LeverEdge – Explained

In this article:

2. What are the benefits of LeverEdge

3. What is needed to use LeverEdge

4. Key concepts

5. LeverEdge – Up and Down direction strategies

- Up vs. Down direction strategies

- LeverEdge profit and loss (PnL)

- Up direction strategy – examples

- Down direction strategy – examples

7. How to subscribe to a LeverEdge strategy

8. How to redeem before settlement

9. FAQ

10. Important notes

1. What is LeverEdge

LeverEdge is an advanced earning product that lets you act on your short-term view of BTC or ETH prices. With up to 200x built-in leverage and a clearly defined maximum loss, it offers the opportunity for enhanced returns if the market moves in your favor.

Whether you expect market prices to go up or down, you can take advantage of crypto market movements by subscribing to predefined earning strategies. If the asset price moves in your chosen direction by the settlement date, you can profit based on the strategy’s built-in leverage. No matter which asset and direction you choose, the most you can lose is the amount you subscribe with for each strategy.

You can base your earning approach around BTC or ETH, choose your desired direction (Up or Down), and a strategy based on the available breakeven price, settlement date, and leverage.

2. What are the benefits of LeverEdge

- Defined maximum loss: You can never lose more than the amount you allocate to a subscription.

- High leverage, no losses before settlement: Even when using up to 200x leverage, you can’t incur losses before the subscription settles.

- Predefined, short-term strategies: You choose from curated strategies with fixed leverage, breakeven prices, and durations.

- Multiple funding options: You can subscribe to a strategy using BTC, ETH, USDT, or USDC.

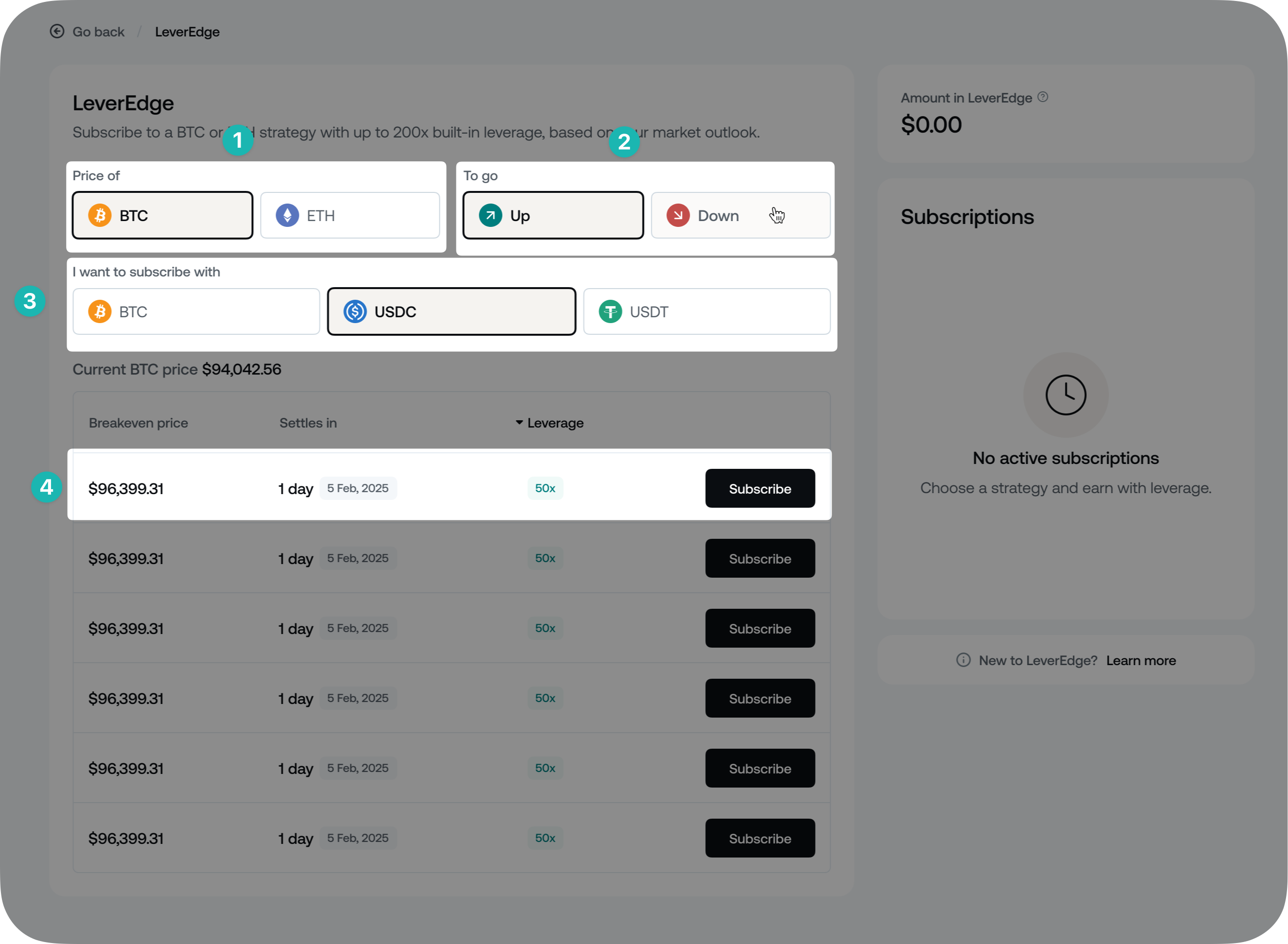

- Built-in PnL projection: Before you subscribe, you can see projected gains or losses based on where the asset price might settle.

- Early redemption: You can exit early under certain conditions, allowing you to realize profits while the price is favorable or to minimize further losses.

3. What is needed to use LeverEdge

Depending on your country of residence, you may be required to complete an introductory 5-question quiz as a preliminary step before you can get started with LeverEdge.

Tip: Before you subscribe to LeverEdge strategies, Nexo recommends going through this article.

You will need to have one of the supported assets available in your Savings Wallet to subscribe to a LeverEdge strategy:

- For BTC strategies: You will need at least $200 worth of BTC, USDT*, or USDC.

- For ETH strategies: You will need at least $200 worth of ETH, USDT,* or USDC.

*Residents of EEA countries cannot use USDT to subscribe to LeverEdge strategies.*

4. Key concepts

Breakeven price

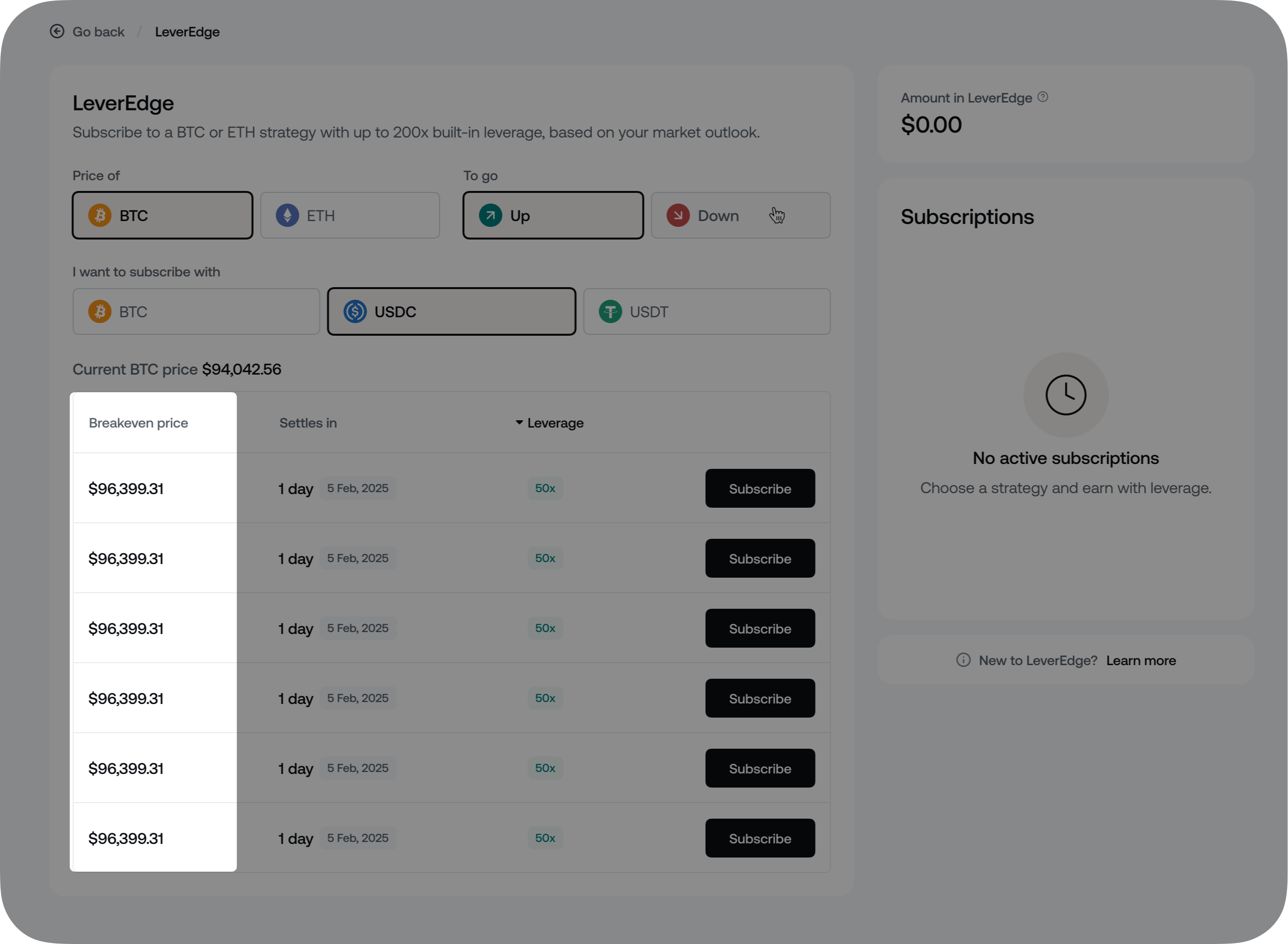

Each LeverEdge advanced earning strategy comes with a predetermined price, visible in the Breakeven price column:

For strategies in the Up direction, the breakeven price is always above the current market price. Conversely, for strategies in the Down direction, the breakeven price is always below the current market price. Once you subscribe to a LeverEdge strategy, the breakeven price will not change.

Note: If the breakeven price is not reached by the time of settlement, part or all of the subscription amount will be lost.

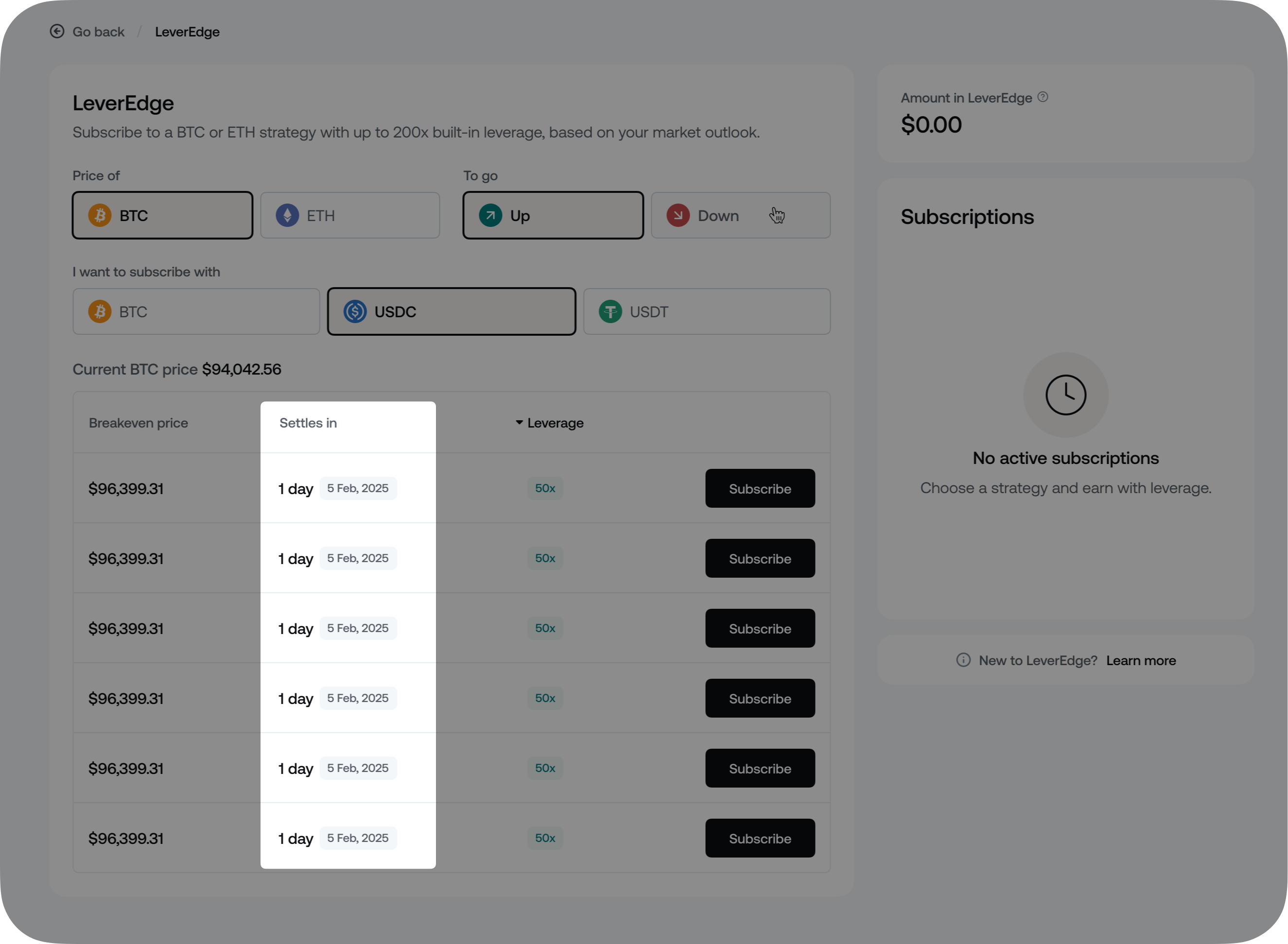

Settlement date

The Settlement date is the specific day when your advanced earning strategy concludes. On this date, your Profit and Loss (PnL) is calculated and distributed based on the price at settlement.

For LeverEdge subscriptions, the settlement occurs at 08:00 AM UTC on the Settlement date.

You can find the Settlement date displayed in the Settles in column:

Note: When you subscribe to a strategy, your BTC, ETH, USDT, or USDC will be held until the settlement date, when you’ll be able to access these funds again, unless you’ve generated a loss equal to your subscription amount. You may also be able to redeem your assets before settlement.

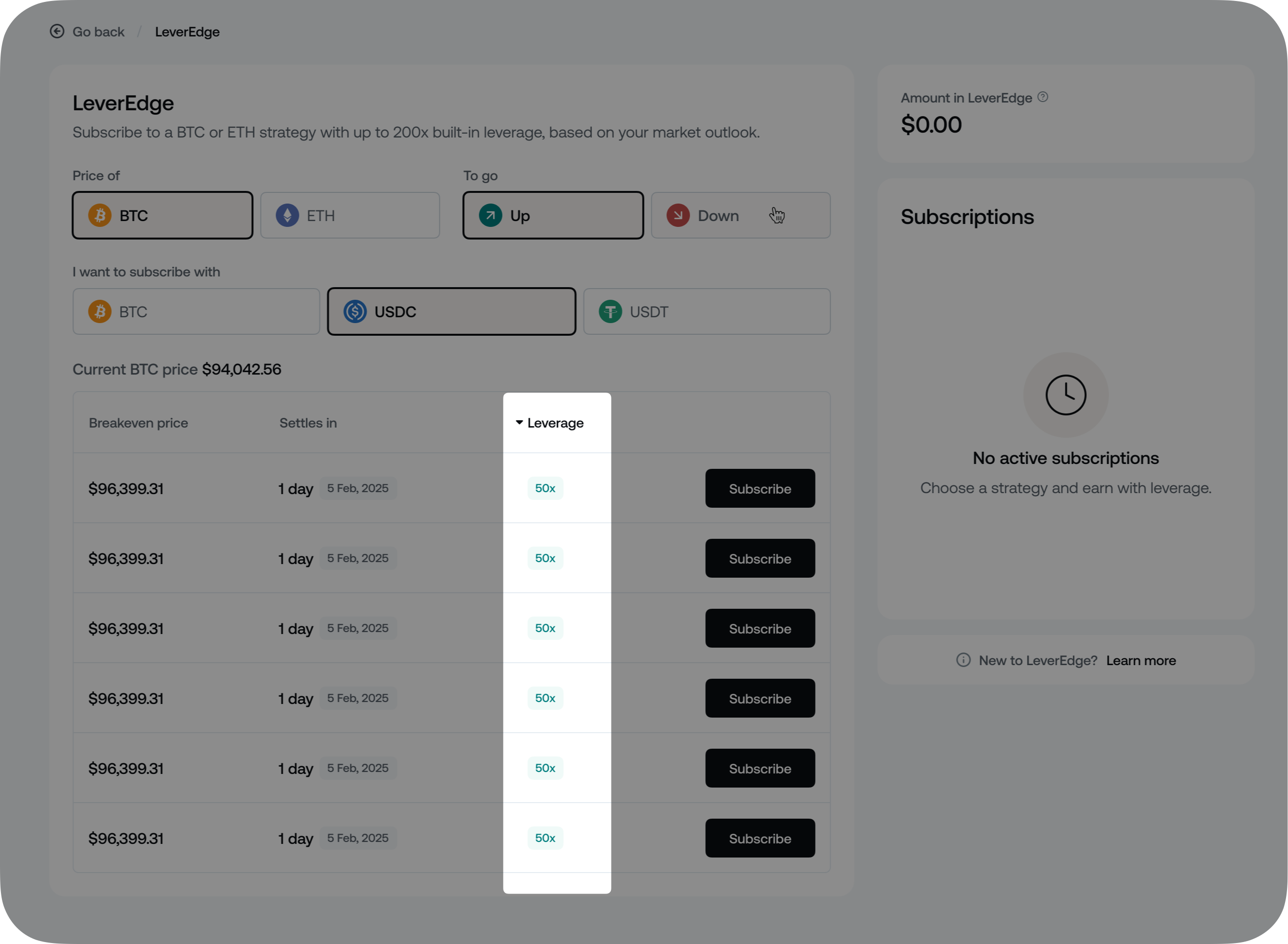

Leverage

LeverEdge uses built-in leverage to amplify your potential profit and loss (PnL) based on the price movement of BTC or ETH. For example, with 100x leverage, a 1% change in the underlying asset’s price can lead to a 100% change in your PnL.

Example – Leverage comparison in an Up direction strategy for BTC:

Leverage: 10x

Subscription amount: 0,000 worth of USDC

Breakeven price: 00,000

Settlement price: 01,000

PnL = ,000

Compared to exactly the same setup with 100x leverage:

PnL = 0,000

Unlike crypto futures trading, where leverage involves borrowing funds and the risk of liquidation, LeverEdge does not use borrowed funds, and your losses are never greater than the amount you subscribe with.

Your PnL is calculated and distributed only at the strategy’s Settlement Date, unless you choose to redeem early. You can find each strategy’s leverage displayed in the Leverage column.

5. LeverEdge – Up and Down direction strategies

Up vs. Down direction strategies

The Up direction strategy offers you a chance to profit if the price of BTC or ETH is higher than the Breakeven price at the time of settlement.

On the other hand, the Down direction strategy offers you a chance to profit in case the price of BTC or ETH is below the Breakeven price on the settlement date.

Further points to consider:

- Assets in a LeverEdge subscription:

- Do not receive Flexible Savings interest and cannot be locked in Fixed-term Savings.

- Cannot be exchanged or withdrawn before the settlement date of the LeverEdge subscription, unless they are redeemed early.

- Cannot be used as collateral for taking out loans and will not count toward your LTV. Will not be automatically transferred to the Credit Wallet if the Automatic Collateral Transfer feature is enabled.

- Cannot be utilized for automatic loan repayments.

- Cannot be transferred to Nexo Pro.

- The PnL of a LeverEdge subscription will be paid out in the same digital asset used to create the subscription, regardless of whether the Interest Payout in NEXO Tokens feature is enabled or if your Loyalty Tier is different on the settlement date.

LeverEdge – Profit and Loss (PnL)

The PnL outcome of your strategy depends on the price at settlement. If the Breakeven price is exceeded, your LeverEdge strategy generates a profit. If the Breakeven price is not reached, the strategy will result in a partial or full loss.

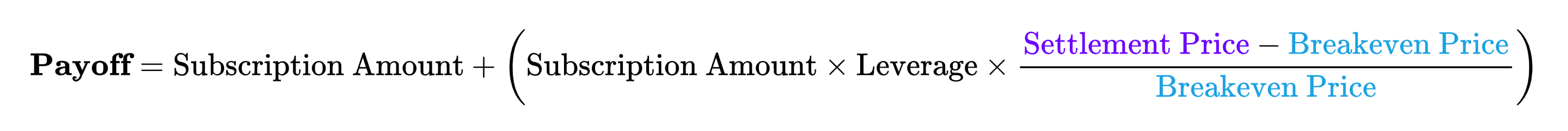

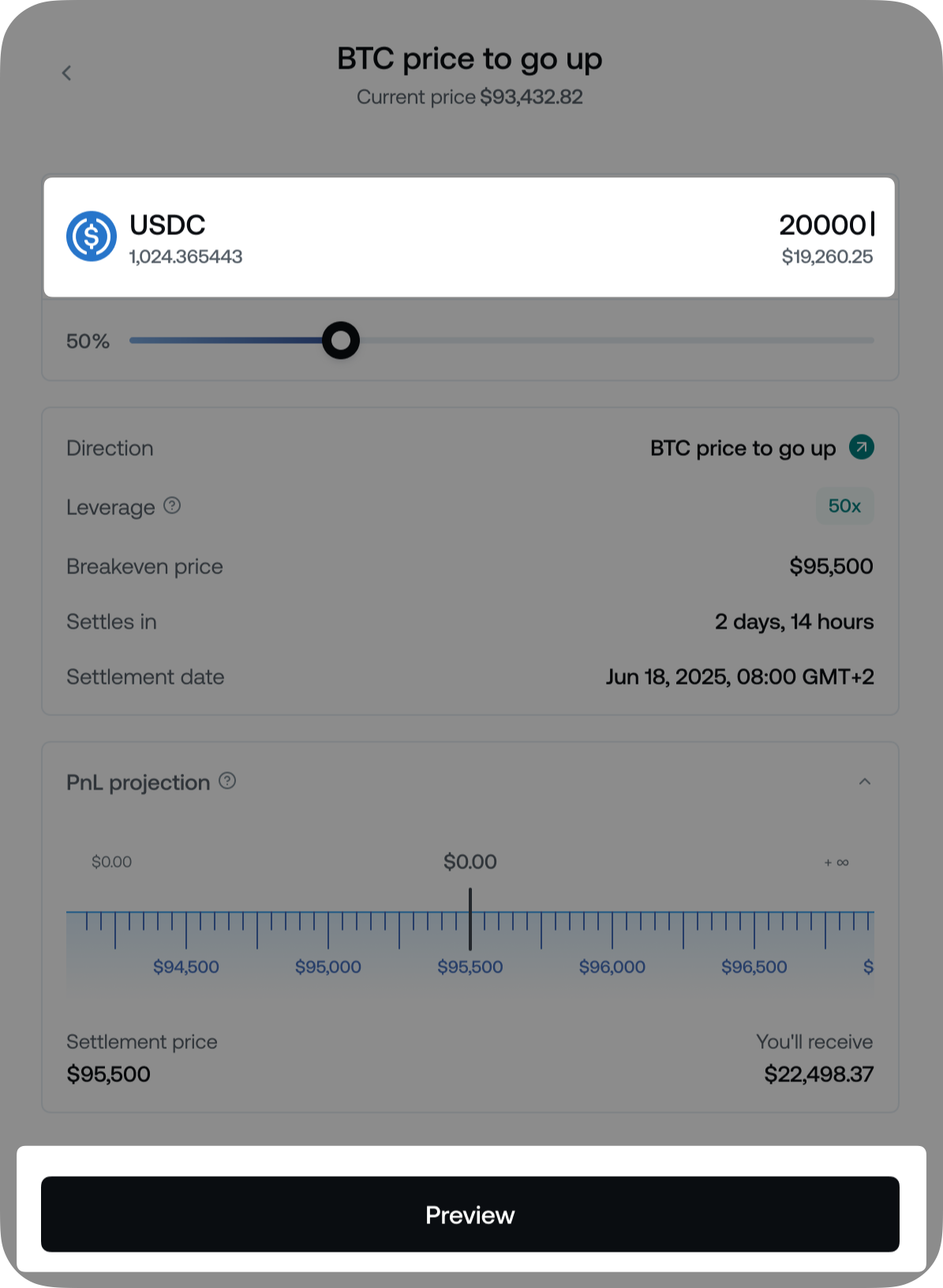

The payoff, which is the sum of the initial amount you subscribe with plus the PnL, can be calculated using these formulas:

Payoff of an Up direction strategy:

Subscription Amount + [Subscription Amount × Leverage × (Settlement Price – Breakeven Price) / Breakeven Price]

Payoff of a Down direction strategy:

Subscription Amount + [Subscription Amount × Leverage × (Breakeven Price – Settlement Price) / Breakeven Price]

Note: The minimum payoff for LeverEdge strategies is $0.00, regardless of the settlement price.

Detailed examples for the Up and Down direction strategies are available in the next sections.

Up direction strategy – examples

Consider the following setup, where you expect the BTC price to increase:

- Entry BTC price: 15,000

- Breakeven price: 18,000

- Leverage: 100x

- Subscription amount: 5,000 worth of USDC

- Settlement date: 10 days from now

Outcome 1: The Breakeven price is met

When the Breakeven Price is met in the Up direction strategy, it means that the price of the selected crypto asset (BTC or ETH) on the settlement date is greater than the Breakeven Price.

In this case, the price of BTC is greater than 18,000 (for instance, 20,000) at the time of settlement (on the 10th day). As a result, you will receive:

- Step 1: Use the Up direction formula

Subscription Amount + [Subscription Amount × Leverage × (Settlement Price – Breakeven Price) / Breakeven Price] - Step 2: Replace the variables

15,000 + [15,000 × 100 × (120,000 – 118,000) / 118,000] = 15,000 + 25,423.73 - Step 3: Calculate the payoff result

$40,423.73 in USDC

Conclusion: Since the Breakeven Price was exceeded, you received your original 5,000 worth of USDC subscription amount back, and also earned an additional profit of $25,423.73 in USDC.

Outcome 2: The Breakeven price is not met

In this case, the price of BTC is less than 18,000 (for instance, 17,000) at the time of settlement (on the 10th day). As a result, you will receive:

- Step 1: Use the Up direction formula

Subscription Amount + [Subscription Amount × Leverage × (Settlement Price – Breakeven Price) / Breakeven Price] - Step 2: Replace the variables

15,000 + [15,000 × 100 × (117,000 – 118,000) / 118,000] = 15,000 – 12,711.87 - Step 3: Calculate the payoff result

$2,288.13 in USDC

Conclusion: You lost 2,711.87 in USDC, so you will receive only $2,288.13 back from your original subscription. If the price of BTC had been even lower, your loss would have been greater, but no more than the 5,000 worth of USDC you subscribed with.

Down direction strategy – examples

Consider the following setup, where you expect the BTC price to decrease:

- Entry BTC price: 14,000

- Breakeven price: 12,000

- Leverage: 50x

- Subscription amount: $40,000 worth of USDC

- Settlement date: 15 days from now

Outcome 1: The Breakeven price is met

When the Breakeven price is met in the Down direction strategy, it means that the price of the selected crypto asset (BTC or ETH) on the settlement date is less than the Breakeven price.

In this case, the price of BTC is less than 12,000 (for instance, 11,000) at the time of settlement (on the 15th day). As a result, you will receive:

- Step 1: Use the Down direction formula

Subscription Amount + [Subscription Amount × Leverage × (Breakeven Price – Settlement Price) / Breakeven Price] - Step 2: Replace the variables

40,000 + [40,000 × 50 × (112,000 – 111,000) / 112,000] = 40,000 + 17,857.14 - Step 3: Calculate the payoff result

$57,857.14 in USDC

Conclusion: Because the Breakeven price was exceeded, you received your original $40,000 worth of USDC subscription amount back, and also earned an additional profit of 7,857.14 in USDC.

Outcome 2: The Breakeven price is not met

In this case, the price of BTC is greater than 12,000 (for instance, 15,000) at the time of settlement (on the 15th day). As a result, you will receive:

- Step 1: Use the Down direction formula

Subscription Amount + [Subscription Amount × Leverage × (Breakeven Price – Settlement Price) / Breakeven Price] - Step 2: Replace the variables

40,000 + [40,000 × 50 × (112,000 – 115,000) / 112,000] = 40,000 – 53,571.42 - Step 3: Calculate the payoff result

$0.00 in USDC

Conclusion: Although the final PnL was for a loss of -$53,571.42 in USDC, you only incurred a loss of -$40,000 in USDC equal to the amount you subscribed with.

Note: Regardless of the strategy, if the price of the selected crypto asset (BTC or ETH) on the settlement date exactly matches the Breakeven Price, the PnL is zero, and you receive back the full amount you subscribed with.

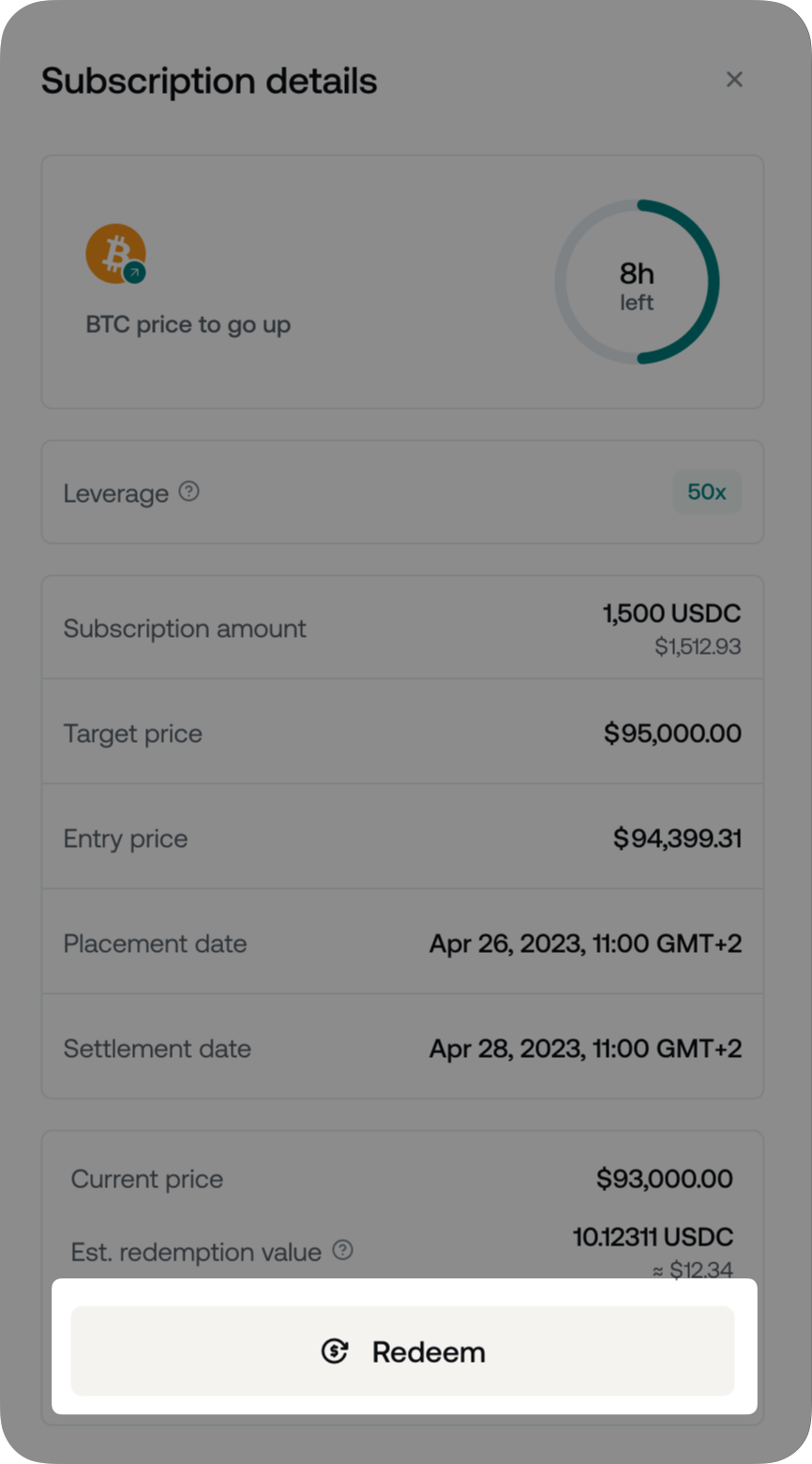

6. Early redemption

You can manually exit an active LeverEdge subscription without any fees if you want to realize potential profits early or limit further losses due to unfavorable market movements. To do so, your projected payoff must be at least 0 in digital assets.

Let’s explore this concept with an example.

Example — early redemption of an Up direction subscription:

- Entry BTC price: 05,000

- Breakeven price: 07,500

- Leverage: 20x

- Subscription amount: $65,000 worth of USDC

- Subscription date: August 1

- Settlement date: August 5

The price of BTC is 08,500 on August 3, at 14:00 UTC, and you decide to exit the subscription early using early redemption. By substituting the Settlement Price with the current Market Price of BTC in the PnL formula, Nexo can calculate the estimated payoff:

Step 1: Use the modified Up direction formula

Subscription Amount + [Subscription Amount × Leverage × (Market Price – Breakeven Price) / Breakeven Price]

Step 2: Replace the variables

65,000 + [65,000 × 20 × (108,500 – 107,500) / 107,500] = 65,000 + 12,093.03

Step 3: Calculate the payoff result

$77,093.03 in USDC

Since the estimated payoff amount is greater than the 0 minimum, you can successfully exit the LeverEdge subscription and realize profits before the settlement date.

Note: Early redemption is unavailable if:

- Your projected payoff is below 0 in digital assets.

- There are less than two hours left before the settlement.

- Less than five minutes have passed since you subscribed to a strategy.

7. How to subscribe to a LeverEdge strategy

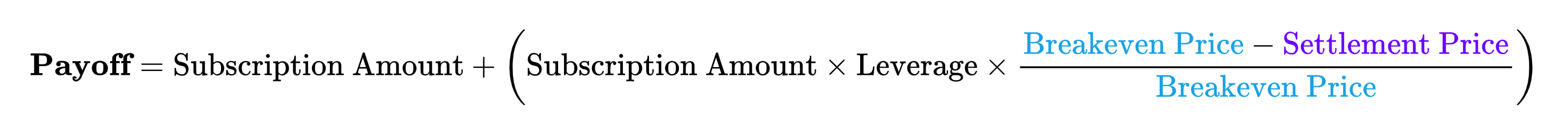

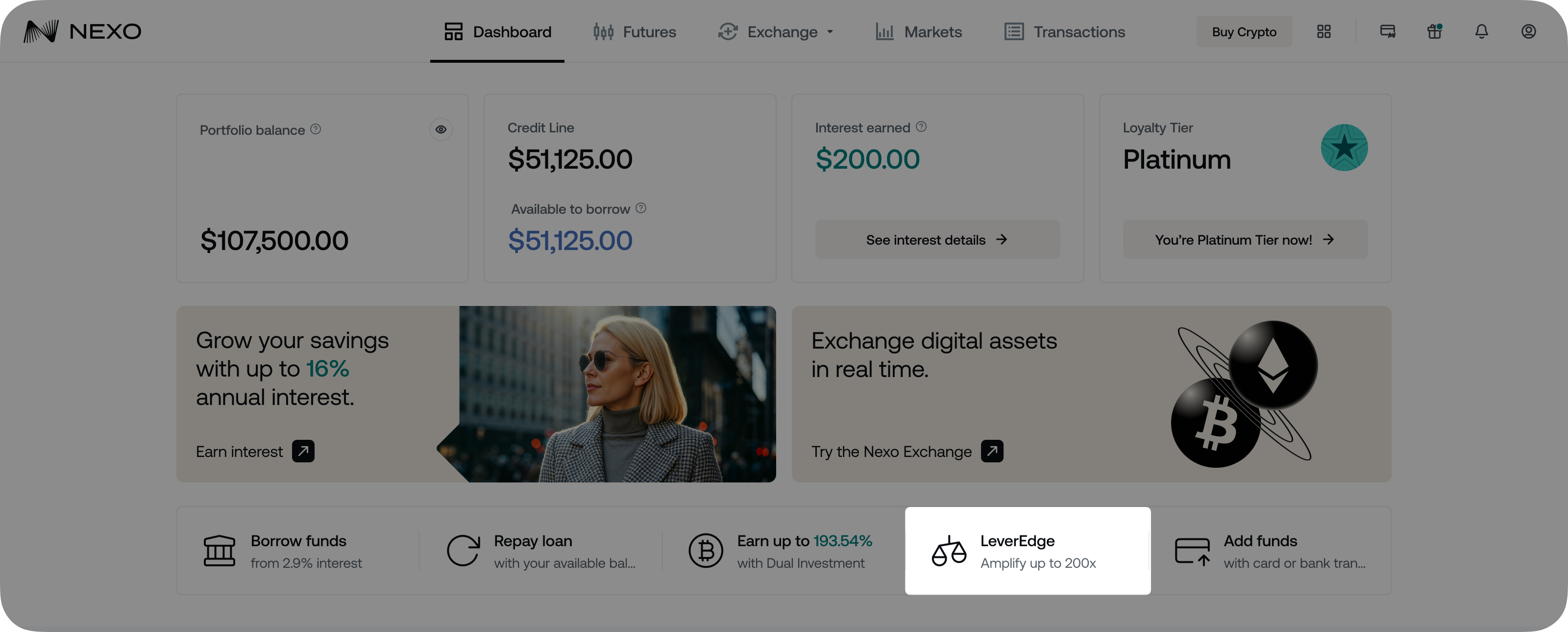

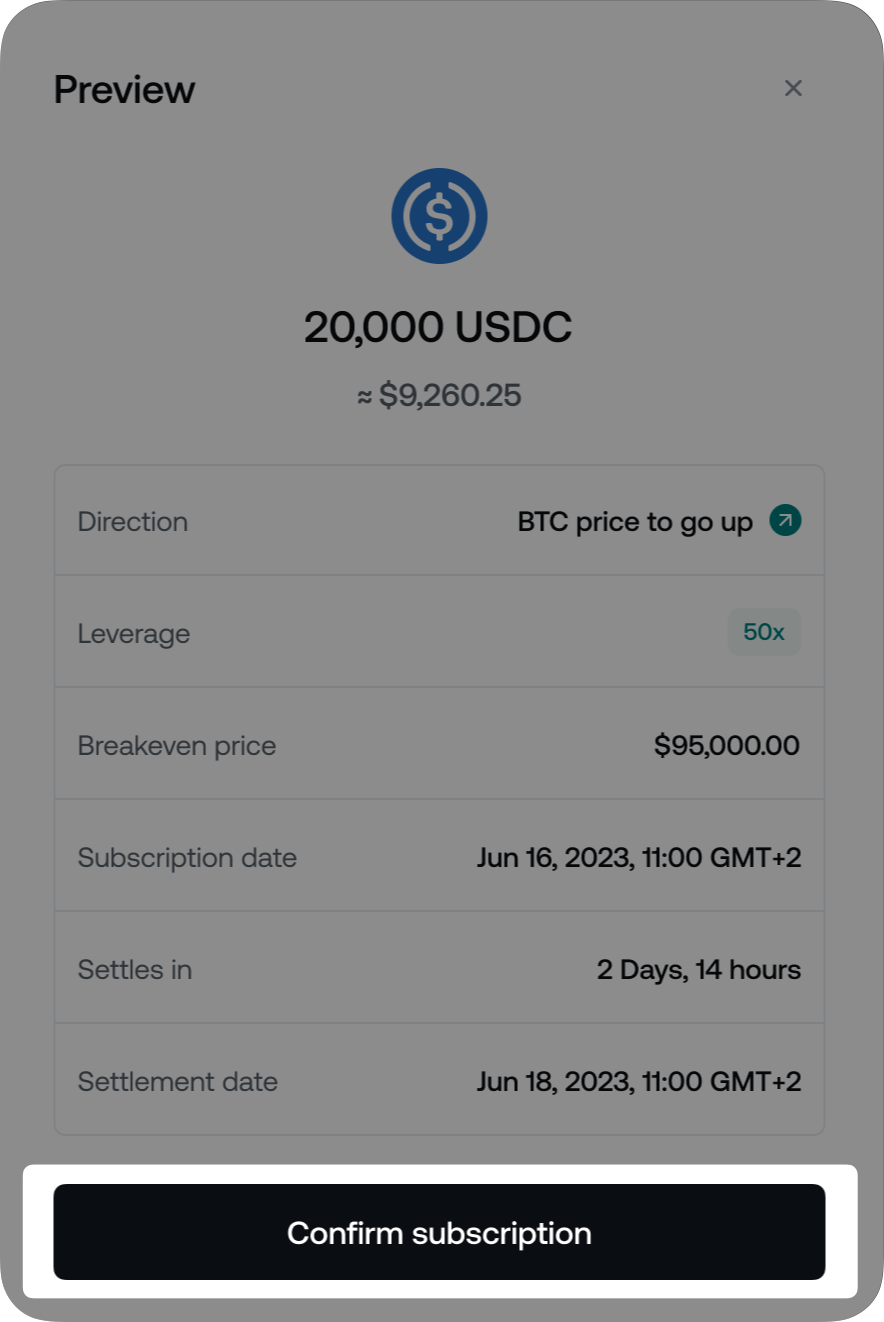

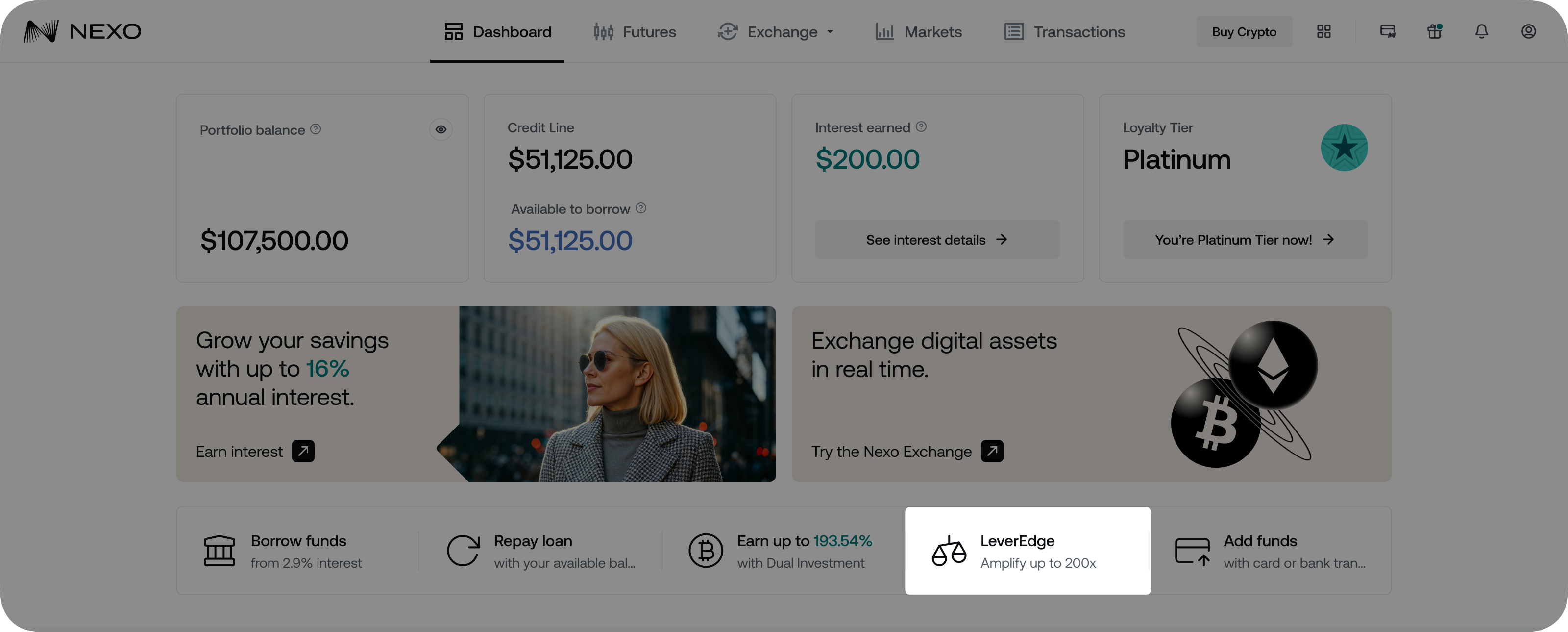

1. Click the Leveredge button on your Dashboard.

Note: Depending on your country of residence, you may be prompted to complete a short quiz.

2. Choose your strategy (Up or Down for BTC or ETH) and your subscription asset (BTC, ETH, USDC, or USDT). Then, select a subscription from the available options by clicking Subscribe.

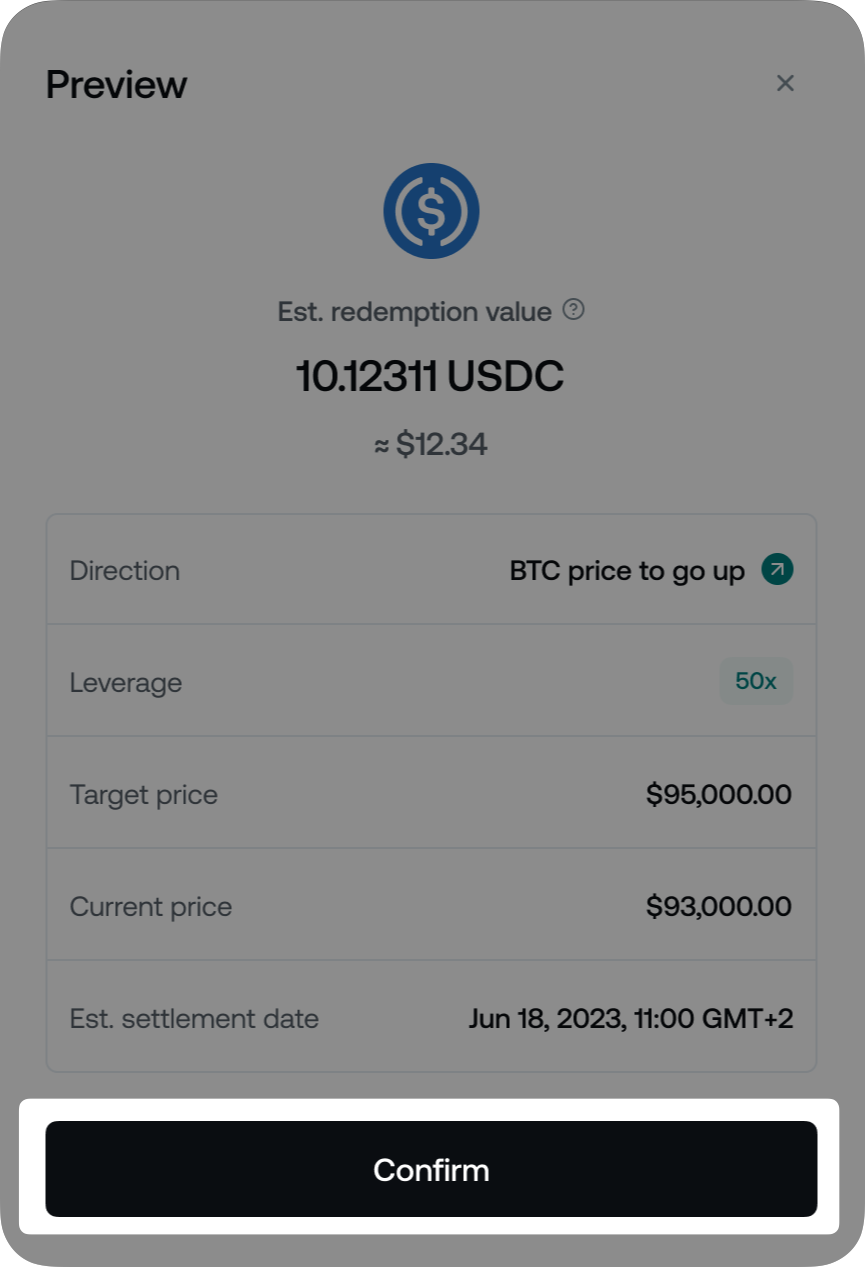

3. Enter the amount you wish to allocate and click Preview.

4. Review the details and click Confirm subscription.

8. How to redeem before settlement

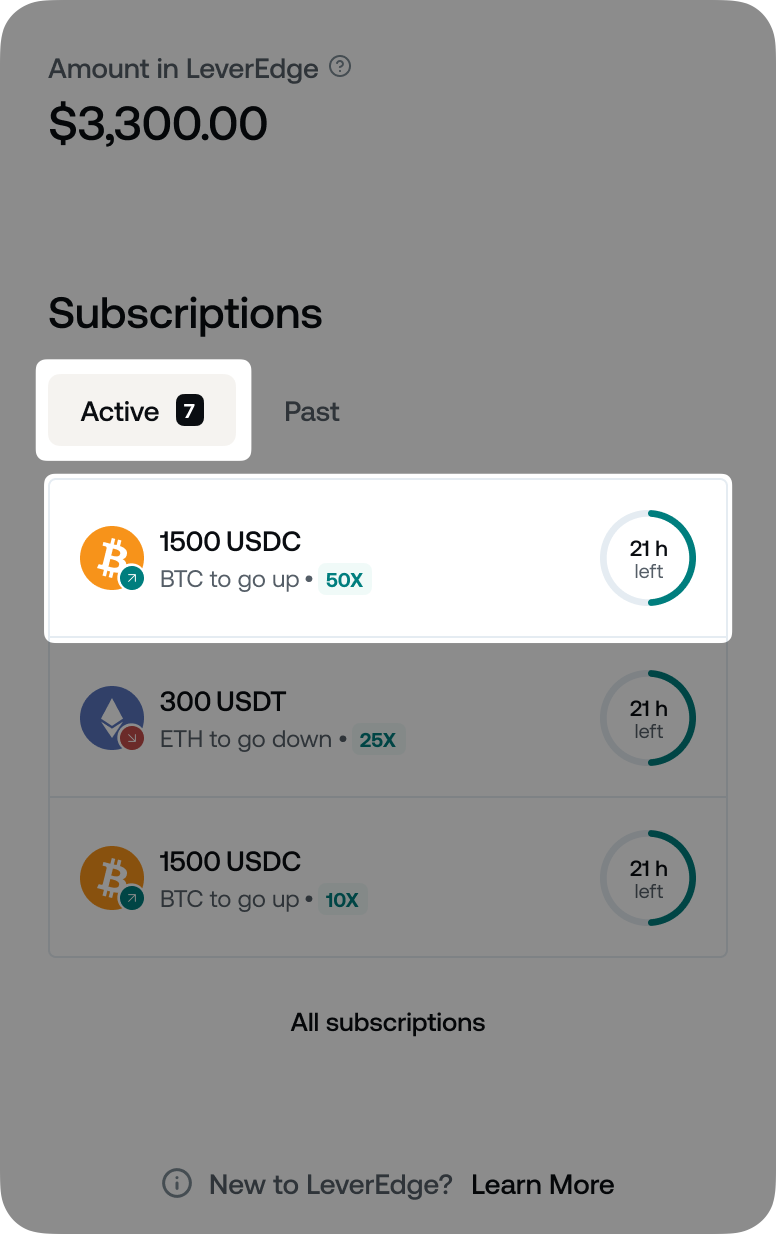

1. Click the Leveredge button on your Dashboard.

2. Go to your active subscriptions and select the one you wish to redeem.

3. Click Redeem.

4. Review the details of the early redemption, and click Confirm.

9. FAQ

Q: What is the minimum amount I can subscribe with for a LeverEdge strategy?

A: $200 worth of digital assets.

Q: What is the maximum amount I can subscribe with for a LeverEdge strategy?

A: The maximum subscription amount depends on the leverage of your chosen strategy:

-

- 5x leverage — $500,000 per subscription

- 10x leverage — $250,000 per subscription

- 25x leverage — 00,000 per subscription

- 50x leverage — $50,000 per subscription

- 100x leverage — $30,000 per subscription

- 200x leverage — 5,000 per subscription

Q: What is the maximum profit I can receive when using LeverEdge?

A: There is no upper limit to your potential profit with LeverEdge. The payoff amount you receive depends on the asset price at settlement. If the market moves significantly in your favor, your positive PnL can be substantial, especially when using higher leverage.

Q: What is the maximum I can lose when using LeverEdge?

A: Your maximum possible loss is limited to the amount you subscribe with for each strategy.

Q: Is LeverEdge a trading product?

A: No, LeverEdge is not a trading product because it does not involve buying or selling assets. Instead, LeverEdge is an advanced earning product that allows you to express your short-term market view on BTC or ETH prices, giving you the opportunity for enhanced returns if the market moves in your favor

Q: How can I project my potential returns?

A: Check the Potential Returns section (located under the PnL projection when placing a LeverEdge subscription).

Q: Can I cancel or modify an active LeverEdge subscription?

A: While you cannot modify an active LeverEdge subscription, you may be able to exit before the settlement date under certain conditions via the early redemption mechanism.

Q: Can I use assets placed in a LeverEdge subscription?

A: No, they will remain unavailable until the settlement date, unless you redeem early. This means you cannot:

-

- Exchange or withdraw these assets

- Transfer them to the Credit Wallet

- Use them for loan repayment

- Transfer them to Nexo Pro

Q: Where can I view my active and past LeverEdge subscriptions?

A: On the Nexo app, go to Savings Hub > LeverEdge, and tap the hamburger menu in the top right corner. Select Active or Past subscriptions. Tap the filter icon to sort your subscriptions.

On the Web platform, go to LeverEdge and check the Subscriptions section to view your Active or Past subscriptions. Click All subscriptions to view all your subscriptions.

Q: Can I filter my subscriptions?

A: You can conveniently filter your subscriptions by direction (Up or Down) and asset (BTC or ETH).

10. Important notes

- The LeverEdge product is unavailable for clients residing in Australia, the United Kingdom, the United Arab Emirates, and some countries in the EEA.

- The content and examples presented in this article are for informational and educational purposes only and include no warranties. They should not be interpreted as financial advice or a recommendation to engage in transactions involving specific assets. Please note that digital assets are volatile, and the value of the funds you subscribed with may fluctuate with market conditions. LeverEdge does not guarantee any returns, as all outcomes depend entirely on the price movement of digital assets. You may lose the full amount you subscribe with. Please use advanced earning strategies responsibly.