How to earn interest with Fixed-term Savings

In this article:

1. What are the benefits and the interest rates

2. Flexible Savings vs Fixed-term Savings

3. How to start earning interest with Fixed-term Savings

- Top up funds

- Minimum portfolio balance requirement

- Opt in to earn interest

- Create a fixed term

- Eligible assets and minimum required amount per asset

- Due (unlock) date

4. What Fixed-term Savings options are available

5. How to exchange assets held in a fixed term

- Supported asset pairs

- How it works

- What are the Fixed-term Exchange limits and fees

- Daily quotas

- How to exchange my fixed term

6. How to benefit from the highest interest rates

7. In what currency is the interest paid out and how is it calculated

8. How to earn in NEXO Tokens for higher interest rates

9. What is the Automatic renewal feature

10. How to check the interest on your active term

11. What is the Fixed-term Savings unlock feature

12. FAQ

1. What are the benefits and the interest rates

Fixed-term Savings lets you lock your digital assets for a set period to earn extra interest of up to 15% annually. Here are the main benefits of this product:

- Diversification: For your mid and long-term goals, combine the stable, high-yielding returns of Fixed-term Savings with daily interest payouts and the flexibility to withdraw funds anytime with Flexible Savings.

- Flexible HODLing: You can have up to 50 terms per asset simultaneously, which allows you to add more assets to your Fixed-term Savings and earn Nexo’s yields without waiting for your previous terms to expire.

- Extended yield: By enabling the Automatic renewal option, you can effortlessly extend the length of your term.

The exact interest rate depends on the specific asset, the duration of the term, your Loyalty Tier, and whether you choose to earn interest in-kind or in NEXO Tokens.

Below are the annual interest rates in Fixed-term Savings for some of the most popular assets on Nexo’s platform:

- USDC: Up to 14%

- BTC: Up to 7%

- ETH/XRP/SOL/BNB: Up to 8%

- POL: Up to 7%

- NEXO: Up to 12%

- DOT: Up to 15%

- EURx/GBPx/USDx: Up to 15%

2. Flexible Savings vs Fixed-term Savings

Understanding the differences between Flexible Savings and Fixed-term Savings can help in choosing the option that aligns best with your individual preferences and financial goals. Flexible Savings offers more adaptability, while Fixed-term Savings provides higher interest rates for longer commitments. Below, you can find a breakdown of the key characteristics of both savings options.

Flexible Savings:

- With Flexible Savings, you can earn up to 14% annually.

- By default, assets credited to your Nexo account generate interest through Flexible Savings.

- Interest is paid out automatically every day to your account.

- Assets are available at any time for various operations, such as swaps on Nexo’s Exchange, loan repayments, withdrawals, and others.

Fixed-term Savings:

- Fixed-term Savings offers the highest interest rates – up to 15% annually.

- Depending on the specific asset, you can lock your funds in fixed terms for 1, 3, or 12 months.

- Similar to Flexible Savings, assets in Fixed-term Savings accrue interest daily, but the earned interest is paid in a single transaction once the term ends.

- Assets locked in fixed terms become accessible and can be withdrawn only after the term ends.

- Assets in active terms can decrease your LTV in case you are at risk of automatic loan repayment only if the Fixed-term Savings unlock option is enabled.

3. How to start earning interest with Fixed-term Savings

Top up funds

Top up your Nexo account by transferring crypto or EUR/GBP/USD to your Nexo account. Alternatively, you can buy digital assets with your credit/debit card.

Minimum portfolio balance requirement

Ensure that you maintain a portfolio balance of at least $5,000 in value to earn interest on your digital assets and access Nexo’s loyalty Program with its perks.

If you already have existing fixed terms and your portfolio balance falls below $5,000, they will continue to accrue interest at the Base Loyalty Tier rate plus the respective fixed-term bonus rate. The bonus rate for earning in NEXO Tokens will not be included. The assets will be unlocked at the term’s due date, regardless of the Automatic renewal status, and the accumulated interest will be credited to your Savings Wallet.

To create new fixed terms and ensure uninterrupted earnings at the respective Loyalty Tier rates for assets held in fixed terms, your portfolio balance must satisfy the minimum portfolio balance requirement. You can learn more in this article.

Opt in to earn interest on your digital assets

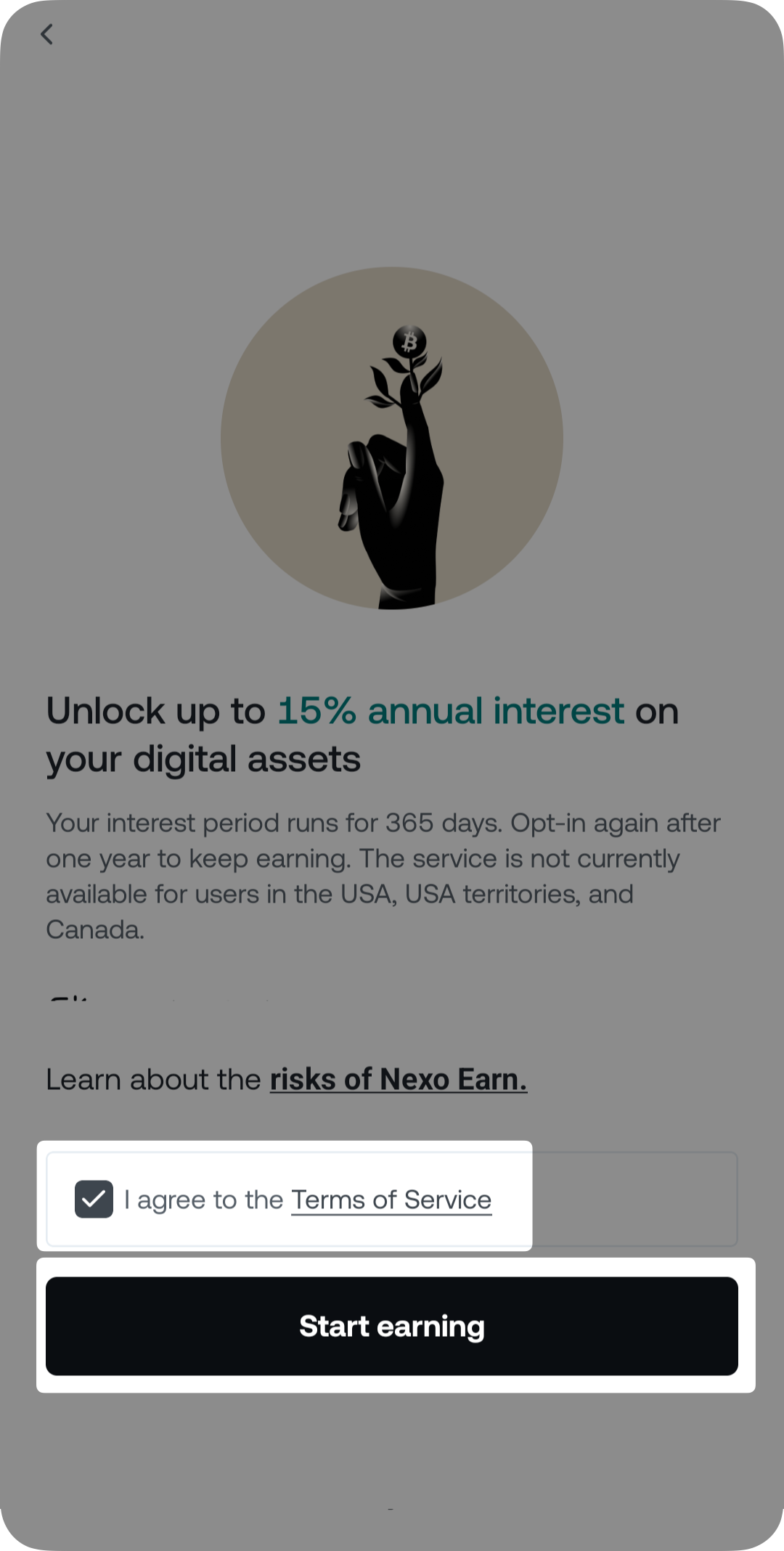

Clients residing in countries outside EEA jurisdictions must opt in to receive interest on their assets. This agreement lasts for 365 days but can be cancelled оr resumed at any time, depending on your preference. Here is how to opt in to earn interest:

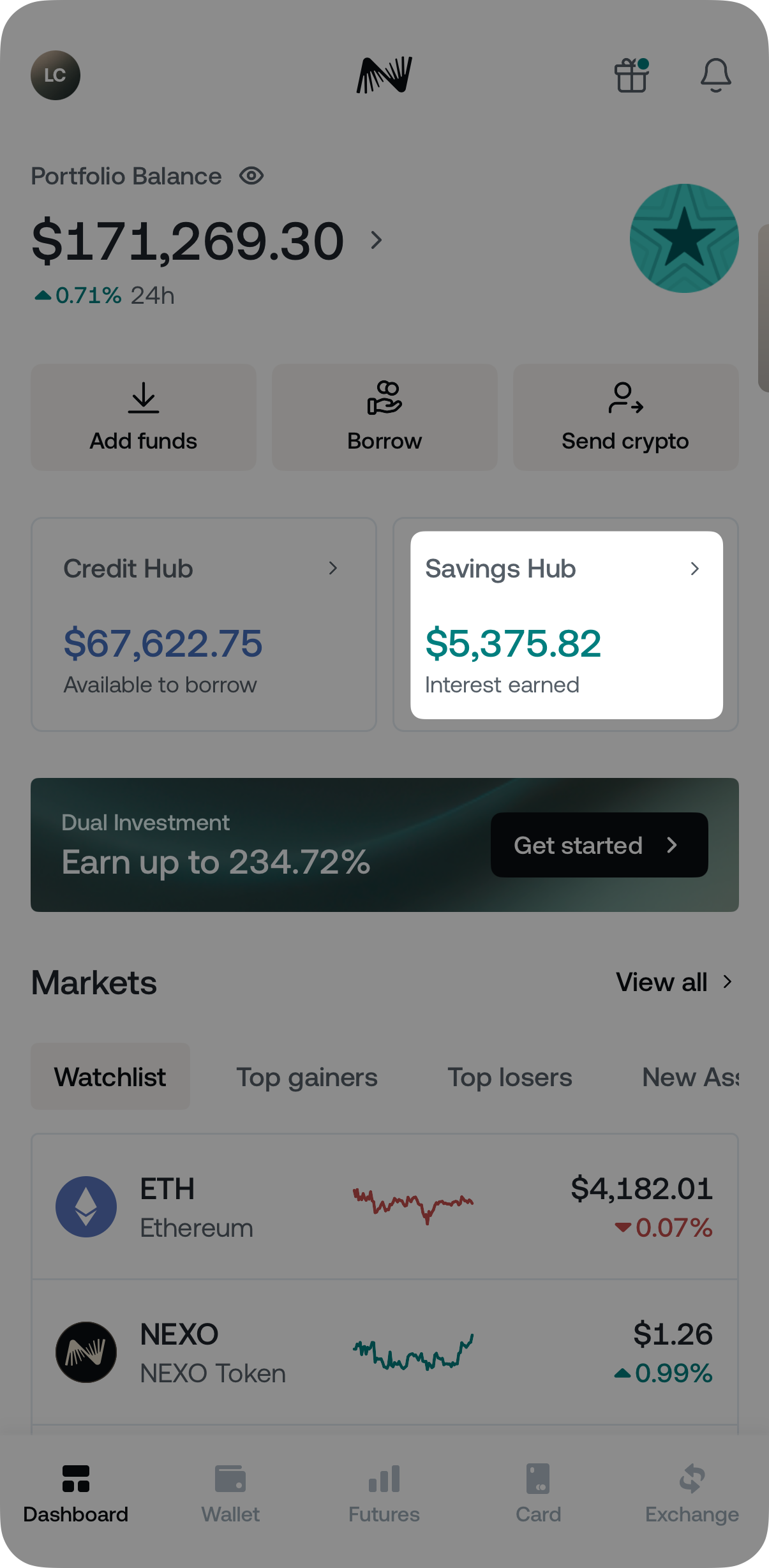

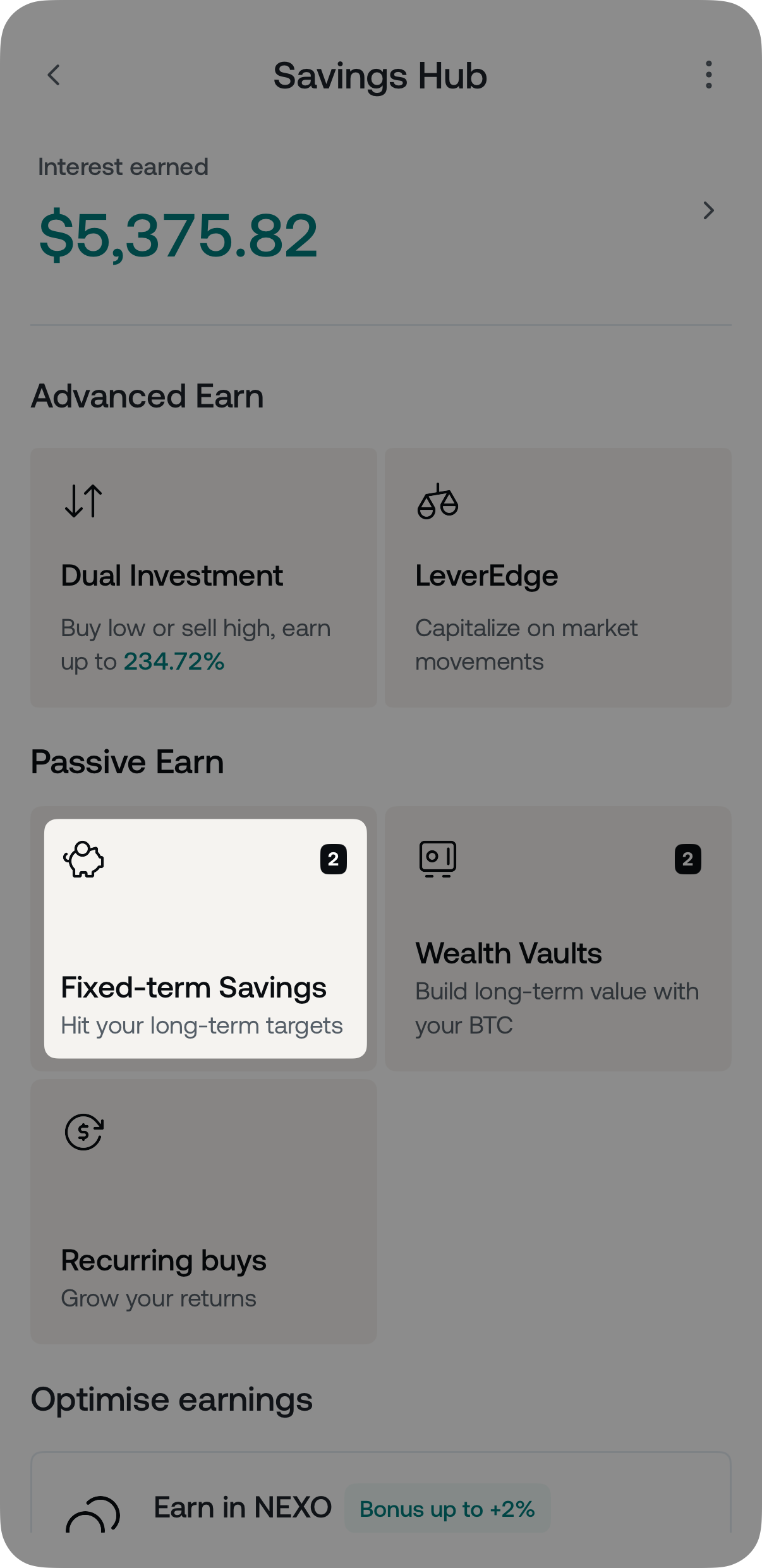

1. Log in to your Nexo account and tap the Savings Hub.

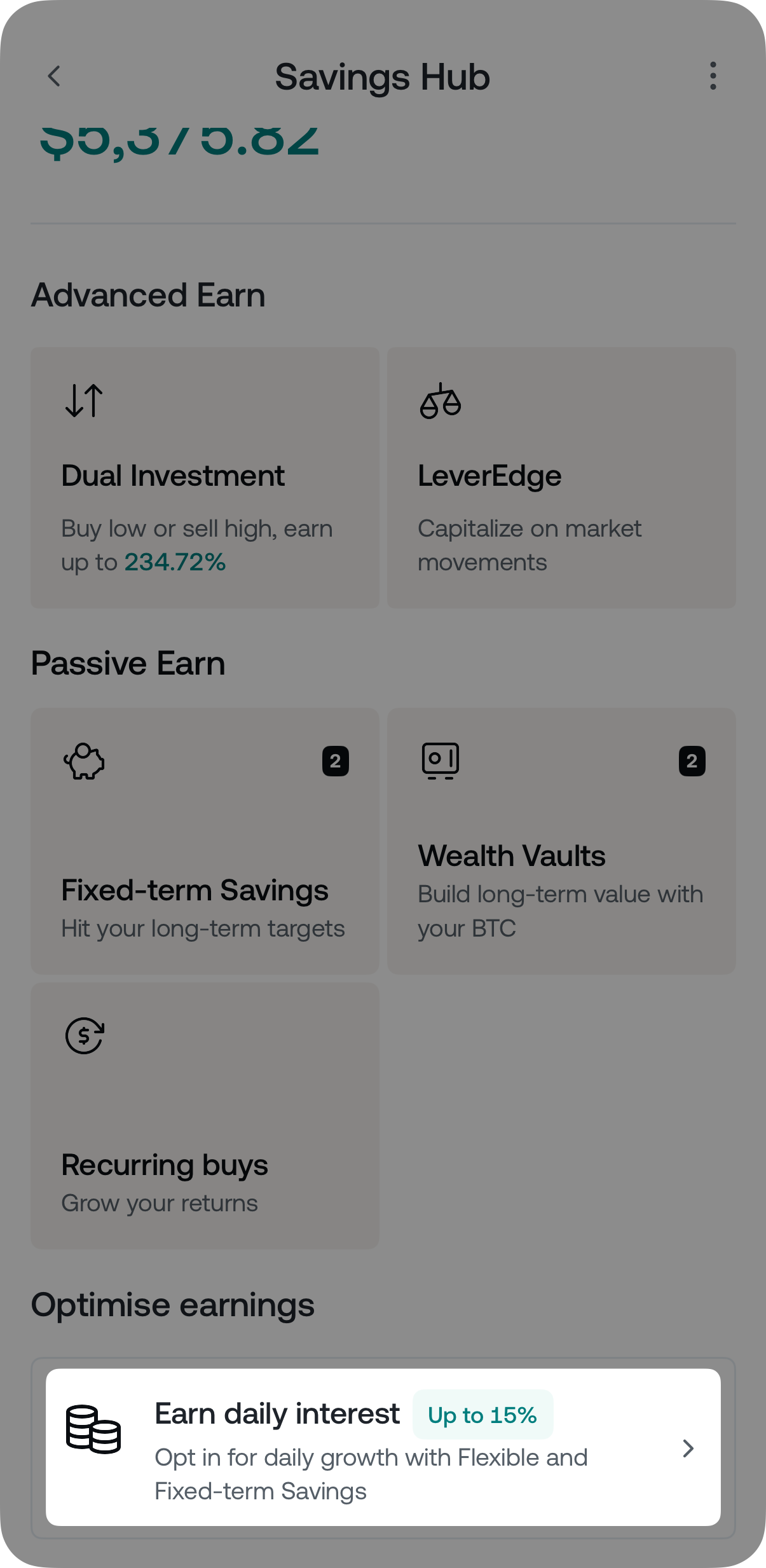

2. Select Earn daily interest in the Optimise earnings section.

3. Agree to the Terms of Service, and tap Start earning.

You are all set! You can now earn interest on your digital assets.

Note: If using the web platform, you can opt in to receive interest by navigating to My Profile > Settings > Savings.

Create a fixed term

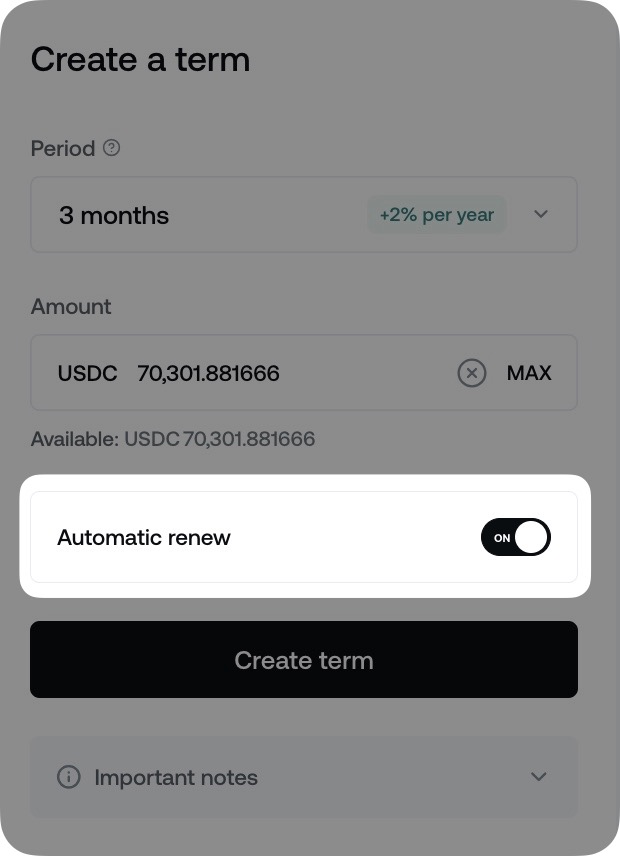

Create a term based on the asset and your duration preference (e.g., 1, 3, or 12 months). To do that, follow these steps:

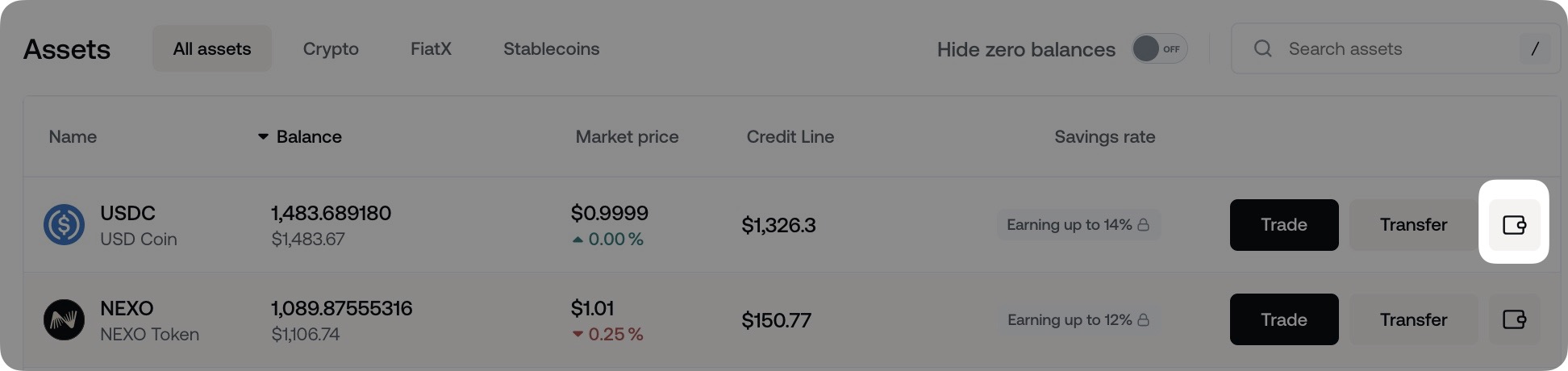

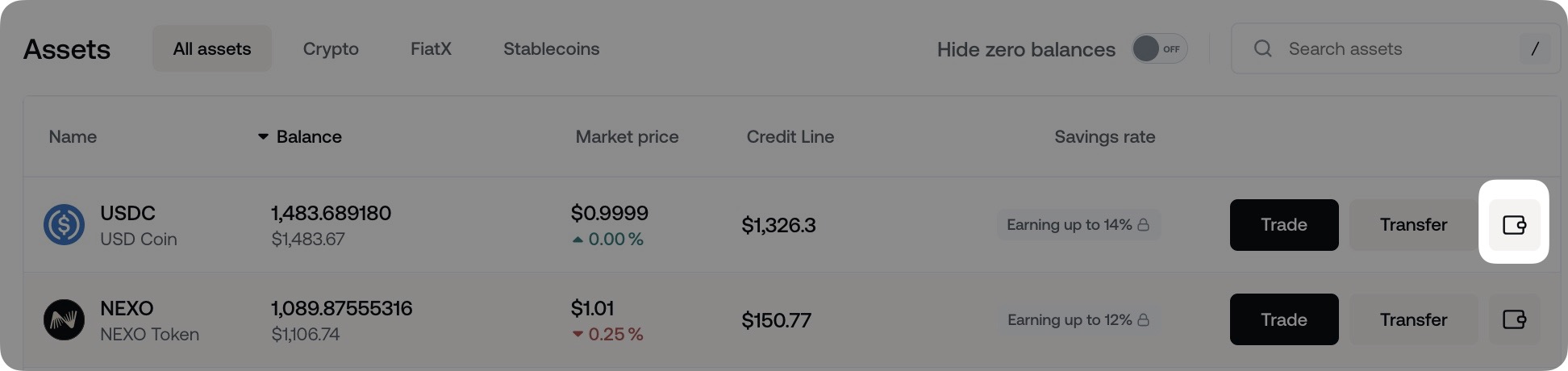

1. Log in to your Nexo account and click the Manage Wallets icon of the desired asset.

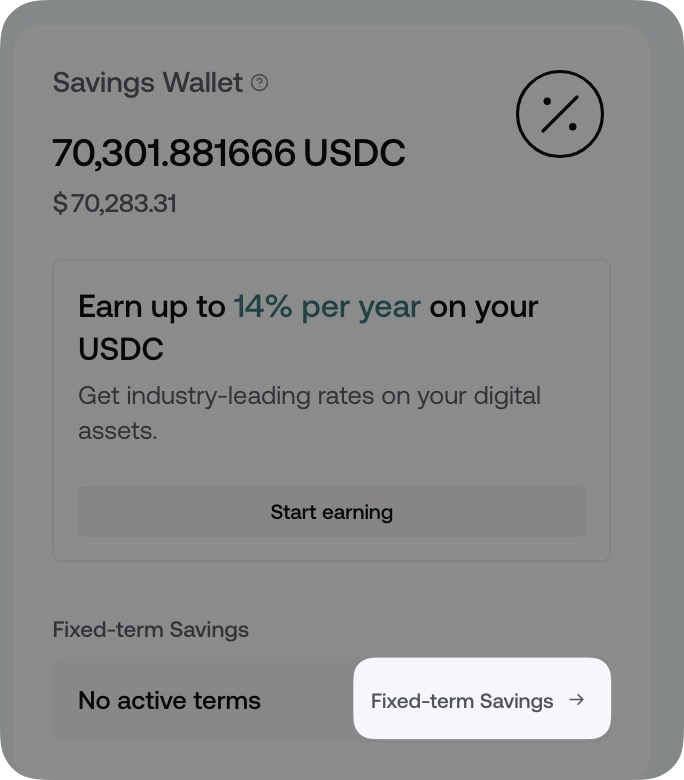

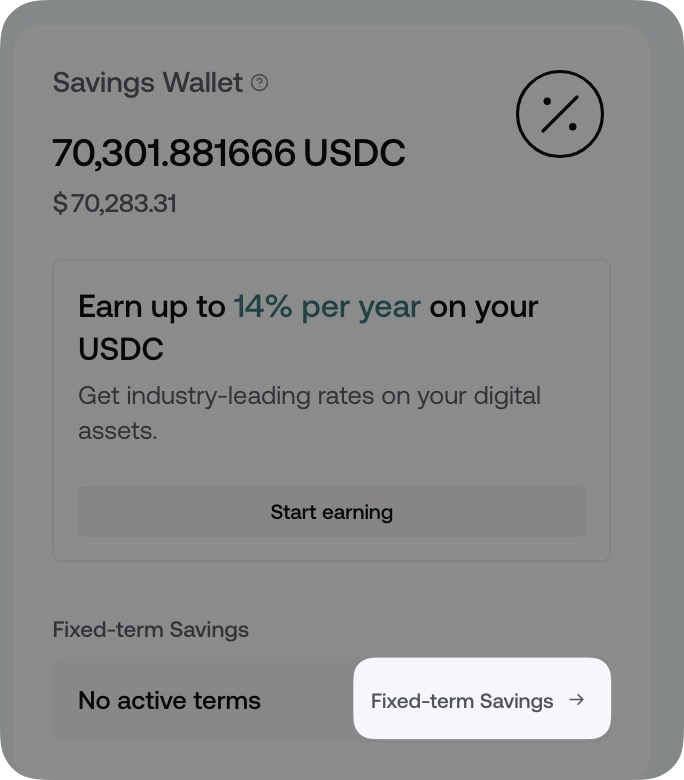

2. In the Savings Wallet section, click Fixed-term Savings.

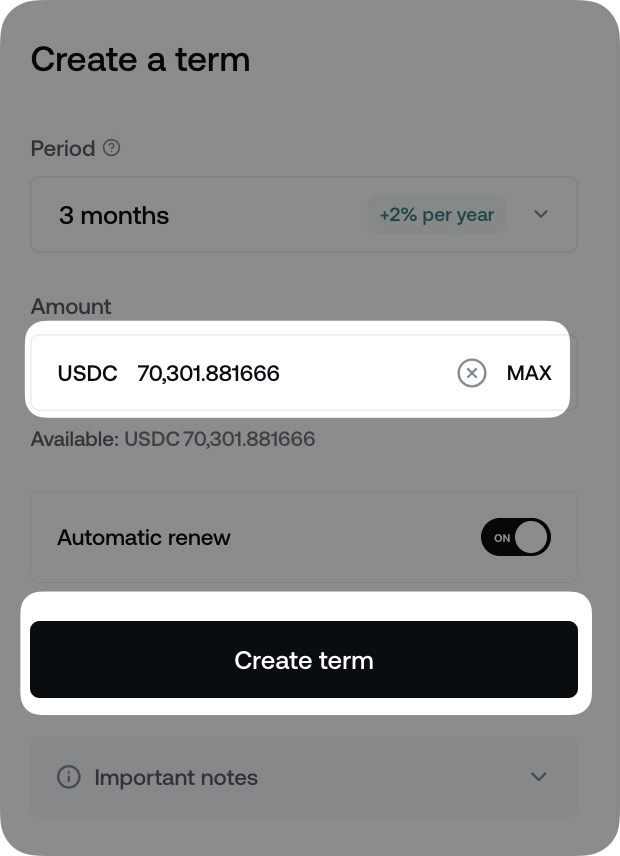

3. Enter the desired amount and duration (when applicable), and click Create term to complete the process.

Eligible assets and minimum required amount per asset

Both Flexible and Fixed-term Savings are available for a wide range of digital assets. However, not all currencies earn interest or can be locked in Fixed-term Savings.

The table below lists all assets on Nexo’s platform, showing which ones can be placed in fixed terms and their required Min. Fixed-term Savings Amount. Assets ineligible for Fixed-term Savings are labelled ‘N/A‘ in the respective field.

N/A — The respective feature (Flexible Savings / Fixed-term Savings / Withdrawal / Repayment) is not available for this asset

Note: Earning interest and creating new fixed terms with USDT, USDP, TUSD, DAI, and PAXG is unavailable for residents of EEA countries.

Due (unlock) date

Assets in Fixed-term Savings are unlocked between 6:00 AM and 11:00 AM UTC on the term’s due date. The accrued interest is also paid out at the same time, unless the Renewal with interest option is enabled.

4. What Fixed-term Savings options are available

Fixed-term Savings vary in duration depending on the asset you choose to lock. Currently, the following duration options are available:

| Asset | Term Duration |

| NEXO Token | 3 or 12 months |

| Other cryptocurrencies* | 1 month |

| Stablecoins** | 3 months |

| EURx/GBPx/USDx | 3 or 12 months |

* For a limited period, Nexo offers additional 3-month and 6-month term options for XRP, BCH, and TRX. Nexo reserves the right to limit these options without prior notice.

** Residents of EEA countries cannot create fixed terms with USDT, DAI, USDP, TUSD, and PAXG. Existing terms with these assets will continue to accrue interest until their due date.

5. How to exchange assets held in a fixed term

The Fixed-term Exchange feature allows you to end an active fixed term and reallocate the funds into a new term with a different digital asset. This lets you adjust your strategy without waiting for the original term to expire.

Supported asset pairs

Currently, the supported asset pairs include BTC/USDC, ETH/USDC, and BTC/ETH, with exchanges available in both directions.

Example: You can exchange an existing BTC term for a USDC term, as well as an existing USDC term for a BTC term.

How it works

- Termination of the current term: When you exchange fixed terms, the existing term will be closed, and any accrued interest will be forfeited.

- Asset conversion: The total principal amount is converted into the new asset using Nexo’s Exchange.

- Crypto cashback: If your account qualifies, you can receive up to 0.5% crypto cashback on the exchanged amount.

- Start a new fixed term: The resulting amount (converted funds + crypto cashback) is immediately placed into a new fixed term for your chosen duration.

Important: Crypto cashback eligibility depends on your Loyalty Tier. For full details, visit Nexo’s on crypto cashback rewards.

What are the Fixed-term Exchange limits and fees

Limits apply for each Fixed-term exchange transaction:

- Minimum: The respective minimum required amount per asset*

- Maximum: $250,000 (same as for regular swaps on Nexo’s Exchange)

*Note: When exchanging a fixed term, the value of your current term must be enough to meet the minimum unit amount required for the new term. For instance, if you exchange an ETH term for a BTC term, the value of the ETH term must be at least 0.001 BTC to create the new BTC fixed term.

Fixed-term Exchange transactions may be subject to a swap fee depending on the order size:

- Orders between 0 and 00 -> Fee: $0.99

- Orders between 00.01 and $250 -> Fee: .99

- Orders above $250.01 -> No fee

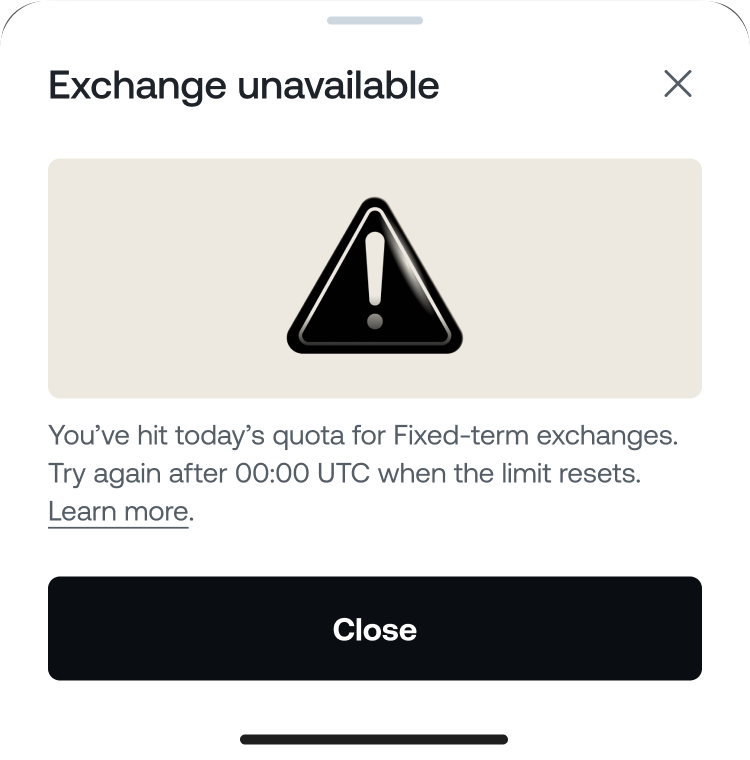

Daily quotas

Fixed term Exchange is subject to a global daily quota (limit) for each supported asset. This means a limited amount of each digital asset can be exchanged from Fixed-term Savings within a 24‑hour period. Below are the daily quotas for each asset:

- BTC: 0 million

- ETH: $5 million

- USDC: $5 million

These quotas are shared across all Nexo clients and apply to the currency of your existing term.

Example: If you have an active fixed term in BTC and the BTC daily quota has already been filled, you will not be able to exchange that BTC term for USDC or ETH until the next reset.

Reset schedule: All quotas reset daily at 00:00 UTC.

When a quota is reached, you’ll see an error message indicating that it has been exceeded:

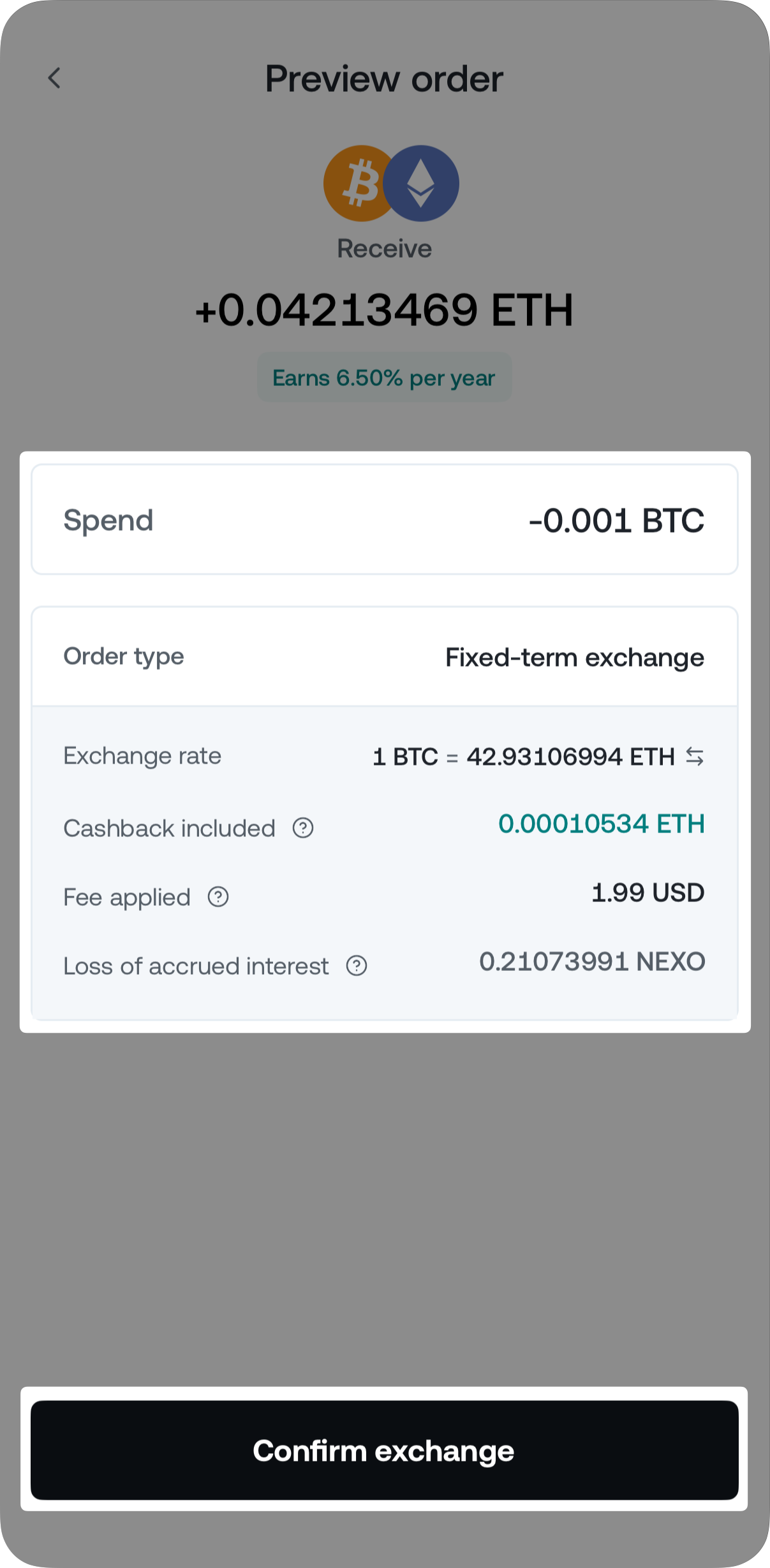

How to exchange my fixed term

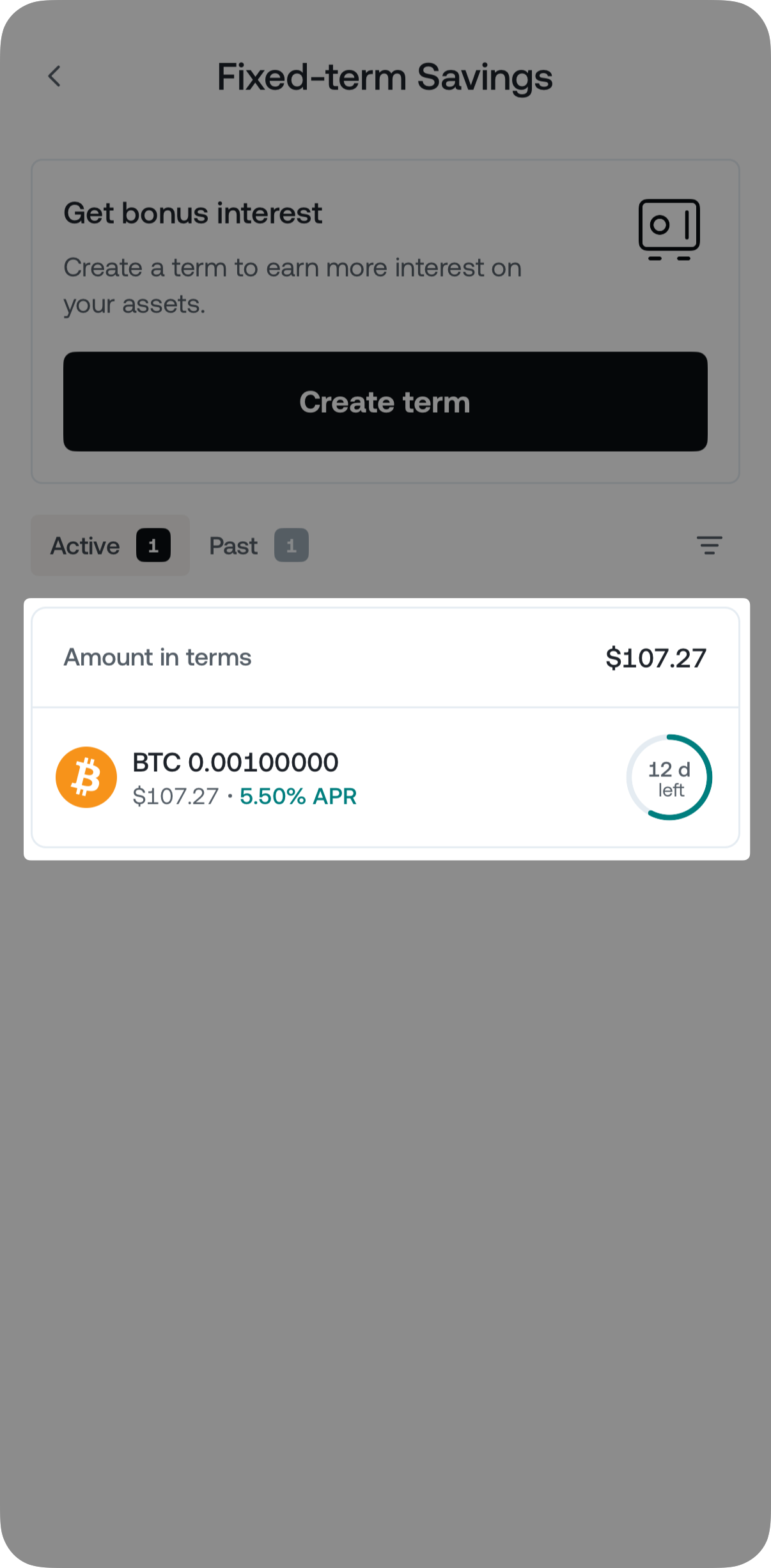

1. Go to your Savings hub and tap the Fixed-term Savings card.

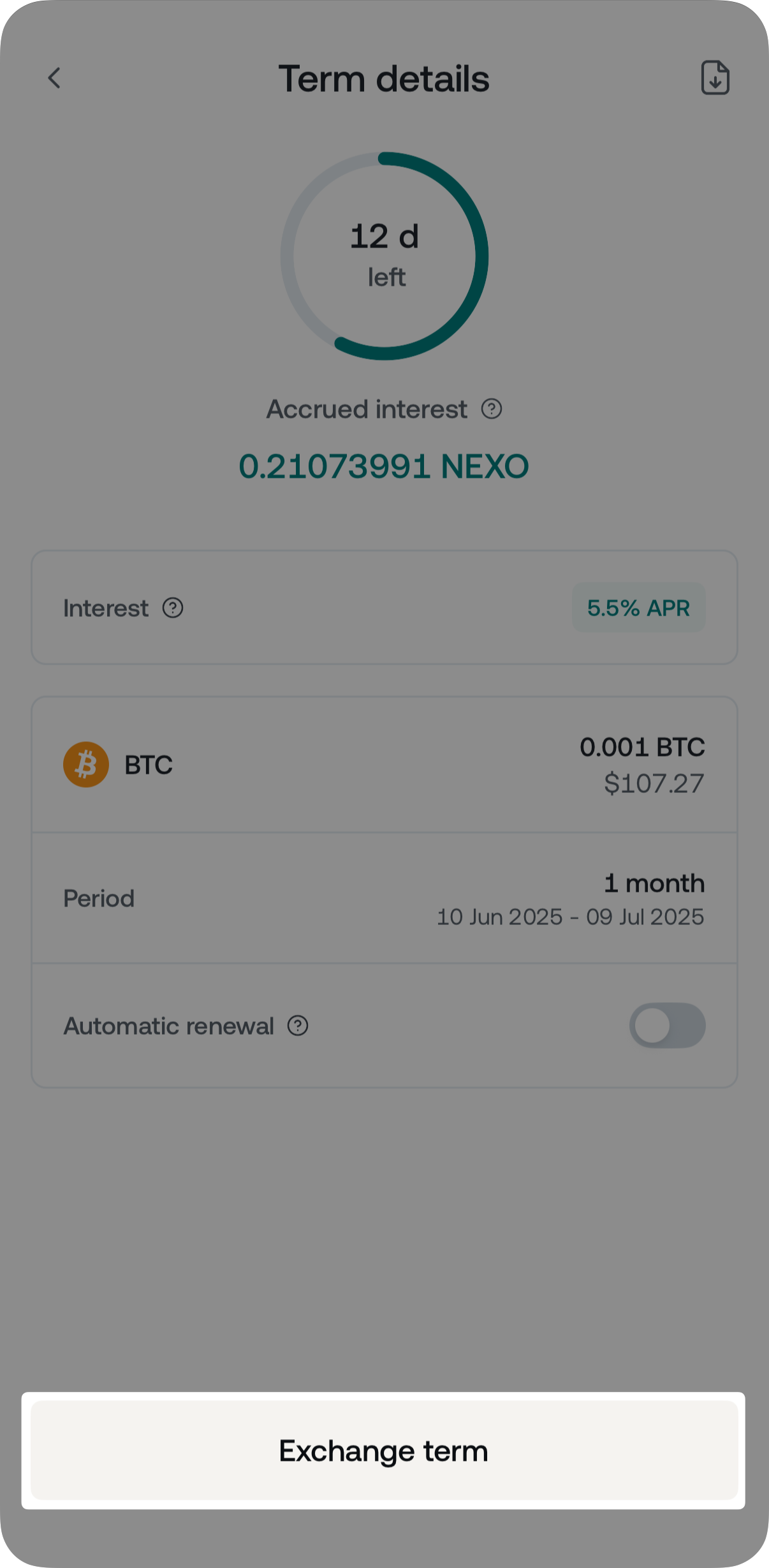

2. Select the fixed term you wish to exchange, and on the next screen, tap Exchange term.

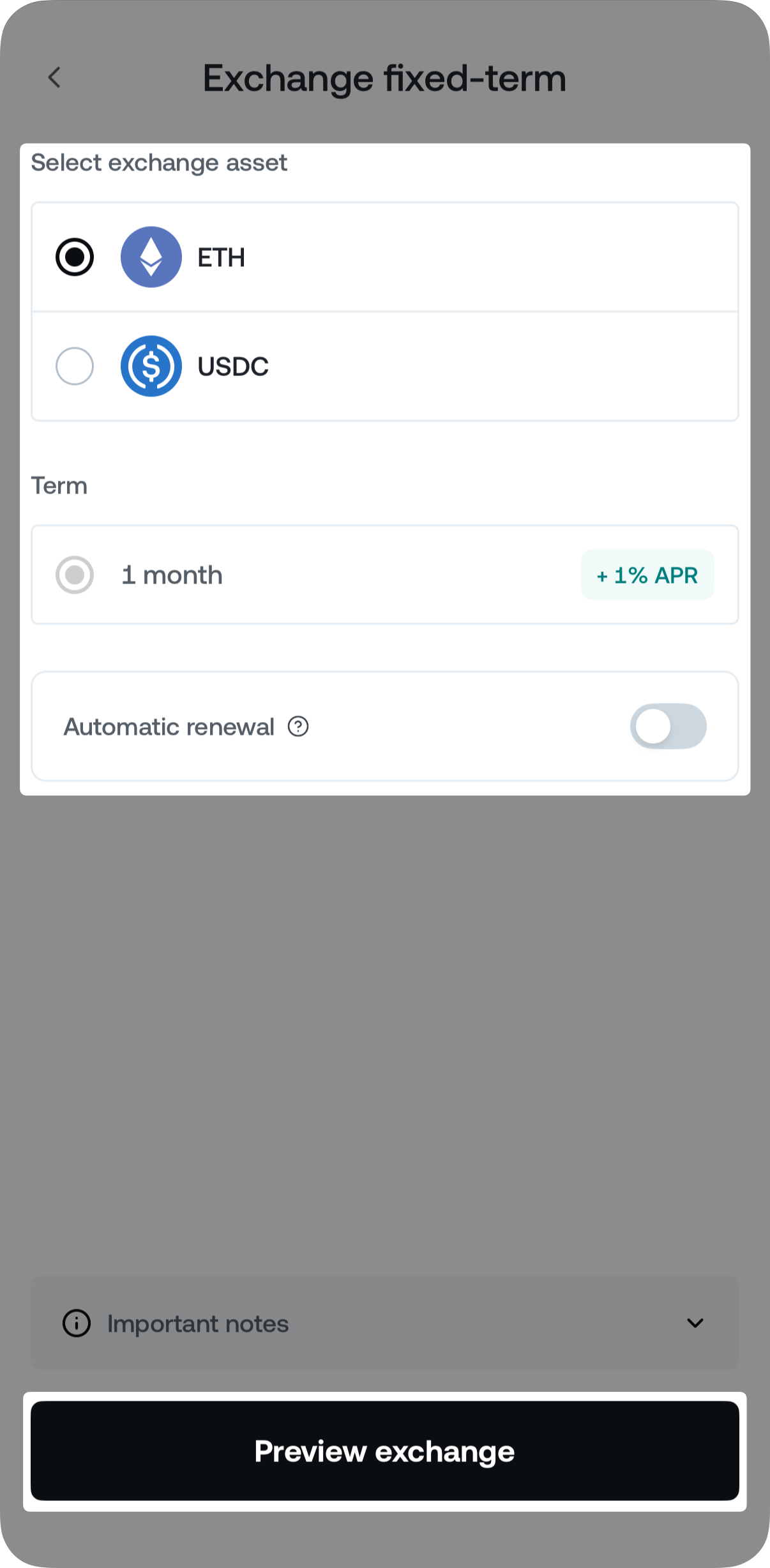

3. On the next screen, select the asset for which you wish to exchange your term, the term duration (if applicable), and whether the new fixed term should automatically renew when it matures. Make sure to read the Important notes section, and tap Preview exchange to proceed.

4. Review the details of the exchange and tap Confirm exchange to finish the operation.

Congratulations! Your new term is active.

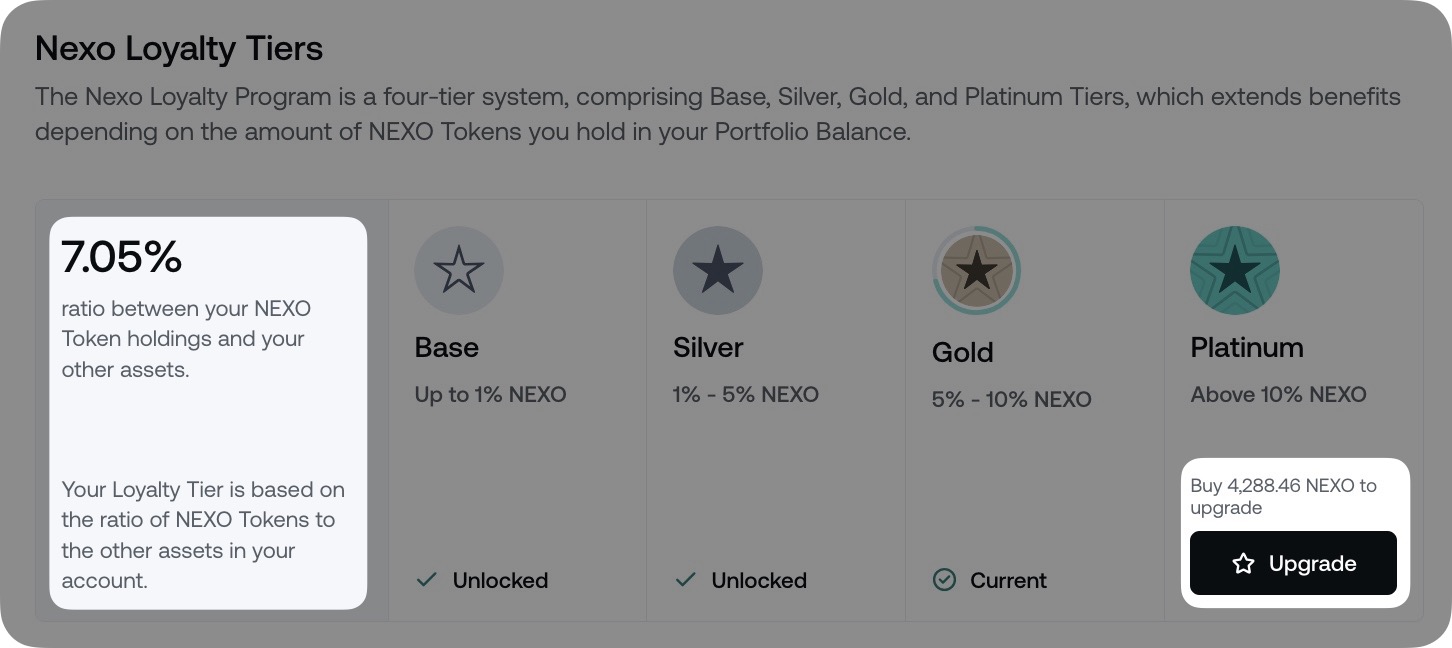

6. How to benefit from the highest interest rates

To benefit from the highest interest rates, your Loyalty Tier must be Platinum, meaning that the value of your NEXO Tokens must be at least 10% compared to the rest of your portfolio.

The exact NEXO amount required for the highest interest rates will depend on the market price of the token at any given moment. It will be displayed in the Loyalty Tiers section of your account:

Example: If your portfolio (excluding NEXO) is worth 00,000, you’ll need to hold at least 0,000 in NEXO Tokens to qualify for the Platinum tier. To avoid changes in your Loyalty Tier due to price fluctuations, Nexo recommends maintaining a small buffer of extra NEXO Tokens in your account.

Note: For fixed terms in EURx/GBPx/USDX and NEXO, you have a 12-month duration option, which offers the highest interest rates for these assets.

7. In what currency is the interest paid out, and how is it calculated

There are two payout types to choose from:

- In NEXO Tokens: The interest is paid out in NEXO Tokens for all assets and fixed terms. Depending on your Loyalty tier, you receive a bonus interest rate of between 0.25% and 2%. This option uses a simple interest model, i.e., it will be calculated on the principal amount only.

- In-kind: The interest is paid out in the underlying currency (e.g., if you have BTC in your Savings Wallet, the interest is also paid out in BTC). This is the default payout type, which uses a compound interest model, taking into account both the principal amount and the accumulated interest.

Examples

In NEXO Tokens

Suppose you’re a Platinum Tier user with 1,000 SOL held in a fixed term, and you’ve chosen to earn interest in NEXO Tokens. With this setup, you’ll benefit from an 8% annual interest rate (5% + 2% bonus for earning in NEXO Tokens + 1% fixed-term bonus) under the simple interest model.

Below, we’ll break down how much interest you’ll earn per day, along with the total accrued over time in this scenario:

Daily interest rate: 8% / 365 = ~0.02191780%

Daily interest earned: 1,000 SOL × 0.02191780% = 0.219178 SOL

After 1 year (365 Days):

- Total interest: 0.219178 SOL × 365 = 80 SOL

- Total balance: 1,000 SOL + 80 SOL = 1,080 SOL

After 2 years (730 Days):

- Total interest: 0.219178 SOL × 730 = 160 SOL

- Total balance: 1,000 SOL + 160 SOL = 1,160 SOL

Note: Since interest is paid in NEXO Tokens, the first step is to determine the USD value of your in-kind (SOL) earnings at the time of payout. Then, the equivalent amount of NEXO is paid out at the end of the fixed term based on the prevailing NEXO/USD exchange rate.

In summary, the simple interest model provides a steady, linear growth on your assets over time.

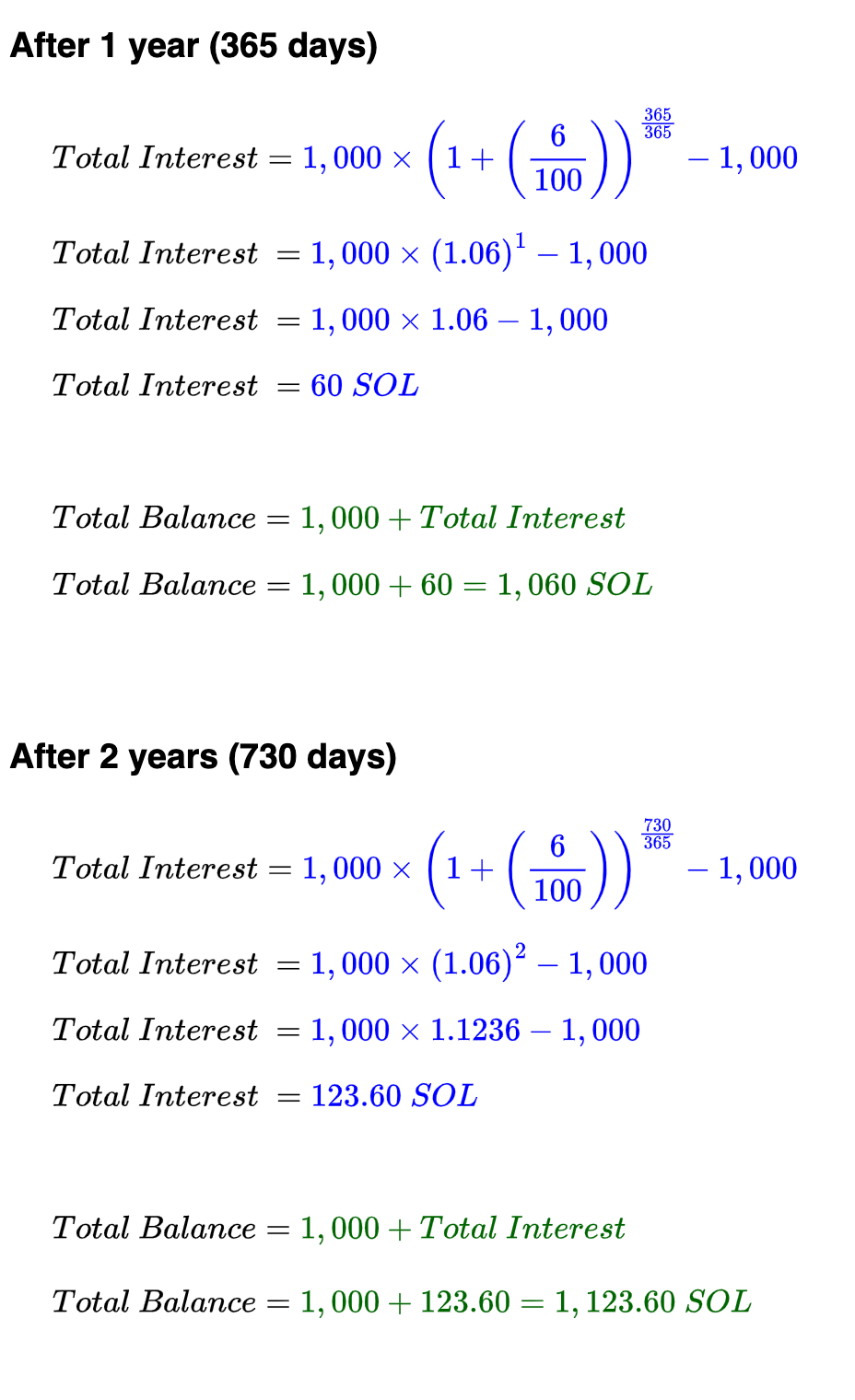

In-kind

Suppose you are a Platinum Tier user with 1,000 SOL in a fixed term and have opted to earn interest in-kind (in SOL). In that case, you’ll have an annual interest rate of 6% (5% plus 1% fixed-term bonus) under the compound interest model.

The image below illustrates how your interest accrues and how your total balance grows over time in this example.

As illustrated above, the compound interest model leads to exponential growth over time, with each day’s interest added to an increasingly larger balance. In other words, the interest earned in year two will exceed that of year one, year three will surpass year two, and so on.

Important notes:

- The compound interest model calculations consider that the fixed term is renewed without any interruptions and that the accrued interest is relocked in the new terms.

- The interest rates are adjusted dynamically based on your current Loyalty Tier. The tier may fluctuate if the value of your NEXO Tokens changes compared to the rest of your portfolio.

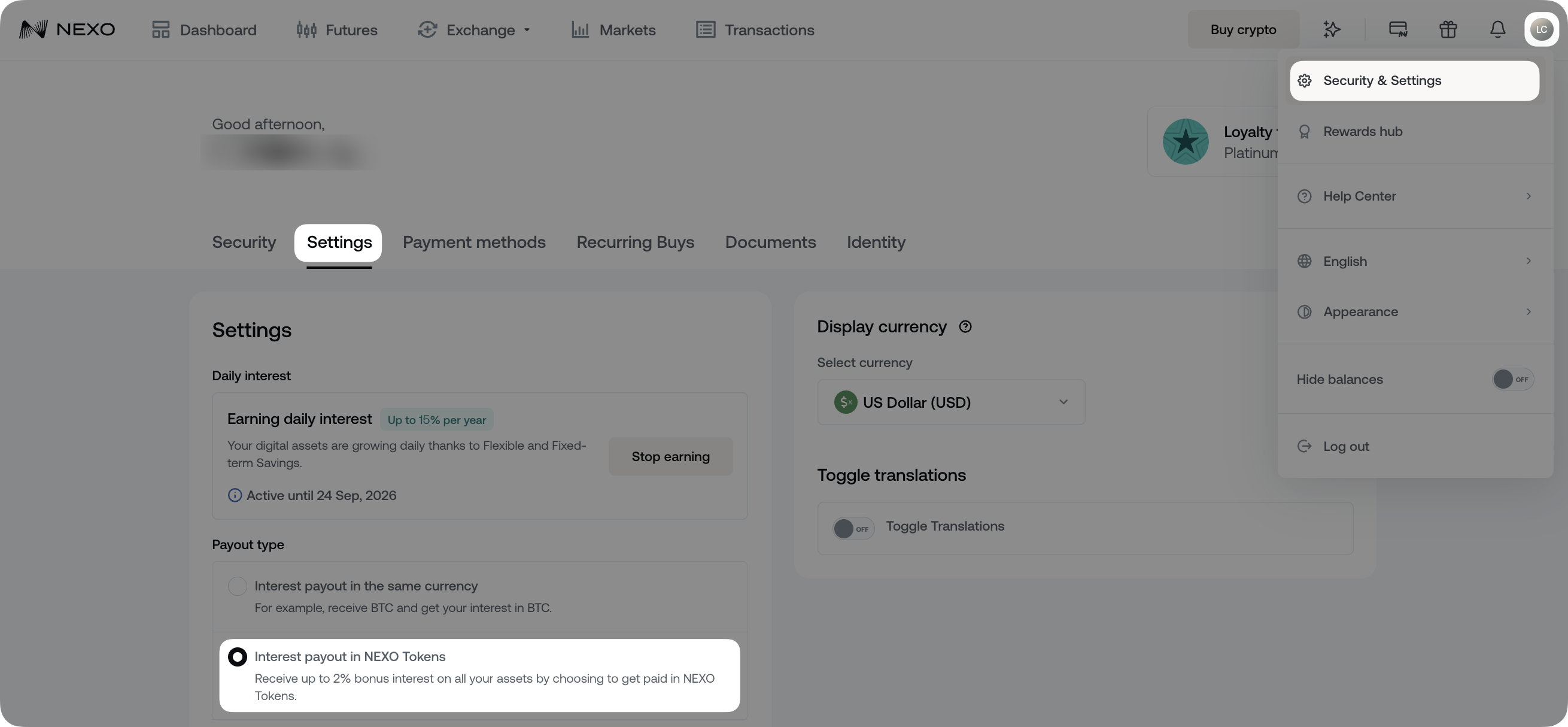

8. How to earn in NEXO Tokens for higher interest rates

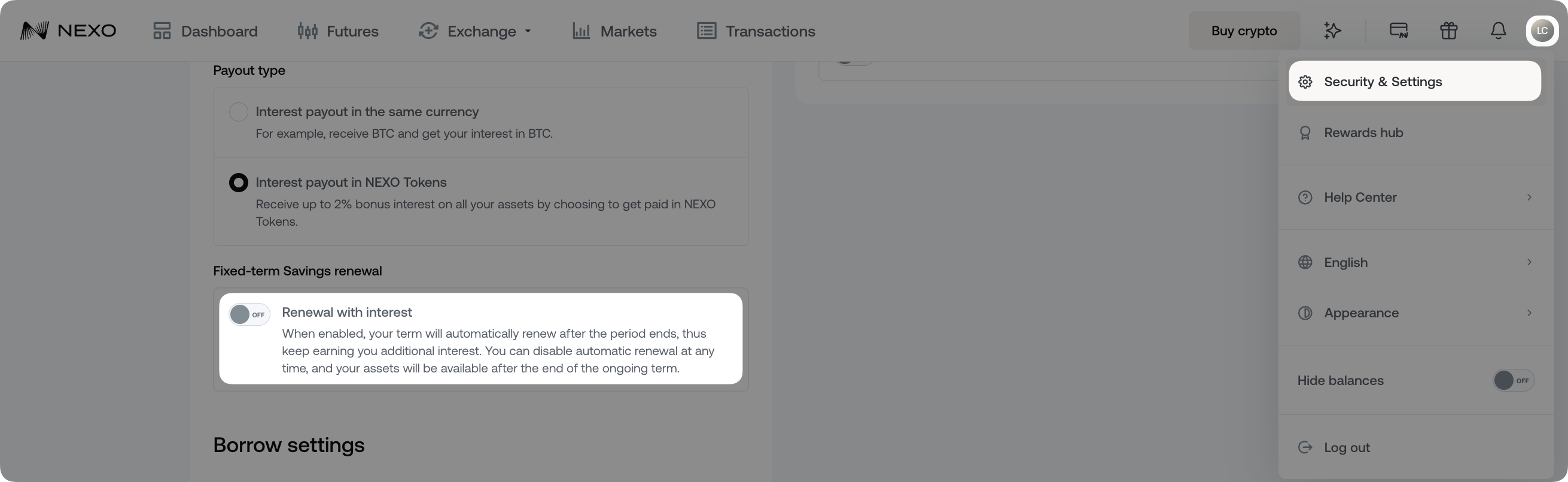

When choosing to earn in NEXO Tokens, you receive between a 0.25% and 2% bonus interest rate, depending on your Loyalty Tier. To activate the option, follow these steps:

- 1. Log in to your Nexo account.

- Navigate to My Profile > Security & Settings > Settings.

- Select Interest payout in NEXO tokens in the Payout type section.

Note: If you change your preferred payout type during an active fixed term, you will receive two separate interest payouts at the end of the term – one in NEXO Tokens and one in-kind.

9. What is the Automatic renewal feature

Automatic renewal is a convenient feature that automatically renews your term for the same duration when it expires. It’s enabled by default when creating a new term:

How does Automatic renewal work

When you set up a term, you agree to lock your assets for a specified period. Once the term reaches its due date, you receive your principal plus the interest earned. The automatic renewal feature then renews your term for the same period once the interest payout is completed, ensuring you continue to earn interest without interruption.

If you prefer not to renew automatically, you can disable automatic renewal on the preview screen before creating your term or before the term’s due date under Manage Wallets > Fixed-term Savings > Active Terms.

What is the Renewal with interest feature

When your term renews automatically, by default, only the principal amount is relocked, while the accrued interest is added to your Flexible Savings balance. However, you can relock both the principal and the accrued in-kind interest during term renewal to achieve a compounding effect.

To do so, navigate to My profile > Security & Settings > Settings on the Nexo app/web platform and enable the Renewal with interest toggle. Once enabled, this feature will apply to all your current and future terms.

| Renewal with interest ON | Renewal with interest OFF |

| On the term’s due date, both the principal and the accrued in-kind interest are relocked into a new term. Any interest earned in NEXO Tokens is added to your Savings Wallet (Flexible Savings) and not relocked. | Only the principal amount is relocked on the term’s due date. The entire earned interest (whether in-kind or in NEXO Tokens) is added to your Savings Wallet (Flexible Savings) and not relocked. |

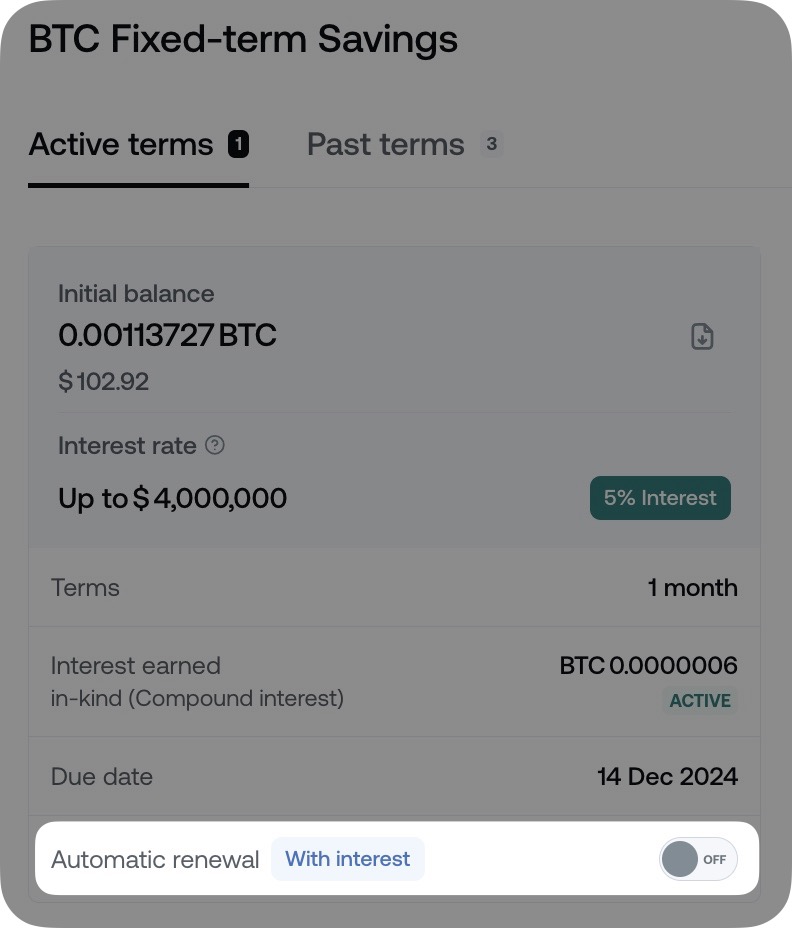

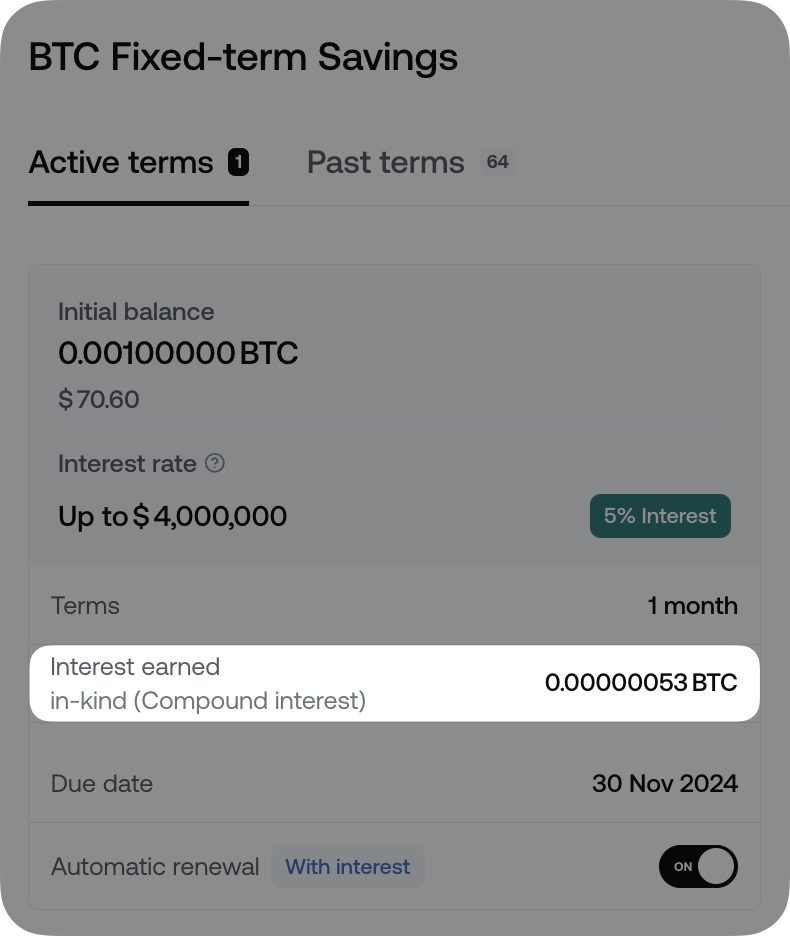

10. How to check the interest on your active term

You can check the amount of interest accrued on an active term by following the steps below:

1. Click the Manage Wallets icon next to the asset on your Dashboard.

2. Select Fixed-term Savings in the Savings Wallet section.

3. The Interest earned section displays the accumulated interest.

Note: If you change the interest payout type during the term, both the interest earned in-kind and in NEXO Tokens will be shown on the screen.

11. What is the Fixed-term Savings unlock feature

The Fixed-term Savings unlock is an extension of the Automatic collateral transfer feature. Both functionalities are used to stabilize your Loan-to-Value (LTV) ratio during market downturns by moving assets from your Savings Wallet to your Credit Wallet, where they act as additional collateral. The latter is first sourced from the Savings Wallet in case the Automatic collateral transfer feature is enabled.

If more collateral is required and the Fixed-term Savings unlock feature is enabled, the system will unlock one or more of your fixed terms and transfer the assets to your Credit Wallet. You can learn more in this article.

12. FAQ

- Q: Which assets can be placed into a fixed term?

- A: You can lock the following earnable assets in fixed terms: Cryptocurrencies, Stablecoins, FIATx.

- Q: Which assets cannot be placed into a fixed term?

- A: Non-earnable assets, DOGE, and ARB cannot be placed into a fixed term. Additionally, residents of EEA countries cannot place USDT, DAI, USDP, TUSD, and PAXG into fixed terms.

- Q: Can I withdraw assets locked in a fixed term?

- A:No, you cannot withdraw assets locked in a fixed term before the due (unlock) date. On the term’s due date, your assets will automatically become available for withdrawal. If you have enabled the Automatic renewal feature for a specific term, the assets will be automatically locked in a new term.

- Q: Can I cancel a fixed term?

- A: No. You cannot cancel a fixed term prior to its due date.

- Q: Can I merge my fixed terms?

- A: No, you cannot merge active fixed terms.

- Q: What is the difference between simple and compound interest?

- A: Simple interest is calculated only on the principal amount, excluding any accumulated interest. On the other hand, compound interest is calculated on both the initial principal and the accumulated interest, effectively increasing the total amount of interest you earn over time. In summary, simple interest is straightforward and only grows linearly, while compound interest can increase exponentially over time, as the interest earned on previous days adds to the base (principal) on which future interest is calculated.