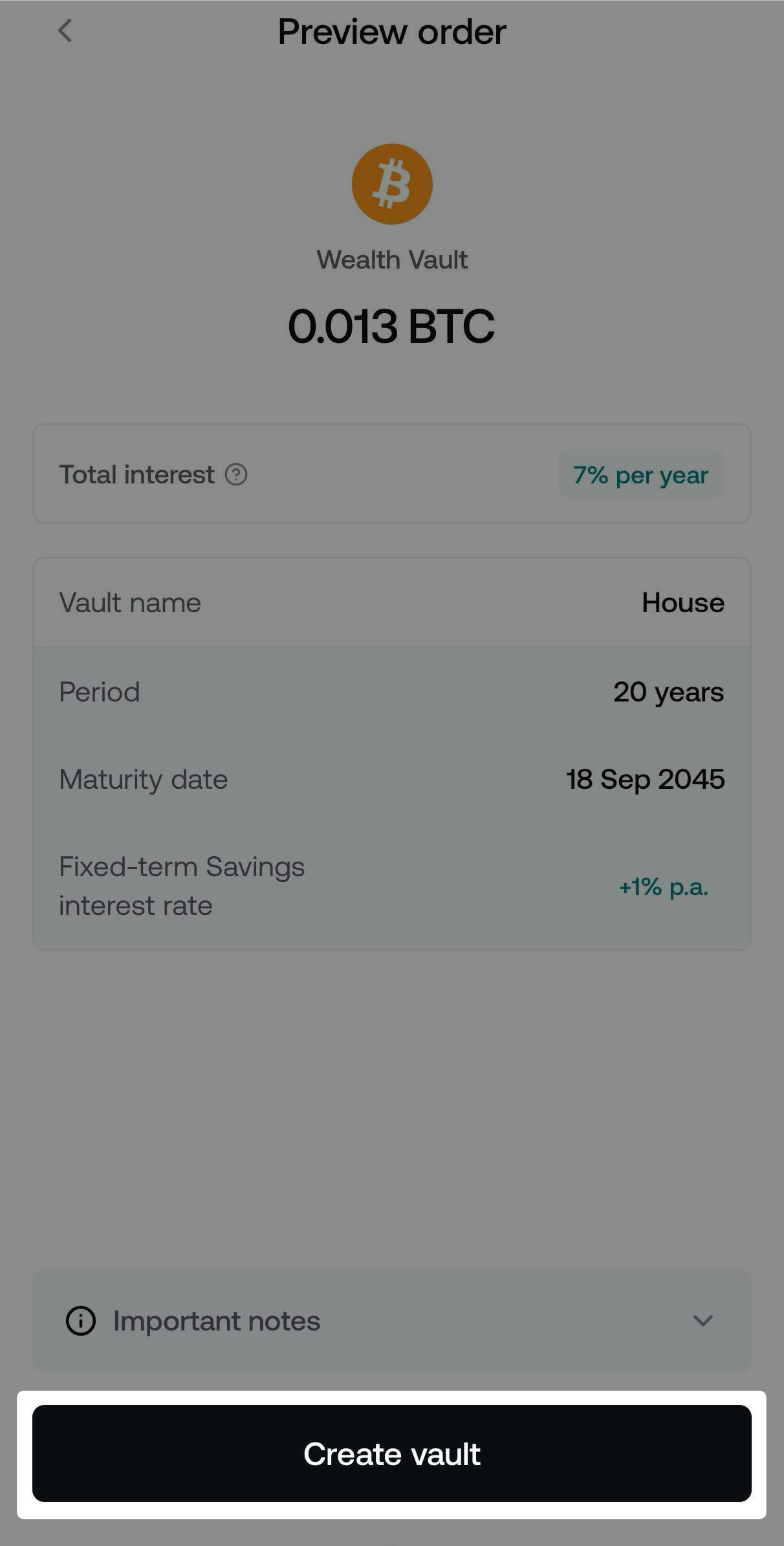

8. Tap Preview term.

9. Check the important notes section if you are new to Wealth Vaults.

10. Tap Create vault.

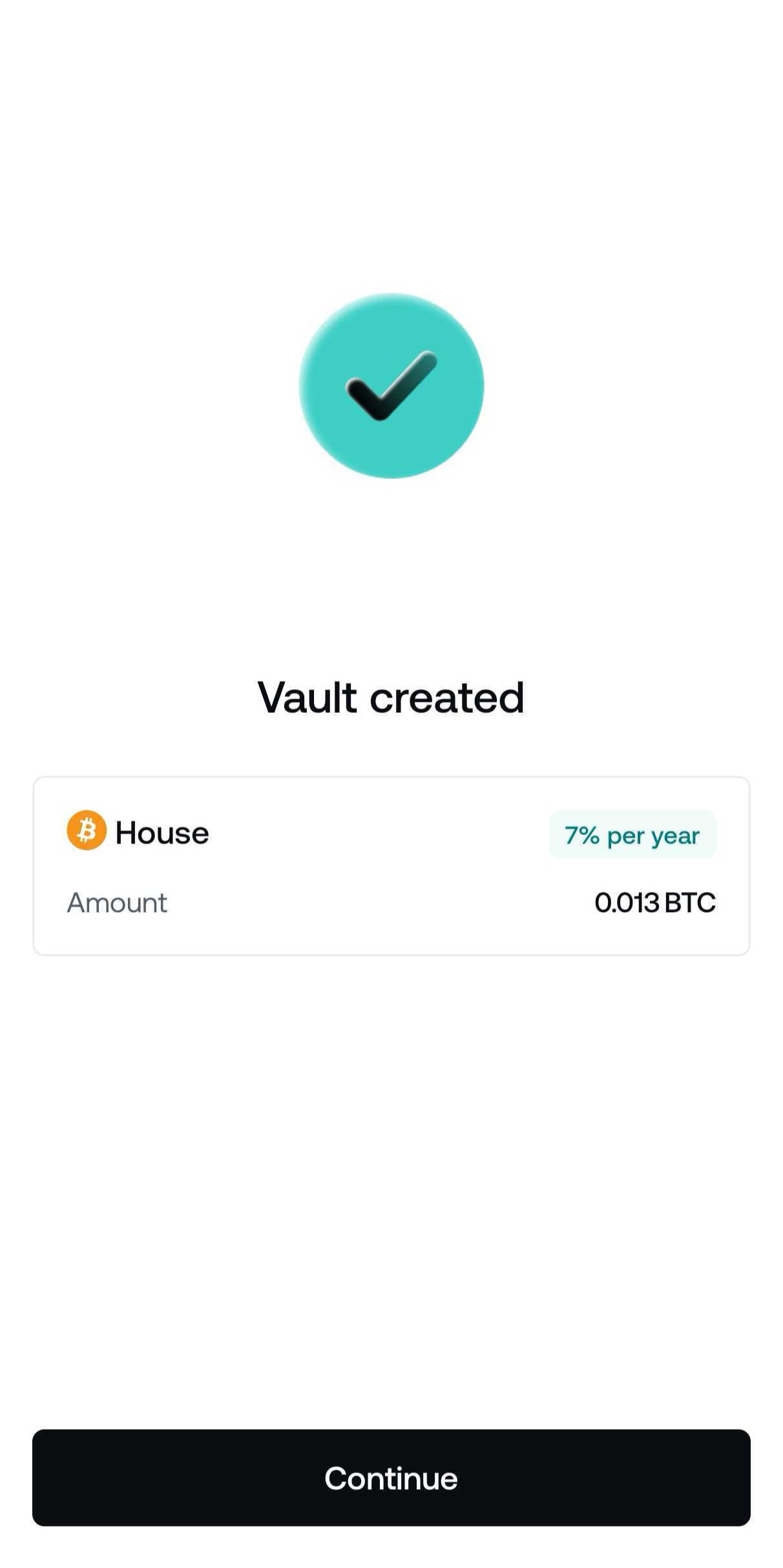

11. Your vault is created!

Once created, your BTC will remain in the vault until the selected maturity date unless an early exit is initiated.

5. Managing your vault

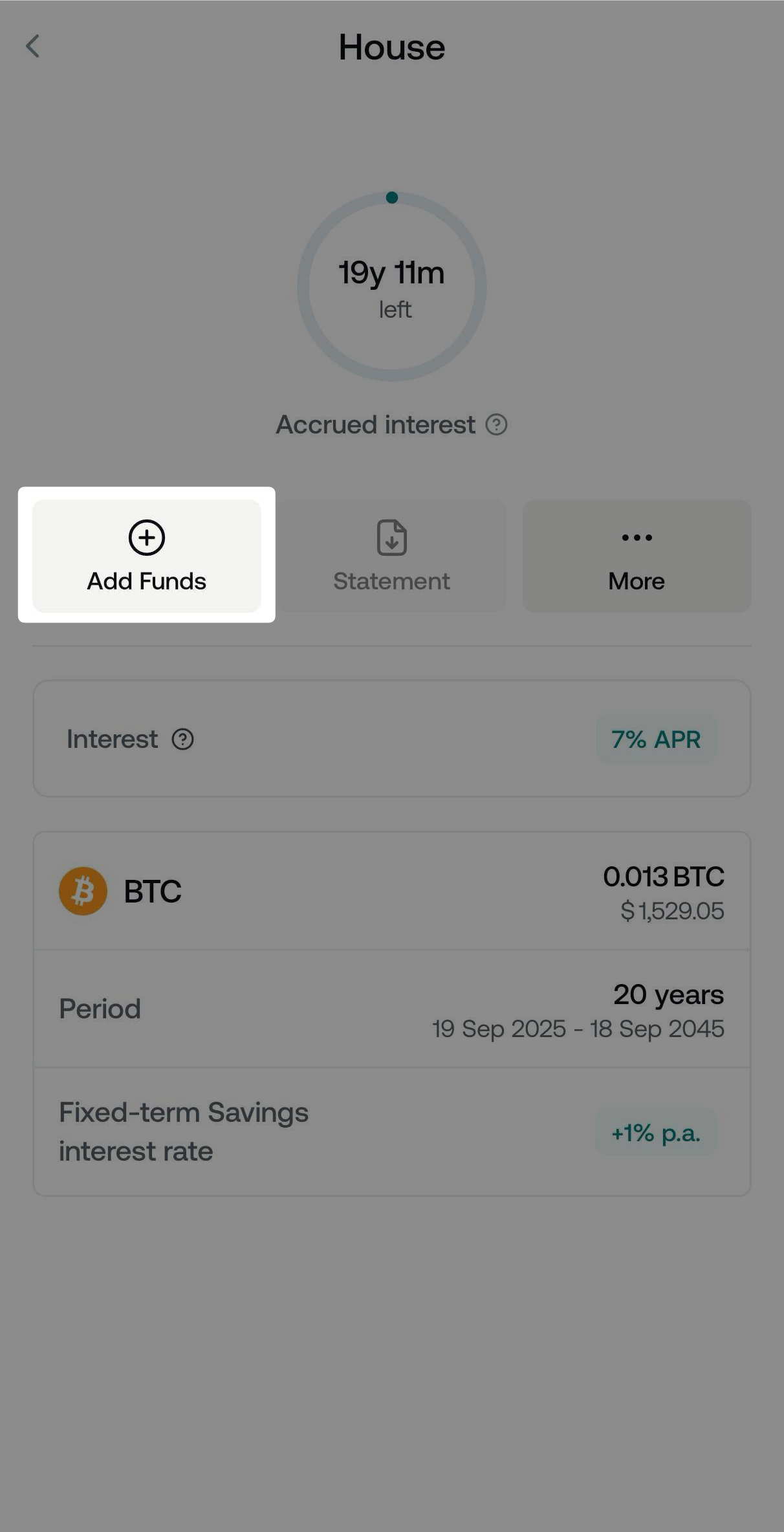

You can top up your vault with additional BTC at any time by clicking on Add Funds in your vault.

No minimum amount is required. Each top-up is reflected in your next day’s interest calculation. The term duration does not reset or extend when you add funds.

You can customize the vault’s name and icon at any time—even if your portfolio has fallen below $5,000 after the creation of the vault.

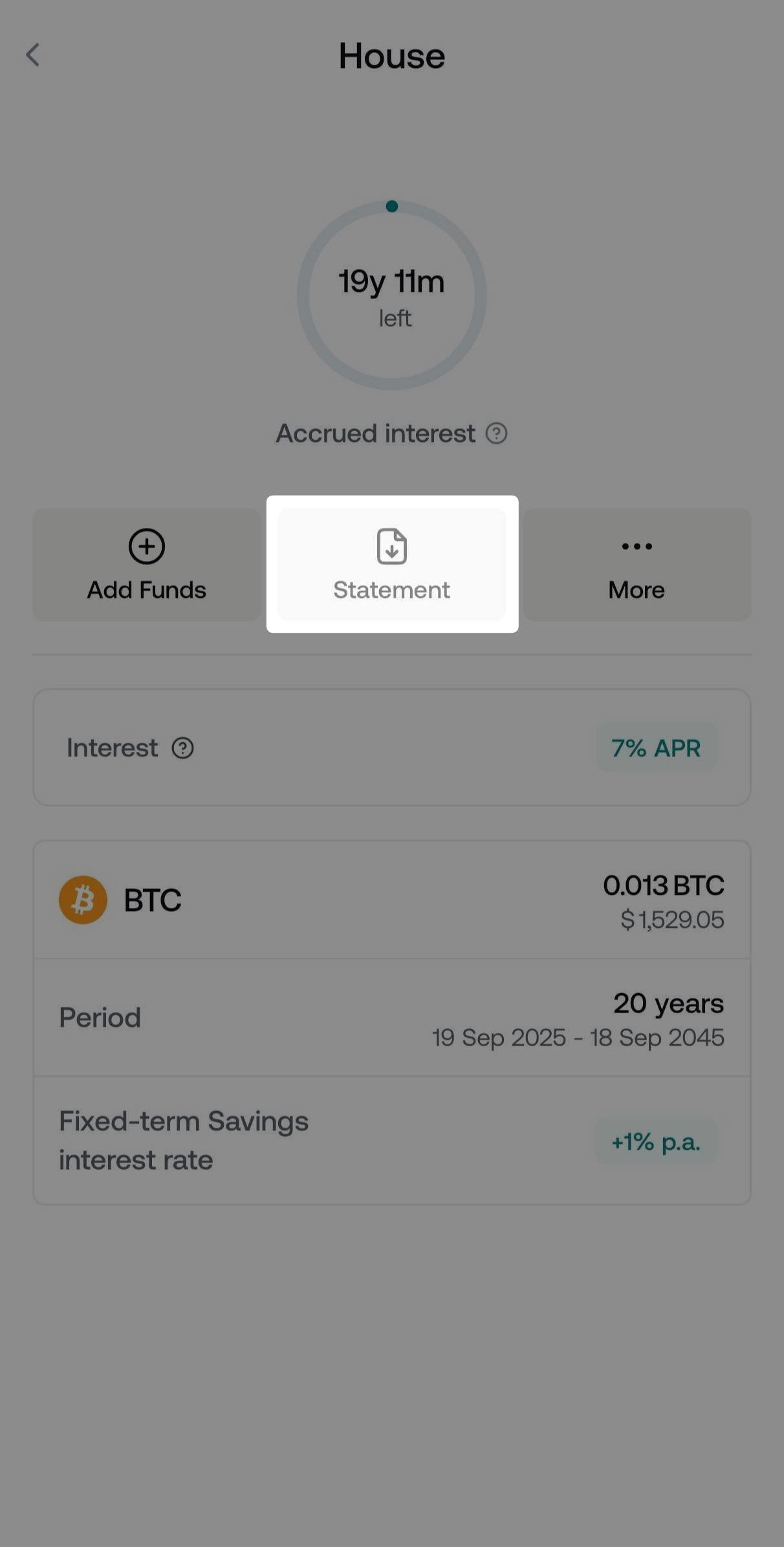

You can check the interest accrued in your vault (active/expired) and download a detailed export by tapping Statement.

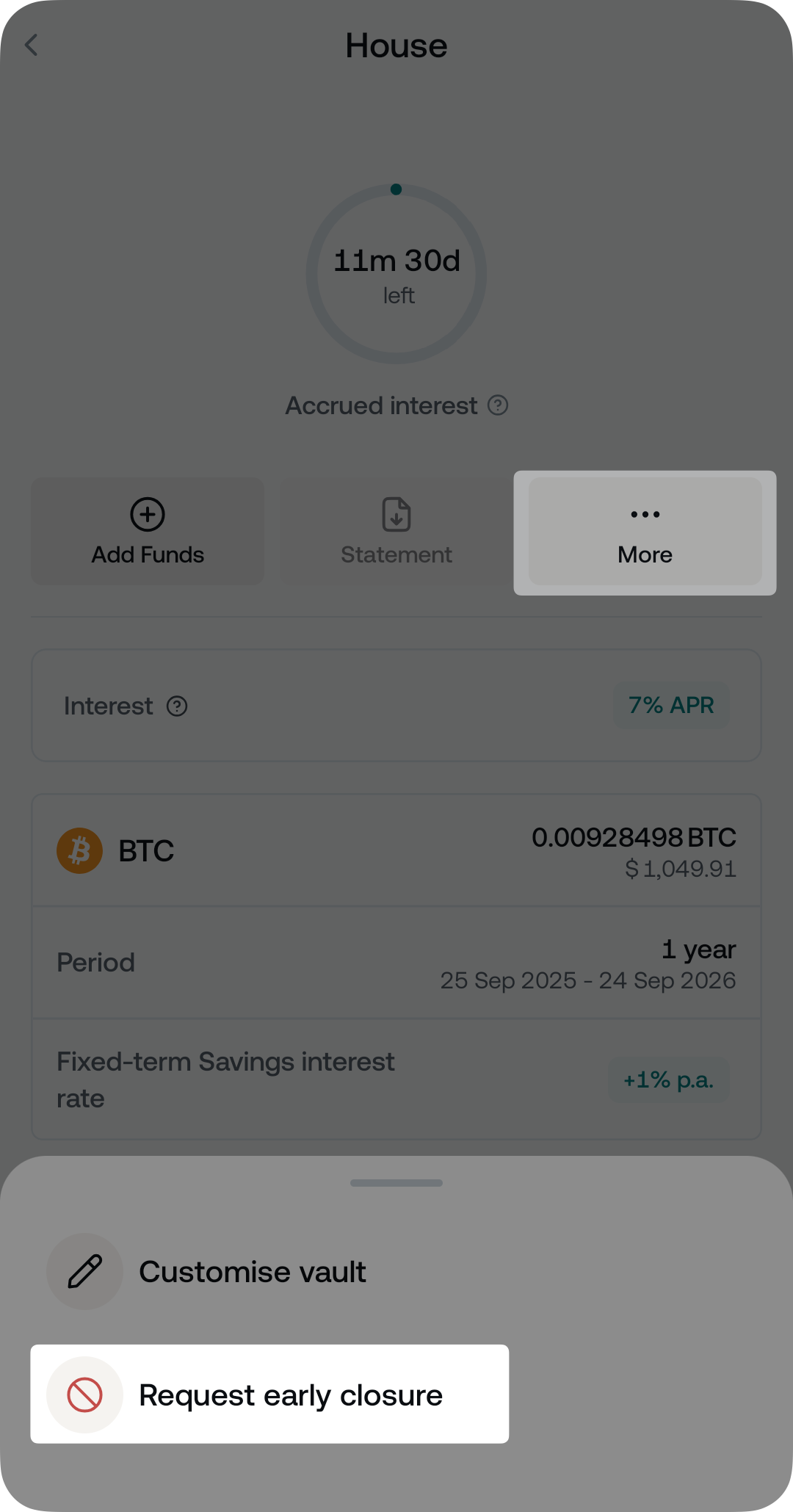

6. Early exit option

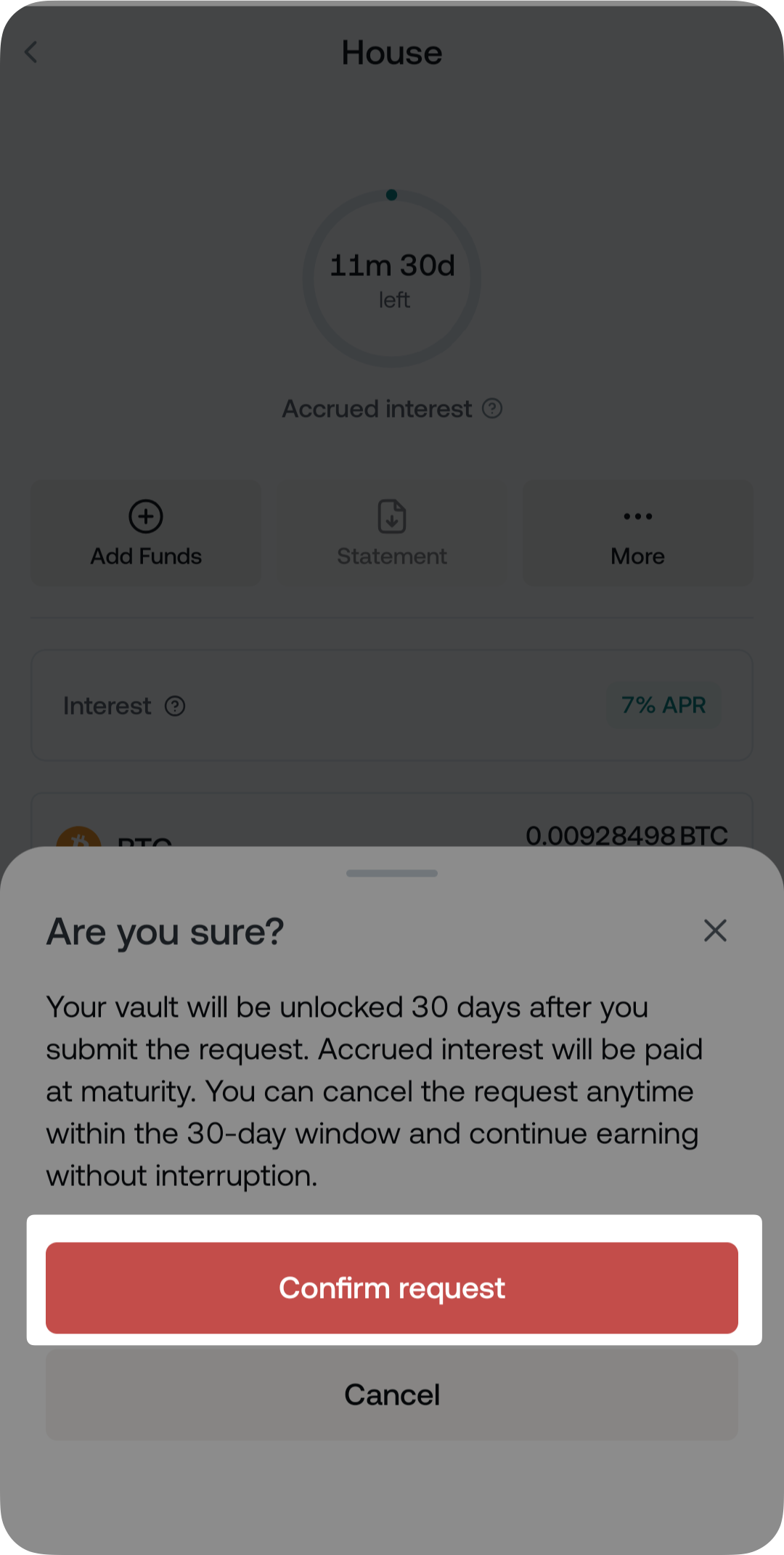

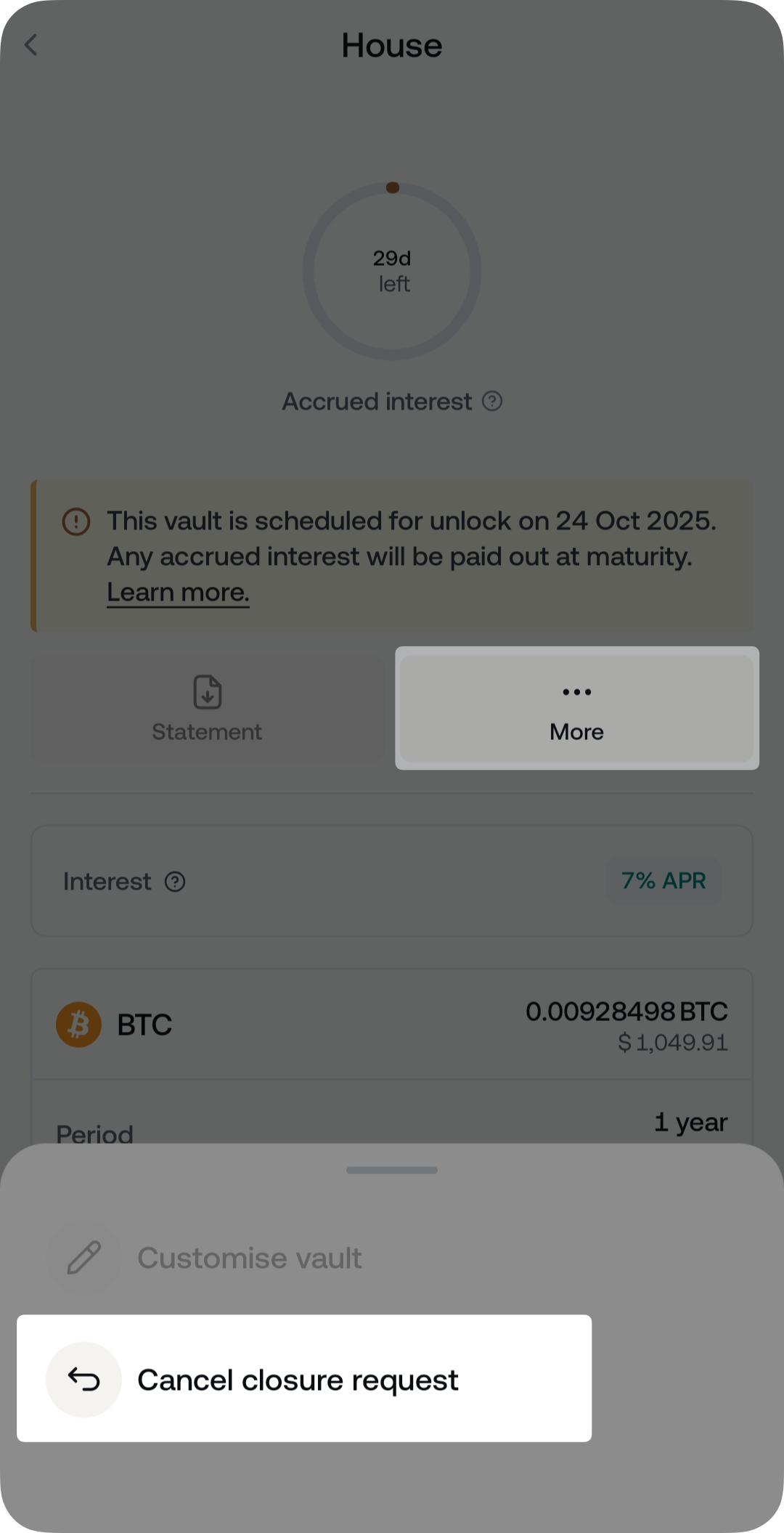

If needed, you can submit a request via the app to exit a vault before its maturity, triggering a 30-day notice period. Your assets will continue to accrue interest until the unlocking of the vault at the end of the notice period.

Once the 30-day notice period is over, the principal and accrued interest will be transferred to your Flexible Savings balance. No penalty is applied for exiting early.

To submit an early closure request, follow the steps below:

1. Open your vault

2. Tap More and select Request early closure

4. Tap Confirm request

You can cancel the termination request at any point during the notice period by tapping More and selecting Cancel closure request. If you do so, your vault remains active and continues as originally planned.

7. Platform access and limitations

- Mobile app (v5.26.0+) is required to create and manage vaults.

- The web platform only allows monitoring Vault balances.

- Vault assets cannot be automatically moved to your Credit Wallet to reduce your LTV.

- Vault assets cannot be exchanged or moved to a fixed term.

- The feature is not available to clients residing in the United Kingdom.

8. Portfolio impact and eligibility

- Vaults count toward your total portfolio balance and Loyalty Tier.

- Interest is not considered toward your portfolio and Loyalty Tier until it’s distributed at maturity.

- Vault balances are included in Referral and Affiliate calculations.

- If your portfolio balance falls below $5,000, or if you opt out of the Savings product:

- Your existing vaults remain active and continue earning until maturity.

- You cannot create new vaults or add funds to existing ones until eligibility is restored.

- You can still edit vault names and icons.

- If your portfolio balance falls below $5,000, the Flexible Savings rate and the Earn in NEXO bonus will no longer apply, and only the 1% vault bonus will remain.

9. Frequently asked questions

- Q: Do I have the option to auto-renew my vaults?

- A: Unlike fixed terms, vaults cannot be auto-renewed.

- Q: Can I open vaults with any crypto?

- A: No, Wealth Vaults is currently only available for BTC.

- Q: How many vaults can I have?

- A: You can have up to 10 Vaults.

- Q: Is there an early cancellation option?

- A: Yes. Early termination follows a 30-day notice model without penalties for withdrawal during that period.

- Q: Will my vault interest change if Nexo updates its Fixed-term bonus rate?

- A: Yes, vaults inherit the highest standard Fixed-term bonus available to your profile. If the base rates change, your Vault’s bonus rate will also update accordingly.

- Q: Can I use BTC in a vault to reduce my LTV or repay a loan?

- A: No. Assets in a vault cannot be transferred to your Credit Wallet or used with any other Nexo product until maturity.

- Q: What happens to my vault if I opt out of receiving interest?

- A: Your vaults will continue to accrue interest until maturity, but you won’t be able to create new vaults or top up existing ones until you opt in again.

- Q: Can I earn interest in NEXO Tokens?

- A: Yes, if Interest payout in NEXO Tokens is enabled in your account settings, you’ll earn an additional bonus, and your interest will be in NEXO Tokens.