Crypto Futures Trading

In this article:

1. What are cryptocurrency futures

2. Funding payments and Mark price

4. Leverage in futures trading

5. Futures Profit and Loss (P&L)

- P&L without leverage

- P&L with leverage

- P&L with leverage – combining same-asset positions in one direction

- P&L with leverage – opening positions using the Unrealized P&L

- Hedge strategy with opposite futures positions

- Hedge strategy – mitigating losses only with a short position

8. Margin risk

10. Trigger orders

11. Funding the Futures Wallet and managing positions

- How to fund the Futures Wallet

- How to open a futures position

- How to close a futures position

- How to place a Trigger entry order

- How to set TP/SL orders for an active position

12. FAQ

- How is cross-margin different from isolated margin

- How is the Last price determined

- What is the difference between Unrealized P&L and Realized P&L

13. Glossary

14. Important notes

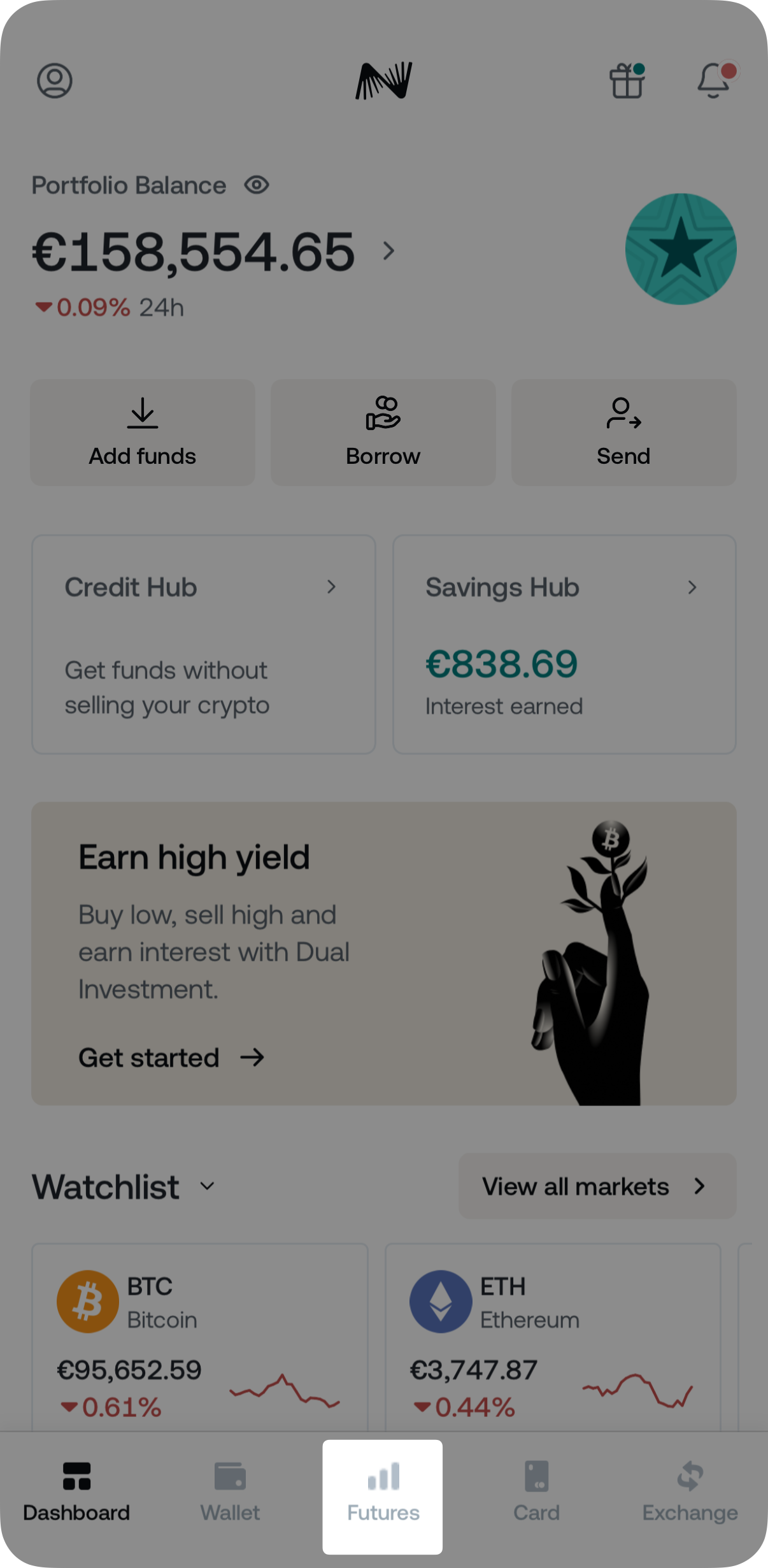

1. What are cryptocurrency futures

Cryptocurrency futures are contracts that let you speculate on the future price of a cryptocurrency without needing to own the actual asset. Like futures in traditional finance, these contracts allow traders to profit from both rising and falling prices of the underlying cryptocurrency.

On the Nexo platform, futures contracts are perpetual and do not have an expiration date, giving you greater flexibility when building your trading strategies. Each contract is denominated and settled in USDT upon closing.

Note:

- To engage in futures trading on the Nexo platform, you may have to complete a short test in the form of a questionnaire.

- Before you can trade perpetual futures contracts, you must fund your designated Futures Wallet with BTC, ETH, XRP, USDC, or USDT.

- All futures positions utilize leverage, magnifying both potential profits and losses.

- Certain assets are only available for futures trading on Nexo.

- There is a fixed 0.06% trading fee for opening or closing a position.

What are the benefits of crypto futures

- Asset offering: You can access over 100 contracts, including Bitcoin, Ethereum, and Solana.

- Speculation: You can speculate on the future price of cryptocurrencies without owning the actual digital assets.

- Leverage: Futures trading on the Nexo platform involves using between 2x and 100x leverage, enabling you to open larger positions than your existing assets would usually allow, magnifying potential profits and losses.

- Collateral variety: You can use BTC, ETH, XRP, USDC, and USDT as collateral for your futures positions.

- Short selling: Futures trading also allows you to profit by going short and betting on the price of an asset to fall.

- Hedging: If you hold a particular cryptocurrency and expect its price to decrease, you can open a short position to offset potential losses.

- Multi-platform support: You can trade contracts on desktop and app using Nexo’s $1-friendly interface.

- Learning experience: Our simulated trading environment allows you to practice your strategies without the risk of actual financial loss.

- Personalized service: Nexo’s $1 Care team is available 24/7 to assist you.

Futures trading quiz

Depending on your country of residence, you may need to complete a short questionnaire before you can start trading futures on Nexo. This assessment is designed to check your knowledge of futures trading and its associated risks.

If you are new to futures trading or want to refresh your knowledge, Nexo recommends going through this article.

Tip: You can always practice futures trading risk-free in Nexo’s simulated trading environment on the Nexo App, without using your own funds.

Long and Short positions

The price of a cryptocurrency can move in two directions (either up or down), meaning you can make two different predictions about it through futures trading. Depending on the type of prediction you make, you will open either a Long or Short position:

- Opening a Long position means that you expect the price of the selected futures contract to rise. You will profit if your prediction is correct and the price increases.

- Going Short, on the other hand, means trading a futures contract anticipating a price decline. In this case, when the underlying asset’s price decreases, you will profit from the trade.

In both cases, you are trying to profit from predicting future price movements without actually owning the contract’s underlying asset (e.g., BTC in the BTCUSDT contract).

For detailed examples, refer to this section.

2. Funding payments and Mark price

Traders holding open futures positions on the Nexo platform pay or receive periodic funding payments every 1, 2, 4, or 8 hours, depending on the contract.

Funding payments are exchanged between traders to keep the price of the futures contract closer to the actual market price.

The amount you pay or receive depends on the current Funding rate, which can be positive or negative. This rate is influenced by prevailing market conditions and reflects whether most traders for that contract hold a Long or a Short position.

Funding rate

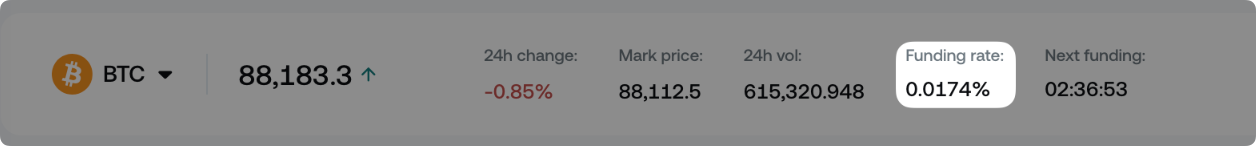

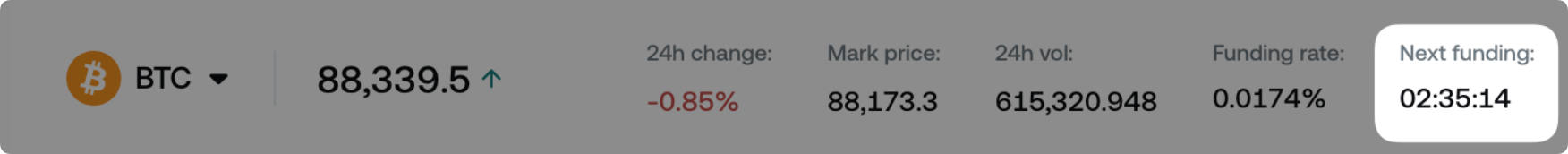

The current Funding rate is shown directly in the futures trading interface:

The Funding rate is not fixed due to the market’s fluctuating nature.

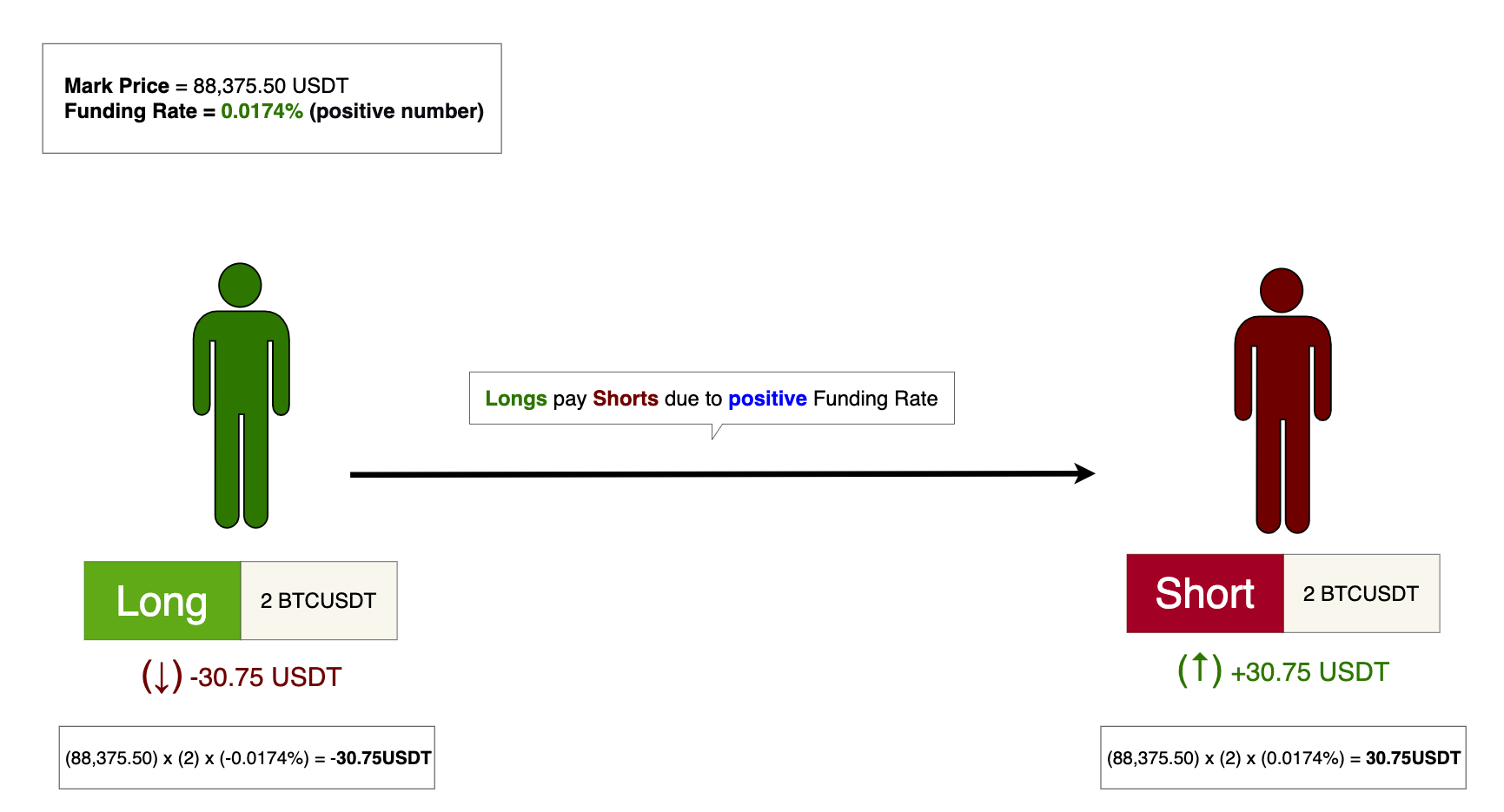

| Funding rate > 0 (positive number) | Traders who are Long pay those who are Short. |

| Funding rate < 0 (negative number) | Traders who are Short pay those who are Long. |

The Funding rate, along with other factors, determines the price of each futures contract, known as the Mark price, which represents the fair value of the futures contract.

Bonus information on the Funding rate:

- A snapshot mechanism records the bid and ask prices from major exchanges at regular intervals, every few seconds, during a 1, 2, 4, or 8 hour period, depending on the contract. These snapshots and other indicators are combined using a time-weighted average to derive the Funding rate and ensure its fairness.

Mark price

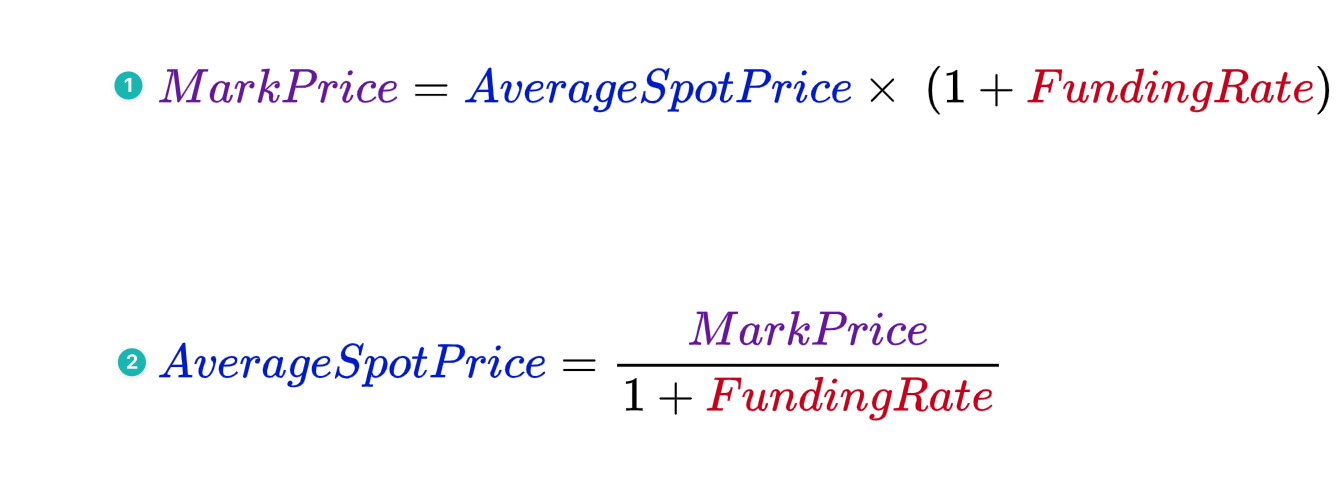

On the Nexo platform, the Mark price of a contract is determined by several factors. For simplicity purposes, Nexo will focus only on two of them: the Average Spot price of an asset over major crypto exchanges and the Funding rate. With these two parameters, Nexo can define the following formulas:

Example 1 – Finding the Mark price: Assume the Average Spot price for BTCUSDT across major exchanges is 100,000 USDT per BTC, and the Funding rate is 0.002%. By applying these values to the formula, Nexo gets:

- Step 1: Mark Price = 100,000 x (1 + 0.002%)

- Step 2: 100,000 x (1 + 0.00002)

- Step 3: 100,000 x (1.00002)

- Result: Mark Price = 100,002.00 USDT per BTC

Example 2 – Finding the Average Spot price: Let’s say the Mark price on the Nexo platform for BTCUSDT is 100,800 USDT per BTC, and the Funding Rate is 0.0025%. Applying these figures to the formula, Nexo gets:

- Step 1: Average Spot Price = 100,800 / (1 + 0.0025%)

- Step 2: 100,800 / (1 + 0.000025)

- Step 3: 100,800 / (1.000025)

- Result: Average Spot Price = 100,797.48 USDT per BTC

Conclusion: The Funding rate allows us to switch between the Mark price on the Nexo platform and the Average Spot price over various leading exchanges.

Funding fee

Having learned about the Funding rate and the Mark price, you can now compute the Funding fee. To do so, consider the following formula:

![]()

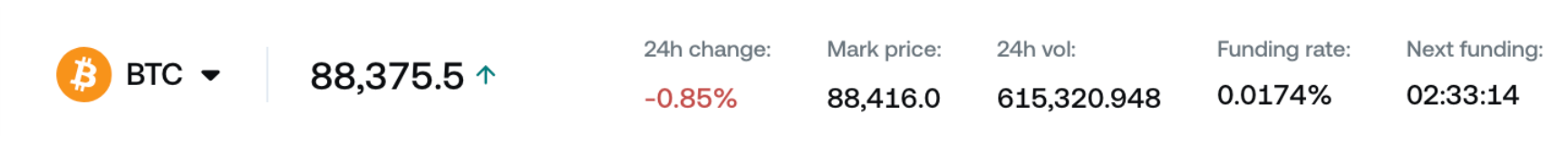

Let’s put it into practice by using the data from the below image.

Depending on whether you are going Long or Short, here is how the Funding fee will be distributed if the position is for 2 BTCUSDT:

Funding countdown

On the Nexo platform, the funding rate is recalculated every 8 hours (12:00 AM UTC, 08:00 AM UTC, and 04:00 PM UTC), 4 hours (12:00 AM UTC, 04:00 AM UTC, 08:00 AM UTC, 12:00 PM UTC, 04:00 PM UTC, and 08:00 PM UTC), 2 hours (04:00 AM UTC, 06:00 AM UTC, 08:00 AM UTC, 10:00 AM UTC, 12:00 PM UTC, etc.) or 1 hour (10:00 AM UTC, 11:00 AM UTC, 12:00 PM UTC, etc.).

The time interval depends on the chosen futures contract.

The Next funding countdown shows the time left until the subsequent funding settlement. The Funding fee will be applied up to 5 minutes after the countdown reaches 00:00:00.

3. Cross-margin mechanism

On the Nexo platform, futures trading uses the cross-margin method. This means the total BTC, ETH, XRP, USDC, and USDT in your Futures Wallet support all your open futures positions.

For example, if you simultaneously open both a Long position in the BTCUSDT contract and a Long position in the ETHUSDT contract, the combined BTC, ETH, XRP, USDC, and USDT balance in your Futures Wallet serves as collateral for both positions.

This pooled approach differs from isolated margin strategies. It allows for asset diversification, more flexibility, better capital efficiency, and may reduce the likelihood of automated position closure (liquidation) if some of your active positions become unprofitable. However, it also means that losses from any one position can impact your entire collateral (margin) balance, potentially increasing liquidation risk across all open positions.

At the same time, any assets held in your Savings Wallet continue to earn interest. Only the BTC, ETH, XRP, USDC, and USDT in your Futures Wallet function as collateral for opening or maintaining a futures position.

Note:

- The BTC, ETH, XRP, and USDC balance in the Futures Wallet is dynamically denominated in USDT based on the current exchange rate. For instance, if you have 15,000 USDC and the rate is 1.0001 USDT per USDC, then your USDC is valued at 15,000 × 1.0001 = 15,001.50 USDT.

- If your Futures Wallet does not contain enough USDT to cover a funding payment, but you hold sufficient BTC, ETH, XRP, or USDC, the required amount of these assets will be automatically converted to USDT at the current exchange rate to cover the payment. The same process applies if there is not enough USDT to cover trading or liquidation fees, or if you close a position with a negative PnL but do not have the USDT to cover the loss.

- The order in which BTC, ETH, XRP, and USDC in your Futures Wallet are automatically converted to USDT may vary, depending on current market conditions.

Collateral weight

All collateral (margin) and position-related values in futures trading on the Nexo platform are measured in USDT. Each asset in your Futures Wallet contributes to your Available margin based on its collateral weight, which reflects its risk-adjusted value.

- BTC, ETH, and XRP have a collateral weight of 70%.

This means only 70% of their market value counts toward your usable margin.

Example: If you have 1 BTC in your Futures Wallet and the current price is 100,000 USDT, its collateral contribution would be 1 × 100,000 × 70% = 70,000 USDT.

- USDC and USDT both have a collateral weight of 100%.

However, USDC must still be measured into USDT-equivalent value based on the real-time exchange rate to determine its collateral contribution.

Example: If you have 25,000 USDC and the current exchange rate is 0.9995 USDT per USDC, the USDT-equivalent margin would be 25,000 × 0.9995 x 100% = 24,987.50 USDT.

Note: Using assets other than stablecoins as collateral for futures trading, such as BTC, ETH, or XRP, offers more flexibility, but it also comes with additional risks. More specifically, the value of these cryptocurrencies can change significantly, and both your potential profits and losses may increase. If the market moves against you, the combined effect of price changes in your collateral and the Unrealized PnL of your open positions can raise the risk of liquidation and the potential loss of your entire margin. For this reason, we advise responsible trading.

4. Leverage in futures trading

Leverage means using borrowed funds to trade cryptocurrencies. It amplifies your ability to buy (Long) or sell (Short) by allowing you to trade with more capital than you have in your Futures Wallet.

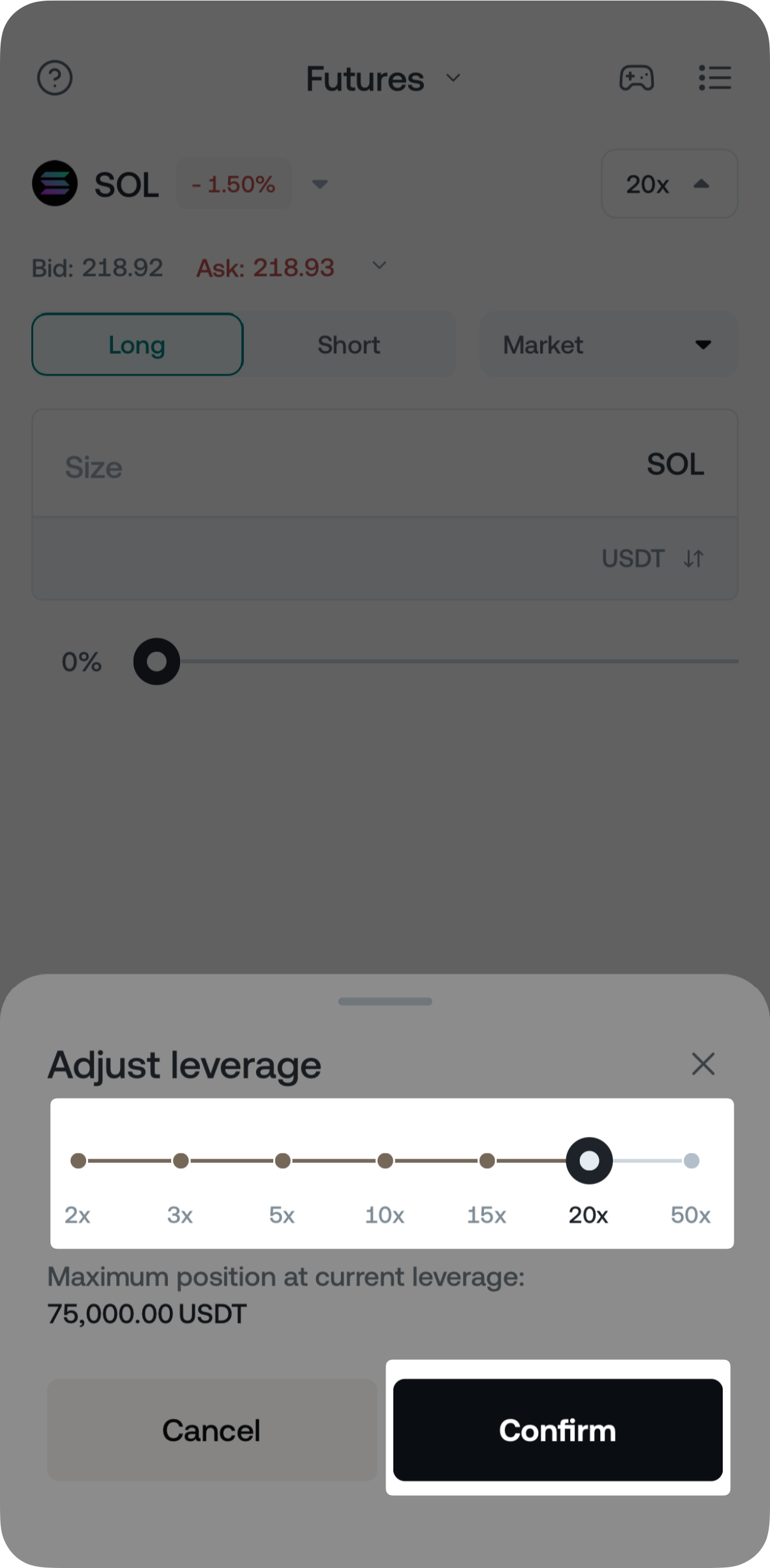

On the Nexo platform, all futures positions use leverage. You can adjust your leverage between 2x and 50x for most assets, while the BTC and ETH contracts offer you the ability to go as high as 100x.

Below is a list of contracts offering up to 50x leverage:

- SOL, XRP, BNB, ADA, DOGE, AVAX, DOT, TRX, ETC, BCH, LINK, LTC, FIL, POL, 1000BONK, 1000PEPE, 1000SHIB, TRUMP, WIF

This range of options helps you customize your trading strategies based on your risk tolerance and market outlook.

Leverage can also be understood as a ratio that reflects how much your initial funds are multiplied to increase your purchasing power. For instance, a 1:10 leverage ratio means your purchasing power is increased ten times.

Example: Suppose you have 1,000 USDT in your Futures Wallet and want to open a position worth 10,000 USDT. Using 10x leverage makes it as though you have 10,000 USDT.

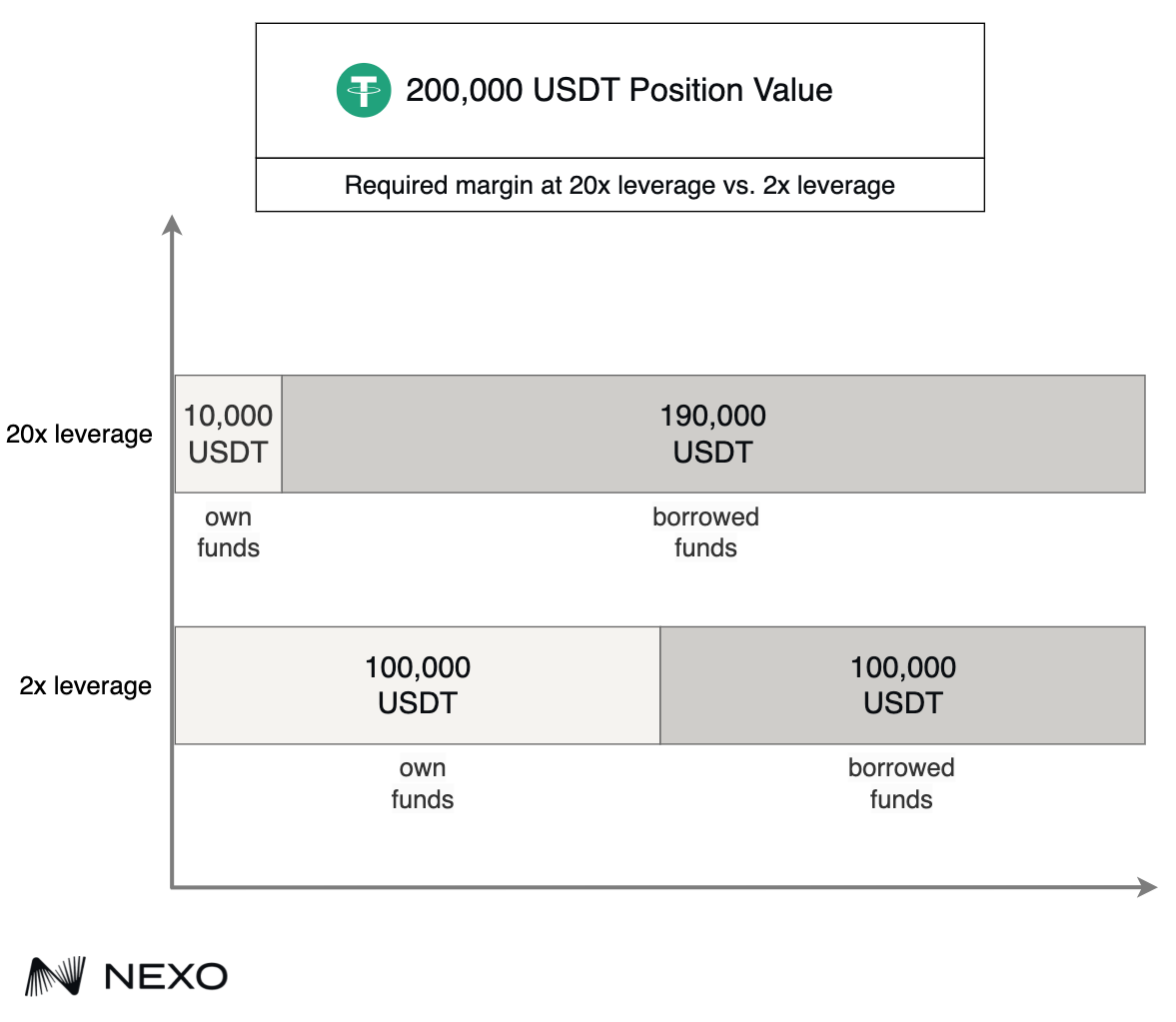

To engage in leveraged trading, you first need to fund your Futures Wallet. The funds serve as collateral (also known as margin). The Required margin varies based on the leverage and the total value of the position.

If you use 2x leverage to open a 200,000 USDT position with 100,000 USDT, increasing the leverage to 20x would reduce the Required margin to 10,000 USDT.

Formula and examples

Calculating Required margin: To open a 200,000 USDT position with 10x leverage, the Required margin is 200,000 / 10 = 2,000 USDT.

Determining Leverage: To open a 300,000 USDT position with 20,000 USDT as collateral, the leverage is 300,000 / 20,000 = 15x.

Using higher leverage allows you to open larger positions with less collateral, amplifying both potential gains and losses. This highlights the significant effect leverage has on your trading capabilities.

Understanding these concepts is vital for managing your exposure and risks in leverage trading.

Because leverage trading is associated with greater risk, it requires a deeper understanding of the process. Nexo recommends reading this article in its entirety before placing perpetual orders on the Nexo platform, especially if you are new to futures trading.

For additional examples, including those related to tracking your Profit and Loss (P&L) performance, please refer to this section.

Note:

- Assets have a maximum Position Value based on the leverage setting (e.g. 50,000 USDT for 50x leverage). However, you can open multiple positions for the same asset and direction to increase the size of your active position up to the maximum value available for that contract.

- Using assets other than stablecoins as collateral for futures positions may increase potential profits and losses.

- If your Margin risk increases significantly, usually because of unfavorable price movements of your active positions or price depreciation of your collateral, all active positions may be closed, and part or all of your collateral in the Futures Wallet might be sold. Learn more

5. Futures Profit and Loss (P&L)

P&L without leverage

Understanding the basic principles of Profit and Loss (P&L) can answer questions like “How soon will my portfolio increase by 10%?”.

Consider you own 10 ETH in your Savings Wallet, valued at $3,000 each, and you aim to increase their USD value by 10%, or $3,000 (which is $300 apiece). Without using leverage, the price of ETH must rise to $3,300 to achieve this. This calculation is based on the formula:

For a 10% increase, Nexo has:

- Step 1: Future Price = $3,000 x (1 + 10%)

- Step 2: Future Price = $3,000 x 1.10

- Result: Future Price = $3,300

On the other hand, the P&L is calculated via:

Using the same example, P&L = ($3,300 – $3,000) x 10 = $3,000.

P&L with leverage

Simply holding your assets and waiting for their value to increase can be risky. For example, if you hold 10 ETH and expect the price to rise, you could face a loss if the price instead decreases.

An alternative strategy is to utilize futures leverage trading. This method allows you to use USDT or USDC, helping to maintain a relatively stable balance during your trading session. You can set your leverage level and decide whether to go Long or Short based on your trading preference. Until a position is closed, we say that the P&L is unrealized.

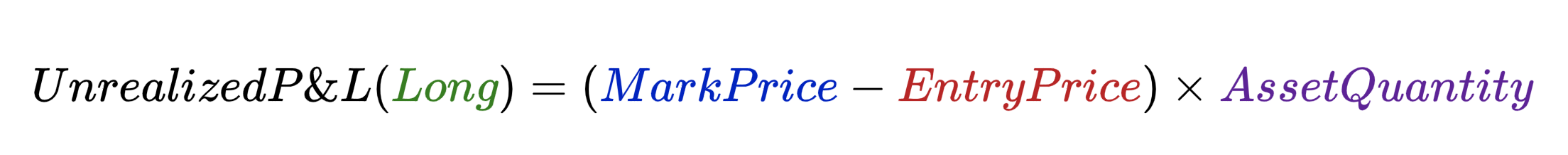

Formulas

Unrealized P&L of a Long position:

Unrealized P&L of a Short position:

Position Value:

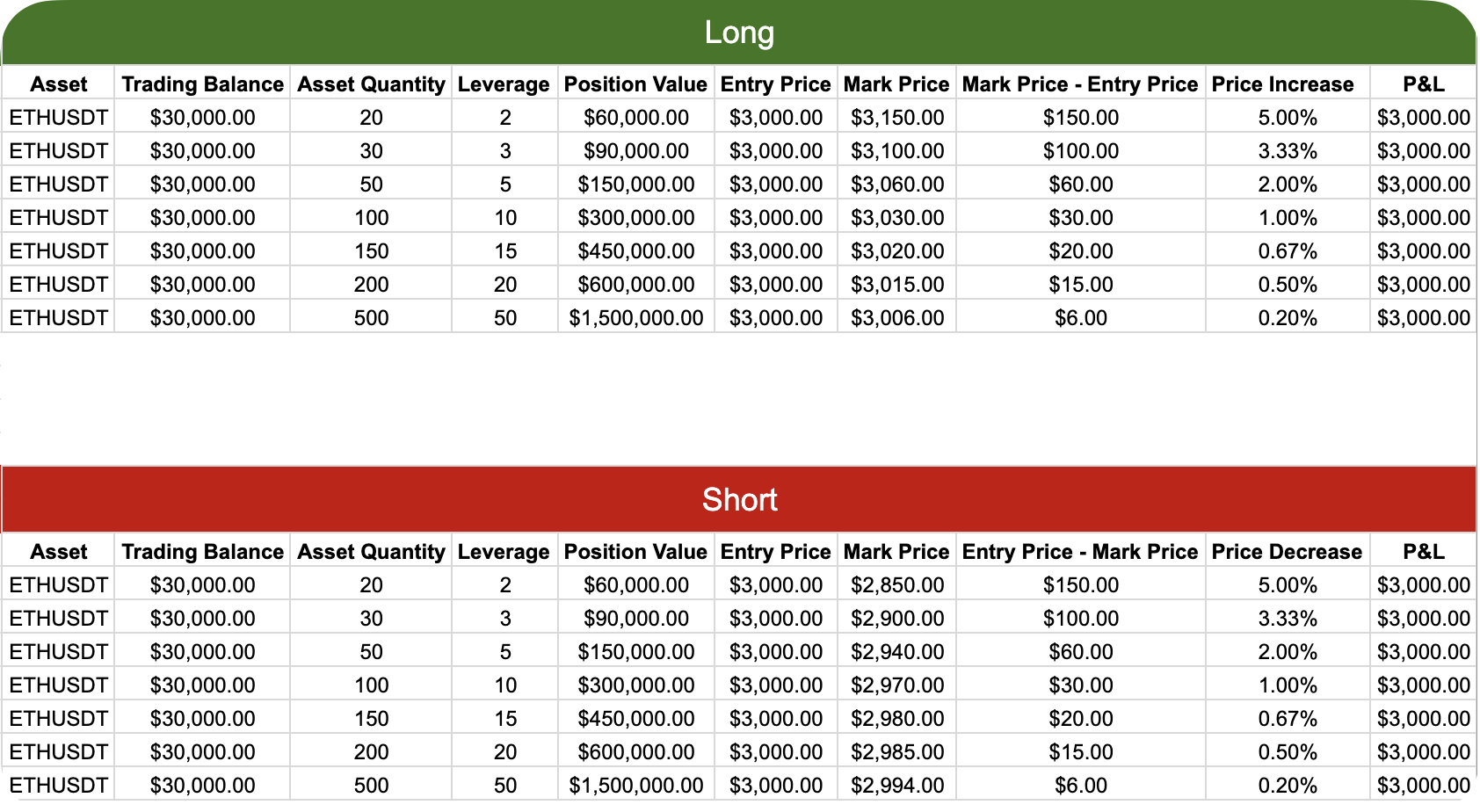

Example 1 – Going Long with 10x leverage. Let us assume that you wish to reproduce the same profit as the above example:

- Trading Balance = 30,000 USDT

- Leverage = 10

- Entry Price = 3,000 USDT per ETH

- Asset Quantity = 100 ETHUSDT

- Desired profit = 10% of the Trading Balance (or $3,000)

To achieve a 10% profit, the calculations are as follows

- Step 1: [Long] Desired Profit (P&L) = (Mark Price – Entry Price) x Asset Quantity

- Step 2: 3,000 = (Mark Price – 3,000) x 100

- Step 3: 3,000/100 = Mark Price – 3,000

- Step 4: 30 = Mark Price – 3,000

- Result: Mark Price = 3,030 USDT

Example 2 – Going Short with 10x leverage. Once again, Nexo aims to reproduce the same profit:

- Trading Balance = 30,000 USDT

- Leverage = 10

- Entry Price = 3,000 USDT per ETH

- Asset Quantity = 100 ETHUSDT

- Desired Profit = 10% of the Trading Balance (or $6,000)

The calculations for you to be at 10% profit would be:

- Step 1: [Short] Desired Profit (P&L) = (Entry Price – Mark Price) x Asset Quantity

- Step 2: 3,000 = (3,000 – Mark Price) x 100

- Step 3: 3,000/100 = 3,000 – Mark Price

- Step 4: 30 = 3,000 – Mark Price

- Result: 2,970 USDT = Mark Price

We’ve learned from the above that the desired Unrealized P&L can be achieved ten times faster with 10x leverage. This works because the Position Value (30,000 x 10 = 300,000 USDT) is ten times larger than the Trading Balance (30,000 USDT). In other words, the profits or losses are scaled by a factor of 10.

The above examples illustrate two opposite ways to profit by 10%, which meant that the asset price had to increase (Long) or decrease (Short) by only 30 USDT instead of 300 USDT.

Nexo has illustrated how the Price Increase and Price Decrease increments are getting smaller and smaller in this particular example as we increase the leverage.

We start with a 5% increase (Long) / decrease (Short) for 2x leverage. That percentage drops to 0.10% when Nexo is at 100x leverage, which equates to only a 3 USDT increase or decrease from the Entry Price.

Conclusion: P&L (often abbreviated as PnL) is a key metric in cryptocurrency trading. It helps traders assess their financial performance by calculating the gains or losses on their positions.

Note:

- The Last price is used instead of the Mark price when opening or closing a position. Learn more

- The Unrealized P&L represents what profit or loss would be realized if the position is closed at the current market price. This value may differ from the Realized P&L. Learn more

- Assets have a maximum Position Value based on the leverage setting (e.g. 50,000 USDT for 50x leverage). That said, you can open multiple positions for the same asset and direction to increase the size of your active position up to the maximum available value for that contract.

- Using assets other than stablecoins as collateral for futures positions may increase potential profits and losses.

P&L with leverage – combining same-asset positions in one direction

In the previous section, we covered how calculations are performed for a single futures position in one direction. However, when you open multiple futures positions for the same asset and in the same direction, these positions are not treated as separate entities. Instead, they are consolidated into a single position with an average price.

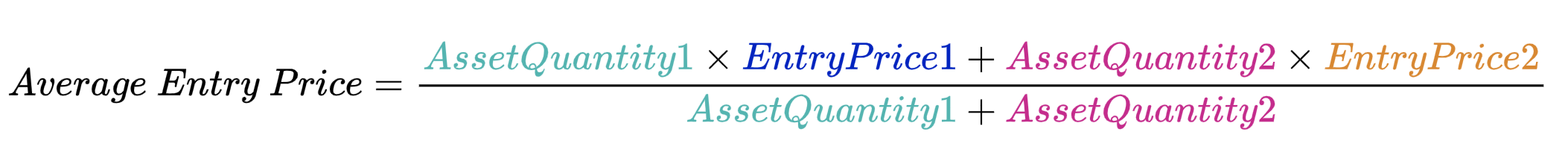

Formula:

Tip: This computation is applicable for any number of positions. For example, if calculating for three positions, add Asset Quantity 3 x Entry Price 3 to the numerator and Asset Quantity 3 to the denominator.

Example 1 – Going Long with two positions:

On November 1 at 11:00 UTC, you open a position with the following parameters:

- Asset Quantity = 0.75 BTC

- Entry Price = 75,000 USDT per BTC

On the next day, November 2, at 10:00 UTC, the Mark Price of BTC is 80,000 USDT per BTC, and the Unrealized P&L is:

- Step 1: [Long] Unrealized P&L = (Mark Price – Entry Price) x Asset Quantity

- Step 2: (80,000 – 75,000) x 0.75 = 3,750 USDT

On November 2 at 10:30 UTC, you decide to open another BTC position:

- Asset Quantity = 1.75 BTC

- Entry Price = 82,000 USDT per BTC

Both positions will be combined into one. Here is how to calculate its Average Entry Price:

- Step 1: Average Entry Price = (Asset Quantity 1 x Entry Price 1 + Asset Quantity 2 x Entry Price 2) / (Asset Quantity 1 + Asset Quantity 2)

- Step 2: Average Entry Price = (0.75 x 75,000 + 1.75 x 82,000) / (0.75 + 1.75)

- Step 3: Average Entry Price = (199,750) / (2.50)

- Step 4: Average Entry Price = 79,900 USDT per BTC

Knowing the Average Entry Price, you can easily calculate the Unrealized P&L. If the Mark Price is 83,500 USDT per BTC on November 2 at 13:00 UTC, then Nexo has:

- Step 1: [Long] Unrealized P&L = (Mark Price – Average Entry Price) x Asset Quantity

- Step 2: (83,500 – 79,900) x 2.50 = 9,000 USDT

Example 2 – Going Short with two positions:

On December 5 at 14:00 UTC, you open a position with the following parameters:

- Asset Quantity = 2 ETH

- Entry Price = 3,000 USDT per ETH

On the next day, December 6, at 15:00 UTC, the Mark Price of ETH is 2,930 USDT per ETH, and the Unrealized P&L is:

- Step 1: [Short] Unrealized P&L = (Entry Price – Mark Price) x Asset Quantity

- Step 2: (3,000 – 2,930) x 2 = 140 USDT

On December 6 at 16:30 UTC, you decide to open another ETH position:

- Asset Quantity = 3 ETH

- Entry Price = 2,880 USDT per ETH

Both positions will be combined into one. Here is how to calculate its Average Entry Price:

- Step 1: Average Entry Price = (Asset Quantity 1 x Entry Price 1 + Asset Quantity 2 x Entry Price 2) / (Asset Quantity 1 + Asset Quantity 2)

- Step 2: Average Entry Price = (2 x 3,000 + 3 x 2,880) / (2 + 3)

- Step 3: Average Entry Price = (14,640) / (5)

- Step 4: Average Entry Price = 2,928 USDT per ETH

Knowing the Average Entry Price, you can easily calculate the Unrealized P&L. If the Mark Price is 2,850 USDT per ETH on December 6 at 17:00 UTC, then Nexo has:

- Step 1: [Short] Unrealized P&L = (Average Entry Price – Mark Price) x Asset Quantity

- Step 2: (2,928 – 2,850) x 5 = 390 USDT

P&L with leverage – opening positions using the Unrealized P&L

Suppose you have an active position with these parameters, which has generated 1,000 USDT Unrealized P&L:

- Position Value = 100,000 USDT

- Leverage = 10x

- Required margin = 10,000 USDT

The 1,000 USDT Unrealized P&L is treated as excess collateral for the active position, or in other words, you have an 11,000 USDT (10,000 + 1,000) margin, but only 10,000 USDT (100,000 / 10) is required. That said, because you have excess collateral worth 1,000 USDT, you can open another position on top of the active one worth 1,000 x 10 = 10,000 USD.

If you do open another position with the 1,000 USDT Unrealized P&L, then you would have:

- Position Value (total) = 110,000 USDT

- Leverage = 10x

- Required margin (total) = 11,000 USDT

Conclusion:

If all of the collateral in your Futures Wallet is used to open positions, then any positive Unrealized P&L can be used to open more positions. If you have more than one active position, then your overall Unrealized P&L has to be positive for you to have excess collateral that can be used to open new positions.

For example, position 1 is at +500 USDT Unrealized P&L, but position 2 is at -700 USDT Unrealized P&L. In that case, your overall Unrealized P&L is 500 – 700 = -200 USDT, which means you do not have excess collateral and cannot open more positions.

6. Hedge strategy

Hedging is a strategy utilized by traders to manage their risk exposure to the market. It involves opening two opposite positions, a Long and a Short, which enables one to profit from any market movement and reduce potential losses.

For instance, you can open and simultaneously maintain both Long and Short positions in the BTCUSDT contract.

Hedging is best utilized when you are interested in a specific contract but are yet unsure about the overall market direction. By choosing to go Long and Short, you can reduce the potential risks. We explore hedging examples below.

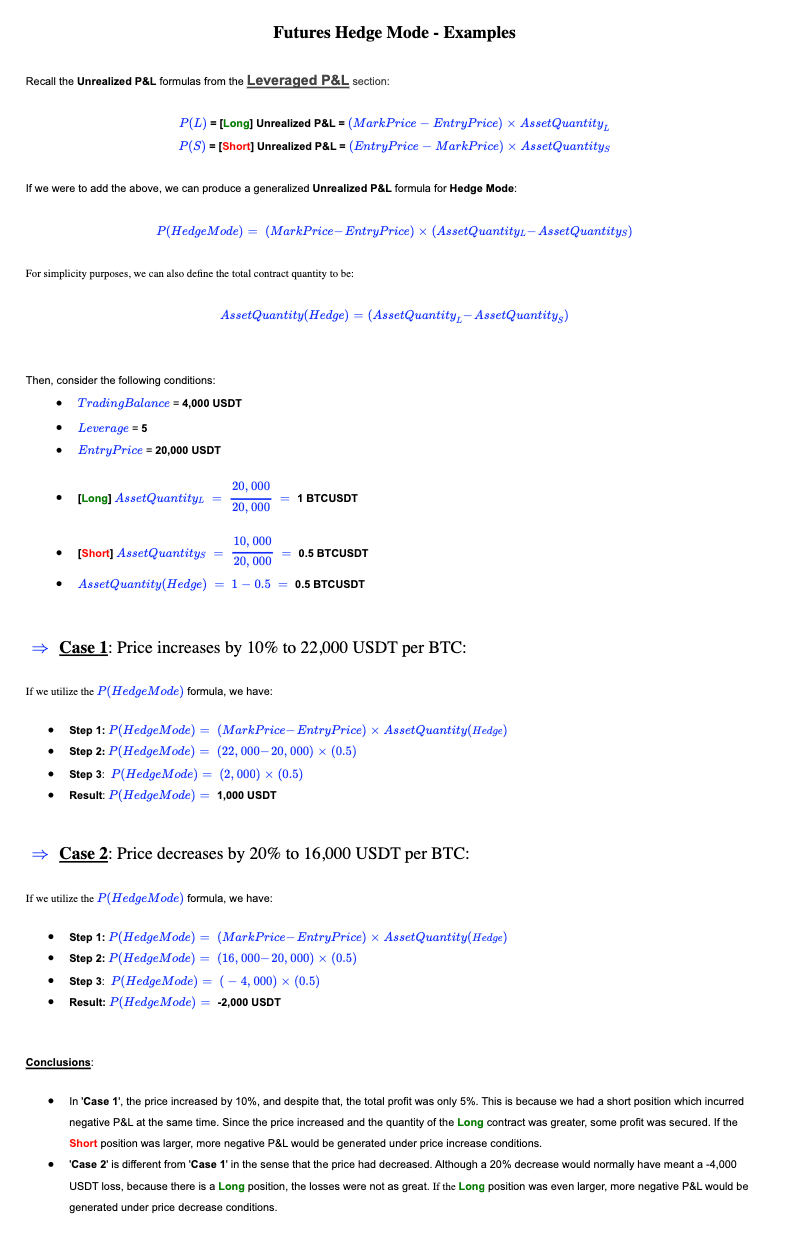

Hedge strategy with opposite futures positions

Hedge strategy – mitigating losses only with a short position

Suppose you hold 1 BTC in your Savings Wallet, currently valued at $100,000, and are concerned about a potential price drop. To hedge against this risk, you decide to transfer the BTC to your Futures Wallet and open a Short futures position on BTCUSDT, using your BTC as collateral.

Setup:

- Trading Balance = 1 BTC (with 70% collateral weight)

- Leverage = 2x

- Entry Price = 100,000 USDT per BTC

- Asset Quantity = 1.4 BTCUSDT (equivalent to a Position Value of 140,000 USDT)

If BTC drops to 98,000 USDT and you close your Short position, your P&L is calculated as follows:

- Step 1: [Short] P&L = (Entry Price – Mark Price) x Asset Quantity

- Step 2: (100,000 – 98,000) x 1.4 = 2,800 USDT

This example shows how profits from your Short futures position can help offset losses from a drop in BTC’s price. As BTC falls from $100,000 to $98,000, your 1 BTC sees a devaluation of $2,000. However, since you still hold your BTC, that loss could be recovered if the price rebounds. Meanwhile, the realized profit of 2,800 USDT from your Short position is credited to your Futures Wallet and remains yours regardless of further BTC price changes.

Note: Although hedging by opening a Short futures position is convenient to mitigate downside risk, it can also reduce profits if the market moves against you. For example, if BTC had risen to $102,000 USDT in the explored scenario, your 1 BTC holding would gain $2,000, but your Short futures position would realize a 2,800 USDT loss. As a result, your net profit would be reduced. This is why Nexo recommends using hedging strategies thoughtfully, understanding that they can impact your returns in both directions.

7. Leverage trading risks

Now that Nexo has explored favorable outcomes where the underlying asset’s price increases (when going Long) or decreases (when going Short), let’s explore an unfavorable scenario:

- Side = Long

- Trading Balance = 30,000 USDT

- Leverage = 2

- Entry Price = 3,000 USDT per ETH

- Position Value = 60,000 USDT (or 500 ETHUSDT)

If the price falls by 5%, the Unrealized P&L would be -3,000 USDT. If the leverage increases to 10x, a price drop of just 0.10% results in the same 3,000 USDT loss.

Note: To avoid automated position closure (liquidation), monitor your Futures Wallet positions, especially when trading at a higher leverage and using assets other than stablecoins as collateral. One way to maintain a healthy position is to transfer more funds from the Savings Wallet to the Futures Wallet. Another option is to close either part or all of your open positions. Learn more

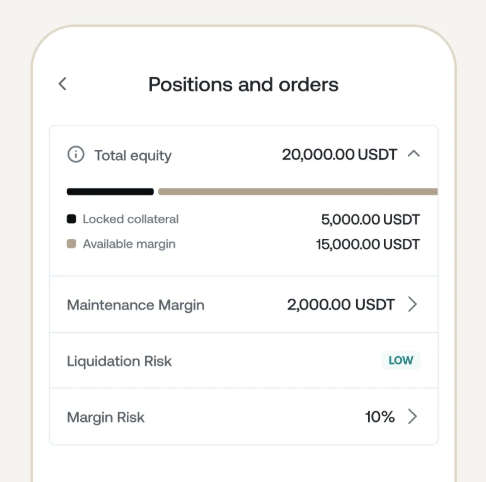

8. Margin risk

Margin risk is a percentage reflecting the relationship between the value of the collateral in your Futures Wallet and your open futures positions, both measured in USDT. A lower Margin risk indicates a healthier state for your active positions.

Upon opening a position, you will see an initial Margin risk rate (e.g., 15.30%). This rate will increase if your positions generate a negative Unrealized P&L and decrease if your positions are profitable. That said, changes to the prices of the assets in your Futures Wallet can also impact your Margin risk.

Note: Remember that increasing the leverage also amplifies the potential profits or losses.

Margin risk is calculated through this formula:

- Margin risk = Maintenance Margin / Equity

Key considerations:

- The Maintenance Margin represents the minimum Equity you must maintain in your Futures Wallet to keep your position open and avoid liquidation. This crucial value will be displayed on the platform interface, as shown above.

- On the other hand, Equity is calculated as the USDT value of the assets in your Futures Wallet (taking into account the collateral weight of each asset) plus the Unrealized P&L on any open positions. If you have 100,000 USDT worth of assets in the Futures Wallet (after collateral weight calculations) and your open position has generated 30,000 USDT profit, then the Equity will be 130,000 USDT.

Example: Let’s say you have an open Long position for 1 BTCUSDT. Your total equity stands at 20,000 USDT, while the system has assessed the required Maintenance Margin to be 2,000 USDT. In this scenario, the calculation of your Margin Risk would be:

- Step 1: Margin Risk = Maintenance Margin / Equity

- Step 2: Margin Risk = 2,000 / 20,000

- Result: Margin Risk = 10.00%

Note:

- Understanding and monitoring your Maintenance Margin and Equity can help you better manage your exposure to the market.

- All active positions are factored into the Maintenance Margin, which will be displayed on the platform interface.

Margin calls

It is crucial to monitor your active positions, especially during market declines. If the crypto contract price drops significantly, the Margin risk will rise due to negative Unrealized P&L.

In such circumstances, the Nexo platform may automatically request via push notification or email that you close your position or add more collateral to your Futures Wallet. The push may be sent once the Margin risk reaches 65%, and the email may be sent once the Margin risk reaches 85%.

Note: If necessary, part or all of your collateralized assets may be automatically sold, and your positions closed. You can prevent this by closing positions or adding extra collateral to your Futures Wallet. Learn more

9. Automated position closure

If the collateral value decreases significantly, you may receive a Margin call notification through a push notification or email asking you to add additional collateral to your Futures Wallet or close part of your open positions to prevent liquidation. The push may be set off once the Margin risk reaches 65%, and the email may be triggered once the Margin risk reaches 85%.

Please be advised that during severe, unfavorable market downturns, if your Margin risk reaches the liquidation threshold of 100.00%, the system will close all your futures positions and sell parts or all of your collateral.

When a position is automatically closed, a 1.25% liquidation fee multiplied by the total USDT value of your positions is deducted from the Futures Wallet balance.

Note:

- Remember that if your Margin risk increases, funds stored in your Savings Wallet or Credit Line Wallet will not be automatically transferred to the Futures Wallet to back your positions.

- The Liquidation price on the Nexo platform signifies at what Mark Price the liquidation will be triggered. The actual price at which each position is closed is the Last price.

- If you have multiple positions, only one has to hit its Liquidation price, and all other positions will be closed regardless of whether they were profitable. For example, it is possible to have one position closed with negative Realized PnL and three positions with positive Realized PnL.

- Margin call notifications are sent for informational purposes only. It remains the client’s responsibility to safeguard their Futures Wallet balance and take any precautionary measures if and when needed.

10. Trigger orders

A Trigger order on the Nexo platform executes a futures market order when a preset Trigger price is reached or exceeded.

This order type helps enter a position (Trigger entry) by placing a trade at a desired future price. It is also practical for exiting a position, functioning as either a Take profit (TP) or Stop loss (SL) order.

The order will only be executed if the Trigger price is met, at which point it converts into a market order executed at the best available price (Last price). Note that in volatile market conditions, the execution price may vary from the Trigger price due to rapid price changes.

Note:

- If a Trigger order is placed but remains unfilled (Pending status), the assets in your Futures Wallet are still available for opening futures market positions.

- Unfilled Trigger orders do not impact your Margin risk.

- When the Trigger price is met and the market order is executed, a fixed trading fee of 0.06% is applied.

Trigger entry order

This mechanism lets you place an order for a price in the future (Trigger price). A futures position will automatically be opened when this price is reached or exceeded. You can place both Long and Short orders at the same time. For instance:

- Current BTC price: 85,000 USDT

- Trigger entry order (Long): Place an order for 1 BTCUSDT at a Trigger price of 86,000 USDT per BTC, anticipating an increase in the price of BTC.

- Trigger entry order (Short): Place an order for 1 BTCUSDT at a Trigger price of 84,000 USDT per BTC, preparing for a possible BTC price decrease.

With this setup, whether the market rises or falls, your orders are prepared to open a position once the specified Trigger price is reached or exceeded.

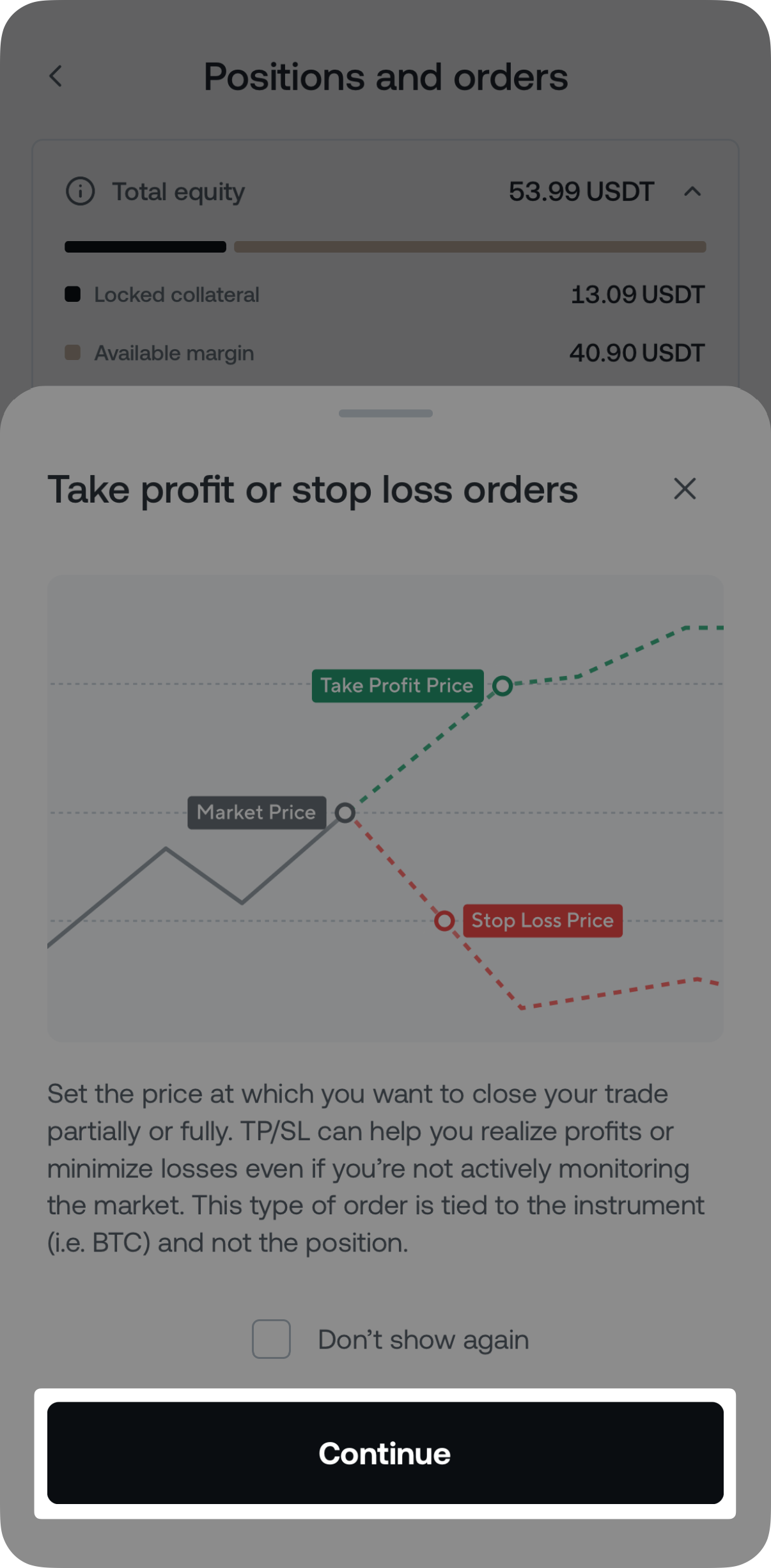

Take profit and Stop loss orders

This section explains how to use Take profit (TP) and Stop loss (SL) orders in perpetual futures.

Imagine you hold a 1 BTCUSDT perpetual futures contract with 2x leverage, going Long, and the current BTC price is 87,000 USDT. Traders often use TP and SL orders to manage risks effectively. Here’s how you might set these orders:

- Take profit: Set this order at a Trigger price of 90,000 USDT per BTC. Once the price reaches or exceeds this level, the order will execute, allowing you to exit with a profit.

- Stop loss: Place this order at a Trigger price of 85,000 USDT per BTC. If the price drops to this level or lower, the order will be executed to prevent further loss.

Setting these orders establishes the maximum profit you aim for and the maximum loss you are willing to accept. If you choose to go Short, adjusting the TP and SL levels accordingly for a similar strategy is equally applicable.

Note:

- If you have set both a TP and an SL order for a particular contract, when one of them is executed, the other order remains active until filled. You can cancel the remaining order at any time.

- If your futures position is liquidated or closed manually, any associated TP or SL orders for the contract (e.g. BTCUSDT) will automatically be canceled.

11. Funding the Futures Wallet and managing positions

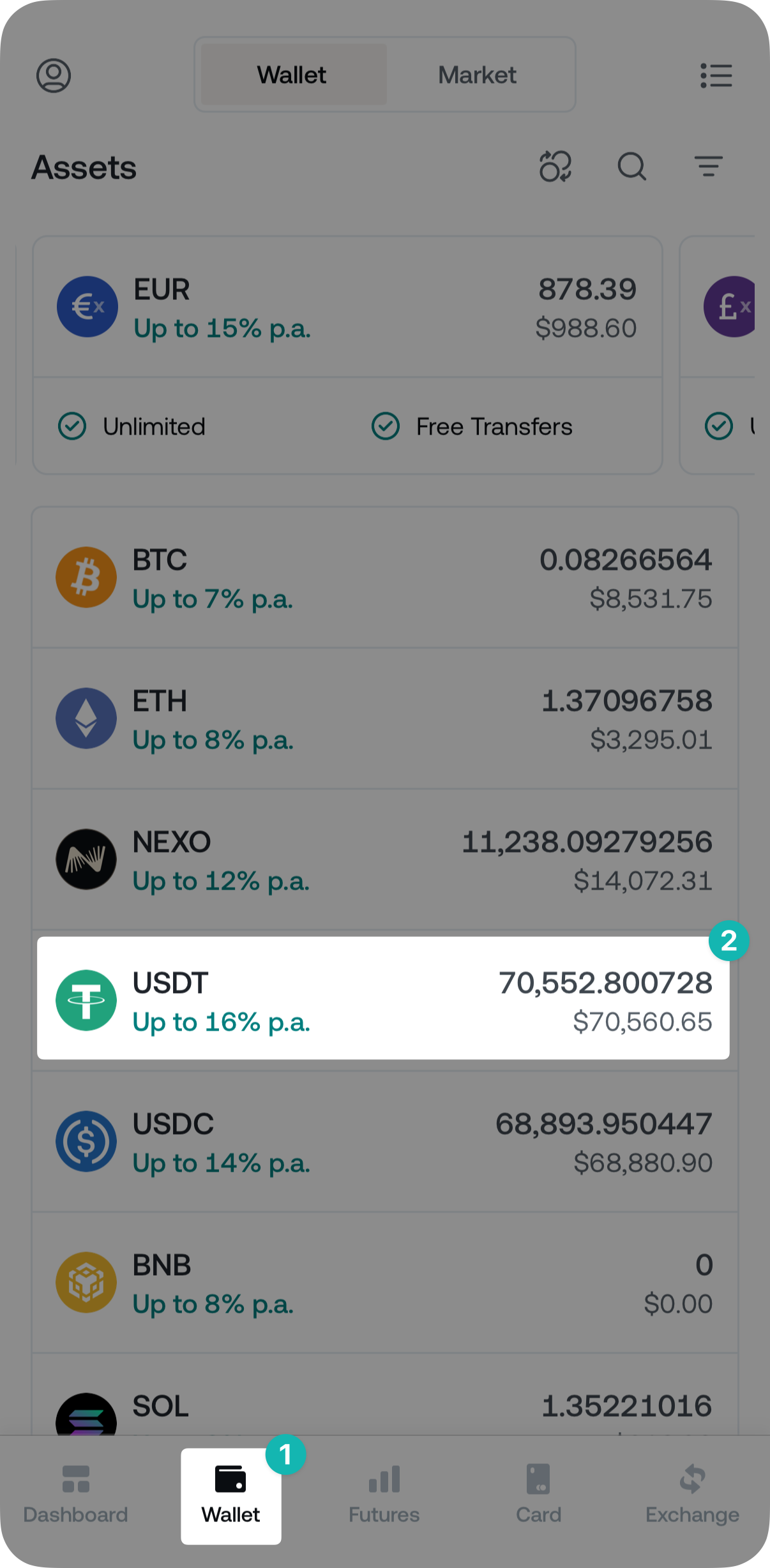

The examples below are from the Nexo App. However, these actions can also be performed on the Nexo web platform.

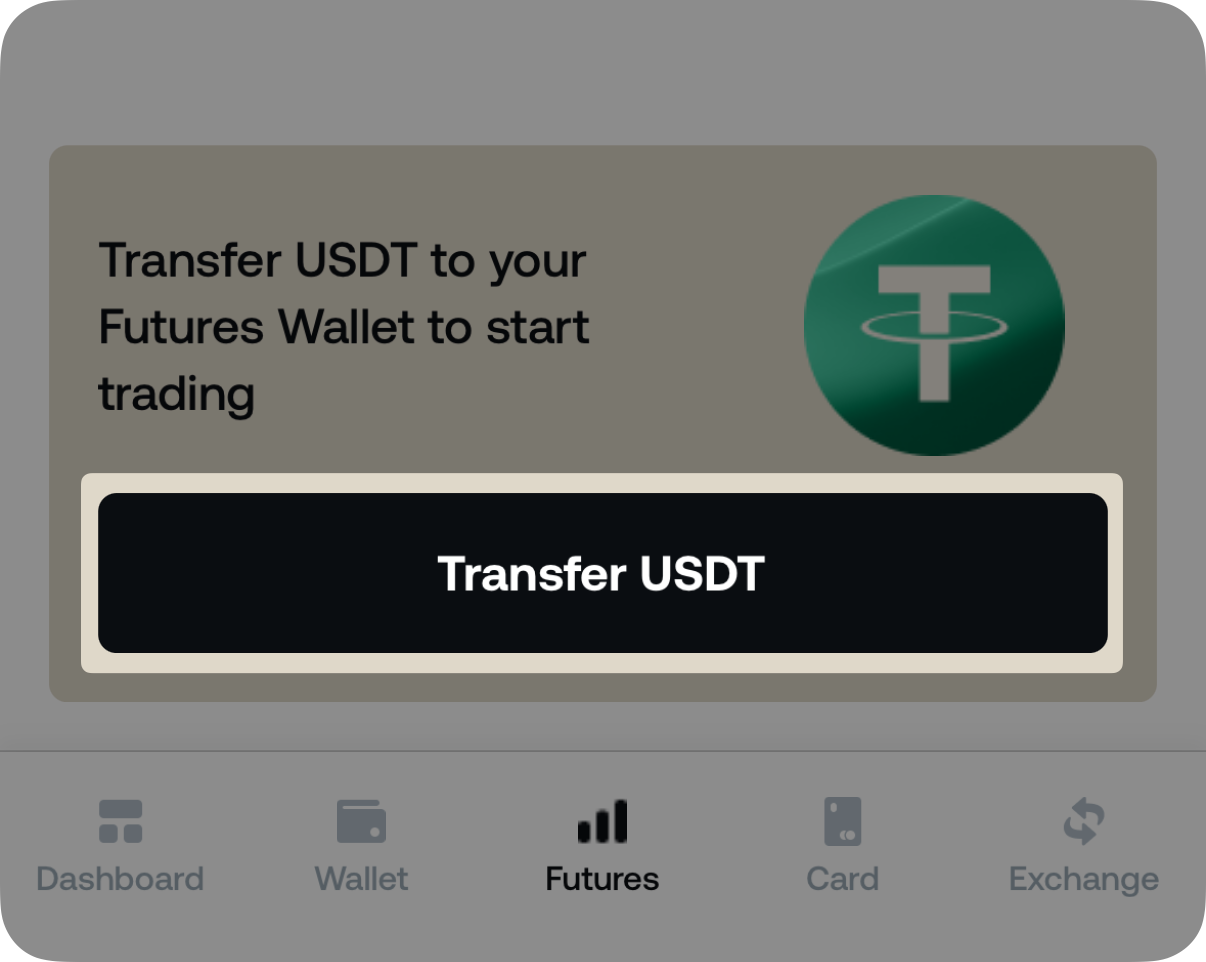

How to fund the Futures Wallet

To fund your Futures Wallet, follow the steps below:

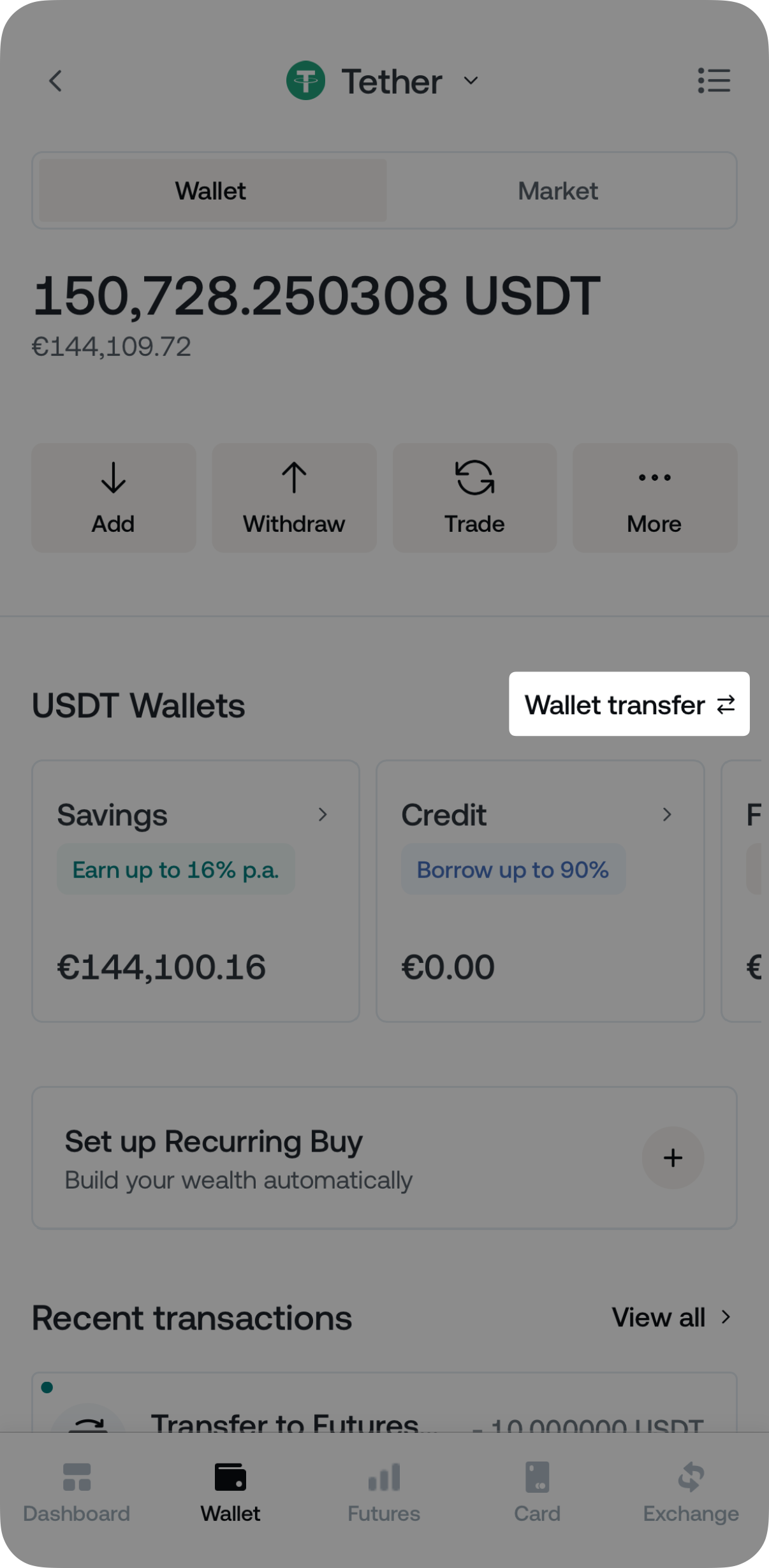

1. Open the Nexo App and visit the Wallet section. Once there, tap on USDT.

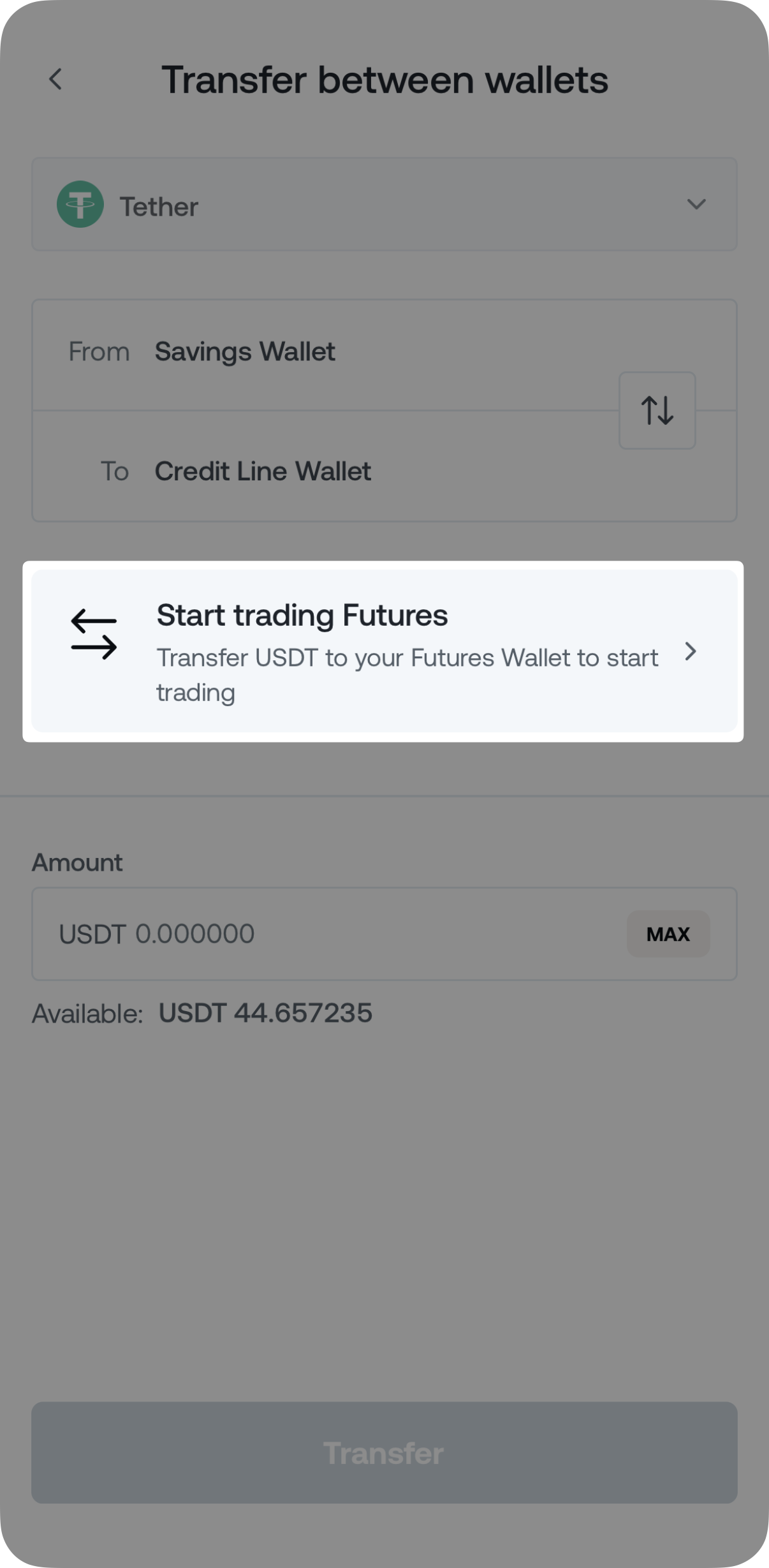

2. Then tap Wallet transfer.

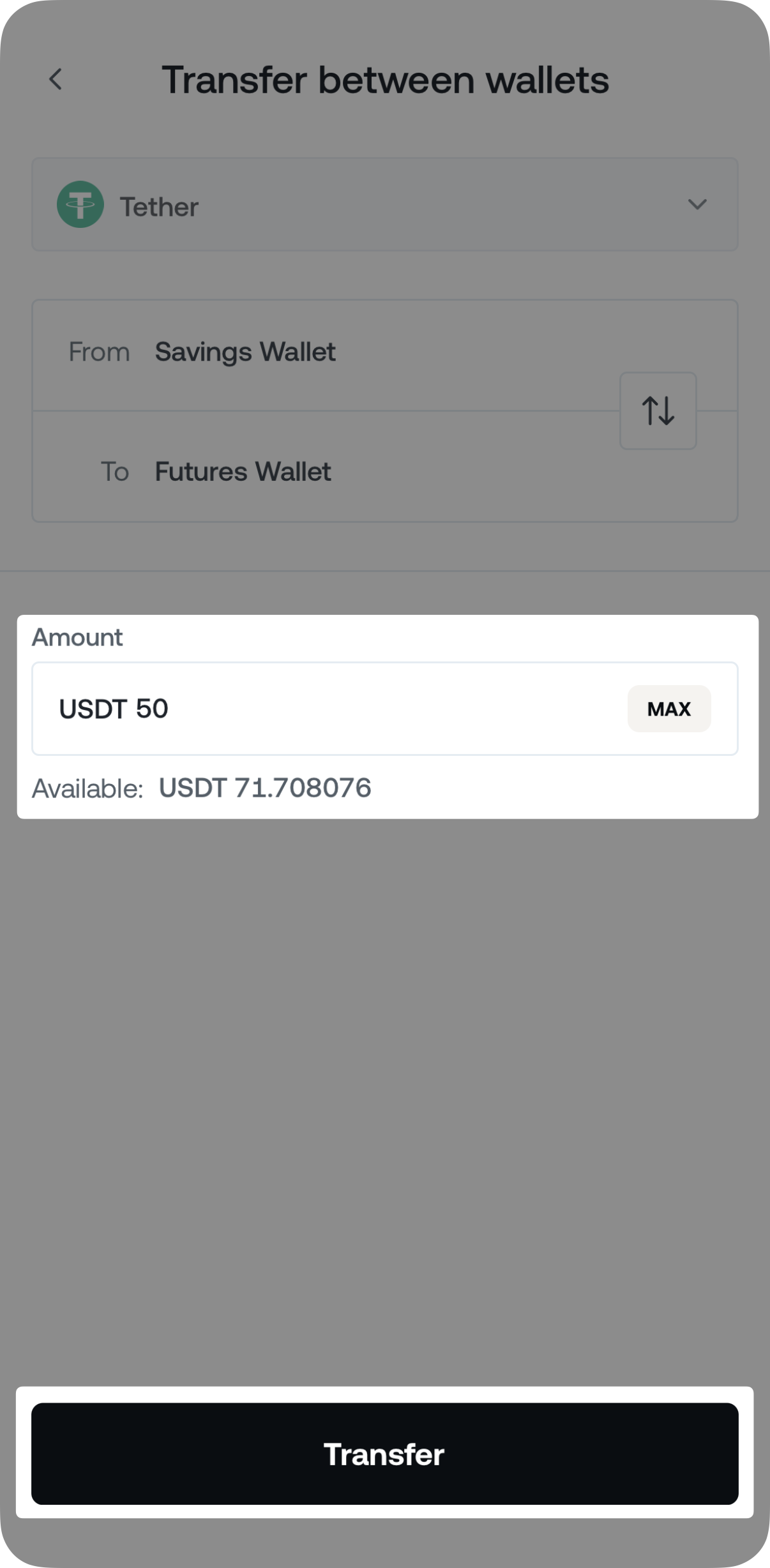

3. Tap Start trading Futures, enter the amount of USDT you wish to transfer, and tap Transfer.

Note:

- You can withdraw assets from the Futures Wallet to the Savings Wallet if you have no open positions or have excess collateral. Keep in mind that withdrawing collateral increases your Margin risk.

- Example: For a 10,000 USDT position at 5x leverage, you need a 2,000 USDT margin. In that case, if your Futures Wallet contains 5,000 USDT and your Unrealized PnL is –500 USDT, you can withdraw up to 5,000 – 2,000 – 500 = 2,500 USDT to your Savings Wallet.

- Negative Unrealized PnL decreases the amount you can withdraw as shown above, while positive Unrealized PnL cannot be withdrawn until your positions are closed and the corresponding profit is realized.

- Assets in the Futures Wallet cannot be utilized for other Nexo services, such as Target Price Swap, Earn, Borrow, etc.

- The assets in the Futures Wallet do count towards your Loyalty Tier. For example:

- You have $3,000 in total assets distributed as follows: $1,500 in the Savings Wallet, $1,000 in the Credit Line Wallet, and $500 in the Futures Wallet.

- Your total Portfolio Balance for the Loyalty Program will be $3,000.

- Any Unrealized PnL from open futures positions does not impact your Portfolio Balance.

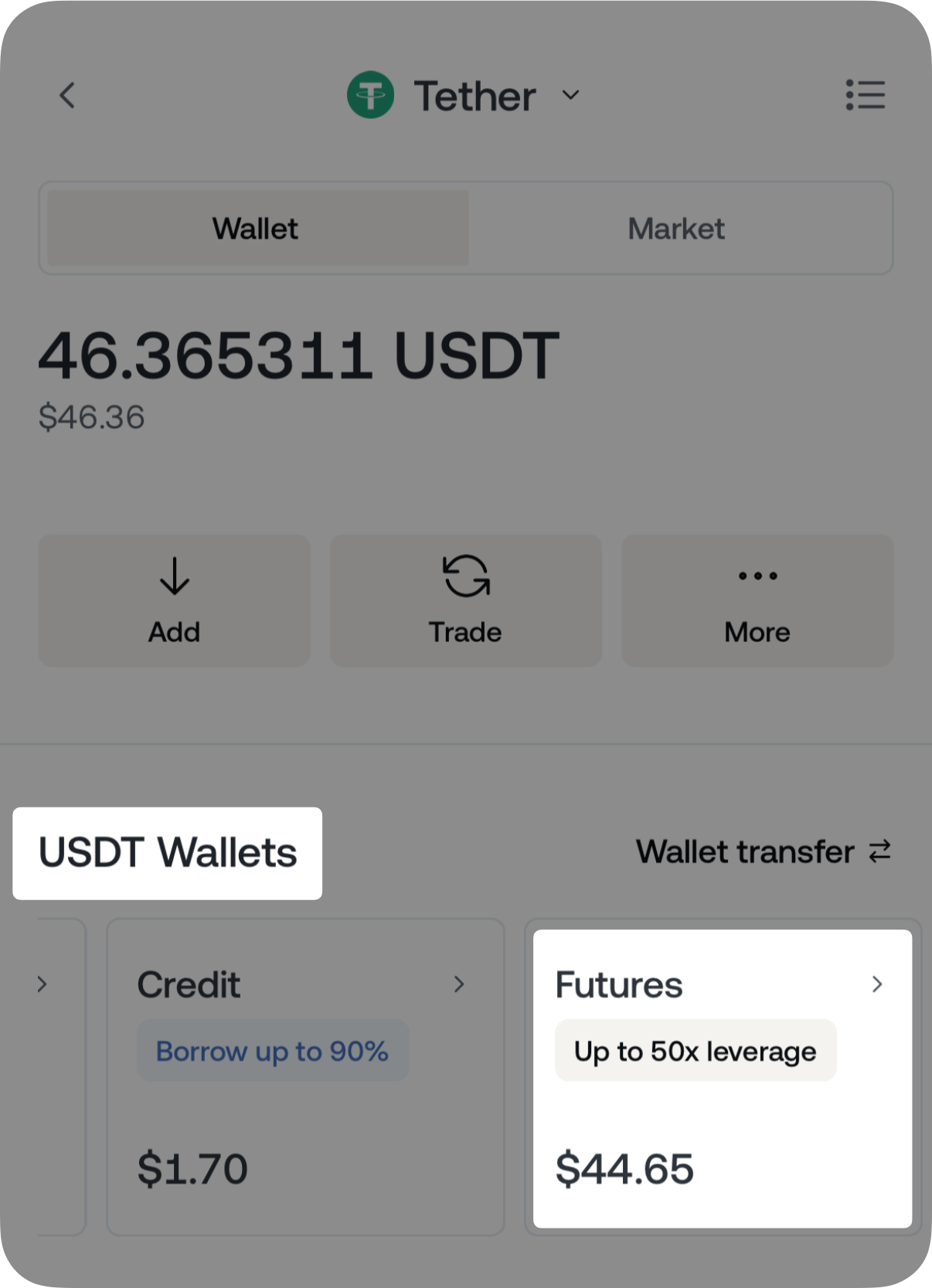

- You can easily check what your current Futures Wallet balance is in terms of USD as follows: select Wallet>USDT>navigate the USDT Wallets section>tap on Futures:

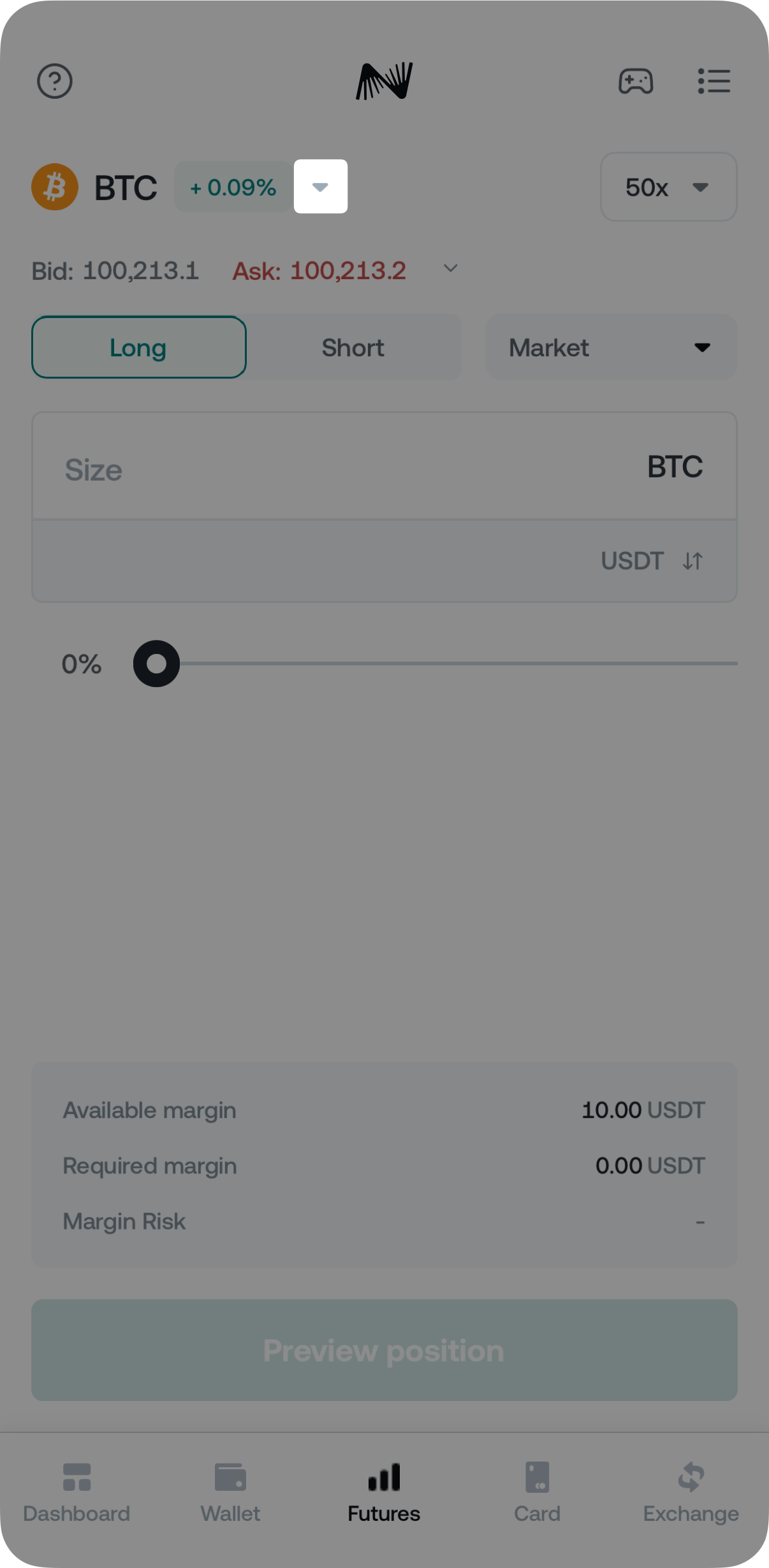

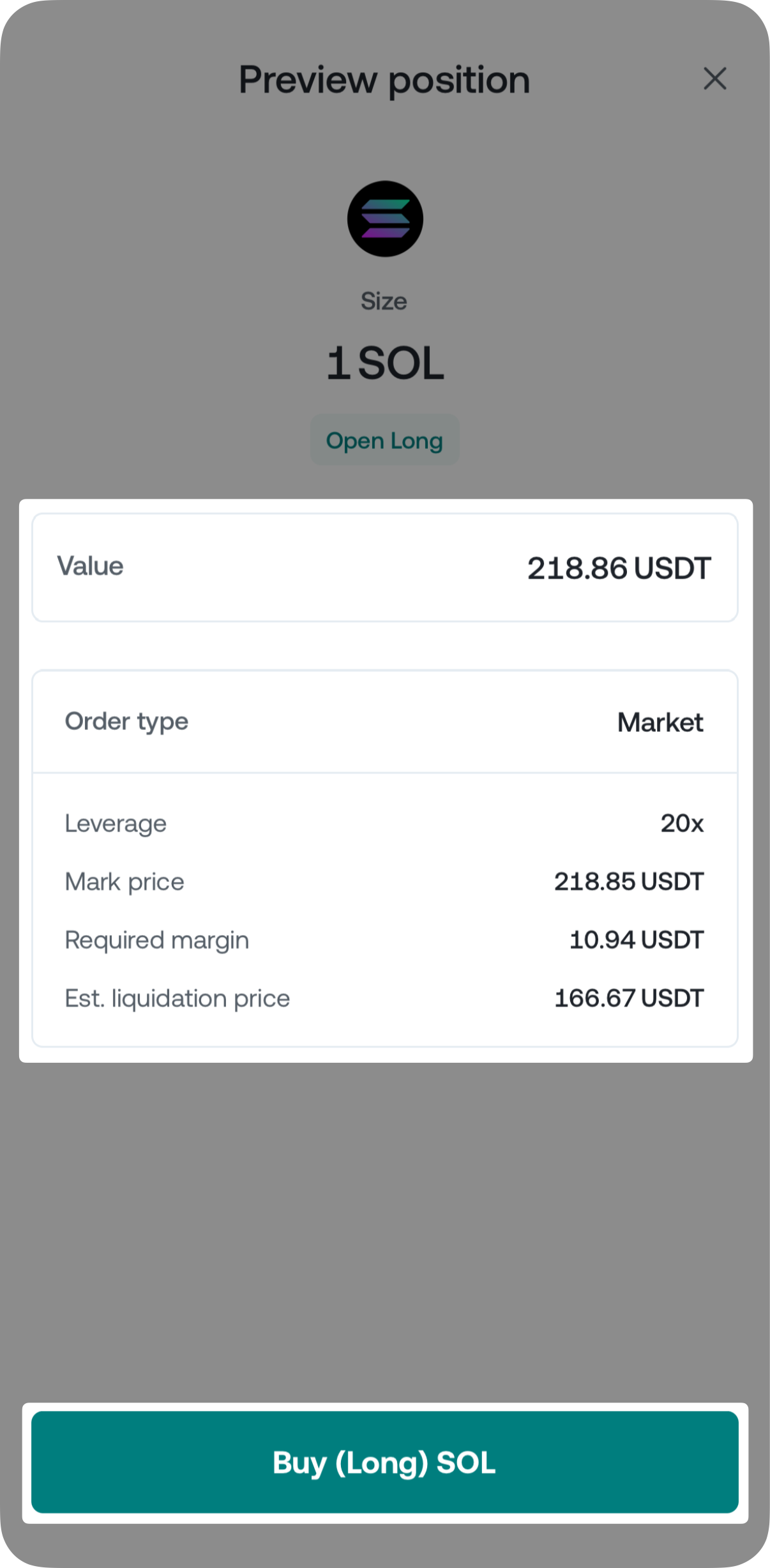

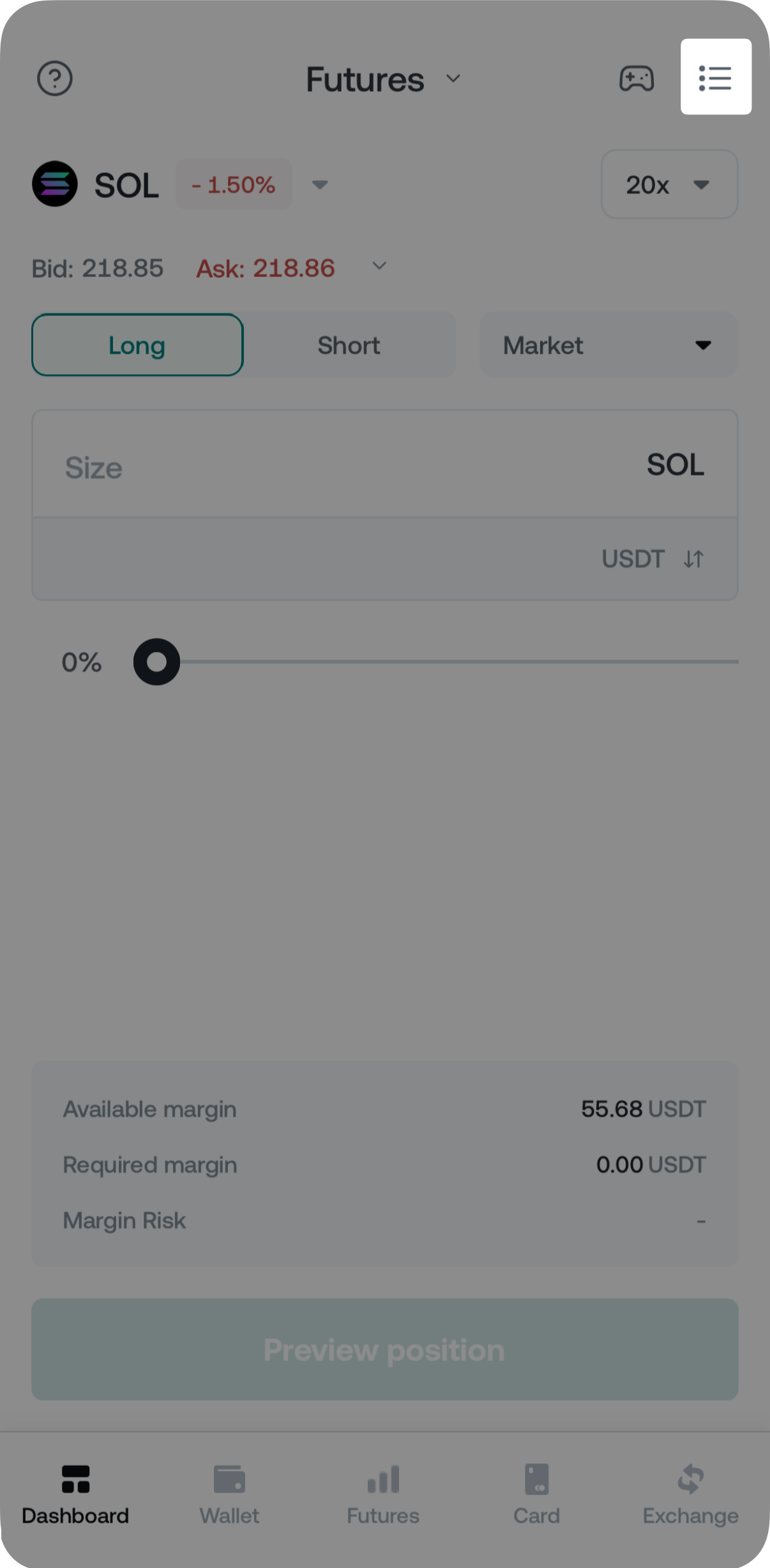

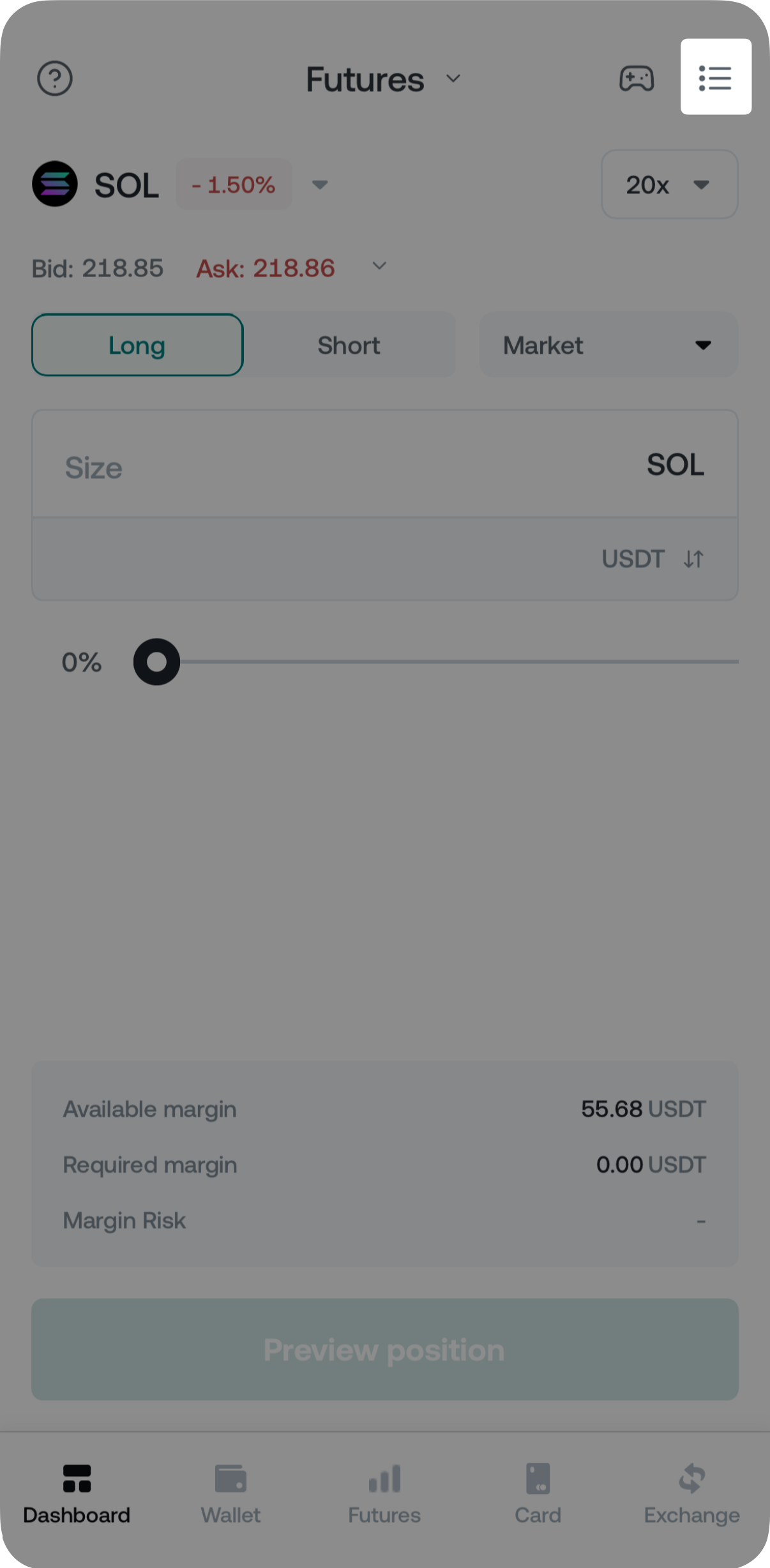

How to open a futures position

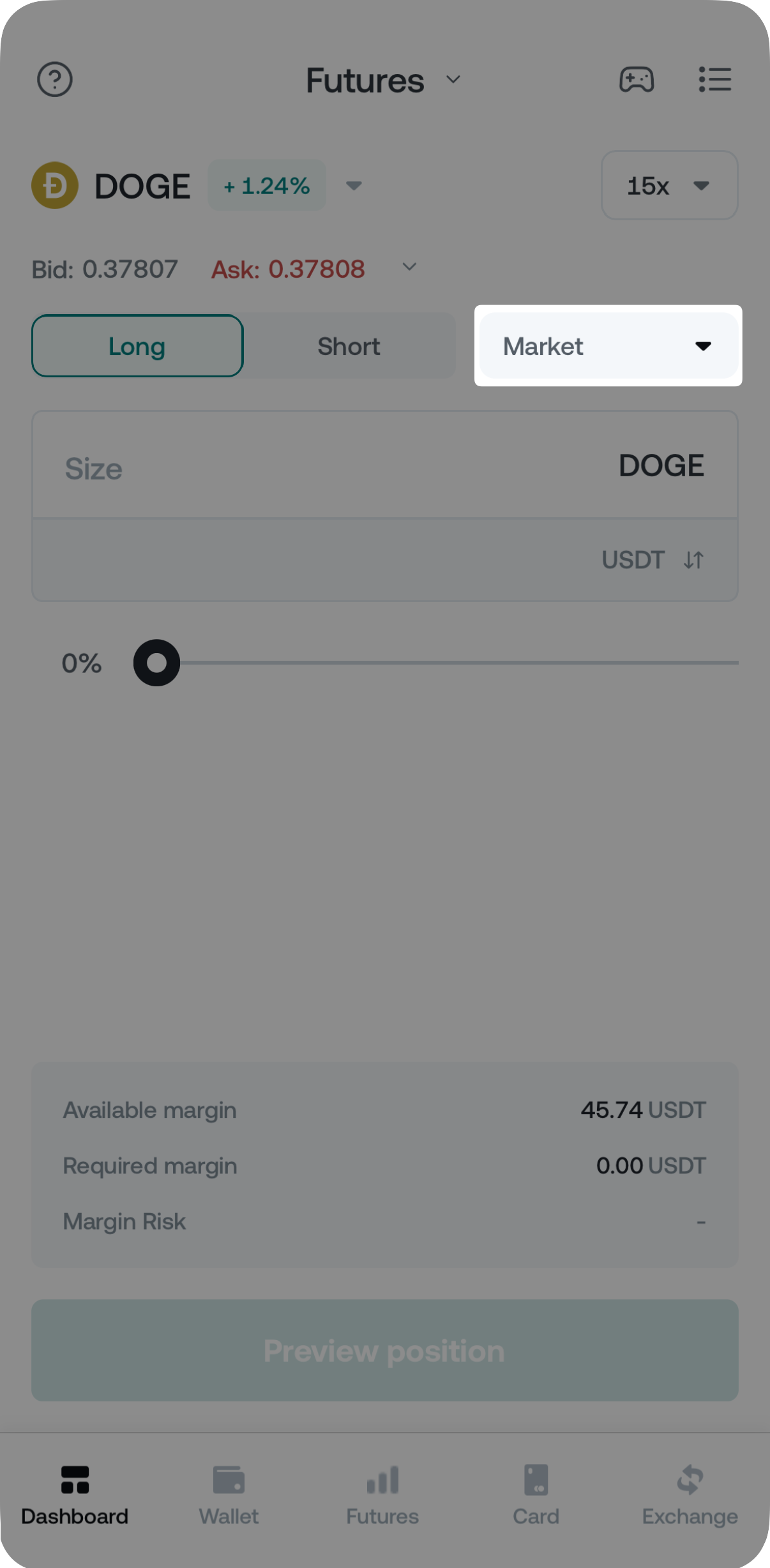

1. Open the Nexo App and tap Futures in the navigation bar.

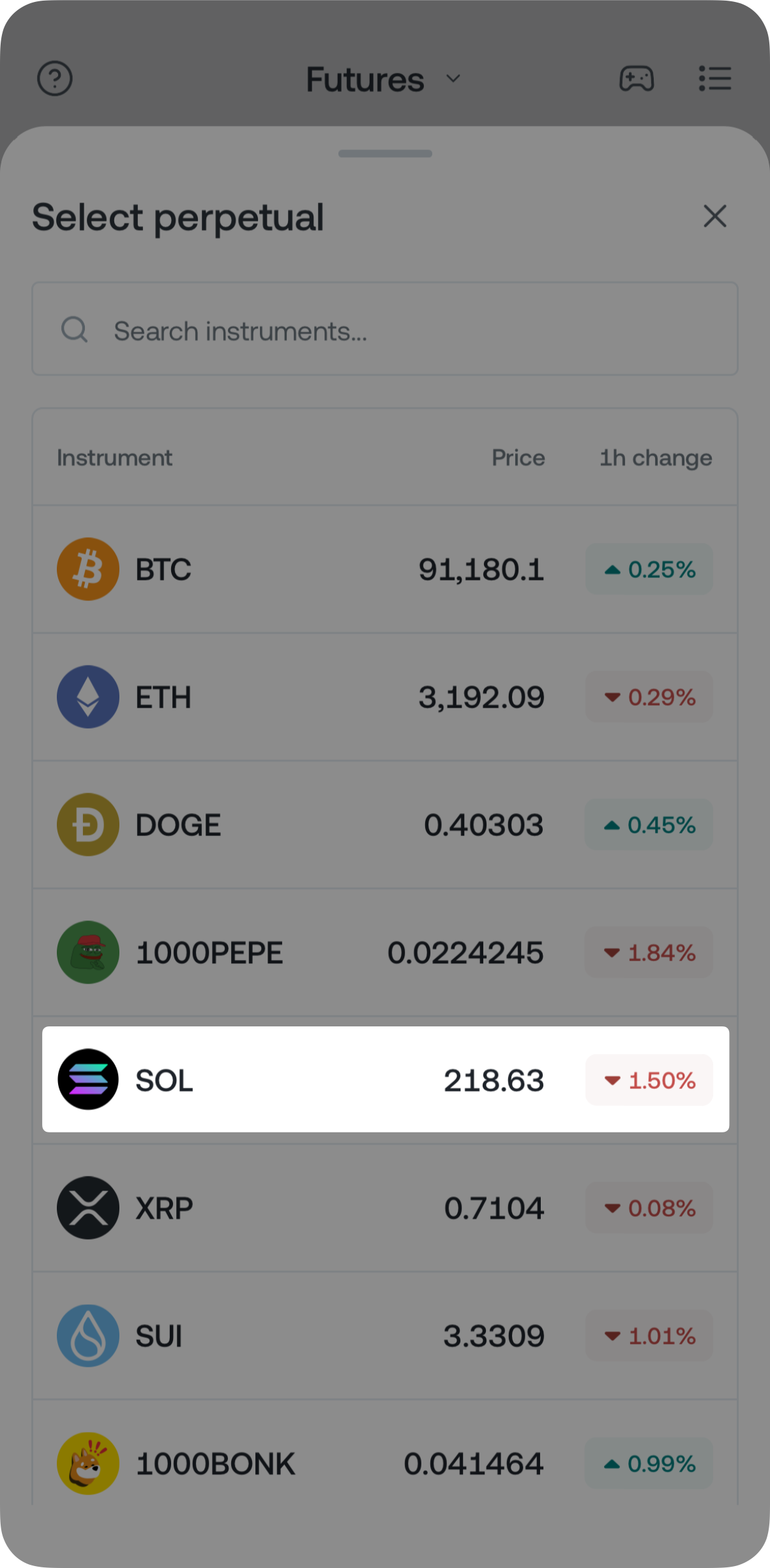

2. If you haven’t funded your Futures wallet, a prompt will appear at the bottom of the screen. Tap Transfer USDT and follow the on-screen instructions.

Then, tap on the top-left corner of the screen to choose the asset you want to trade.

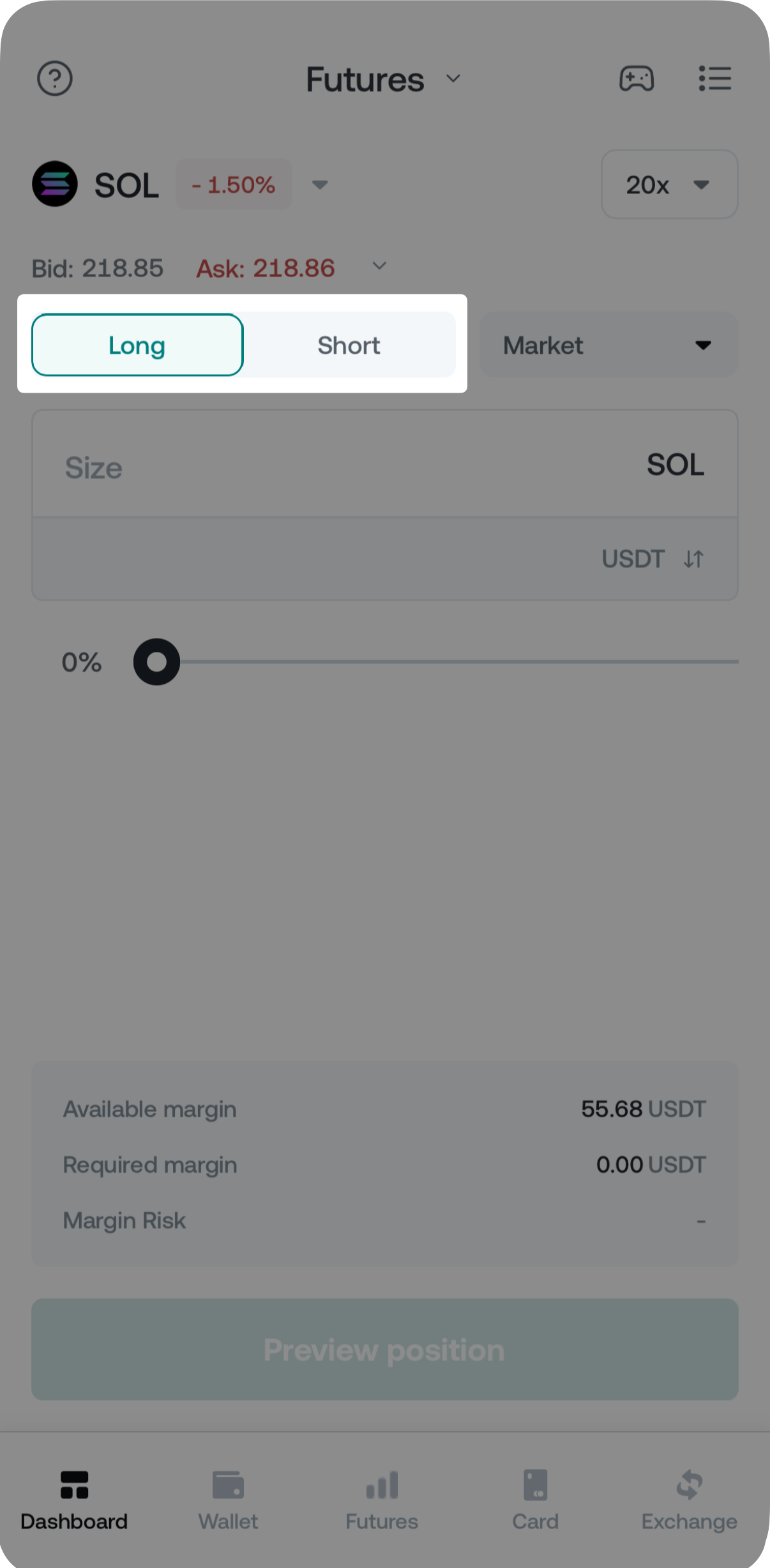

3. Once you have made your selection, choose whether you want to go Long or Short.

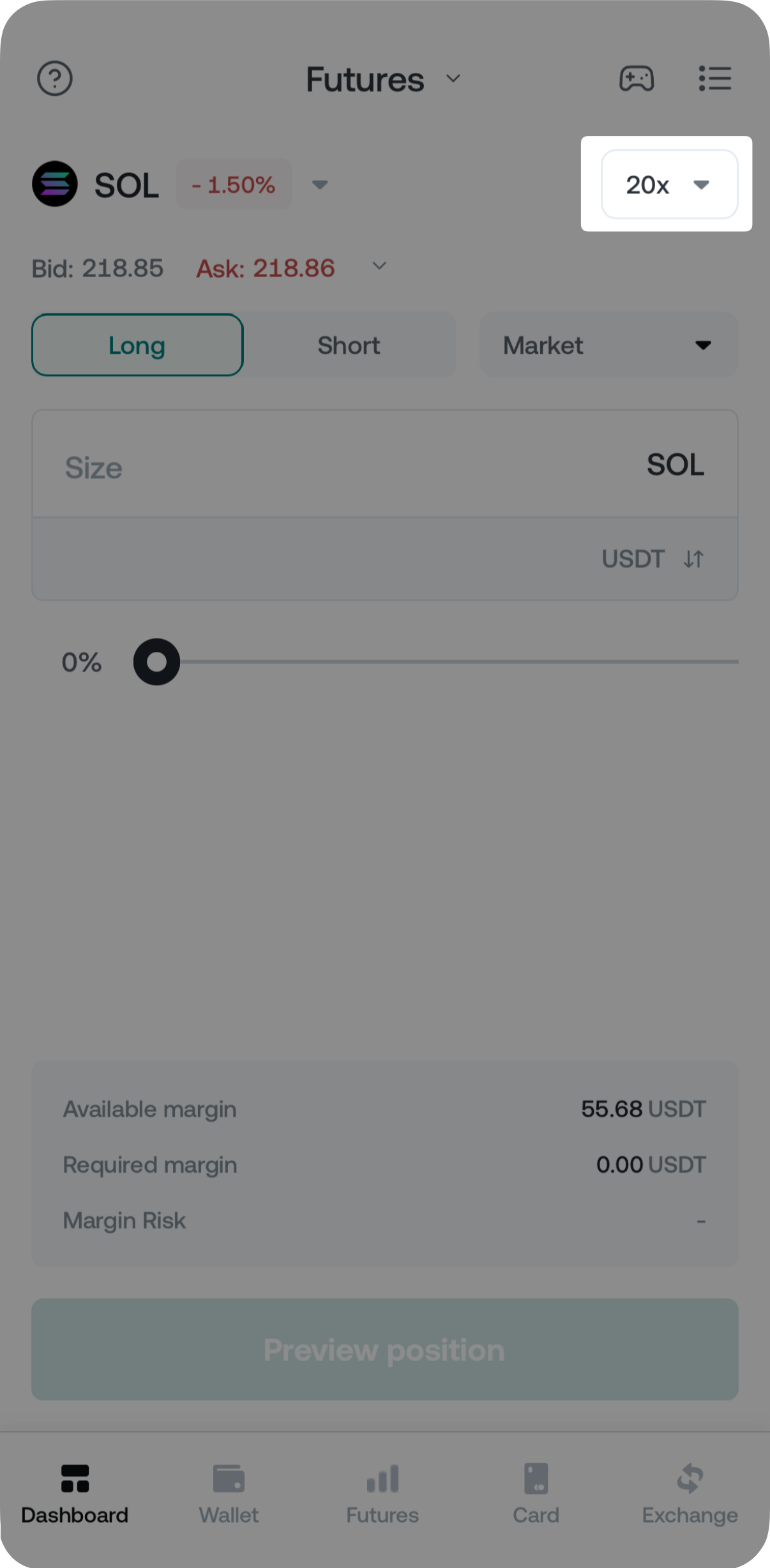

4. Then, adjust the leverage. By default, the highest leverage option available is preselected.

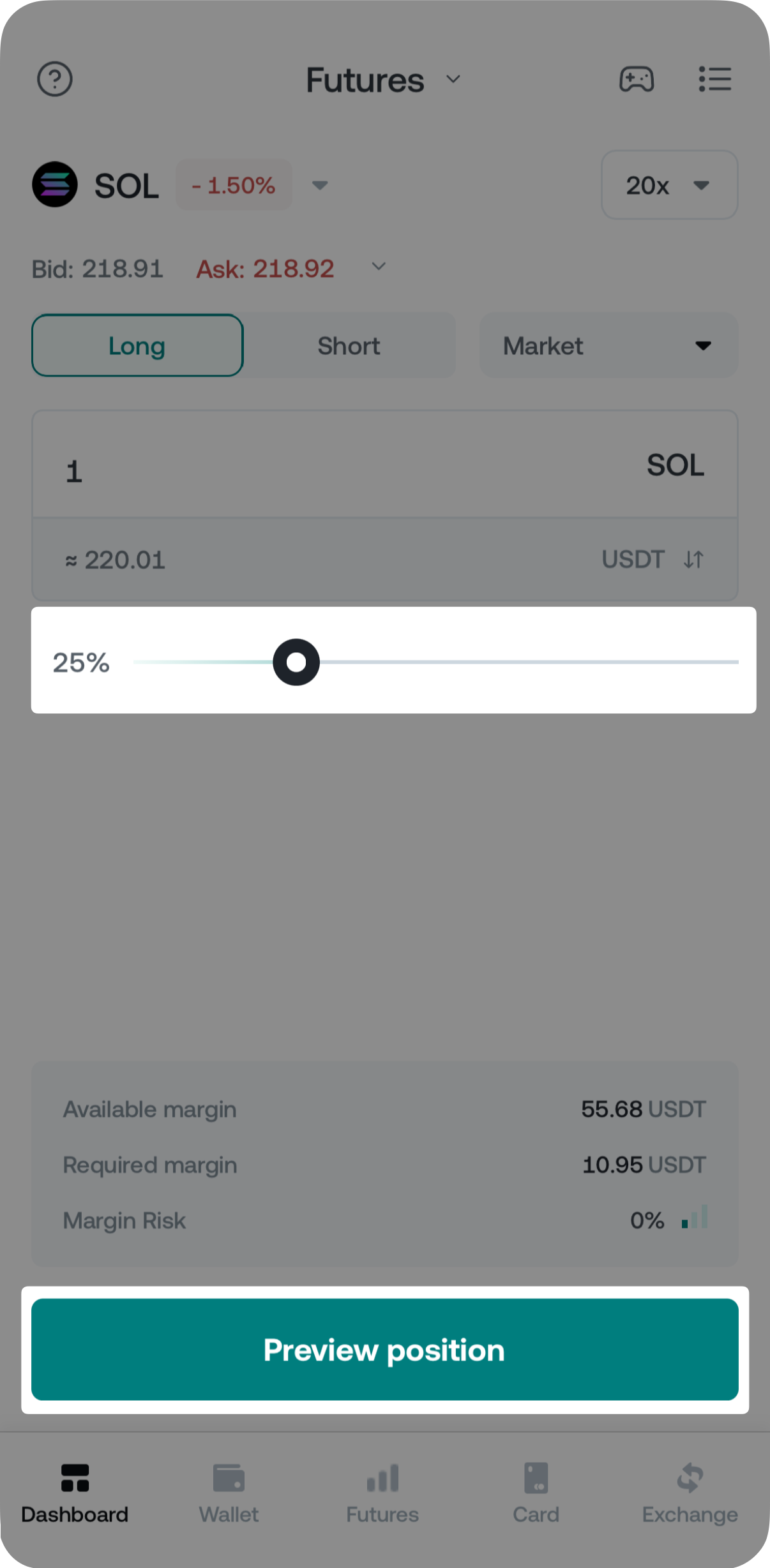

5. Enter the amount you want to trade and select Preview Position. To proceed, tap Buy (Long) or Buy (Short), respectively.

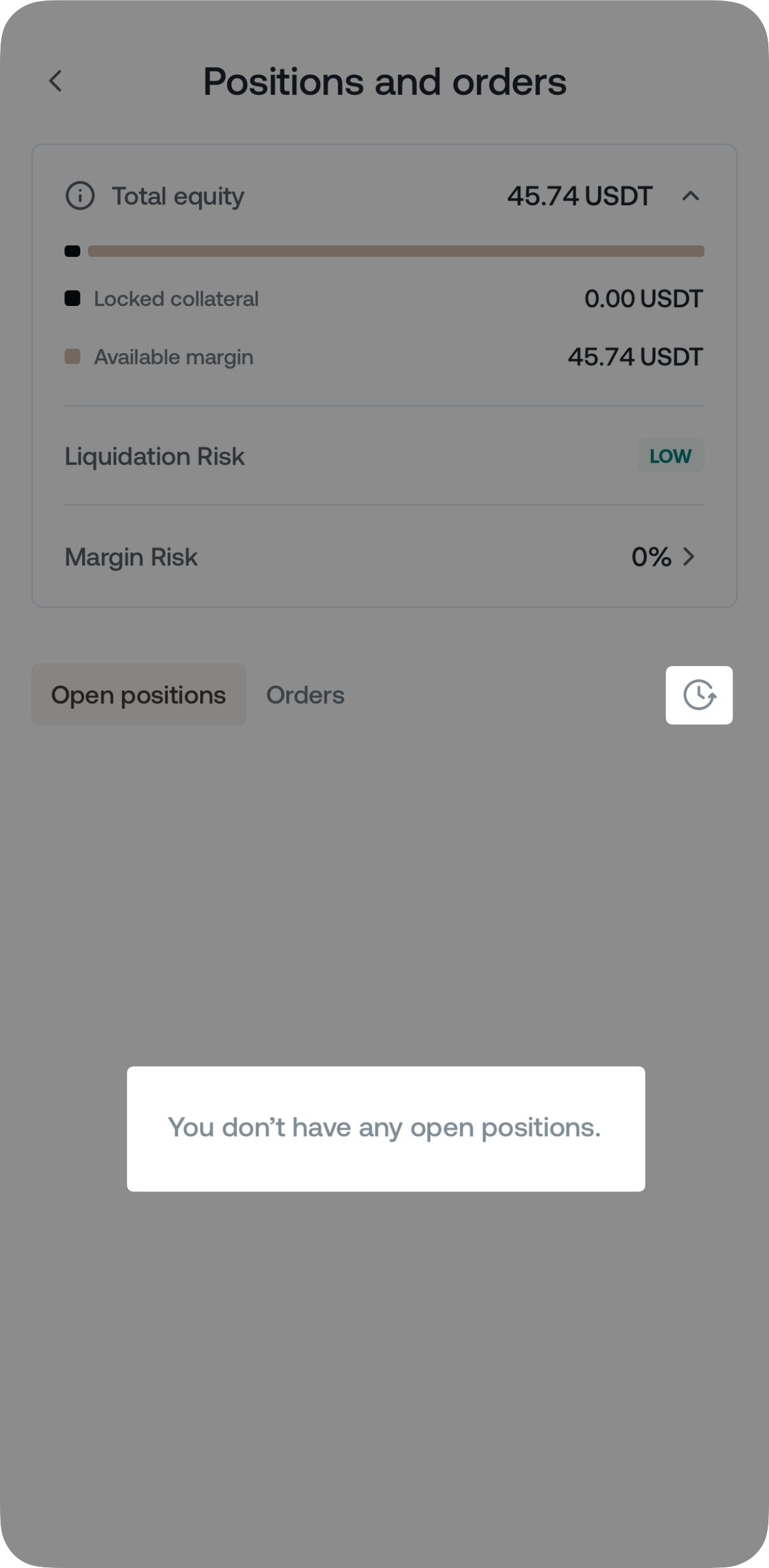

6. Congratulations, you have successfully placed a futures order. You can track it, close it, or add Trigger Orders (TP and SL) to it by returning to the Futures section and tapping the ⁝≡ icon in the top-right corner of the screen.

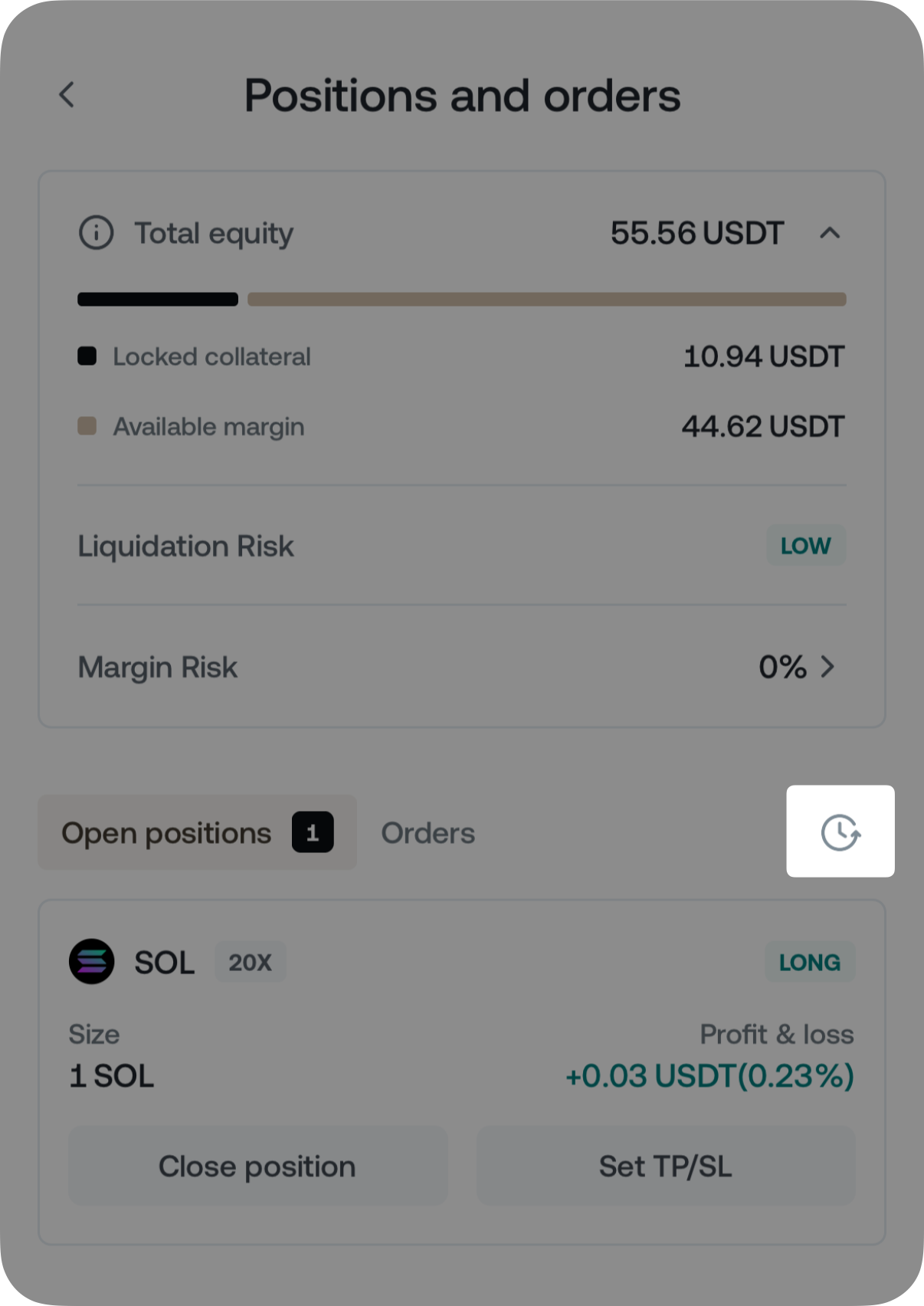

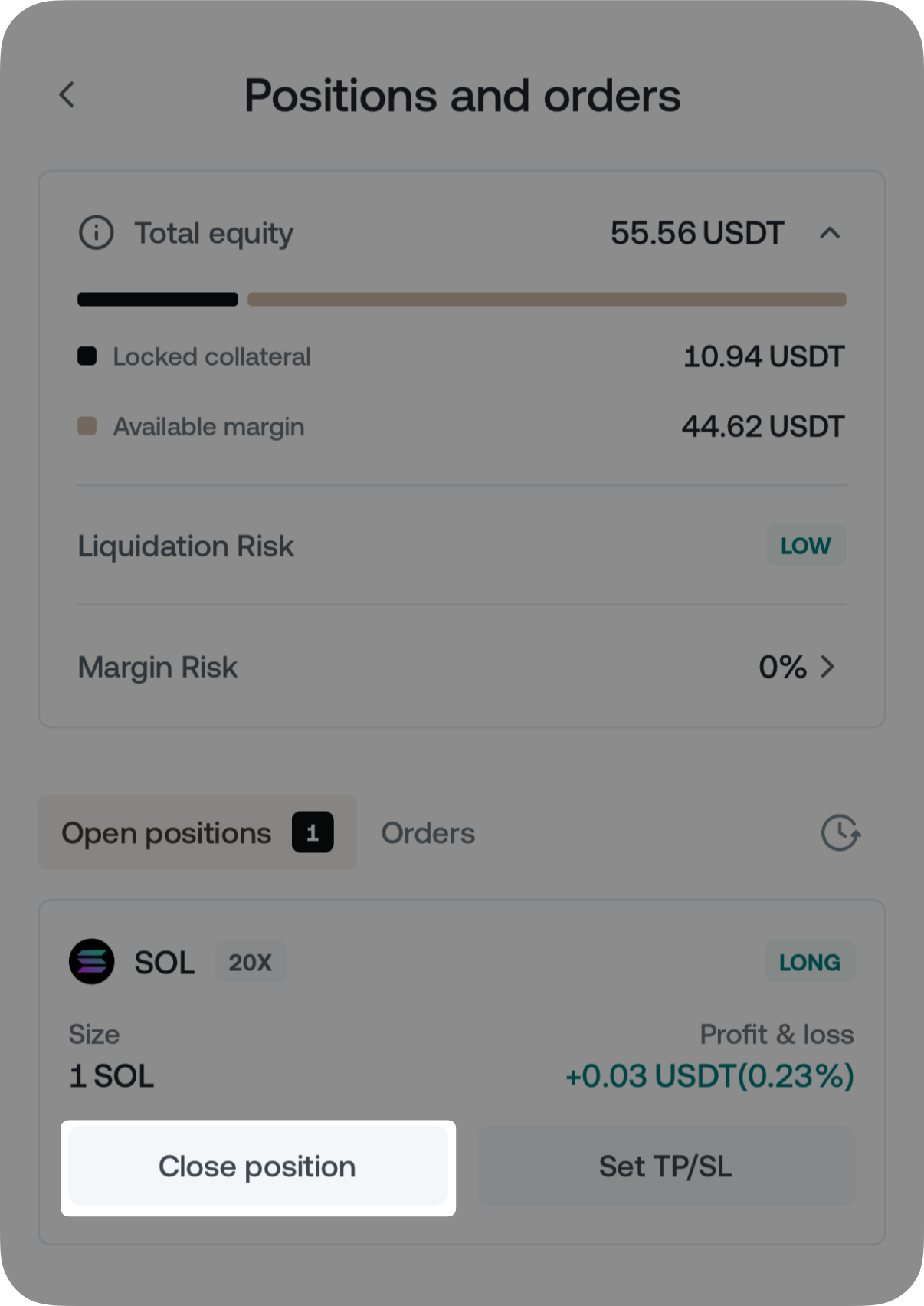

How to close a futures position

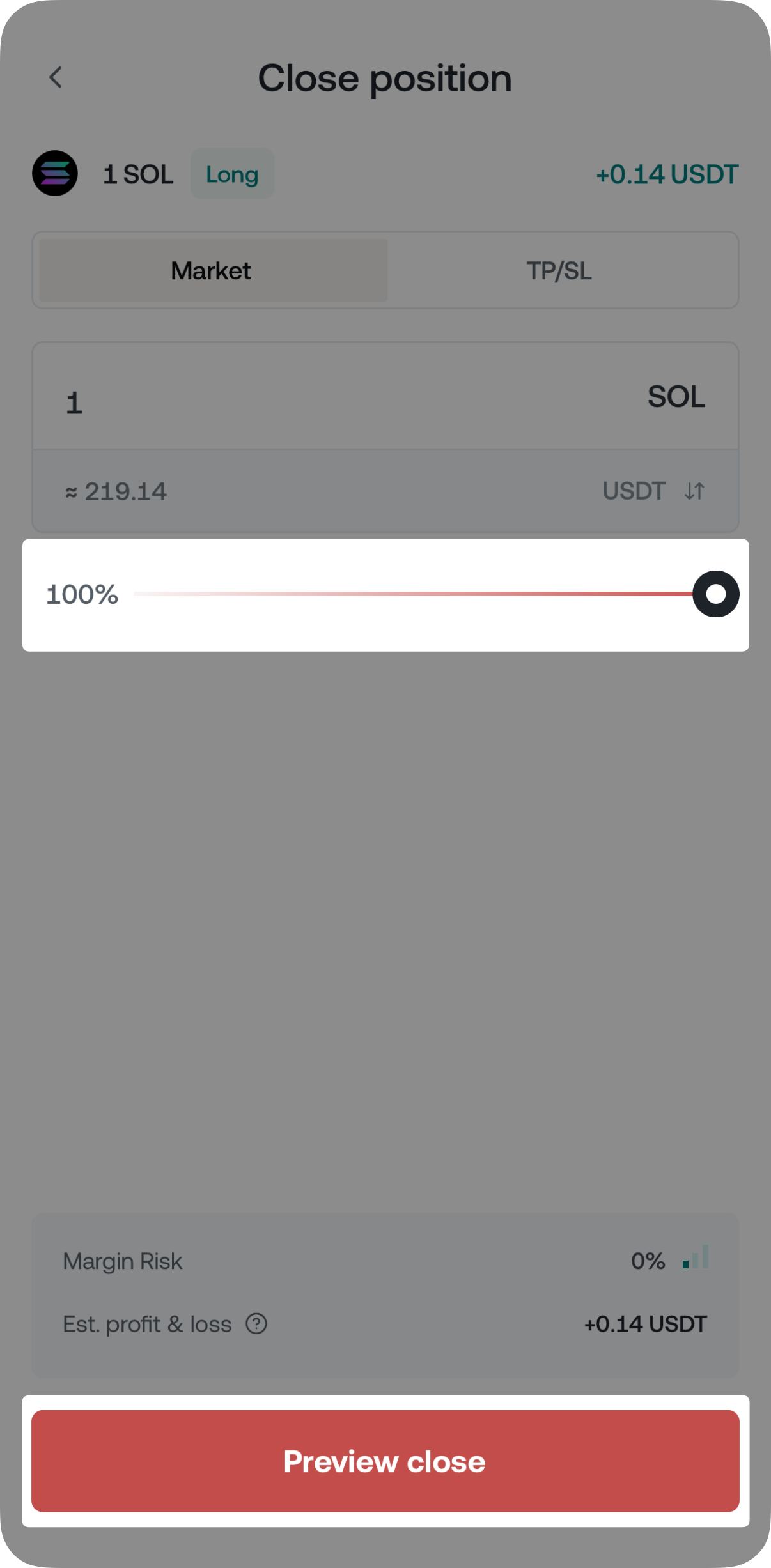

You can close your active futures positions (partially or fully) using the Nexo App anytime. Visit the Futures section and tap the ⁝≡ icon in the top-right corner. Here’s how to proceed:

1. Tap the Close position button.

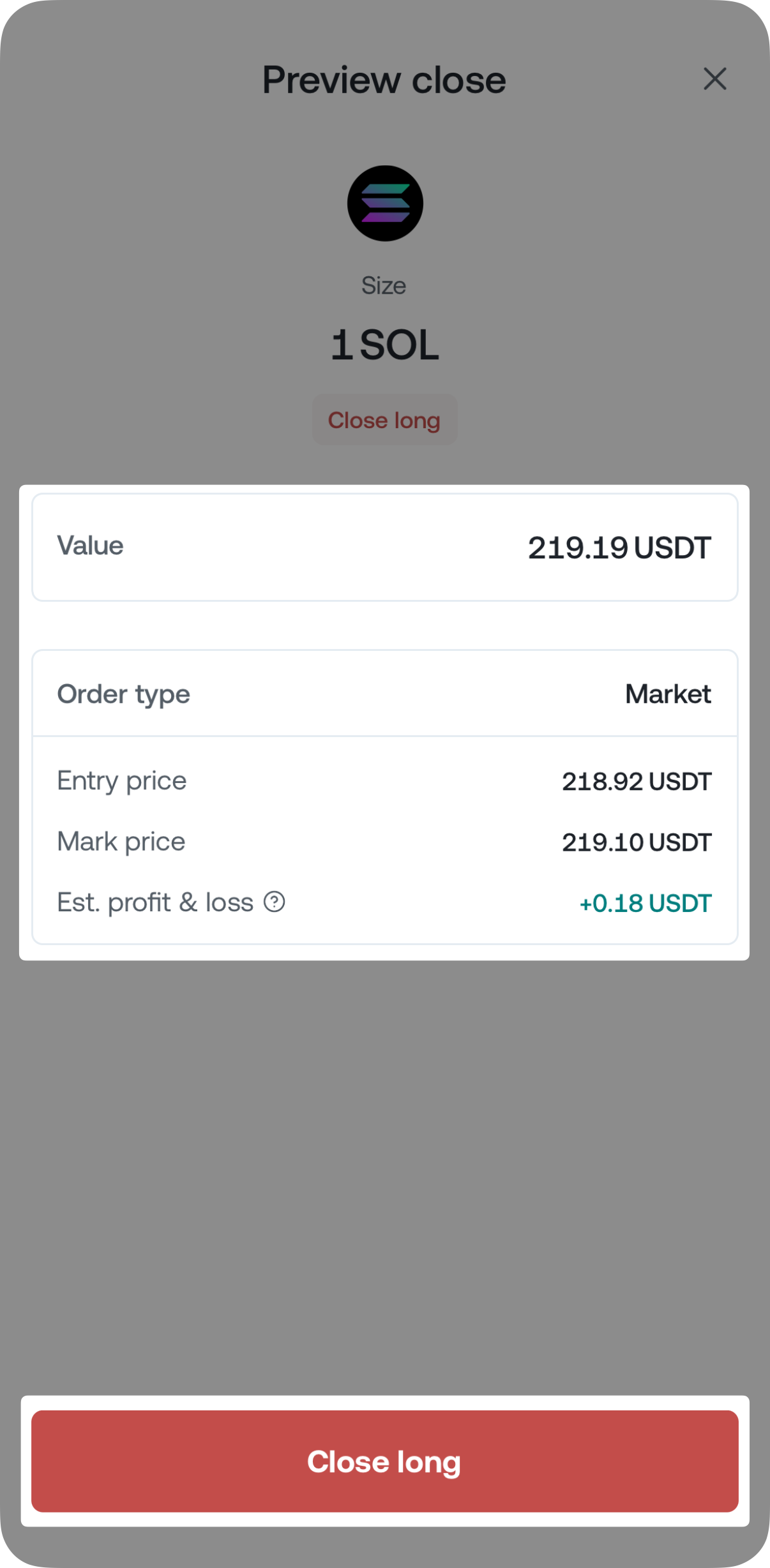

2. Choose the amount you want to close. You can close the entire position or just a portion of it. If you opt to close partially, you can close the rest later. Click Preview close to continue.

3. Tap Close long or Close short, depending on your position.

4. Your position is now closed. To view the realized PnL for this position, return to the Futures section and tap the ⁝≡ icon in the top-right corner of the screen.

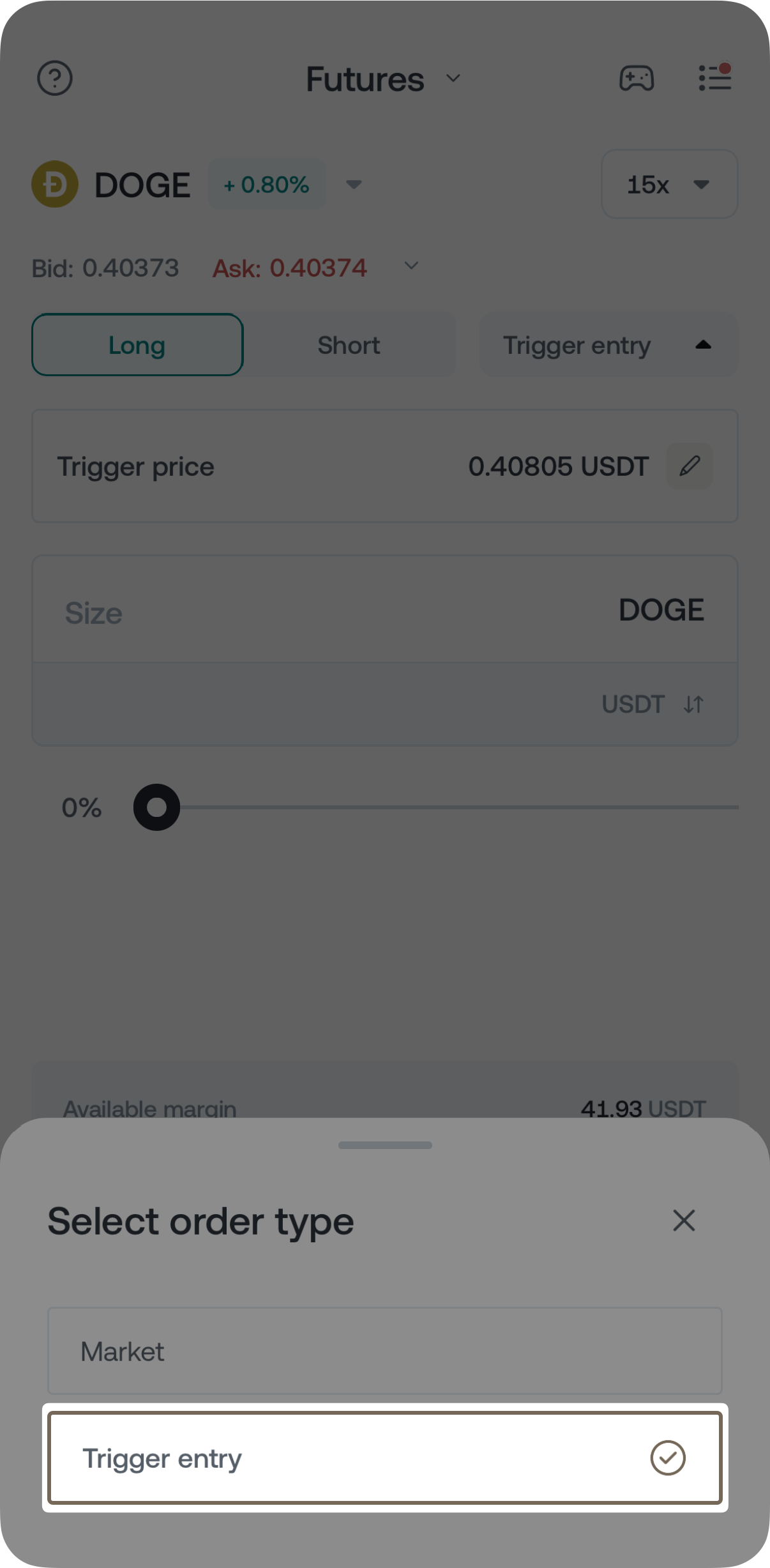

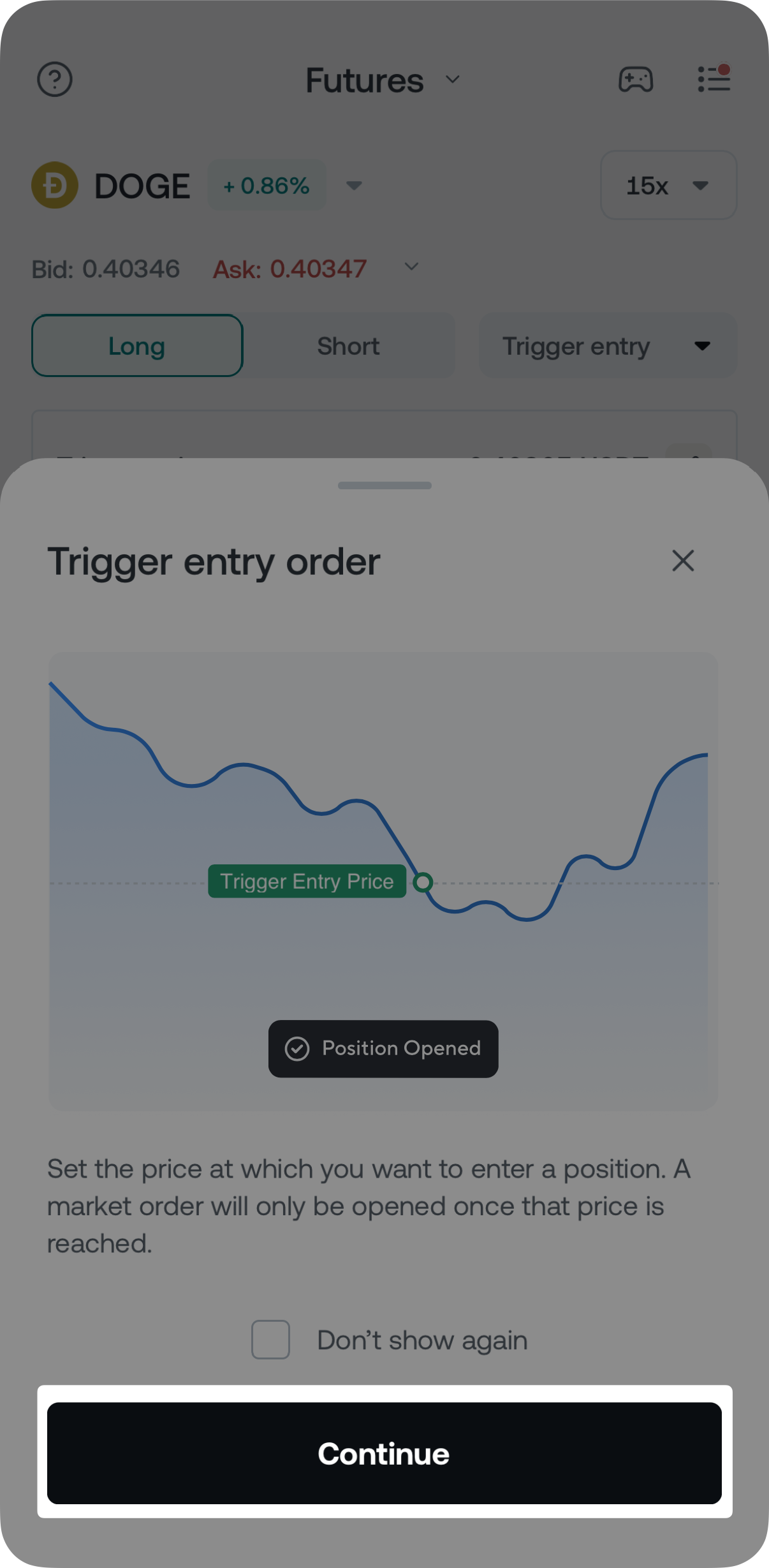

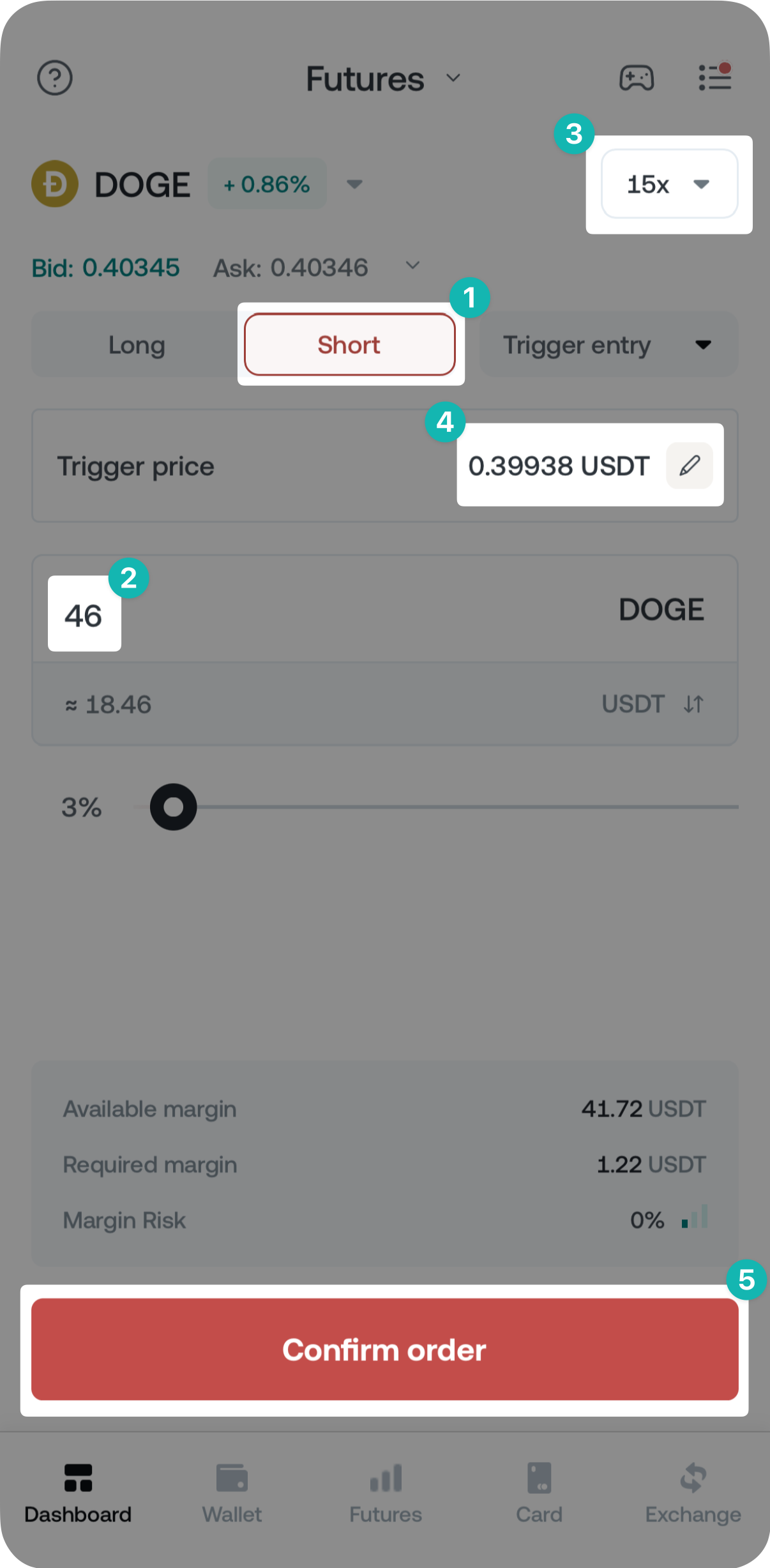

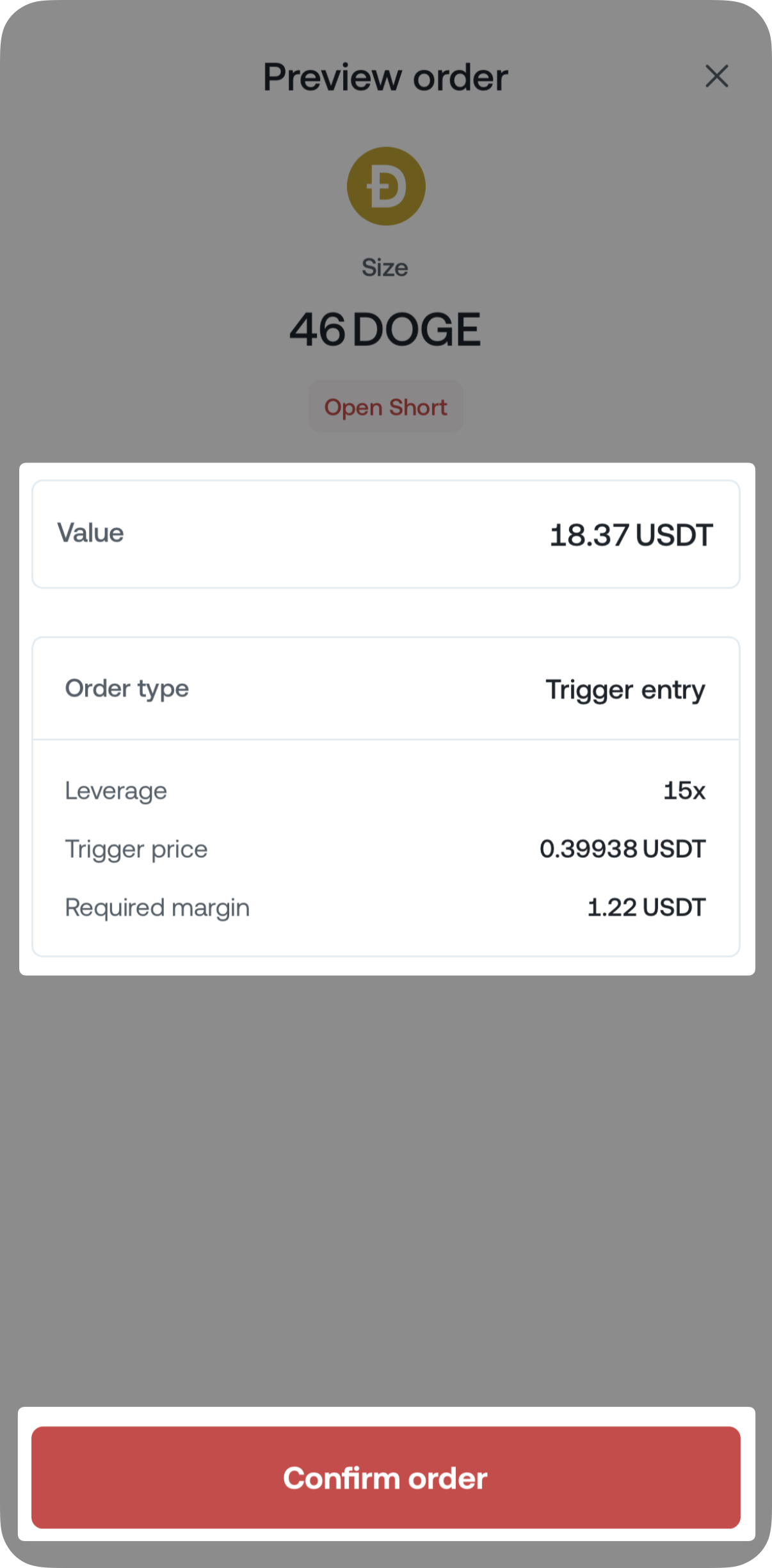

How to place a Trigger entry order

You can place a pending futures order (Long or Short) that will activate when your specified Trigger price is met. Follow these steps in the Futures section after selecting the contract:

1. Tap the Market button and select Trigger entry.

2. An info pop-up box will appear, tap Continue.

3. Choose the desired market direction (Long or Short), the order’s size, and leverage, then enter the Trigger price in the respective field. Once ready, tap Confirm order.

4. Review the details and confirm the order again by tapping Confirm order.

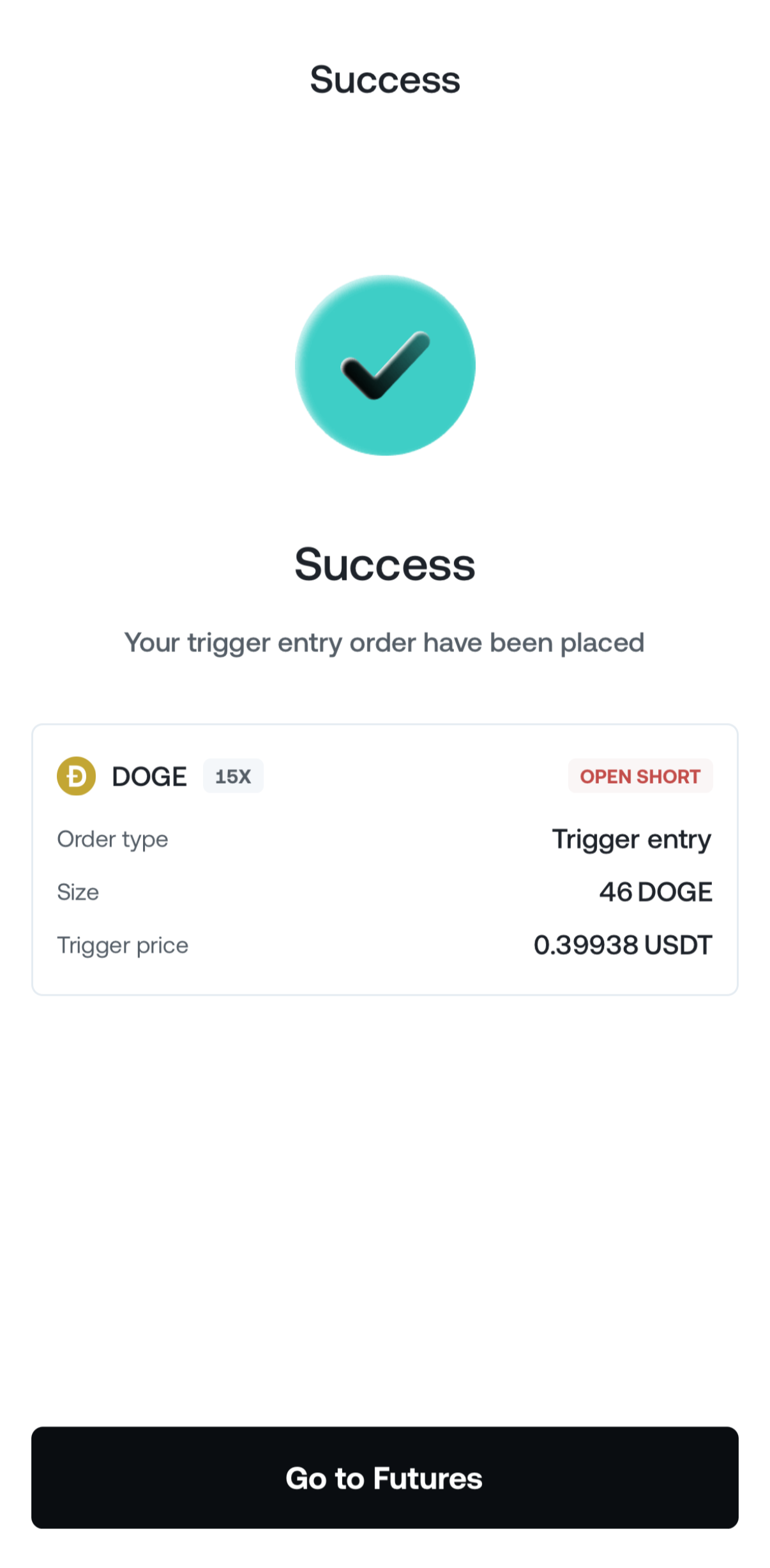

5. Your trigger order is now successfully placed.

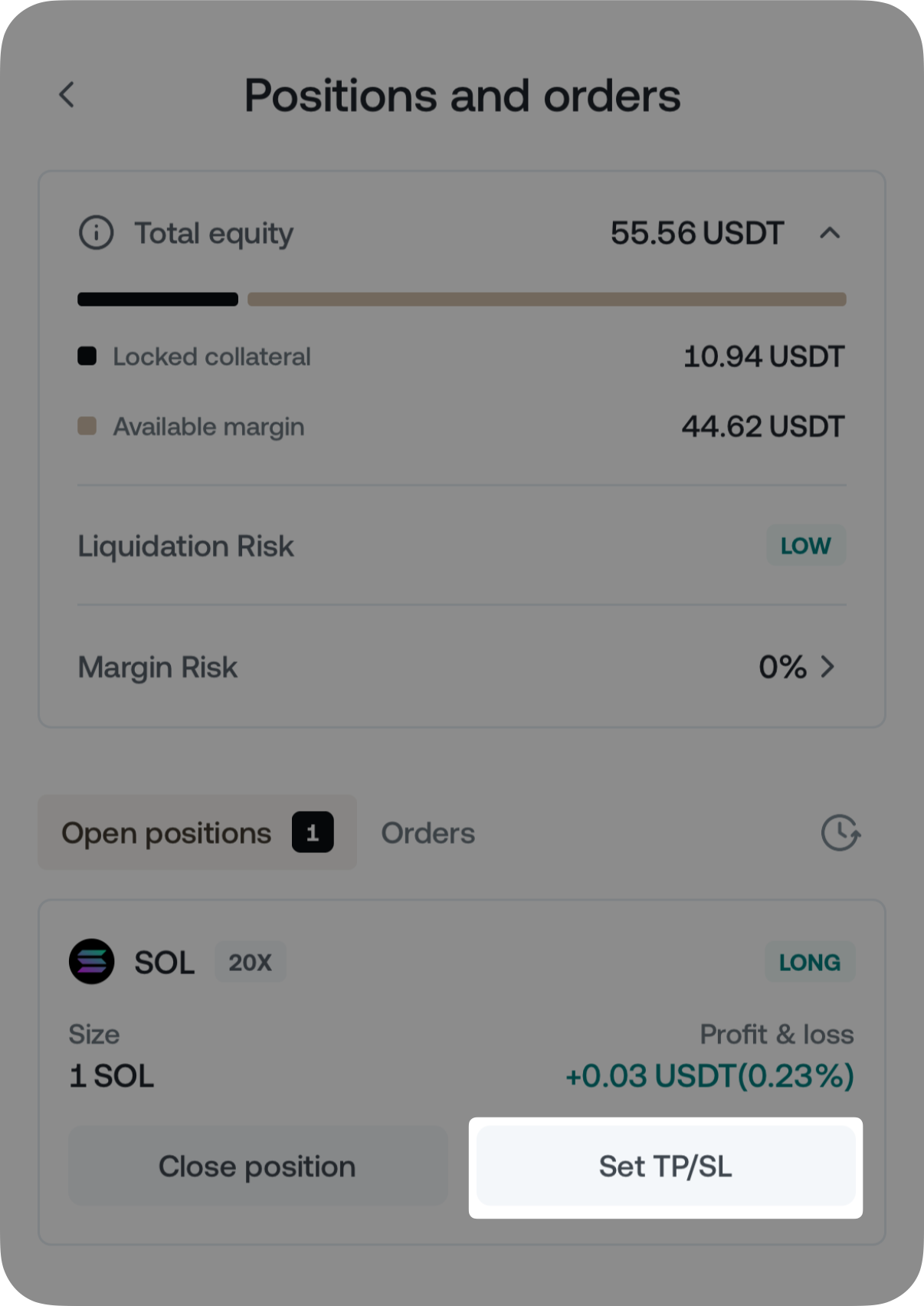

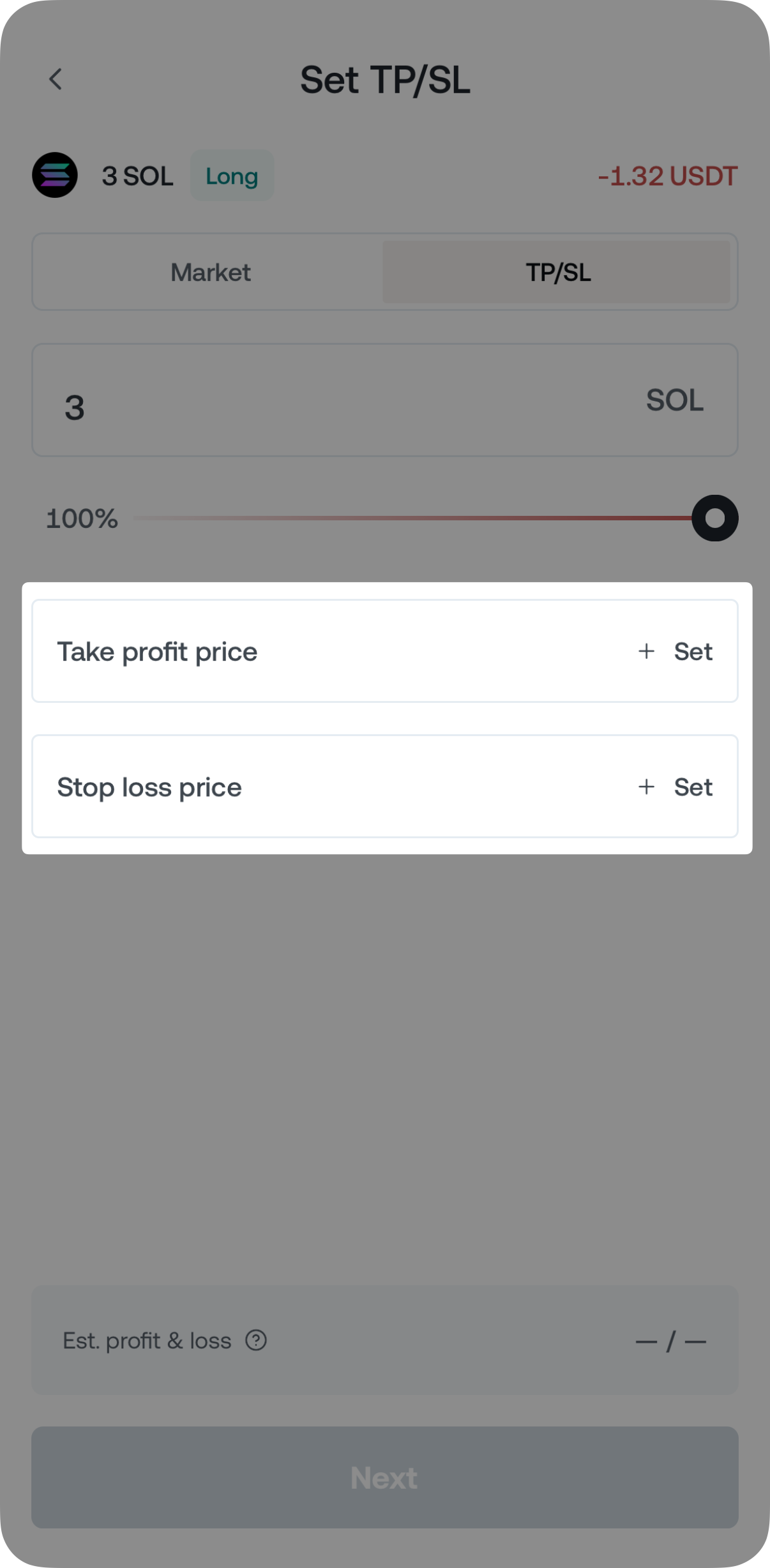

How to set TP/SL orders for an active position

If you have an open futures position and want to add to it a Stop loss (SL) or Take profit (TP) order, go to the Futures section and tap the ⁝≡ icon in the top-right corner. Here’s how to place TP/SL orders:

1. Tap the Set TP/SL button for your open position and select Continue on the info popup.

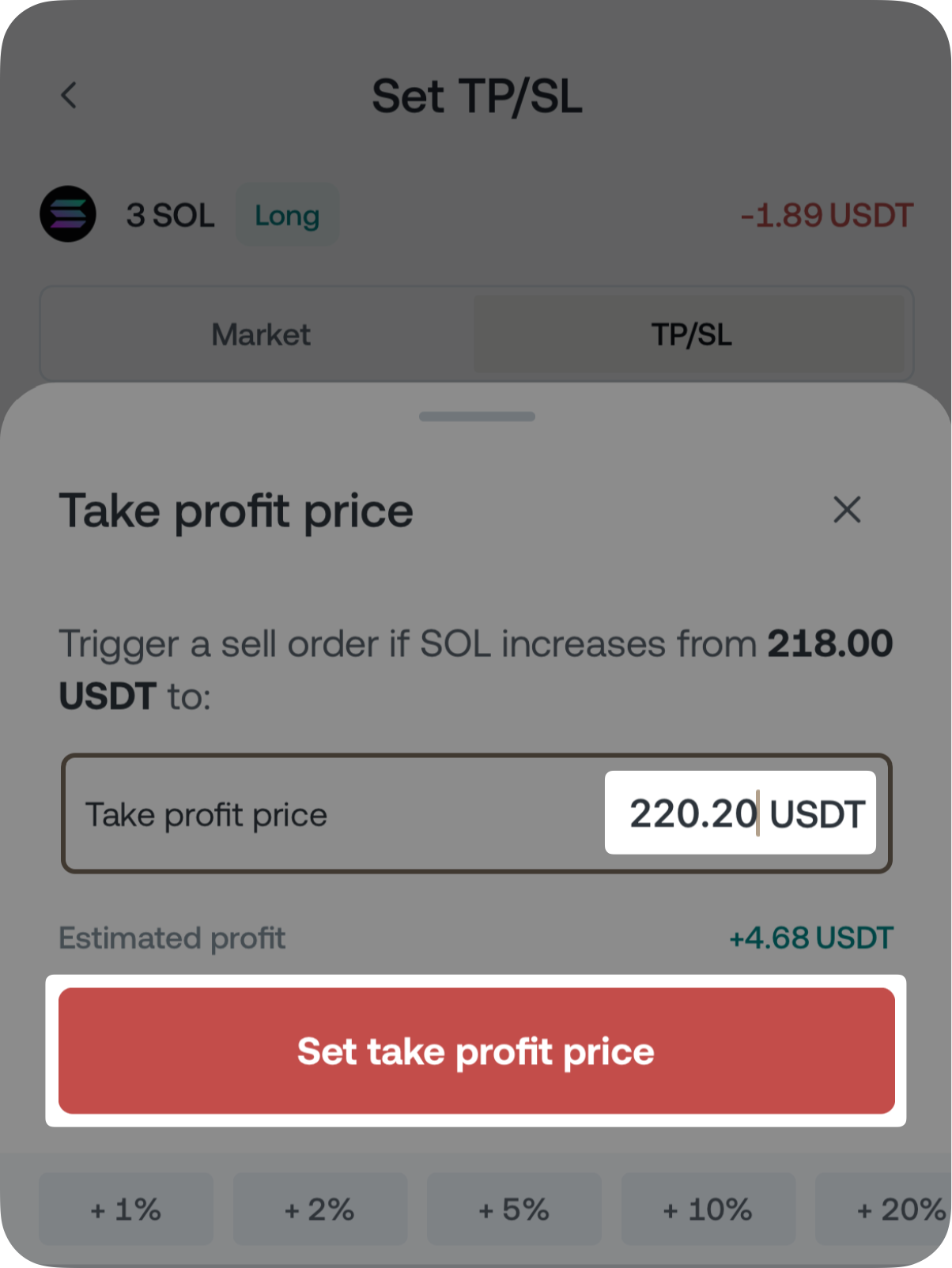

2. Tap Take profit price or Stop loss price.

3. Enter the desired Take profit or Stop loss price level.

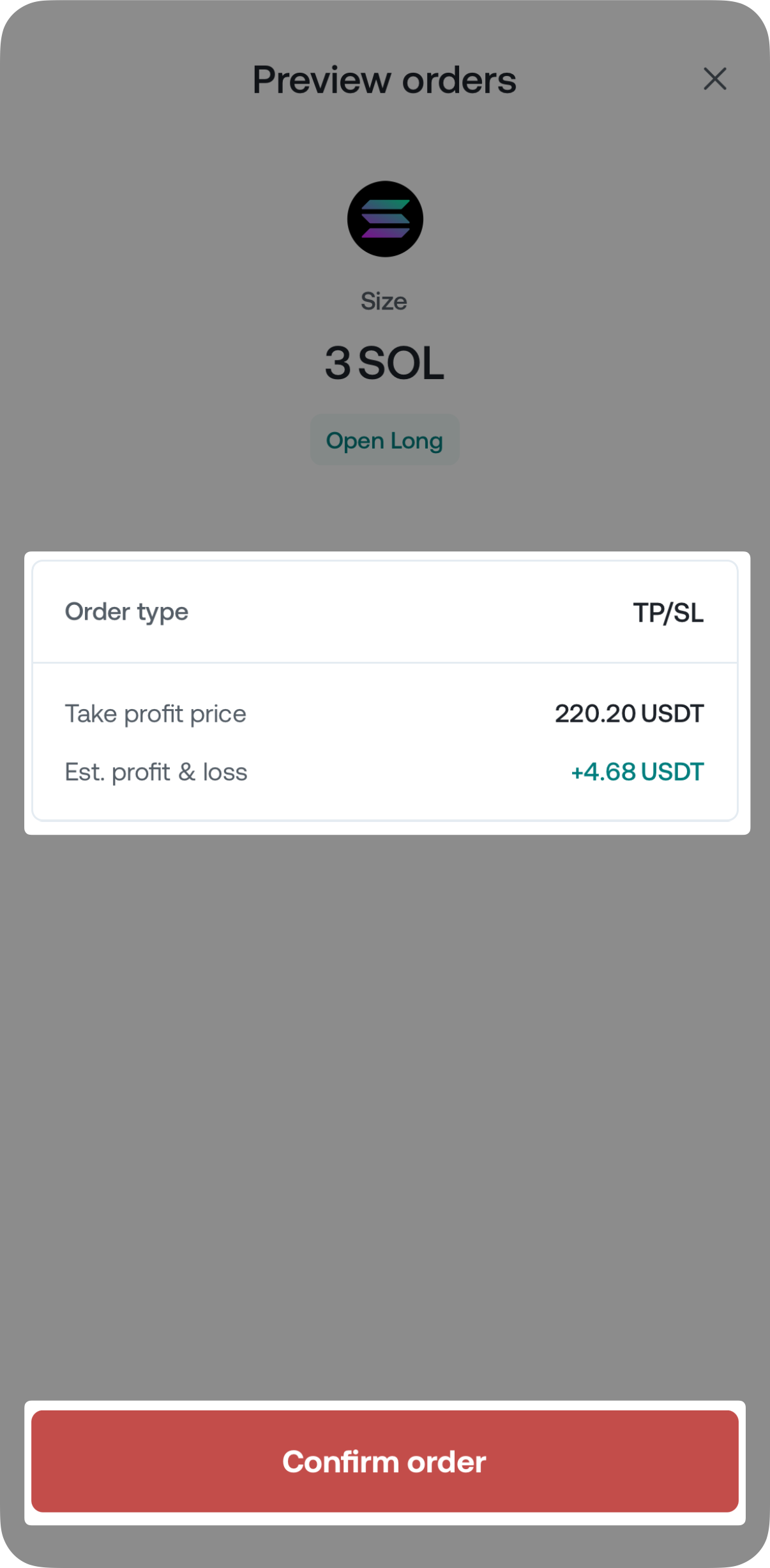

4. Review the details and tap Confirm order.

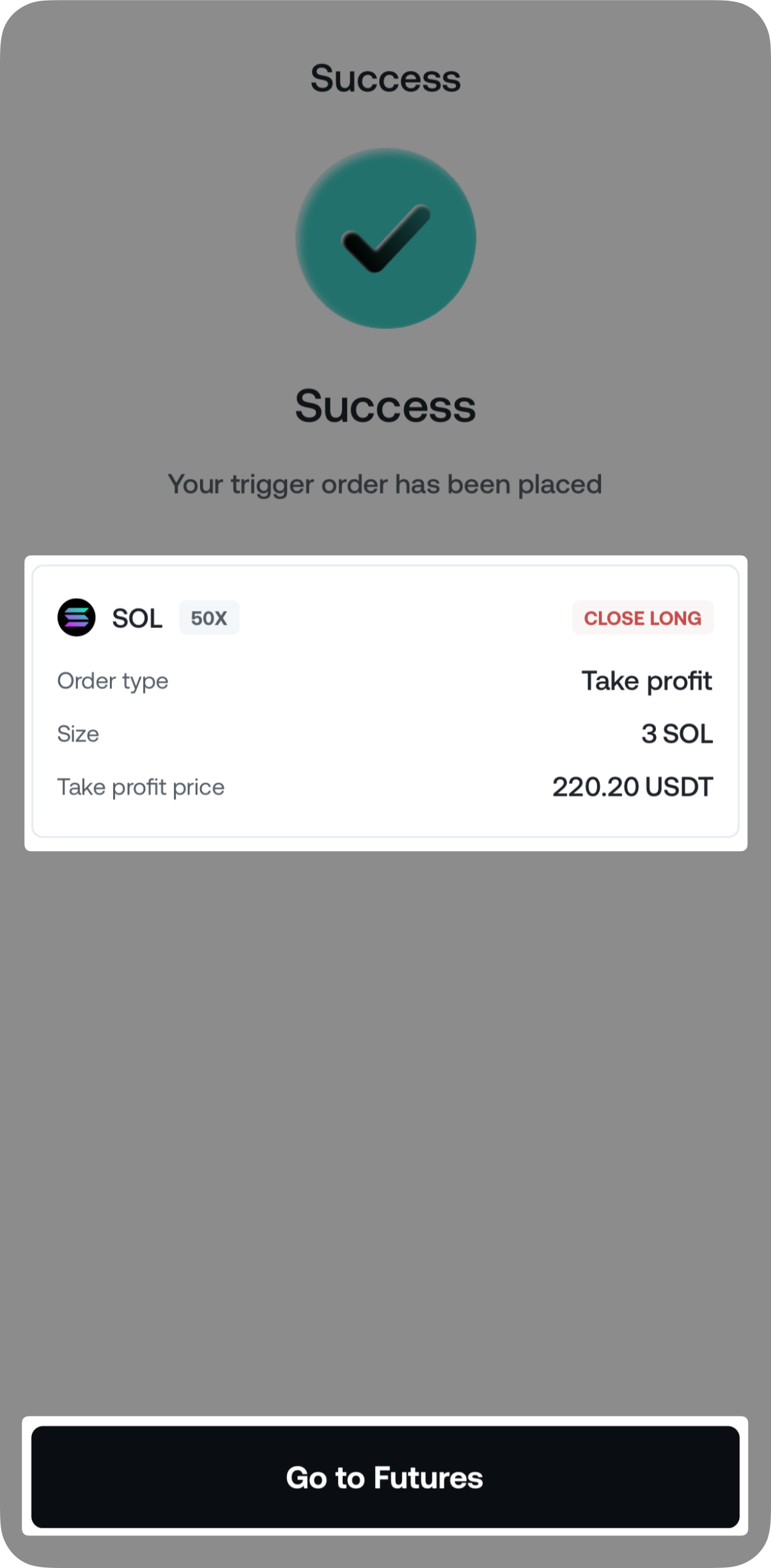

5. Your trigger order is now successfully placed.

12. FAQ

How is cross-margin different from isolated margin

Cross-margin and isolated margin are two different methods of managing collateral (margin) in trading, particularly futures.

Cross-margin, or spread margin, is a risk management method where all available balances in the trader’s account (the BTC, ETH, XRP, USDT, and USDC in the Futures Wallet) are used to prevent liquidation across all open positions.

Isolated margin is a risk management method where only a specified amount of collateral is allocated to each futures position. With this method, the trader can control the maximum amount of funds that can be lost if the trade does not go as expected.

Note: Futures trading on the Nexo platform utilizes only the cross-margin method.

Comparison: Cross-margin is usually suitable for traders running multiple positions who want to balance the risks across each position. An isolated margin method is sought mainly by traders who prefer to manage risk on a per-position basis.

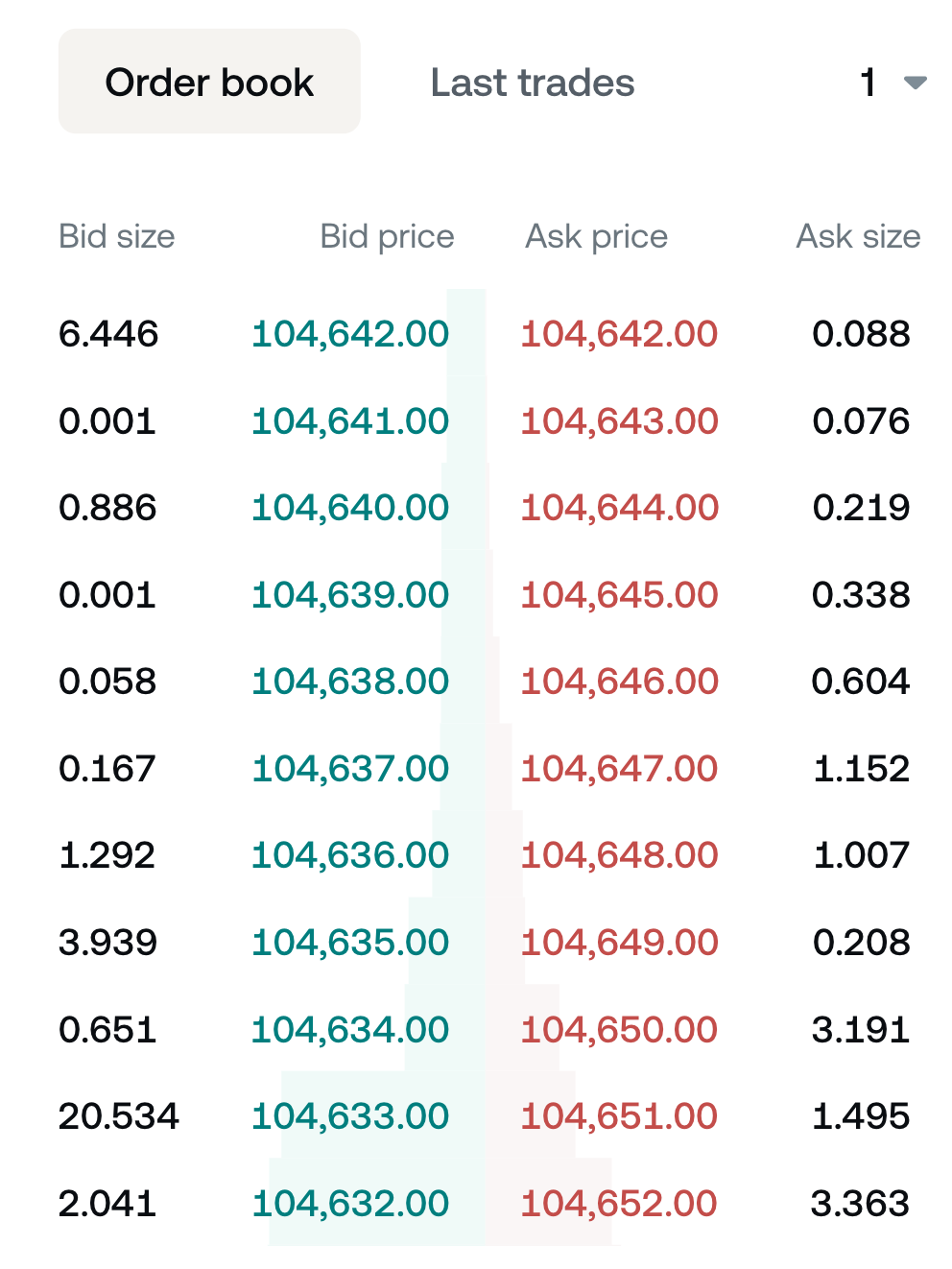

How is the Last price determined

The Last price in futures trading refers to the price at which the last contract was traded. It is essentially the most recent price at which a buyer and a seller agreed to transact. This price is constantly updated as new trades are executed.

The key to understanding the Last price is to understand the order book. The order book lists all pending orders for a futures contract. It is divided into two main sections:

- Bid: This side of the order book lists all the buy orders, organized by price from the highest (e.g. 104,642) to the lowest (e.g. 104,632). The highest bid price is the most someone is willing to pay for the futures contract, known as the Best bid.

- Ask (or offer): This side lists all the sell orders, sorted from the lowest (e.g. 104,642) to the highest price (e.g. 104,652). The lowest ask price is the minimum at which someone is willing to sell, and it is known as the Best ask.

Example: Let’s assume Nexo is looking at the order book for the BTC futures contract. Here’s a simplified view:

Bid prices:

- Best bid: 85,000 USDT per BTC (Ask size: 5 BTC)

- Second bid: 84,990 USDT per BTC (Ask size: 10 BTC)

- Third bid: 84,980 USDT per BTC (Ask size: 15 BTC)

Ask prices:

- Best ask: 85,010 USDT per BTC (Ask size: 5 BTC)

- Second ask: 85,020 USDT per BTC (Ask size: 10 BTC)

- Third ask: 85,030 USDT per BTC (Ask size: 15 BTC)

The Last Price will be the price at which the last trade occurred. Suppose the last trade was a buy order (to open a Long futures position) matched with the lowest available sell order at 85,010 USDT for 5 BTC. Thus, the Last Price will now be 85,010 USDT.

Consideration of spread/slippage:

- Spread: The difference between the Best ask and the Best bid is known as the spread. In Nexo’s example, the spread is 85,010 – 85,000 = 10 USDT. This spread can affect the Last Price, especially in a less liquid market where the spread is wider, potentially causing new trades to execute at prices significantly different from the Last Price.

- Slippage: This occurs when the execution price of an order is different from the expected price. For instance, if someone places a large buy order that exceeds the quantity at the Best ask, part of the order might fill at the second or third ask prices, thus affecting the average execution price.

Example with slippage: Imagine a trader places a large buy order for 20 BTC. The order might be filled as follows:

- 5 BTC at 85,010 USDT per BTC (Best ask)

- 10 BTC at 85,020 USDT per BTC (Second ask)

- 5 BTC at 85,030 USDT per BTC (Third ask)

- Calculation:

- Step 1: Average Last Price = [(Best ask x 5) + (Second ask x 10) + (Third ask x 5)] / (Asset Quantity)

- Step 2: Average Last Price = [(85,010 x 5) + (85,020 x 10) + (85,030 x 5)] / 20

- Step 3: Average Last Price = [1,700,400] / 20

- Result: Average Last Price = 85,020 USDT per BTC

The Average execution price (Last Price) will be higher than the Best ask (85,020 USDT instead of 85,010 USDT). Thus, the slippage for the order was:

- Step 1: Slippage = Average executed price – Expected price

- Result: Slippage = 85,020 – 85,010 = 10 USDT

In other words, Nexo’s $1 was for a high amount and took up much of the available order book, which is why there was slippage and the Average executed price (Last Price) of 85,020 USDT per BTC differed from the Best ask of 85,010 USDT per BTC.

When trading futures, it is essential to consider the market’s liquidity (as reflected in the order book) and the potential impact of spreads and slippage on trade execution and the Last Price.

What is the difference between Unrealized P&L and Realized P&L

Unrealized P&L refers to the profit or loss on your open position measured against current market conditions. It represents the P&L that would be realized if the position were closed at the current market price.

Mark price is used to calculate Unrealized P&L for several reasons:

- Fair pricing: Mark price is derived from a blend of spot prices across multiple leading exchanges. This method provides a more accurate reflection of the underlying asset’s current market value, offering a fair basis for all traders.

- Minimizing liquidations: Because the Mark price tends to be more stable, traders are less likely to experience unnecessary liquidations during times of high volatility or when the Last price is temporarily skewed due to thin order books or market anomalies.

Illustrative example:

Consider a scenario where the current Mark price for BTC is 100,000 USDT, while the Last price is 99,800 USDT. Assume you hold a Long BTC position with a liquidation price of 99,900 USDT.

- In this case, liquidation is triggered if the Mark price drops to 99,900 USDT or lower. However, if the Last price is used for this calculation, your position would have already faced liquidation since it is below the liquidation price.

This example highlights the difference between the Mark price and the Last price. The Last price can be lower than the Mark price due to dynamics within the order book.

For instance, if large Short futures positions are placed, they are filled at the best available bid prices. If these large orders occur rapidly, they might exhaust the quantity at the Best bid, leading to fills at subsequent lower bid prices, thus dropping the average execution price (Last price).

Although futures trading typically offers substantial quantities at each bid/ask level, temporary price deviations can still occur. In such instances, the Last price, which is directly influenced by the order book, can fall below the Mark price, which is derived from broader spot prices across multiple top exchanges.

In analogy, the Last price can be temporarily skewed upwards when large quantities of Long positions are opened. In that case, the Last price (100,400 USDT per BTC) would be higher than the Mark price (e.g. 100,000 USDT per BTC). Here traders with Short futures positions would be more likely to be liquidated if the Last price was used instead of the Mark price.

Note: Although the Mark price is used to trigger a liquidation, the price at which positions will be automatically closed is the Last price. This is because position closure sends an order in the order book and the bid/ask prices are used to determine the execution price.

Realized P&L refers to the profit or loss that is actually locked in when a position is closed. This calculation tells the trader what they have definitively gained or lost as a result of their trading decisions.

Last price is used to calculate Realized P&L because:

- Transaction specificity: The Last price is the most recent price at which a trade was executed, influenced by the supply and demand dynamics in the order book. It directly reflects the actual transaction price at which the futures contract was bought or sold.

13. Glossary

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

A

Ask Price: The lowest price a seller is willing to accept for an asset.

Ask Price (Best): In a trading environment where multiple sellers might be offering the same asset at different prices, the Best Ask Price is the lowest of these prices. This is the most competitive price that buyers can accept to purchase the asset immediately. This would be the ask at the top of an order book.

Available Margin: The amount of USDT available in the Futures Wallet to open new positions or maintain existing positions.

B

Base: The underlying asset (or the first asset) in a trading pair. For BTCUSDT, the underlying asset is BTC.

Bid Price: The highest price a buyer is willing to pay for an asset.

Bid Price (Best): In a trading environment where multiple buyers might be offering the same asset at different prices, the Best Bid Price is the highest of these prices. It is the most favorable bid price available to sellers. In an order book, this would be the topmost bid.

C

Candlestick Chart: A type of financial chart used to describe the price movements of an asset.

Collateral: Assets pledged by a borrower to back a loan.

Contract Size: The quantity of assets specified in a futures contract. For instance, if you open a position for 5 BTC, then the Contract Size will equal 5 BTCUSDT.

Cross-Margin: A method of position collateralization that uses the total trading balance to cover potential losses. On the Nexo platform, all USDT held in the Futures Wallet serves as collateral.

D

E

Entry Price: The price at which a position is entered. If Bitcoin costs 80,000 USDT per BTC and you open a position, that is your Entry Price. This price is used to determine your profits and losses.

Execution: The completion of a buy (Long position) or sell (Short position) order for an asset.

Expiration Date: The date on which a futures contract expires. On the Nexo platform, all futures contracts are perpetual and do not have an expiration date.

F

Fluctuations: Variations in the price or value of digital assets.

Funding Payment: Payments made or received by holders of perpetual futures contracts to ensure the price of the contract tracks the underlying spot price. Traders who are Long pay those who are Short, and vice versa.

Funding Rate: This represents the fee that has to be paid by holders of one side of the perpetual contract to the other to maintain the futures contract price close to the spot price. The Funding Rate also portrays the difference between an asset’s futures and spot market prices.

Futures Contract: An agreement to buy or sell a digital asset at a predetermined price and time. With futures contracts, you can speculate on the price of an asset without owning it.

G

H

Hedging: Opening a Short position for a futures contract to reduce the risk of adverse price decrease of that asset held in the Savings Wallet or the Credit Line Wallet. This strategy requires a deeper understanding of the mechanisms and risks associated with futures trading. Learn more

I

Initial Margin: The initial amount required to open a futures position in USDT.

Inverse Futures Contract: Inverse futures contracts are denominated in the cryptocurrency itself (e.g. BTC), not in another currency like USDT. This means that the contract’s value and the trader’s profits or losses are calculated in the base cryptocurrency (e.g., BTC, ETH). Contracts on the Nexo platform are traded and settled only in USDT (the quote currency).

Isolated Margin: A risk management system that allocates collateral to each position individually. Futures trading on the Nexo platform utilizes Cross-Margin instead, where the collateral is shared among all positions simultaneously.

J

K

L

Last Price: The most recent price at which a trade was executed. Learn more

Leverage: Using borrowed funds to increase the value of a position beyond what would be available from one’s trading balance alone.

Linear Futures Contract: Linear futures contracts are denominated and settled in a stablecoin (e.g. USDT). Contracts on the Nexo platform are traded and settled only in USDT (the quote currency).

Liquidation: The closing of positions when the active futures positions have accumulated significant Unrealized losses (negative PnL).

Long Position: Betting that a digital asset will rise in value in the future.

M

Margin: This is the USDT collateral in the Futures Wallet, used to open and maintain positions.

Margin Call: A notification asking the trader to add more collateral or close their positions to prevent automatic position closure.

Mark Price: The futures price of a digital asset used for calculating Unrealized profits and losses, determining if a Margin Call is needed, and triggering liquidations.

N

O

Order: An instruction to open a position for buying (going Long) or selling (going Short). Orders are also used to close positions.

Order book: This real-time list records all the bid and ask prices for a specific futures contract. It is essential for market participants because it offers detailed information about the various quantities available at each price level for that contract.

P

Perpetual Contract: A type of futures contract that does not have an expiry date. All futures contracts on the Nexo platform are perpetual and do not expire.

Position: The total holdings of a particular digital assets contract. A position for 1 BTC means having acquired a futures contract for 1 BTCUSDT.

Position Value: The value of an active futures position in USDT.

Profit and Loss (P&L): This is how a position’s performance is measured. If the P&L is a positive number, the position is profitable, while a negative P&L indicates a losing position. P&L (sometimes called PnL) is relative to the size of the position.

Q

Quote: A currency used to determine a digital asset’s estimated current value or price. In futures trading on the Nexo platform, the quote asset is USDT, which means all contracts are denominated in USDT.

R

Realized Profit and Loss (P&L): The total profit or loss generated by closing a position. The Last Price is used when closing a position to determine the final value of the P&L.

Required Collateral: The minimum amount of collateral necessary to back a position. Increasing the leverage lowers the Required Collateral amount but increases the trading risk. We advise proceeding with caution when using higher leverage.

Return on Investment (ROI): A measure used to evaluate the efficiency of a trade, calculated by ROI = (Realized PnL / Required Collateral) x 100%. For instance, if you realized 1,000 USDT PnL and had 2,000 USDT as collateral, your ROI is (1,000 / 2,000) x 100% = 50%.

Risk Management: The process of identifying, analyzing, and responding to various risks associated with trading futures contracts. This involves strategies and methods to mitigate potential losses due to the high volatility, leverage, and market unpredictability associated with digital assets.

S

Short Position: Betting that a digital asset will be lower in value in the future.

Slippage: The difference between the expected price of a trade and the price at which the trade is executed. For instance, there are bid/ask prices in the order book for Bitcoin at 80,000 USDT per BTC, but due to the order size, the actual price at which you open a Long position is 80,010 USDT per BTC.

Speculation: The practice of engaging in trade to profit from short or medium-term fluctuations in the futures market value of a digital asset.

Spot Market: A place for immediate swapping of digital assets between two traders.

Spread: The difference between a digital asset’s Best Ask and the Best Bid price.

Stop Loss Order: An order to close a position at a future price to mitigate further losses.

T

Take Profit Order: A type of order that specifies the exact price at which to close out an open position for a profit.

Total Equity: The value of USDT in your Futures Wallet, calculated as the trading balance plus the Unrealized profits or losses on any open positions.

Total Unrealized Profit and Loss (P&L): The profit or loss tracked for all active futures positions.

Trading Volume: The amount of an asset that changes hands over some time, often over a day.

Trigger Entry Order: An order that is commonly used as a strategy to enter the market. It specifies the price at which one wants to open a futures position.

U

Underlying Asset: The asset on which the futures contract price is based. This is also known as the Base Asset. In the BTCUSDT contract, the underlying asset is BTC.

Unrealized Profit and Loss (P&L): The potential profit or loss on an open position that has not yet been closed. Once the position is closed, the Unrealized PnL turns into Realized PnL.

V

Volatility: The degree of variation in the prices of cryptocurrency futures contracts within a specific period. High volatility in crypto futures can lead to significant trading opportunities but also poses greater risks.

W

X

Y

Z

14. Important notes:

- Trading futures on the Nexo platform is unavailable for clients residing in the USA, Canada, Australia, the United Kingdom, and some countries in the EEA.

- The content and examples presented in this article are for informational and educational purposes only and include no warranties. They should not be interpreted as financial advice or a recommendation to buy specific assets. Please note that digital assets are volatile, and the value of your investment can fluctuate based on market conditions. We advise you to trade responsibly.

- The glossary provided herein is meant to enhance understanding and is not intended to provide official definitions or interpretations of crypto futures trading terms. Users should not rely solely on this content to make decisions. The explanations and descriptions are subject to change from time to time.