How to take out a loan in stablecoins

Our Borrow product allows you to withdraw a crypto credit in stablecoins: USDT or USDC.

Unlike withdrawing the proceeds to your bank account, loan withdrawals in stablecoins will be automatically placed into your Savings Wallet. You will then be able to swap these assets on our Exchange or withdraw them to an external wallet.

Keep in mind that Platinum users have one free FIATx or crypto withdrawal per month (either on the Bitcoin, Ethereum, BNB Smart Chain (BEP-20) or Celestia networks or for USDT withdrawals over the TRON network).

In this article:

1. Step-by-step instructions

1. Log in your Nexo account.

2. Top up crypto assets or buy crypto on the Nexo Exchange if you have not already.

You can find a list of supported assets that can be used as collateral here.

Important: Please make sure to only transfer supported crypto assets over the respective blockchain network supported by Nexo.

Topping up unsupported assets to your Nexo account or transferring assets via an unsupported network will result in permanent loss.

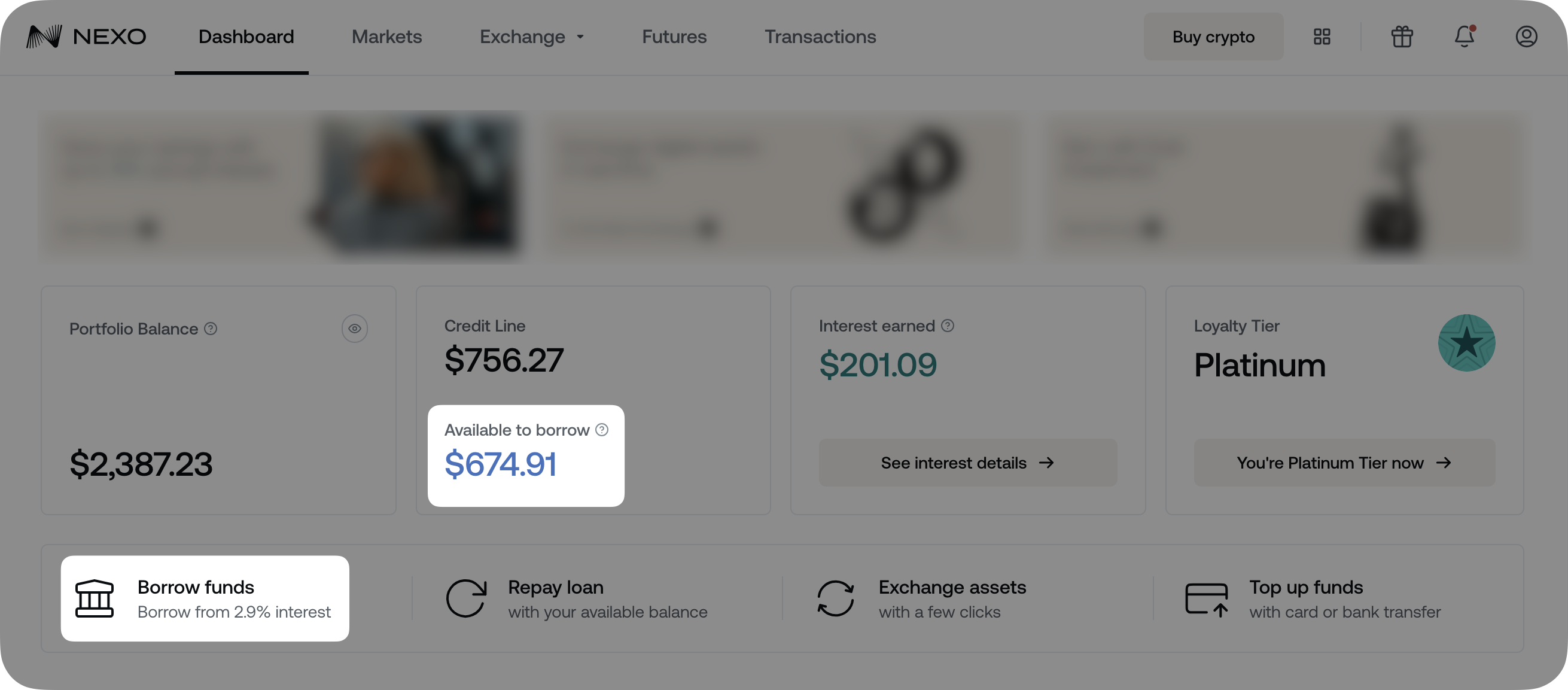

3. You can see the available loan amount under Available to borrow on your Dashboard.

Click Borrow funds to request a loan.

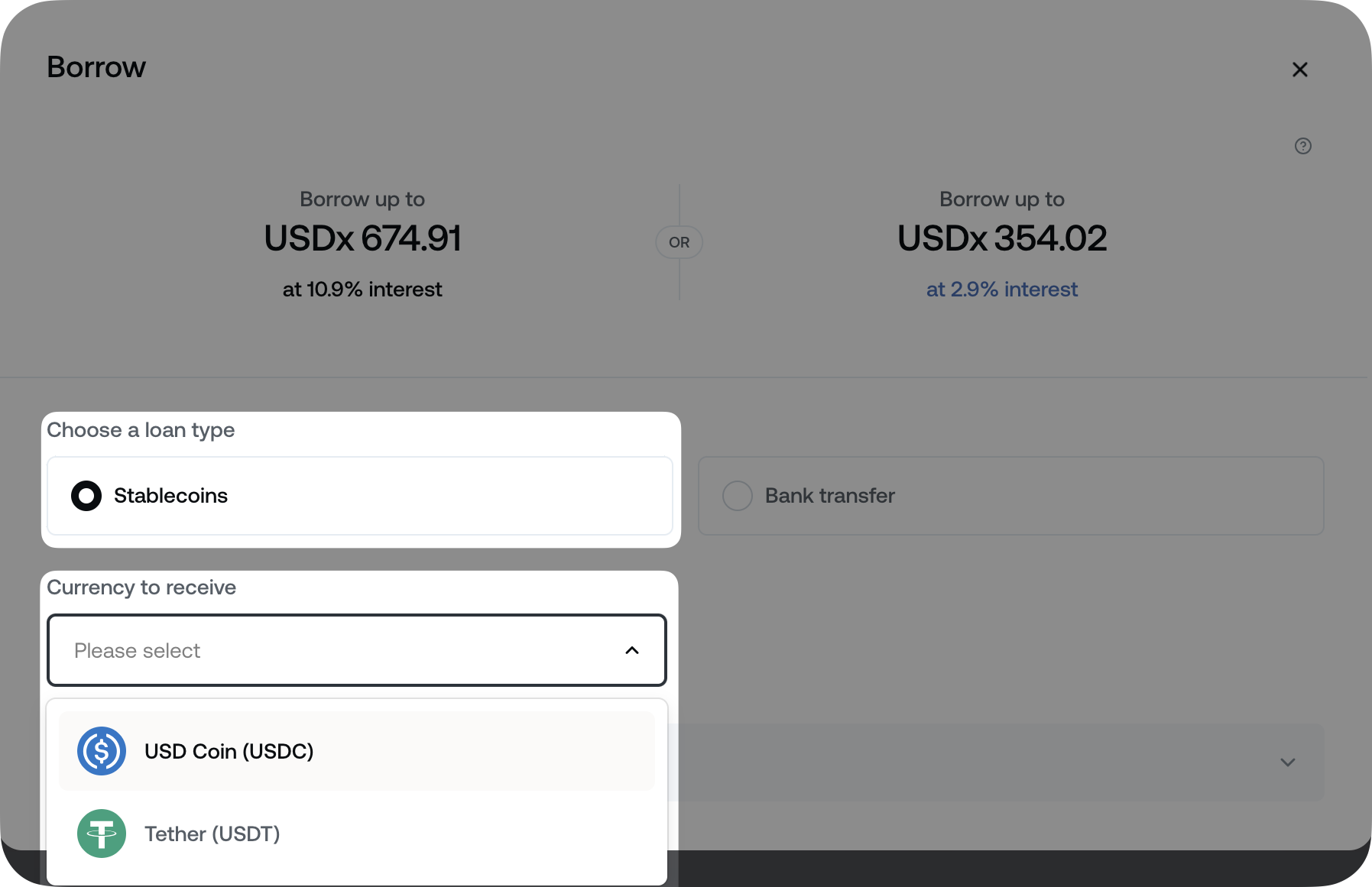

4. Select one of the two available stablecoins.

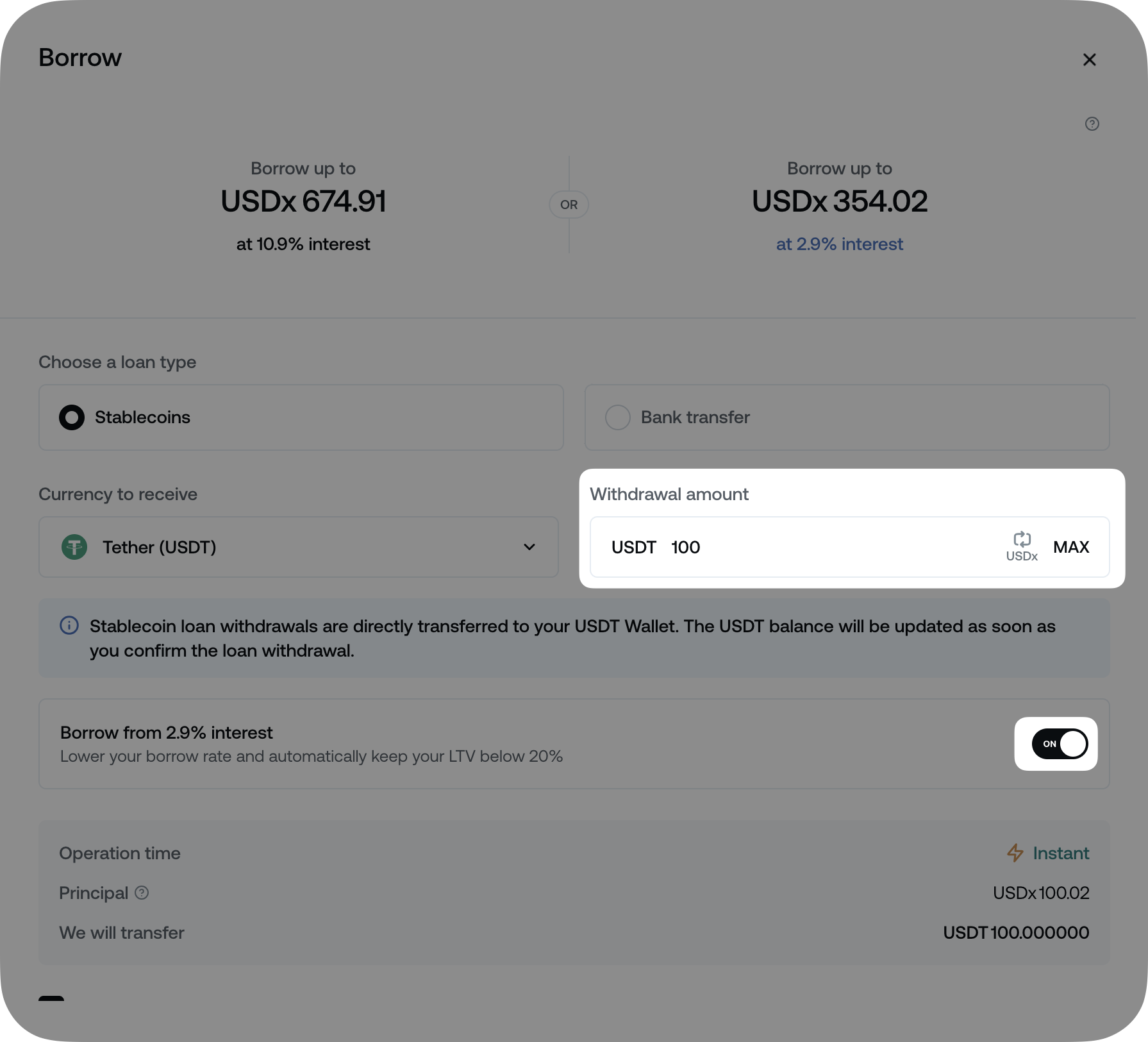

5. Enter the amount you want to borrow.

The Low-Cost Loan option may be available if you have access to our Loyalty Program and your tier is either Gold or Platinum with enough crypto collateral. The Borrow from 2.9% interest toggle is off by default.

If you enable it, the system will transfer the necessary collateral amount to bring your Credit Line wallet LTV below the 20% threshold.

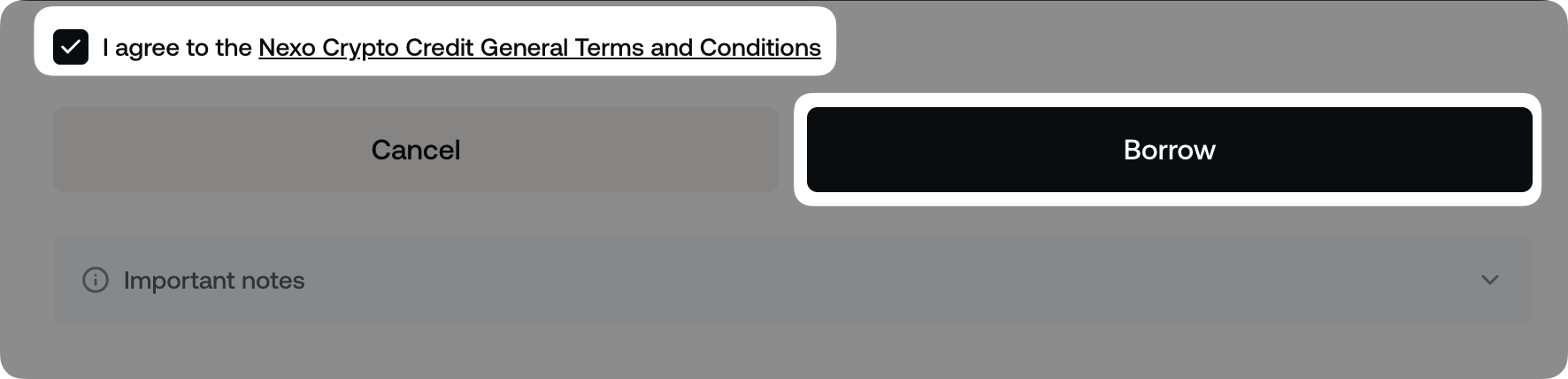

6. Agree to the Nexo Crypto Credit General Terms and Conditions and click Borrow to submit your loan withdrawal request.

7. Confirm your loan withdrawal by entering your Two-Factor Authentication code (2FA).

8. Congratulations! The stablecoin you selected (USDT or USDC) has now been transferred to your Savings Wallet and is visible in the respective balance.

2. Important notes

- Interest is added to your outstanding balance daily at 00:00 UTC.

- The interest applied to your loans is compound interest, i.e., it is calculated based on both the initial principal and the accumulated interest.

- The minimum interest charge is 0.01 USD.

How to take out a loan in stablecoins?

To allow for a broader and vast utilisation that meets the dynamic demands of the crypto space, we offer our Borrow product not only in 40+ fiat currencies but in stablecoins as well – USDT, USDC and BUSD. It is important to note that, unlike fiat loans, loan withdrawals in stablecoins will be automatically placed into your Nexo wallet. The respective balance will be immediately updated, and you will then be able to either convert the assets on our exchange or withdraw them to an external wallet. Keep in mind that the number of free withdrawals depends on our loyalty tier, as explained in this article.

Tip: BUSD transfers over the Binance Smart Chain network are Fee-free and do not count towards the number of free withdrawals applicable to your loyalty tier. The same applies to USDT withdrawals over Polygon.

Taking out a loan from Nexo is pretty straightforward. All you need to do is log into your account, locate the Borrow section on the main page and follow the easy and intuitive steps:

1. Pick one of the three available stablecoin currencies.

2. Type in the amount you would like to borrow and choose whether you would like to opt for a Zero-Cost loan. Keep in mind that the Zero-Cost toggle will be turned off by default. Enabling it will indicate the system to lock up sufficient collateral so your Credit Line wallet LTV afterwards is below the 20% threshold.

3. Please also keep in mind that you need to agree to the Nexo Crypto Credit General Terms and Conditions in order to submit your loan withdrawal request.

4. Once you have agreed to the terms, the ‘Withdraw’ button will become active and you will be free to proceed by clicking on it.

5. After that, you will be prompted to confirm your loan withdrawal via the Two-Factor Authentication code that is usually delivered to your mobile device by SMS or through an authentication app.

6. Congratulations! You have successfully taken out a loan in a stablecoin, and your USDT, USDC or BUSD balance on your Nexo account has been updated automatically to reflect the new amount.

You should also know that:

- Interest is added to your outstanding balance daily at 00:00 CET

- The interest applied to your loans is compound interest i.e. it is calculated based on both the initial principal and the accumulated interest

- The minimum interest charge is 0.01 USD