How does the Nexo Card work in Credit Mode

Is the Nexo Card a credit card? In this article, Nexo will delve into the Credit Mode functionality. To learn more about the Debit Mode, visit How does the Nexo Card work in Debit Mode.

In this article:

- What is Nexo Card Credit Mode

- What is the interest rate on my Nexo Card credit

- How can I activate Credit Mode

- How much available credit do I need to have to make Nexo Card purchases in Credit Mode

- How do I confirm my online purchases

- What are the currency conversion rates and fees of the Nexo Card

- How can I repay a purchase made in Credit Mode

- Early repayment policy

- Why can’t I repay a purchase made in Credit Mode

- Why are assets transferred to the Credit Line Wallet when I make Nexo Card purchases in Credit Mode

- Why did I not receive crypto cashback on my purchase in Credit Mode

- How can I enable Low-Interest Borrowing for Credit Mode purchases

- Important notes

1. What is Nexo Card Credit Mode

In Credit Mode, the Nexo Card functions as a credit card linked to your Credit Line. When you make a purchase, the amount is automatically deducted from your Available to Borrow balance, which is backed by your crypto assets, and is added to your total Outstanding Loan in USDx.

2. What is the interest rate on my Nexo Card credit

The borrowing rate depends on your Loyalty Tier. The following Low-Cost Credit Line rates are available to Gold and Platinum Loyalty Tier clients with Credit Line Wallet LTV ratio below 20%:

-

Gold: 5.9% p.a.

-

Platinum: 2.9% p.a.

3. How can I activate Credit Mode

When you activate your Nexo Card, it will automatically be set to Credit Mode.

You can change your Card Mode anytime. Here’s how to do it:

-

Open the Nexo app and log in to your account.

-

Navigate to the Card tab.

-

Scroll down and tap Card Mode.

-

Select Debit or Credit.

You need to have an available balance to switch between Card Modes:

-

To switch to Debit Mode, you must have some FIATx, stablecoins, or crypto assets in your Flexible Savings.

-

To switch to Credit Mode, you must have some crypto or stablecoins in your Flexible Savings or in your Credit Line Wallet.

For more information about the Debit Mode, visit this article.

4. How much available credit do I need to have to make Nexo Card purchases in Credit Mode

When you use the Nexo Card in Credit Mode, make sure you have enough collateral to cover your expenses. The Available to Borrow balance on your Dashboard must be higher than the amount you plan to spend.

To ensure a smooth experience, Nexo recommends keeping some extra available collateral (crypto assets or stablecoins) in your account. This way, you can make purchases without interruption even if the prices of cryptocurrencies change.

To use your card at Automated Fuel Dispensers (MCC 5542) or Service Stations with or without Ancillary Services (MCC 5541), you need at least 175 USDx in your Available to Borrow balance. As recommended by Mastercard and Visa, this limit helps reduce the risk of having an insufficient balance on your Nexo account.

5. How do I confirm my online purchases

Certain merchants may require customers to complete an additional verification step (3D Secure) when making online payments. If you use your Nexo Card for an online payment that requires 3DS, you will need to confirm it within 5 minutes by tapping on a push notification on your device.

If you have turned off push notifications, open the Nexo app and approve the transaction through an in-app message. If push notifications are not working due to maintenance or service disruption, you may need to verify your purchase with an SMS code.

6. What are the currency conversion rates and fees of the Nexo Card

Nexo Card purchases made in Credit Mode involve several different currencies:

- Card Currency (EUR or GBP): The currency of the Nexo Card you selected during the initial activation.

- Local Currency: The local currency in the area where the merchant is located. For example, PLN (Polish złoty) is the official currency of Poland, so local merchants will typically charge you in PLN.

- Loan Currency (USDx): The currency of the loan generated by your Nexo Card purchase. Just like regular Nexo loans, it is always calculated in USDx.

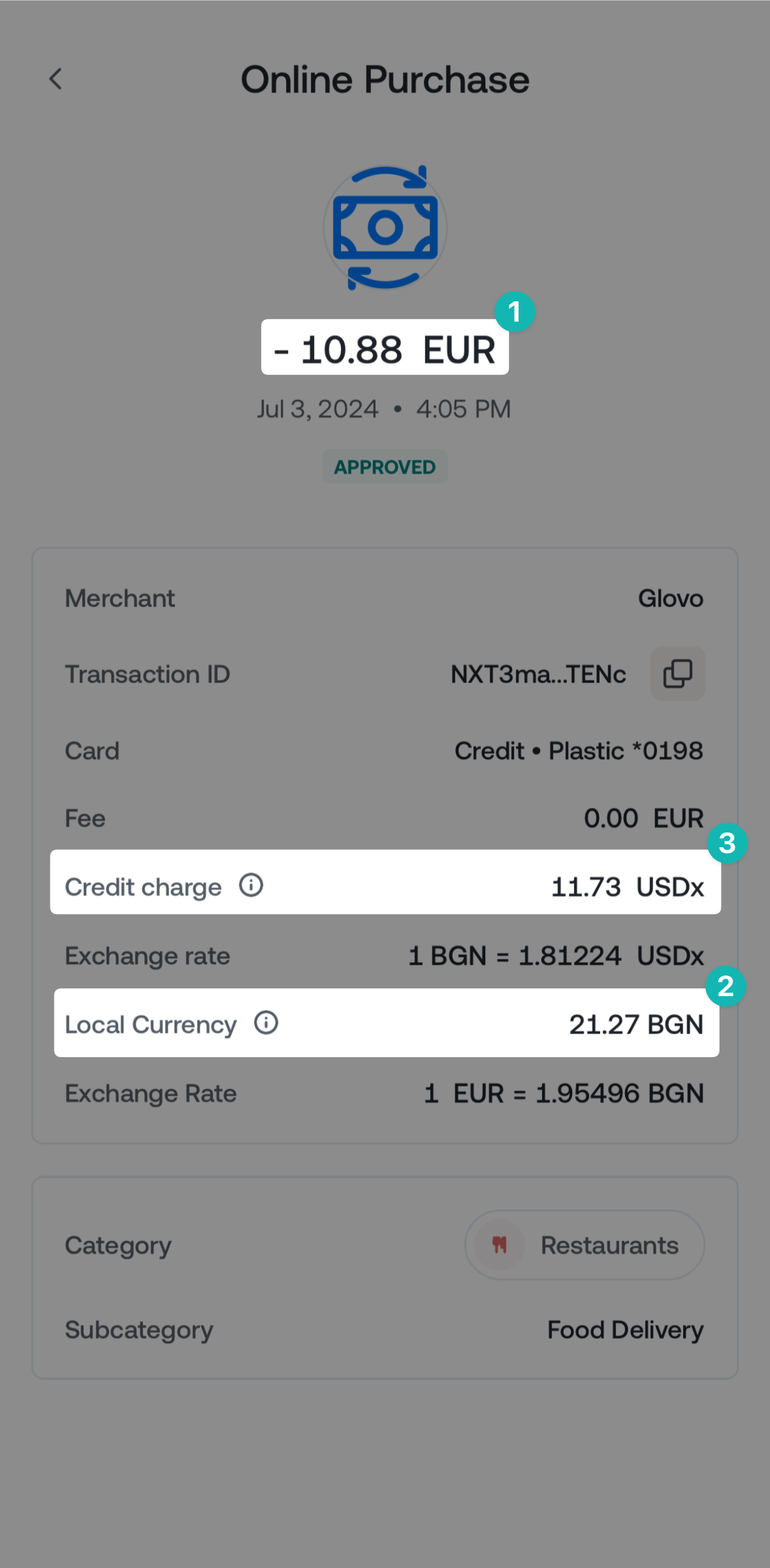

You can check the currencies of your purchase in the transaction details (see the image below):

-

(1) The transaction amount is always denominated in your Card Currency.

-

(2) The amount charged by the merchant is displayed under Local Currency.

-

(3) The loan amount generated by the purchase is displayed under Credit Charge.

The following types of currency conversions occur in Credit Mode:

-

Foreign exchange (FX). Purchases where the Local Currency differs from your Card Currency are known as foreign exchange (FX) transactions. In such cases, the transaction amount denominated in the Local Currency has to be converted into your Card Currency.

-

Such conversions are performed at the Exchange Rate listed below the Local Currency in the purchase details. This rate is based on the Mastercard rate.

-

All FX conversions are subject to a 0.2% or 2% fee, depending on the Local Currency. An additional 0.5% fee is applied on weekends. For more information, please visit this article.

-

-

Conversion to Loan Currency. The transaction amount denominated in the Local Currency has to be converted into the Loan Currency (USDx). This USDx amount will be added to your Outstanding Loan when the purchase is finalized.

-

The conversion is performed at the Exchange Rate listed below the Credit Charge in the purchase details. For purchases where the Local Currency is USD, it is automatically converted to its USDx equivalence. For purchases in other Local Currencies, the rate is obtained from a third-party currency conversion service (fixer.io) at the time of purchase and remains the same, regardless of when the merchant completes the transaction.

-

-

Third-party conversions. Using the Nexo Card through third-party payment wallets, such as Google/Apple Pay, Curve, PayPal, and others, may be subject to additional fees, depending on the policies of the respective third-party wallet.

-

Matching the currency in the third-party app with your Nexo Card Currency (EUR/GBP) may minimize currency conversion fees. However, for an optimal experience, Nexo recommends reviewing the respective third-party policies in advance.

-

7. How can I repay a purchase made in Credit Mode

Every time you make a purchase in Credit Mode, its USDx value is added to your total Outstanding Loan. Once the transaction is completed and its status changes to “Approved,” you can make a repayment:

Nexo app:

-

Go to the Card tab.

-

Tap Repay under your card.

Web platform:

-

Go to your Dashboard.

-

Click on the Repay Loan button.

Keep in mind that all crypto repayments (excluding FIATx and stablecoins) are subject to a flat 0.26% fee, which is factored into the USDx value displayed on the repayment screen. You can find more information on loan repayment here.

Loans generated by your Nexo Card purchases are added to your total Outstanding Loan amount. But unlike regular loans, Nexo Card purchases do not reset the 45-day early repayment period.

Depending on whether your Outstanding Loan consists of Nexo Card purchases only or both Nexo Card purchases and regular loans, repaying the loan may be subject to additional interest:

-

No additional interest is applied if your entire Outstanding Loan is generated from Nexo Card purchases in Credit Mode (you have no active loans withdrawn through the Borrow button) or if more than 45 days have passed since your last regular loan withdrawal.

-

Additional interest is applied if you decide to make a repayment within 45 days of your last regular loan withdrawal (through the Borrow button). In this case, the additional interest will be applied to the total repayment amount, even if part of your Outstanding Loan was generated by Nexo Card purchases.

Example: You take out a regular 00 loan via the Borrow button on Jan 1. On Jan 10, you make a Nexo Card purchase that generates a loan of $200, resulting in a total outstanding loan of $300. If you decide to make a $300 repayment on Jan 25, the additional interest charge will be calculated on the total repayment amount ($300) for the 20 remaining days since the Nexo Card purchase didn’t reset the 45-day period that started with the last loan withdrawal on Jan 1.

9. Why can’t I repay a purchase made in Credit Mode

When you use the Nexo Card for a purchase, the merchant has up to 45 days to claim the funds, though this process usually takes only a few days.

During this time, the purchase will be pending in your Transactions tab and will not be added to your Outstanding Loan. In other words, the purchase value will be deducted from your Available to Borrow balance, but the amount will not be available for repayment yet.

The loan generated from the purchase will accrue interest while the purchase is pending. The total accrued interest will be added to your Outstanding Loan once the purchase is completed.

If the merchant does not claim the funds within the 45-day period, the transaction will be rejected automatically, and no loan interest will be charged.

This principle also applies to crypto cashback on purchases, which is credited only after the card transaction is completed.

10. Why are assets transferred to the Credit Line Wallet when I make Nexo Card purchases in Credit Mode

Crypto assets and stablecoins are used as collateral for the loan that fuels your Credit Mode purchases.

When you make a purchase, Nexo’s system will automatically transfer enough assets from your Savings Wallet to your Credit Line Wallet to serve as collateral unless you already have enough collateral in your Credit Line Wallet to cover this purchase.

If you want to use a specific crypto asset or stablecoin as collateral, you will need to manually move it to your Credit Line Wallet before purchasing. Keep in mind that each asset has a different “borrowing power,” which is the percentage of its value that you can borrow, expressed as a Loan-to-Value ratio.

11. Why did I not receive crypto cashback on my purchase in Credit Mode

There could be several reasons why you did not receive crypto cashback on your purchase:

-

Your portfolio balance is below the minimum of $5,000 required to access Nexo Card crypto cashback, part of Nexo’s Loyalty Program perks.

-

The crypto cashback is below the minimum payout value of $0.01. If your purchase generates crypto cashback of less than $0.01, it cannot be processed.

-

The transaction is ineligible for crypto cashback.

-

You have reached the monthly crypto cashback limit for your Loyalty Tier.

12. How can I enable Low-Interest Borrowing for Credit Mode purchases

Gold and Platinum Loyalty Tier clients can benefit from our Low-Cost Credit Lines with borrowing rates of 5.9% p.a. (Gold) and 2.9% p.a. (Platinum) for loans with a Credit Line Wallet LTV ratio below 20%.

To enable Low-Interest Borrowing for Credit Mode purchases, follow the steps below:

-

Open the Nexo app and go to the Card tab.

-

Tap Card Settings.

-

Tap Spend at 5.9% Interest or Spend at 2.9% Interest, depending on your Loyalty Tier.

-

Enable the Low-Interest Borrowing toggle.

With this option on, the system will automatically transfer enough collateral to your Credit Line Wallet to keep its Loan-to-Value ratio below 20%, allowing you to enjoy Nexo’s -cost borrowing rates.

Important notes

-

The Nexo Card is available only to personal (individual) account holders. Corporate (business) account holders cannot order Nexo Cards.

-

The Nexo card is available to citizens or residents of the EEA.

-

Loan interest is compound (it is calculated on both the initial principal and the accrued interest).