How to transfer EUR, GBP, and USD to Nexo

In this article, you will learn how to transfer EUR, GBP, and USD to Nexo:

4. Processing times of EUR, GBP, and USD transfers

5. FAQ

1. How to top up EURx

Currently, EURx top-ups are supported only via SEPA. Refer to the step-by-step guide below to top up EURx from your bank account via SEPA, and keep in mind that the minimum transfer is 100 EUR:

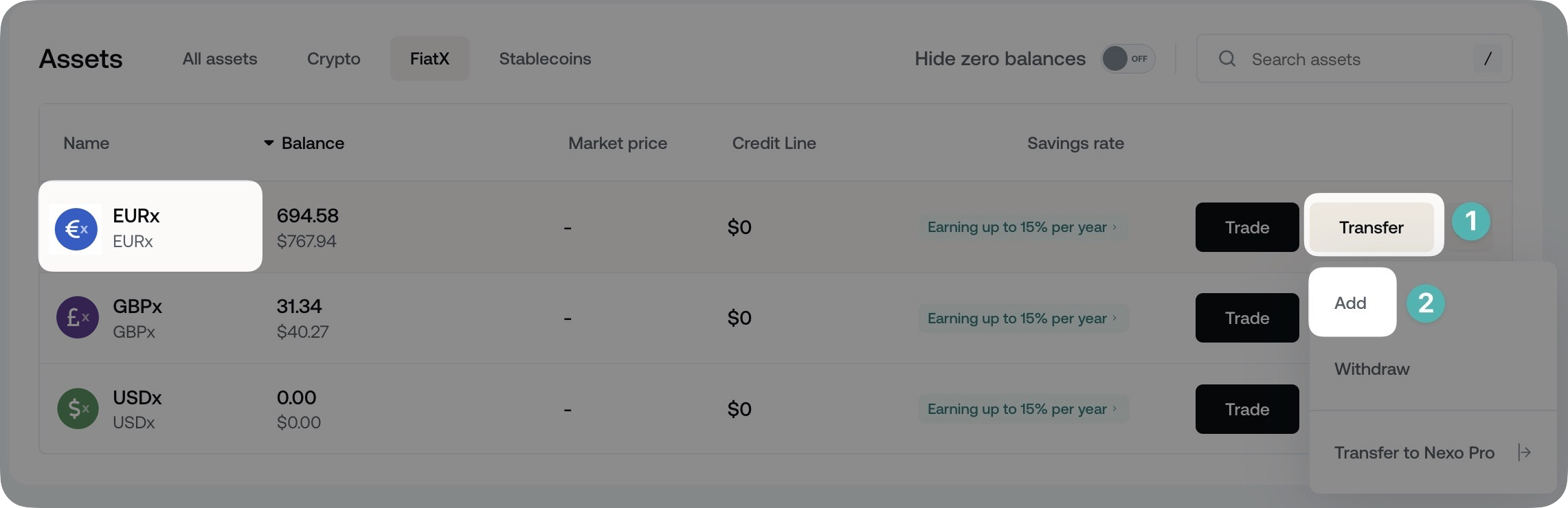

1. Log in and click the Transfer button for EURx. Then select Add.

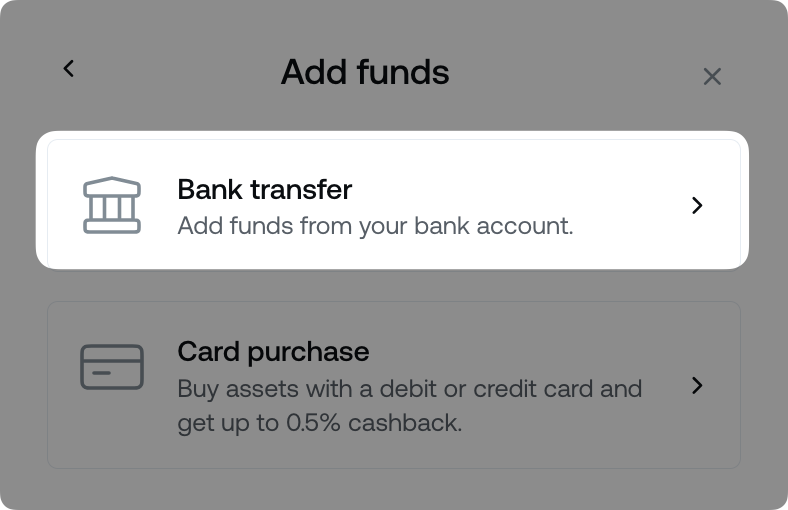

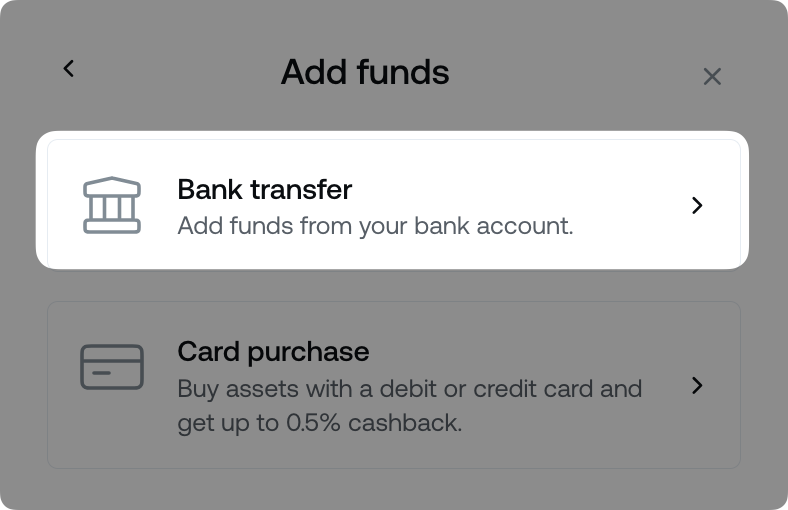

2. From the two available options, choose Bank Transfer.

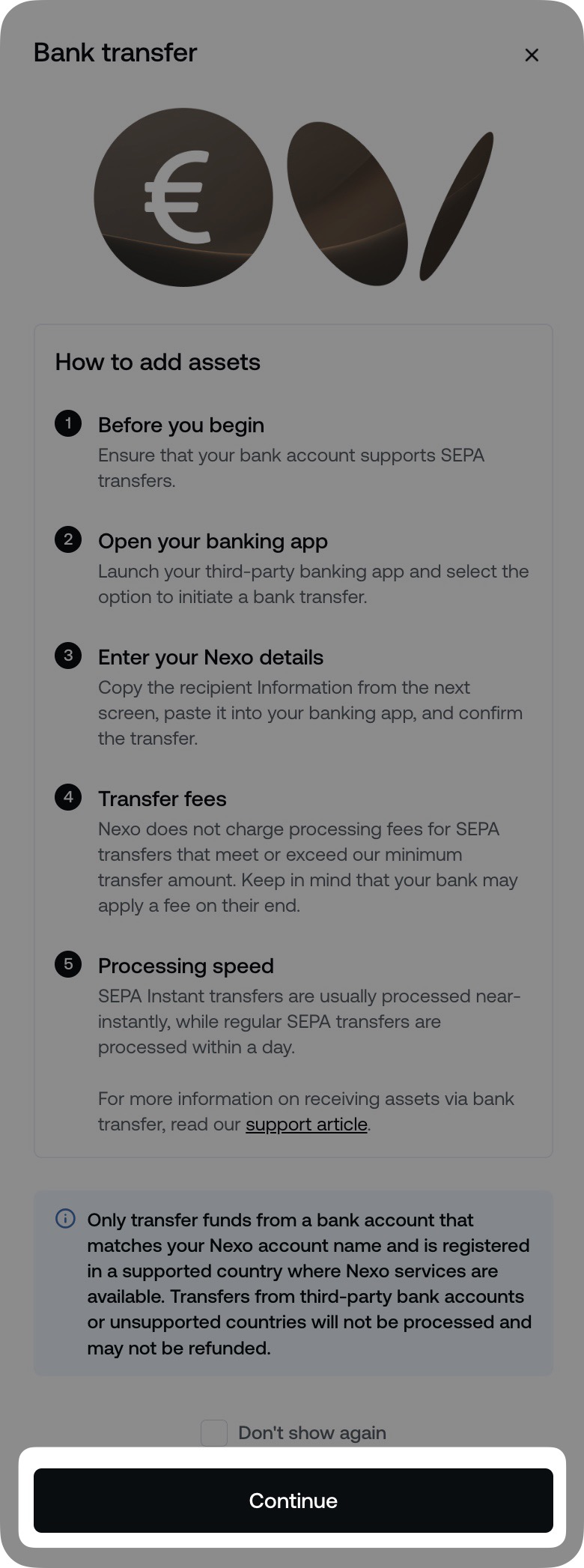

3. Read the onscreen instructions for making a successful bank transfer. Once ready, click Continue.

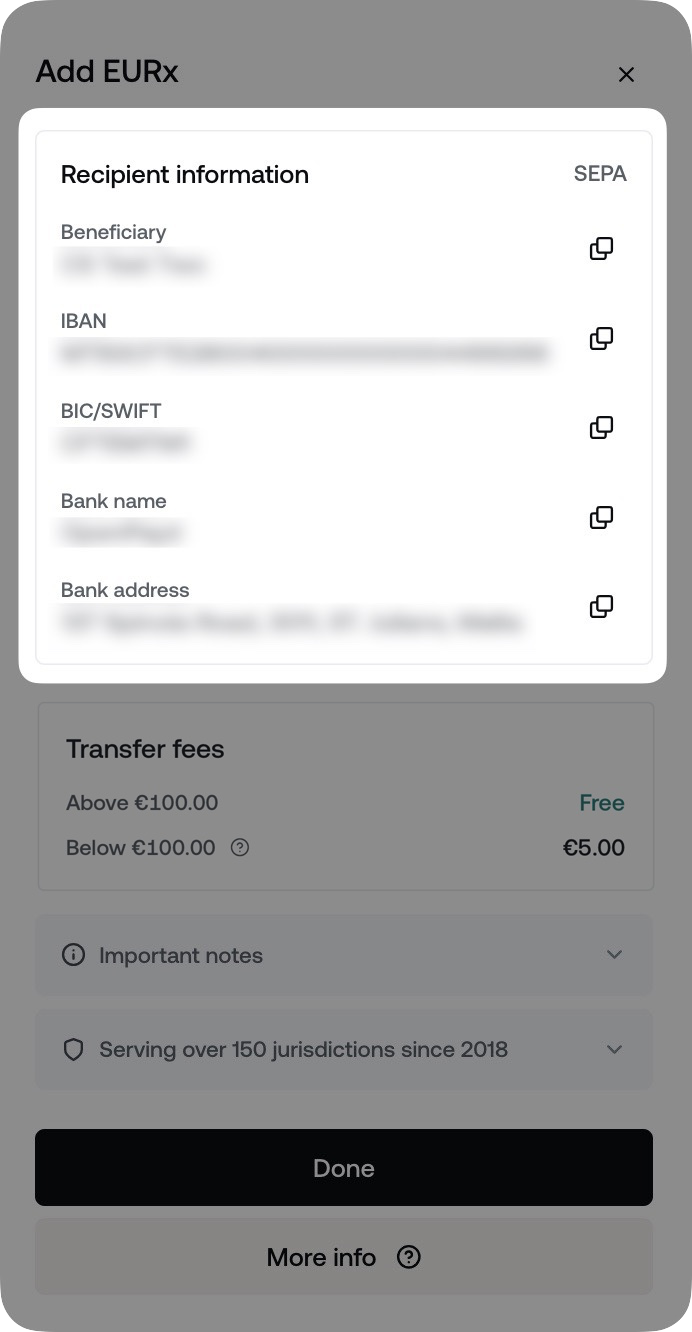

4. Use the on-screen details to initiate a bank transfer to Nexo from your bank. When doing that, make sure to enter your name in the beneficiary field, as it is written on the Add EURx screen.

Note: Depending on your country of residence, a reference code may also be required. In those cases, it will be presented to you in the Recipient Information window.

EUR processing fee

SEPA transfers:

A 5 EUR processing fee in EURx will be deducted from each SEPA top-up below 100 EUR.

Example: If you send 90 EUR to your Nexo account via SEPA, 85 EURx will be added to your Savings Wallet balance. However, note that your bank may also apply a separate processing fee on their end.

Supported countries for EUR transfers

This service is available only if you reside in one of the following jurisdictions:

Countries from the European Economic Area (EEA), Aland Island, Andorra, Angola, Argentina, Australia, Brazil, Cayman Islands, Colombia, French Polynesia, Gibraltar, Guadeloupe, Guernsey, Hong Kong, Isle of Man, Israel, Jersey, Malaysia, Maldives, Martinique, Mauritius, Mayotte, Mexico, Monaco, Montenegro, New Caledonia, New Zealand, Paraguay, Reunion, Serbia, Singapore, South Africa, Switzerland, Taiwan, Thailand, United Arab Emirates, United Kingdom, Wallis and Fatuna Island.

Supported bank countries for EUR transfers

- SEPA transfers: Your bank account must be in a Single Euro Payments Area (SEPA) country and support SEPA transfers.

2. How to top up GBPx

You can choose between two transfer options: FPS or SWIFT. The minimum transfer is 100 GBP for both. Refer to the step-by-step guide below to top up GBPx via a bank transfer:

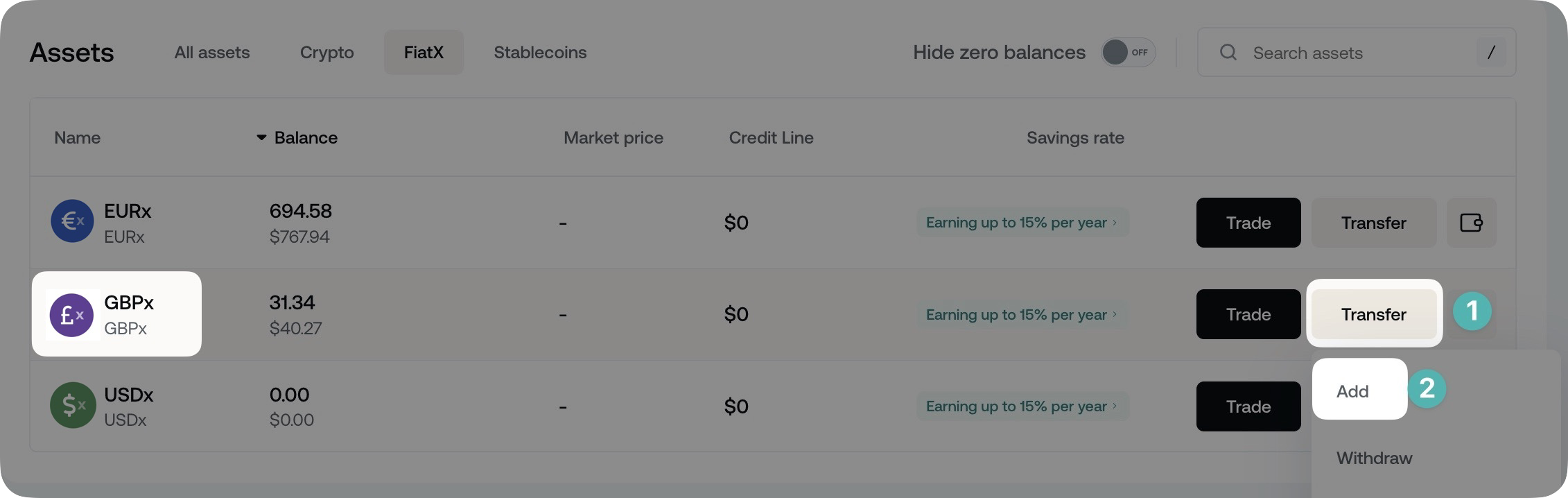

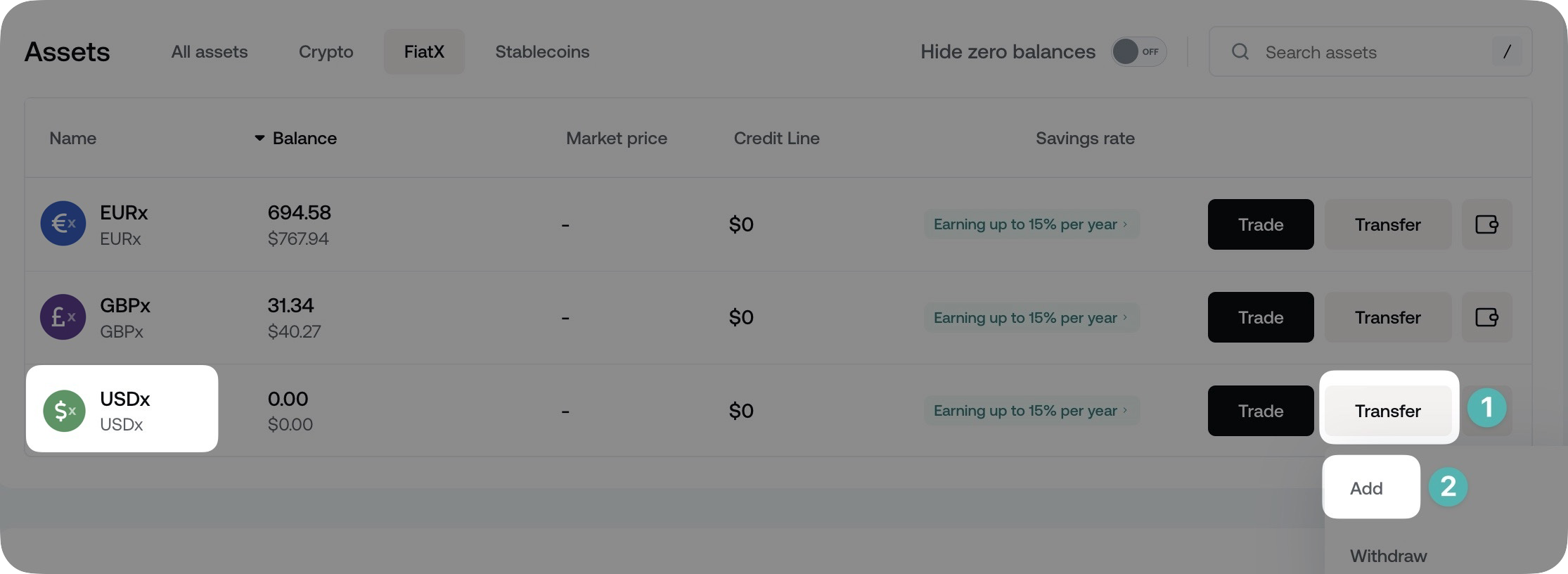

1. Log in and click the Transfer button for GBPx. Then select Add.

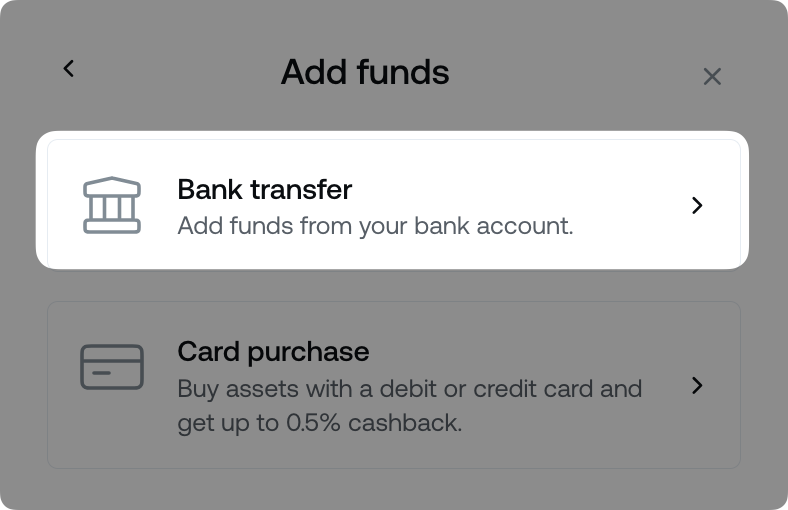

2. From the two available options, choose Bank Transfer.

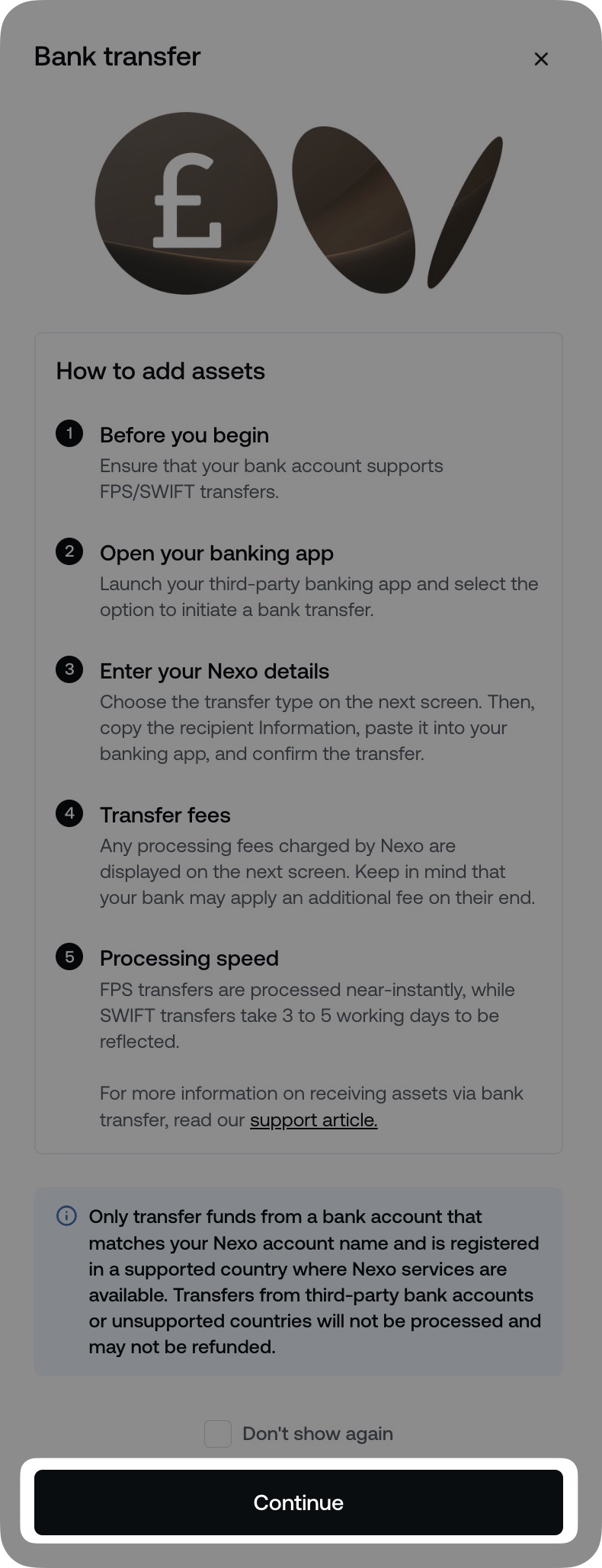

3. You will be presented with transfer instructions. Once you’ve read them, click Continue.

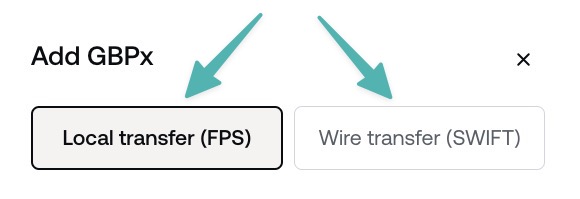

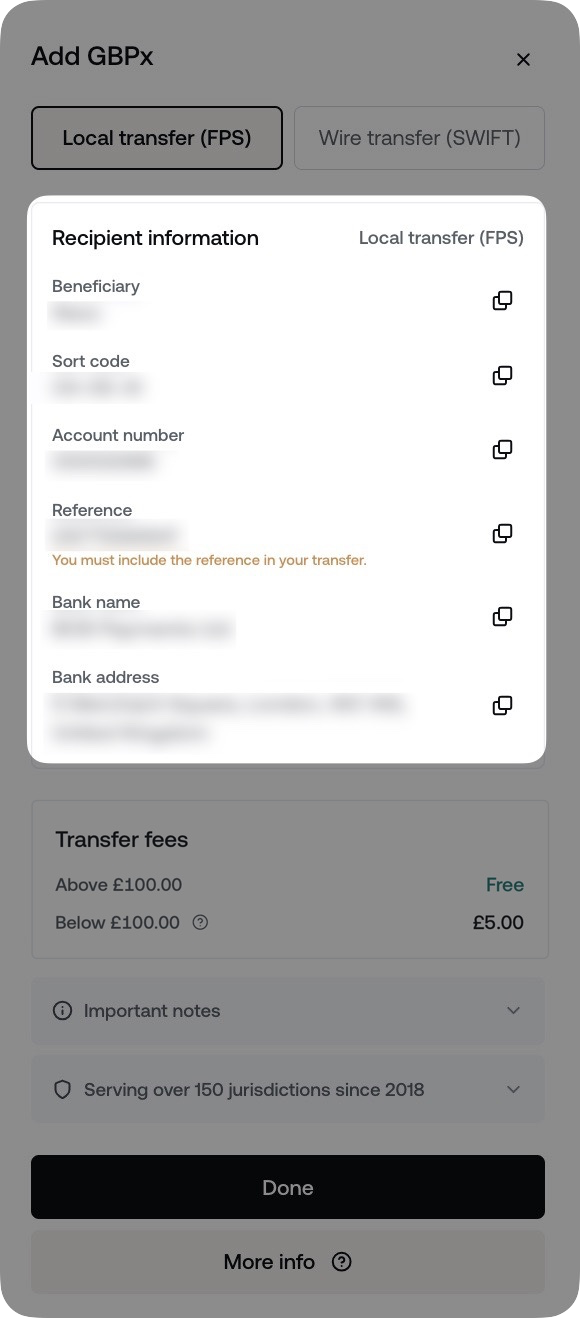

4. Choose between the two available options for GBPx top-ups – FPS or SWIFT.

If the SWIFT option is not visible to you, contact our Client Care team for further assistance.

5. Use the on-screen details to initiate a bank transfer to Nexo from your bank. When doing that, make sure to enter your name in the beneficiary field, as it is written on the Add GBPx screen.

Note: Depending on your country of residence, a reference code may also be required. In those cases, it will be presented to you in the Recipient Information window.

GBP processing fee

FPS transfers:

A 5 GBP processing fee in GBPx will be deducted from each FPS top-up below 100 GBP.

Example: If you send 90 GBP to your Nexo account via FPS, 85 GBPx will be added to your Savings Wallet balance. However, note that your bank may also apply a separate processing fee on their end.

SWIFT transfers:

A 25 GBP processing fee in GBPx will be deducted from each SWIFT top-up, regardless of the amount transferred.

Example: If you send 1,000 GBP to your Nexo account via SWIFT, 975 GBPx will be added to your Savings Wallet balance. However, note that your bank may also apply a separate processing fee on their end.

Unsupported countries for GBP transfers

This service is unavailable if your bank account is located in one of the following jurisdictions:

Afghanistan, Albania, Anguilla, Antigua & Barbuda, Barbados, Belarus, Bosnia and Herzegovina, Burkina Faso, Cambodia, Cameroon, Croatia, Democratic Republic of Congo, Ethiopia, Ghana, Guyana, Haiti, Iraq, Jamaica, Jordan, Lebanon, Libya, Laos, Mali, Mongolia, Morocco, Mozambique, Myanmar, Nicaragua, Nigeria, Palestine, Pakistan, Panama, Philippines, Senegal, Somalia, South Africa, South Sudan, Sri Lanka, Sudan, Tanzania, Trinidad and Tobago, Tunisia, Turkey, Uganda, Ukraine, United Arab Emirates (UAE), United States (US), Virgin Islands, Venezuela, Vietnam, Vanuatu, Yemen, Zimbabwe.

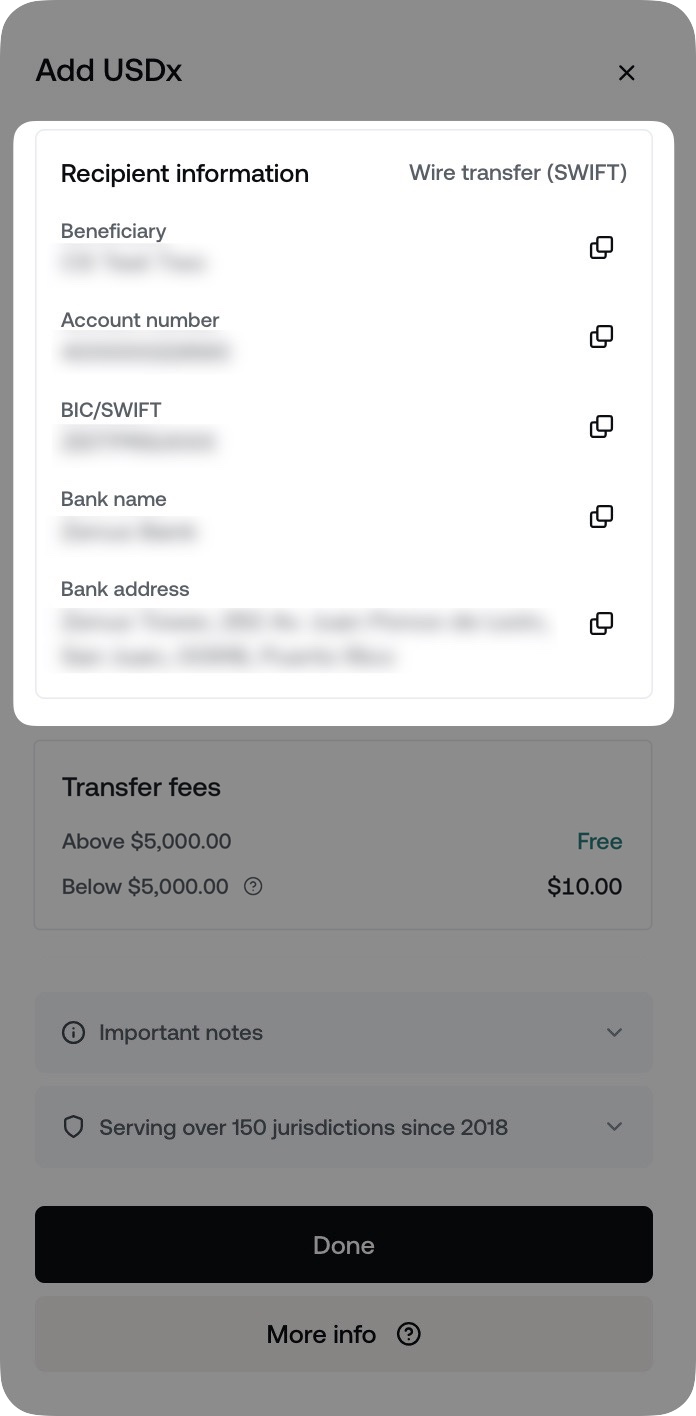

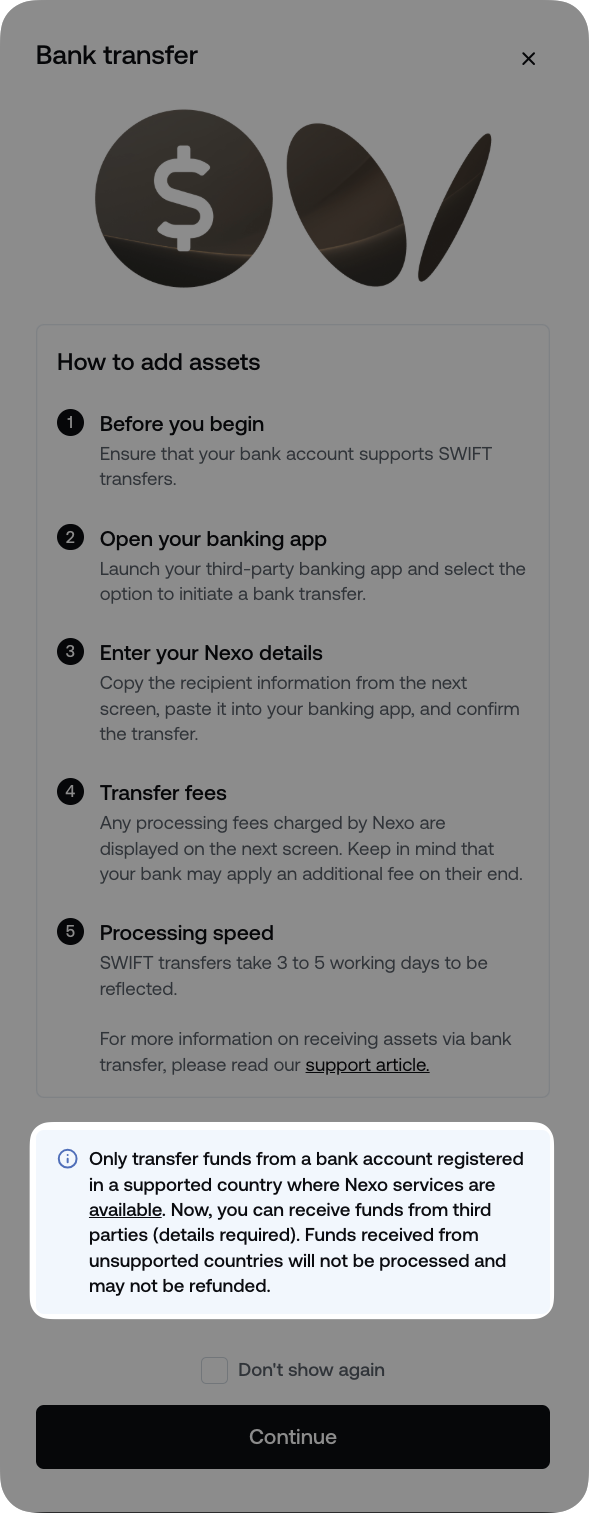

3. How to top up USDx

Currently, only SWIFT transfers are supported for USD, and the minimum transfer is 100 USD. Follow the step-by-step guide below to top up USDx to your Nexo account via a bank transfer:

1. Log in and click on the Transfer button for USDx. Then select Add.

2. From the two available options, choose Bank Transfer.

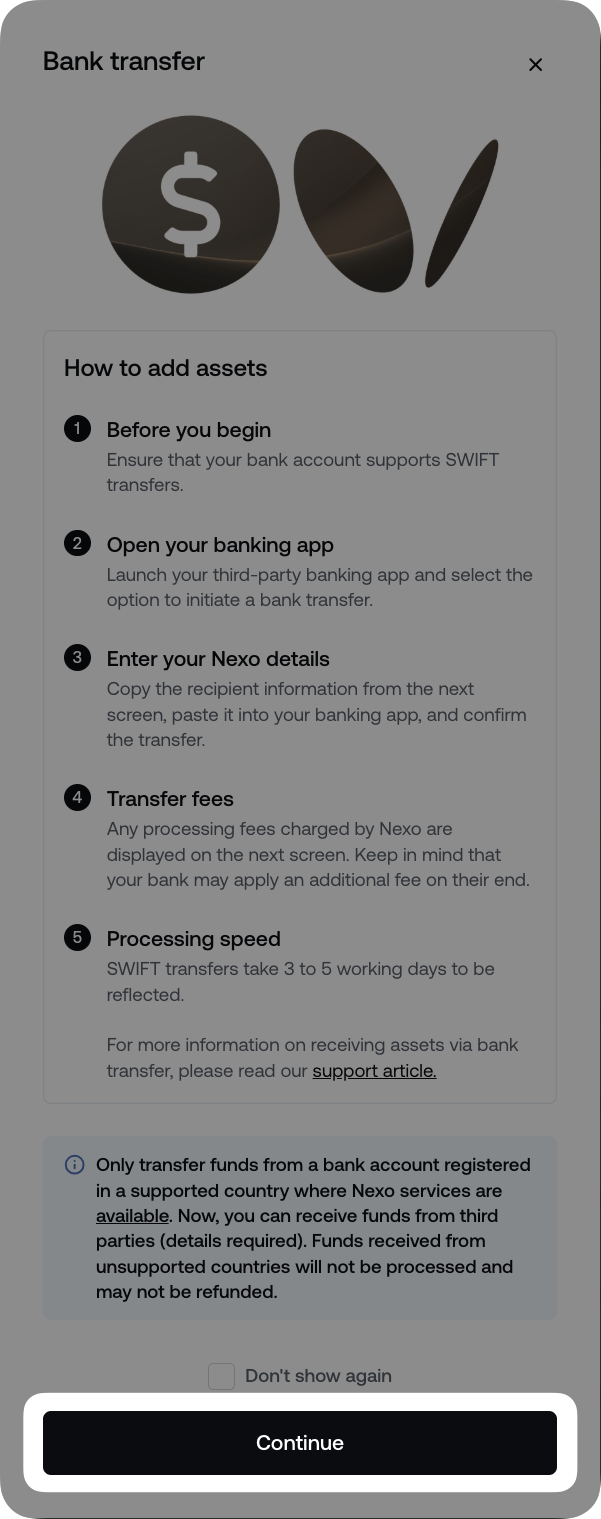

3. You will be presented with transfer instructions. Once you’ve read them, click Continue.

4. Use the on-screen details to initiate a bank transfer to Nexo. When doing that, make sure to enter your name in the beneficiary field, as it is written on the Add USDx screen.

Note: A reference code may also be required depending on your country of residence. In those cases, it will be presented to you in the Recipient Information window.

The option to receive USD from third-party bank accounts is available in selected countries (see the image below). In case this is not indicated on the transfer screen, ensure you only send funds from bank accounts in your own name.

USD processing fee

Transfers below 5,000 USD:

A 10 USD processing fee in USDx will be deducted from the transferred amount.

Example: If you send 3,500 USD to your Nexo account via SWIFT, 3,490 USDx will be added to your Savings Wallet balance. However, note that your bank may also apply a separate processing fee on their end.

Transfers above 5,000 USD:

No processing fee will be applied.

Unsupported countries for USD transfers

This service is unavailable if you reside in or if your bank account is located in one of the following jurisdictions:

Afghanistan, Belarus, China, the Democratic Republic of the Congo, Libya, Myanmar, Nicaragua, the State of Palestine, South Sudan, Ukraine, and Venezuela.

4. Processing times of EUR, GBP, and USD transfers

If you are wondering how long your transfer would take, below you can find the processing times associated with each currency and payment method:

EUR

-

- SEPA Instant – processed near-instantly

- SEPA – processed within 1 business day

GBP

-

- FPS – processed near-instantly

- SWIFT – processed within 3 to 5 business days

USD

-

- SWIFT – processed within 3 to 5 business days

5. FAQ

- Q: Can I send funds from a third-party account?

-

A: Depending on your country of residence, you can receive USD transfers from third parties. If this option is available, you’ll find specific guidance in your account’s USD transfer section. However, if this option is not supported in your country, USD transfers from third-party bank accounts will not be processed and may not be subject to refund.

EUR and GBP transfers from third-party bank accounts will not be processed and may not be subject to refund. Ensure you’re transferring EUR and GBP from a bank account that matches the name associated with your Nexo account.

-

- Q: Does it matter where my bank account is located?

- A: Make sure you’re transferring funds from a supported bank country. Transfers from a bank account opened in an unsupported country will not be processed and may not be subject to refund.

- Q: What if my top-up is below the processing fee?

- A: Transfers below the respective fee amount will not be processed or refunded.

- Q: Can I top up GBP from my Wise and Monese accounts?

- A: Transferring GBP through Wise (formerly TransferWise) and Monese is not an option because the respective money transfer service will decline the transfer based on their policies.

- Q: Do I have to enter a Reference code?

- A: A Reference code is required only in certain cases, depending on the top-up currency and your country of residence. Please refer to the respective top-up screen in your Nexo account to see if this unique identifier is required.

6. Important notes

- After a successful EUR/GBP/USD transfer, the amount is automatically exchanged to its EURx, GBPx, or USDx equivalence.

- In case of a refund, all bank fees and/or taxes associated with the refund will be subtracted from the refunded amount.

- The Wire Transfer (SWIFT) option is being revamped, and we temporarily cannot process EUR SWIFT top ups. Such transfers may be returned to the original bank account. SEPA top-ups remain uninterrupted, and you may use this transfer type instead.

- If the first top-up via bank transfer is credited within 24 hours of completing Identity verification, a 24-hour cool-off period for crypto withdrawals will be placed on your account. Subsequent operations of that type will not reset the cool-off period.

- Transferring EUR, GBP, and USD to a Nexo account is currently unavailable to residents of Syria.