How to earn interest with Flexible Savings

If you’re looking to earn high-yielding annual interest on your digital assets, the guide here will provide all the necessary information to get you started.

In this article:

1. What are the benefits and the interest rates

2. Flexible Savings vs Fixed-term Savings

3. How to start earning interest with Flexible Savings

- Top up funds

- Minimum portfolio balance requirement

- Opt in to earn interest

- Keep your assets in the Savings Wallet

- Eligible assets and minimum required amount per asset

4. How to benefit from the highest interest rates

5. When is the first interest payout

6. In what currency is the interest paid out and how is it calculated

7. How to earn in NEXO Tokens for higher interest rates

8. What are the balance limits

9. How to check the earned interest

10. How to opt out of earning interest

11. FAQ

1. What are the benefits and the interest rates

With Nexo’s Flexible Savings product, you can earn up to 14% annual interest on digital assets with daily interest payouts. Here are the main benefits of this product:

- Higher flexibility: Access your funds at any time, while they generate interest.

- Daily interest payouts: Receive interest payouts daily, enabling quicker access to earnings.

- Competitive interest rates: Earn up to 14% annual interest on your digital assets.

- Streamlined experience: Start earning interest shortly after topping up your account.

The interest rates differ depending on the specific asset, your Loyalty Tier, and your preferred payout type. You can find a detailed breakdown of the interest rates in the Loyalty Tiers section of your account.

Below are the annual interest rates in Flexible Savings for some of the most popular assets on Nexo’s platform:

- USDC: Up to 12%

- BTC: Up to 6%

- ETH/XRP/SOL/BNB: Up to 7%

- POL: Up to 5%

- NEXO: 4%

- DOGE: Up to 3%

- DOT: Up to 14%

- EURx/GBPx/USDx: Up to 9%

2. Flexible Savings vs Fixed-term Savings

Understanding the differences between Flexible Savings and Fixed-term Savings can help in choosing the option that aligns best with your individual preferences and financial goals. Flexible Savings offers more adaptability, while Fixed-term Savings provides higher interest rates for longer commitments. Below you can find a breakdown of the key characteristics of both savings options.

Flexible Savings:

- With Flexible Savings, you can earn up to 14% annually.

- By default, assets credited to your Nexo account generate interest through Flexible Savings.

- Interest is paid out automatically every day to your account.

- Assets are available at any time for various operations, such as swaps on Nexo’s Exchange, loan repayments, withdrawals, and others.

Fixed-term Savings:

- Fixed-term Savings offers the highest interest rates – up to 16% annually.

- Depending on the specific asset, you can lock your funds in fixed terms for 1, 3, or 12 months.

- Similar to Flexible Savings, assets in Fixed-term Savings accrue interest daily, but the earned interest is paid in a single transaction once the term ends.

- Assets locked in fixed terms become accessible and can be exchanged or withdrawn only after the term ends.

- Assets in active terms can decrease your LTV in case you are at risk of automatic loan repayment, only if the Fixed-term Savings unlock option is enabled.

3. How to start earning interest with Flexible Savings

Top up funds

Top up your Nexo account by transferring crypto or EUR/GBP/USD to your Nexo account. Alternatively, you can buy digital assets with your credit/debit card.

Minimum portfolio balance requirement

Ensure that you maintain a portfolio balance of at least $5,000 in value to earn interest on your digital assets and access Nexo’s loyalty Program with its perks. You can learn more in this article.

Opt in to earn interest on your digital assets

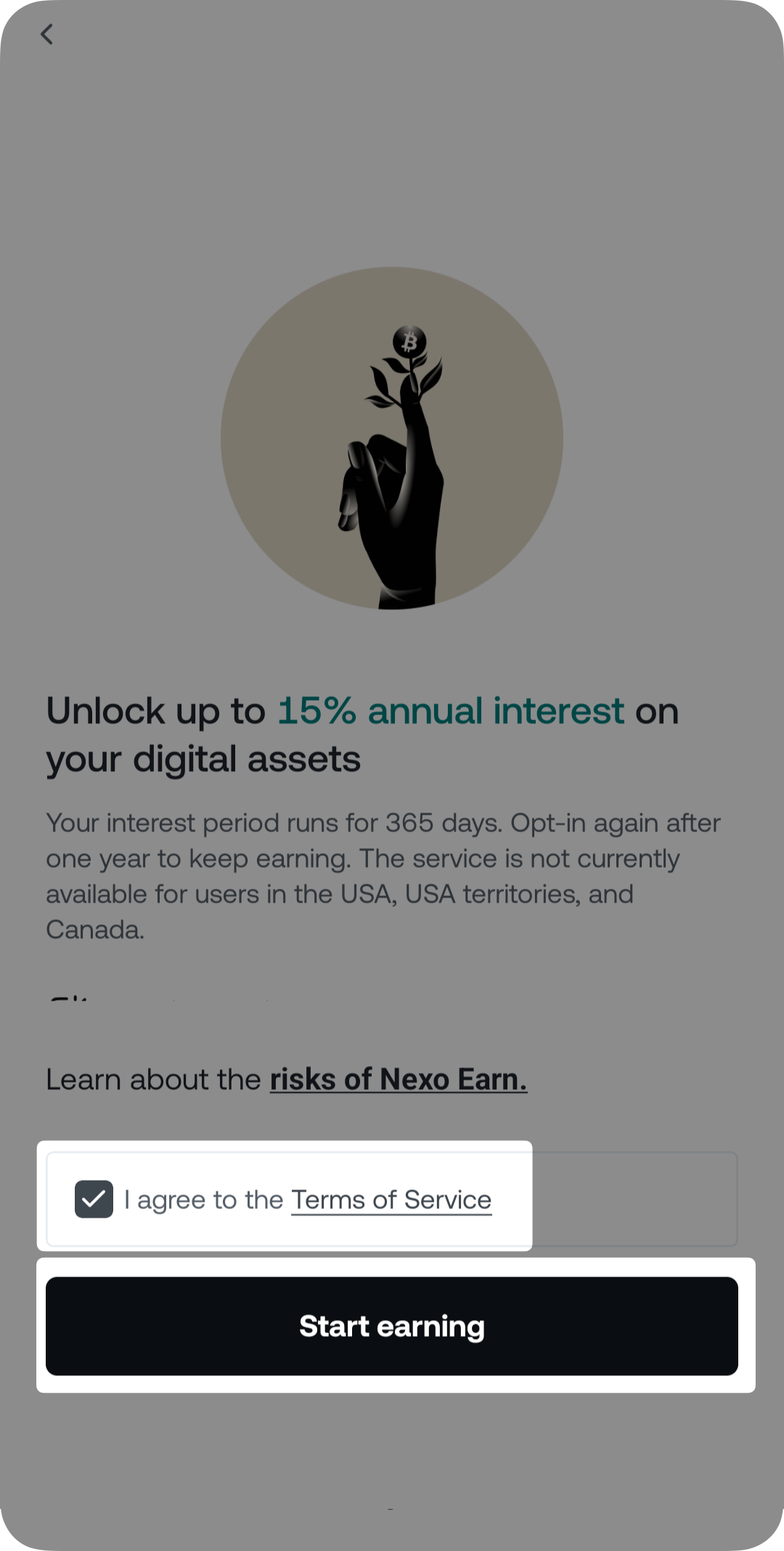

Clients residing in countries outside EEA jurisdictions must opt in to receive interest on their assets. This agreement lasts for 365 days but can be cancelled оr resumed at any time, depending on your preference. Here is how to opt in to earn interest:

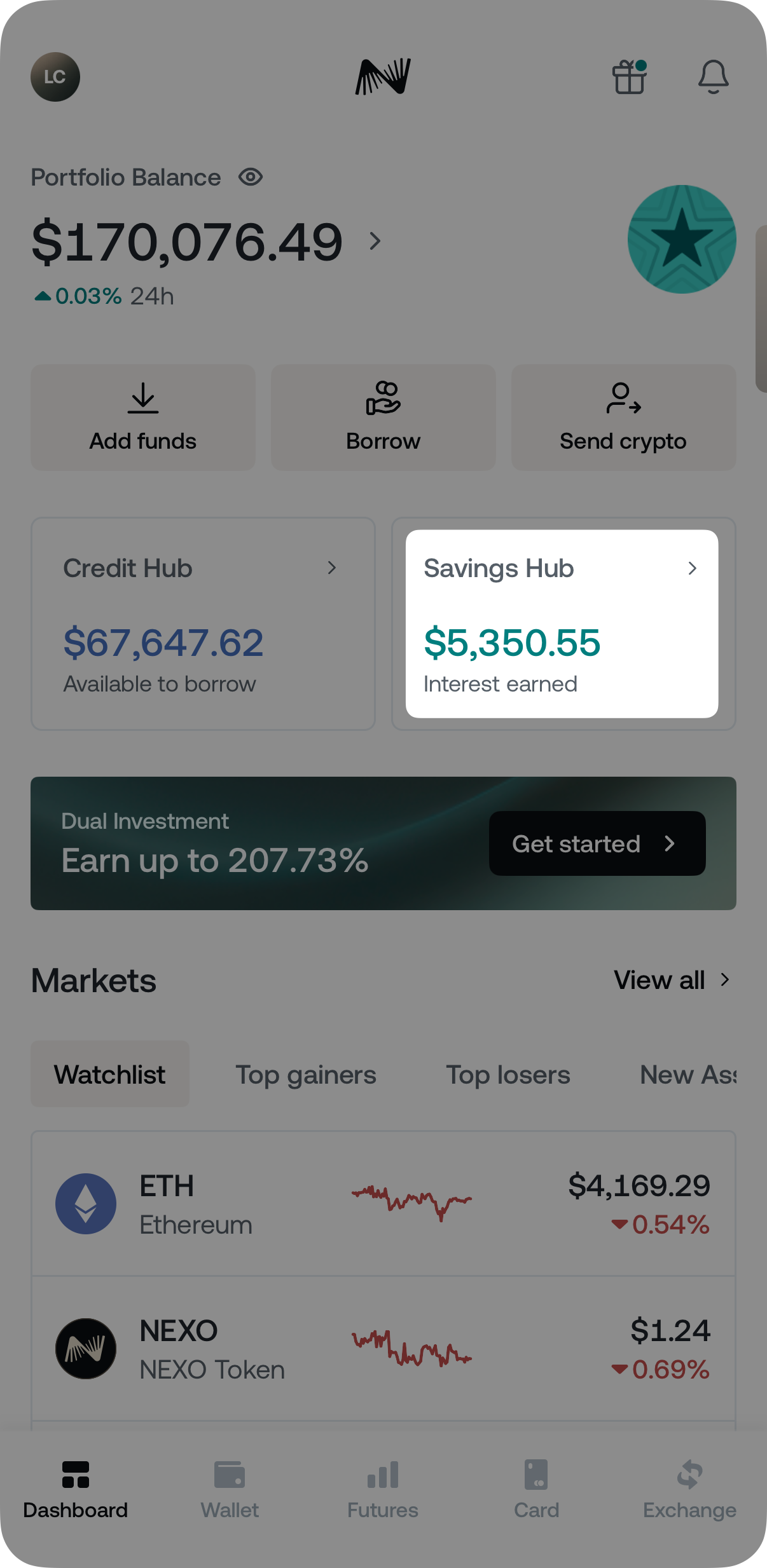

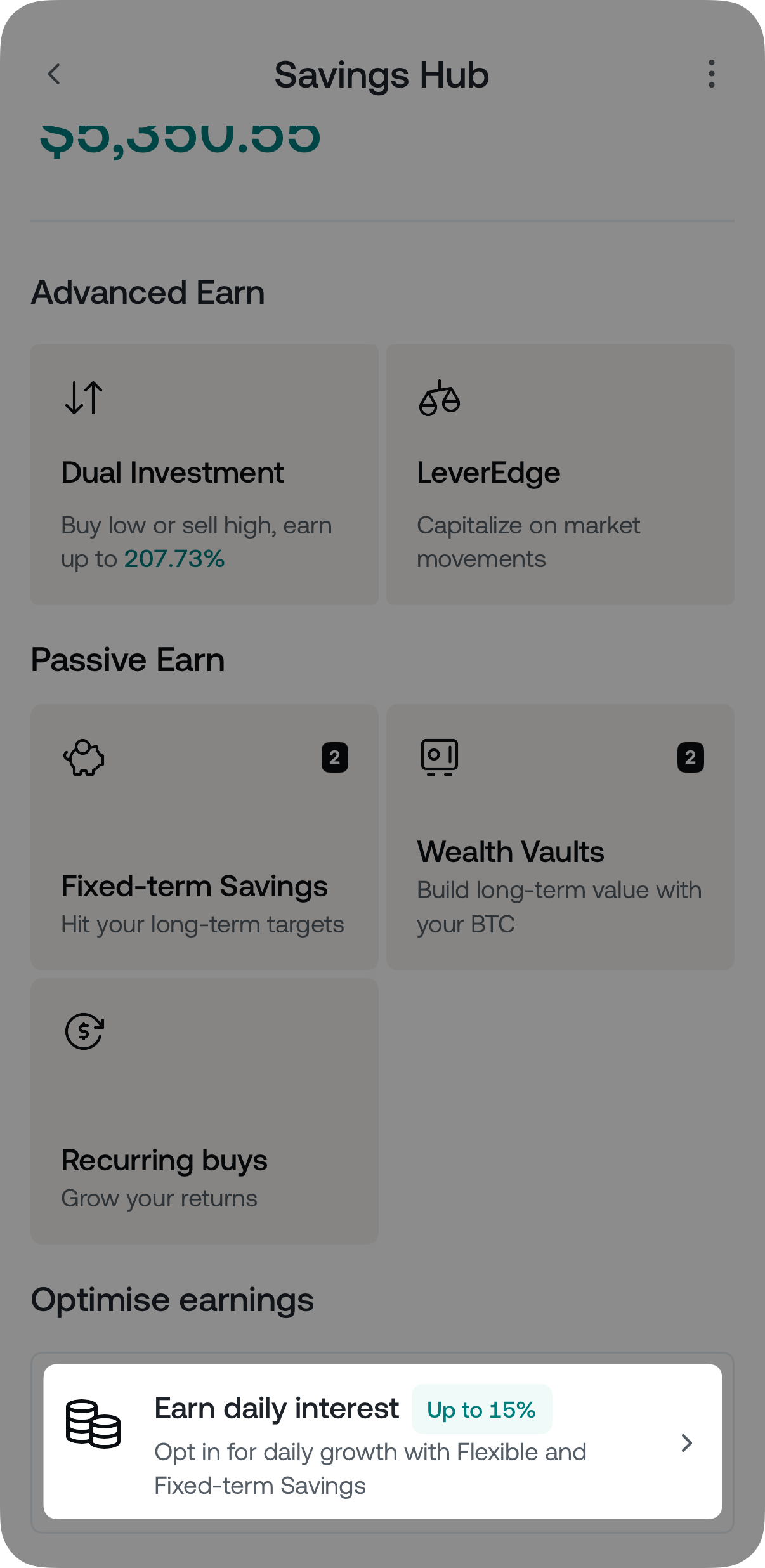

1. Log in to your Nexo account and tap the Savings Hub.

2. Select Earn daily interest in the Optimise earnings section.

3. Agree to the Terms of Service, and tap Start earning.

You are all set! You can now earn interest on your digital assets.

Note: If using the web platform, you can opt in to receive interest by navigating to My Profile > Security & Settings > Daily interest section.

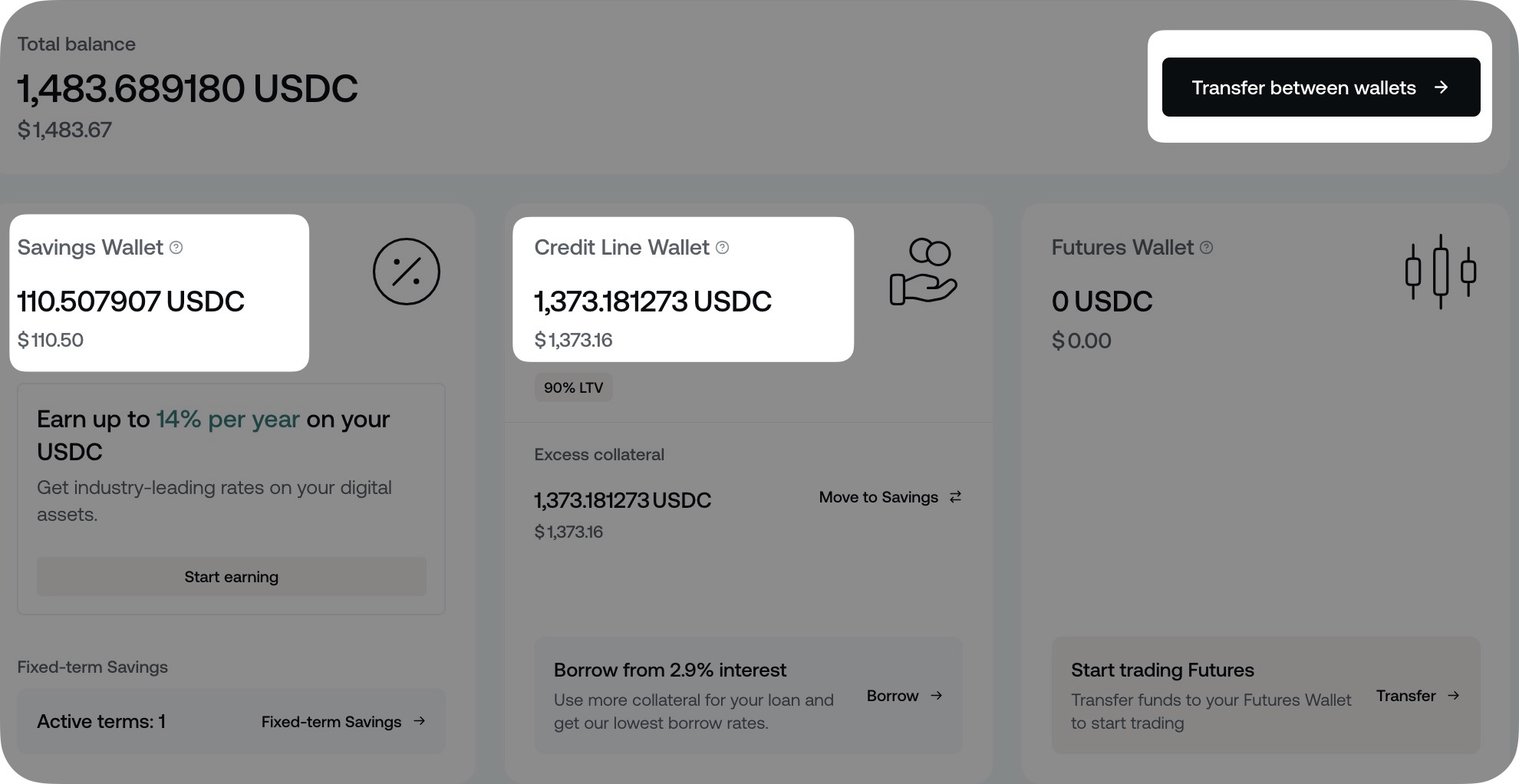

Keep your assets in the Savings Wallet

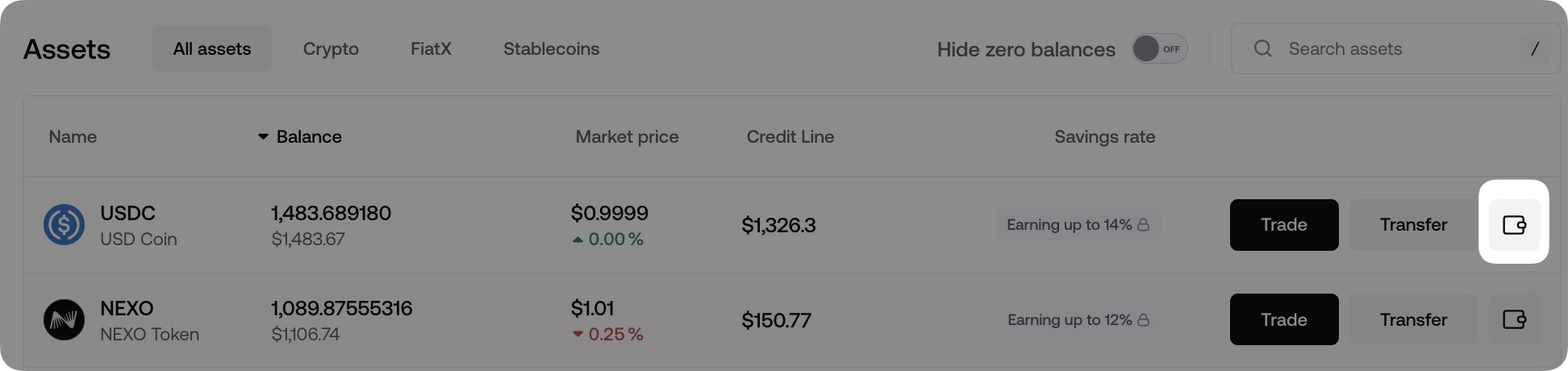

To earn interest, assets must be held in your Savings Wallet. The only exception is the NEXO Token, which earns interest in both the Savings and Credit Wallets.

To see which wallet your assets are currently positioned in, click the Wallet icon on your Dashboard to navigate to the Wallet screen. There, you can also transfer assets between your wallets.

Eligible assets and minimum required amount per asset

Both Flexible and Fixed-term Savings are available for a wide range of digital assets. However, not all currencies are eligible to earn interest.

The table below lists all assets on Nexo’s platform, showing which ones earn interest and their required Min. Earning Amount. Assets that are ineligible for interest are labelled N/A in the respective field.

N/A — The respective feature (Flexible Savings / Fixed-term Savings / Withdrawal / Repayment) is not available for this asset

Note: Earning interest on USDT, USDP, TUSD, DAI, and PAXG is unavailable for residents of EEA countries.

4. How to benefit from the highest interest rates

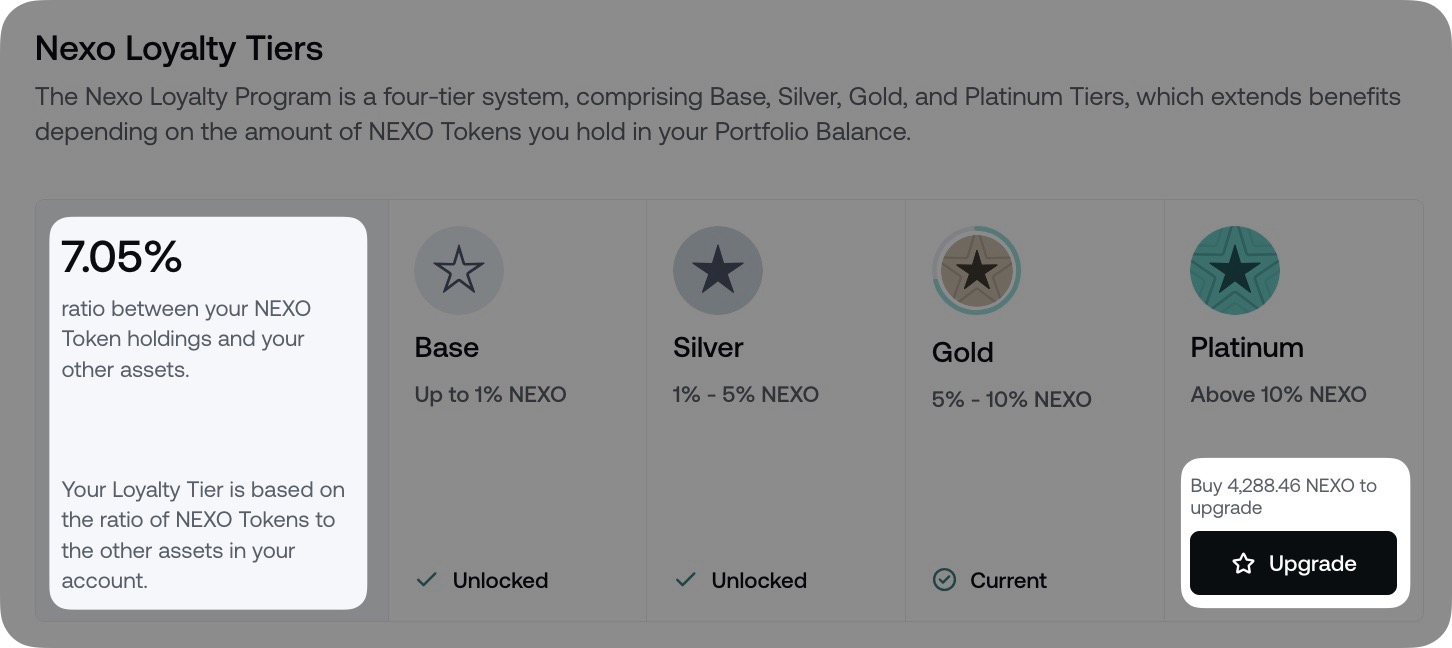

To benefit from the highest interest rates, you need to be in the Platinum Loyalty Tier, meaning that the value of your NEXO Tokens must be at least 10% compared to the rest of your portfolio.

The exact NEXO amount required for the highest interest rates will depend on the market price of the token at any given moment. It will be displayed in the Loyalty Tiers section of your account:

Example: If your portfolio (excluding NEXO) is worth 00,000, you’ll need to hold at least 0,000 in NEXO Tokens to qualify for the Platinum tier. To avoid changes in your Loyalty Tier due to price fluctuations, Nexo recommends maintaining a small buffer of extra NEXO Tokens in your account.

5. When is the first interest payout

When you top up funds to your Nexo account, they are automatically placed in your Savings Wallet and are initially marked as non-earnable as they enter a cool-off period.

At 05:00 UTC each day, these balances are marked as earnable. However, interest does not begin to accrue immediately.

A daily snapshot of your balances (both earnable and non-earnable) is taken at 23:59:59 UTC. Only after this snapshot verifies your balance as earnable does the interest payout occur the following day between 05:00 and 09:00 UTC.

Due to the above mechanics, the first interest payment will be made between 24 to 52 hours after the assets are credited to your Savings Wallet.

When an asset in the cool-off phase is exchanged, the corresponding amount of the new currency will become earnable after the original asset’s cool-off period concludes.

The same 24-52 hour cool-off is also applied to assets that are:

- Bought with a credit/debit card

- Transferred from the Credit Wallet

- Transferred from the Futures Wallet

- Transferred from Nexo Pro

Examples:

Scenario 1: A top-up is credited at 04:30 UTC on June 10. The first interest payment will take place between 05:00 and 09:00 UTC on June 11.

Scenario 2: A top-up is credited at 05:30 UTC on June 10. The first interest payment will happen between 05:00 and 09:00 UTC on June 12.

Scenario 3: On June 10, you top up 50 USDT at 04:00 UTC, which completes the cool-off period on June 11 between 05:00 and 09:00 UTC. Then, on June 12, you exchange the USDT tokens for ETH at 14:00 UTC. Since these assets have already passed the cool-off period, they aren’t subject to an additional one. Therefore, the interest for the ETH assets (equivalent to 50 USDT) you acquire from the exchange will be credited between 05:00 and 09:00 UTC on June 13.

Scenario 4: On June 10, you top up 100 USDT, which is credited at 22:00 UTC. On June 12, you exchange 20 USDT for BTC at 00:30 UTC. Since the system takes a snapshot of your balance at 23:59:59 UTC on June 11, the interest you receive between 05:00 and 09:00 UTC on June 12 is calculated based on the 100 USDT balance. The interest for the BTC assets (equivalent to 20 USDT) you acquire from the exchange will be credited on June 13 between 05:00 and 09:00 UTC.

6. In what currency is the interest paid out, and how is it calculated

Interest calculation varies based on the payout type:

- In NEXO Tokens: The interest is paid out in NEXO Tokens for all assets. Depending on your Loyalty tier, you receive a bonus interest rate of between 0.25% and 2%. This option uses a simple interest model, i.e., it will be calculated on the principal amount only.

- In-kind: The interest is paid out in the underlying currency (e.g., if you have BTC in your Savings Wallet, the interest is also paid out in BTC). This is the default payout type, which uses a compound interest model, taking into account both the principal amount and the accumulated interest.

Examples

In NEXO Tokens

Suppose you’re a Platinum Tier user with 1,000 SOL held in your Savings Wallet, and you’ve chosen to earn interest in NEXO Tokens. With this setup, you’ll benefit from a 7% annual interest rate (5% + 2% bonus for earning in NEXO Tokens) under the simple interest model.

Below, we’ll break down how much interest you’ll earn per day, along with the total accrued over time in this scenario:

Daily interest rate: 7% / 365 = ~0.01917808%

Daily interest earned: 1,000 SOL × 0.01917808% = 0.1917808 SOL

After 1 year (365 Days):

- Total interest: 0.1917808 SOL × 365 = 70 SOL

- Total balance: 1,000 SOL + 70 SOL = 1,070 SOL

After 2 years (730 Days):

- Total interest: 0.1917808 SOL × 730 = 140 SOL

- Total balance: 1,000 SOL + 140 SOL = 1,140 SOL

Note: Since interest is paid in NEXO Tokens, the first step is to determine the USD value of your in-kind (SOL) earnings at the time of payout. Then, the equivalent amount of NEXO is allocated based on the prevailing NEXO/USD exchange rate.

In summary, the simple interest model provides a steady, linear growth on your assets over time.

In-kind

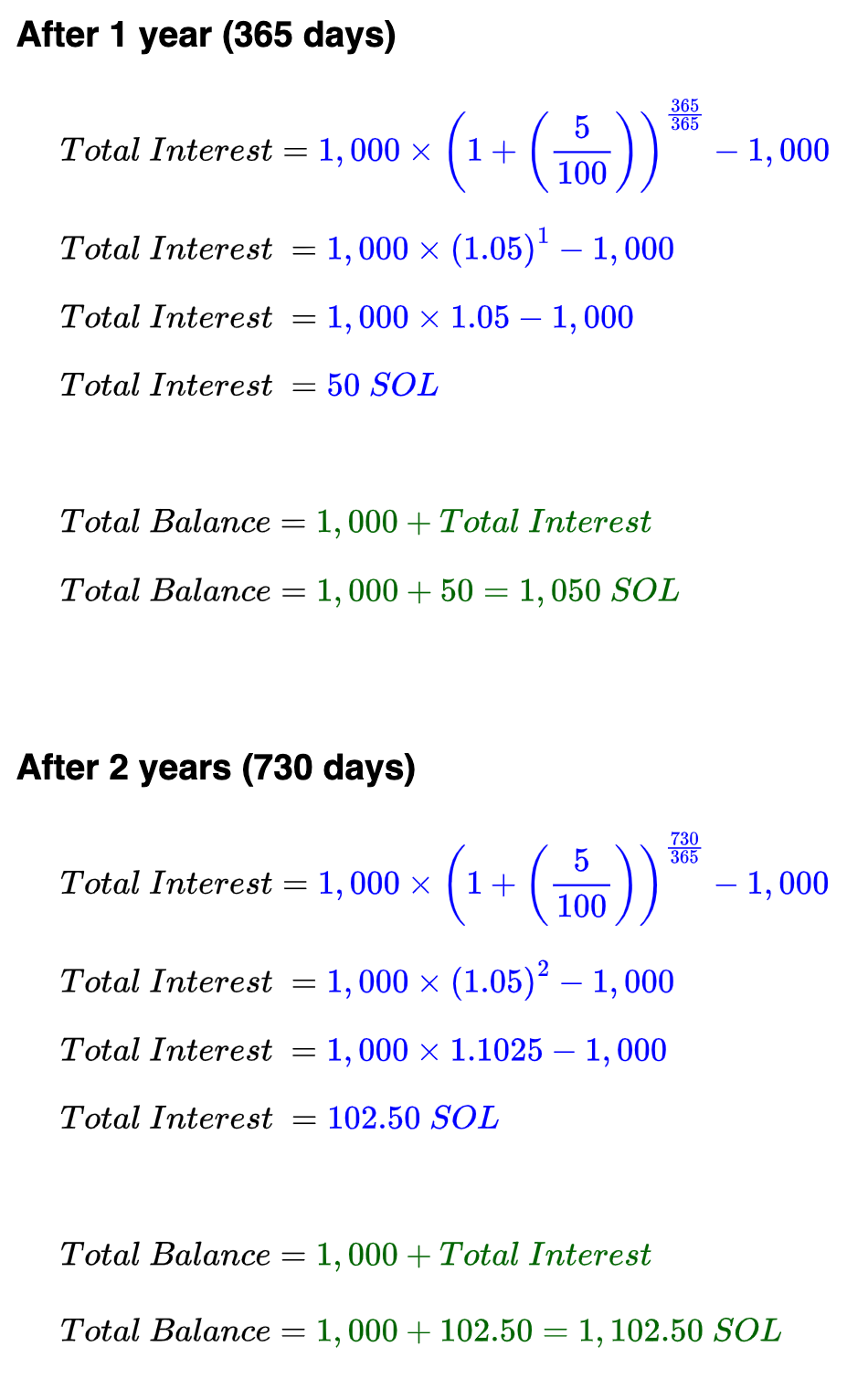

Suppose you’re a Platinum Tier user with 1,000 SOL in your Savings Wallet, and have opted to earn interest in-kind (in SOL). In that case, you’ll have an annual interest rate of 5% under the compound interest model.

The image below illustrates how your interest accrues and how your total balance grows over time in this example.

As illustrated above, the compound interest model leads to exponential growth over time, with each day’s interest added to an increasingly larger balance. In other words, the interest earned in year two will exceed that of year one, year three will surpass year two, and so on.

Important: The interest rates are adjusted dynamically based on your current Loyalty Tier. The tier may fluctuate if the value of your NEXO Tokens changes compared to the rest of your portfolio.

7. How to earn in NEXO Tokens for higher interest rates

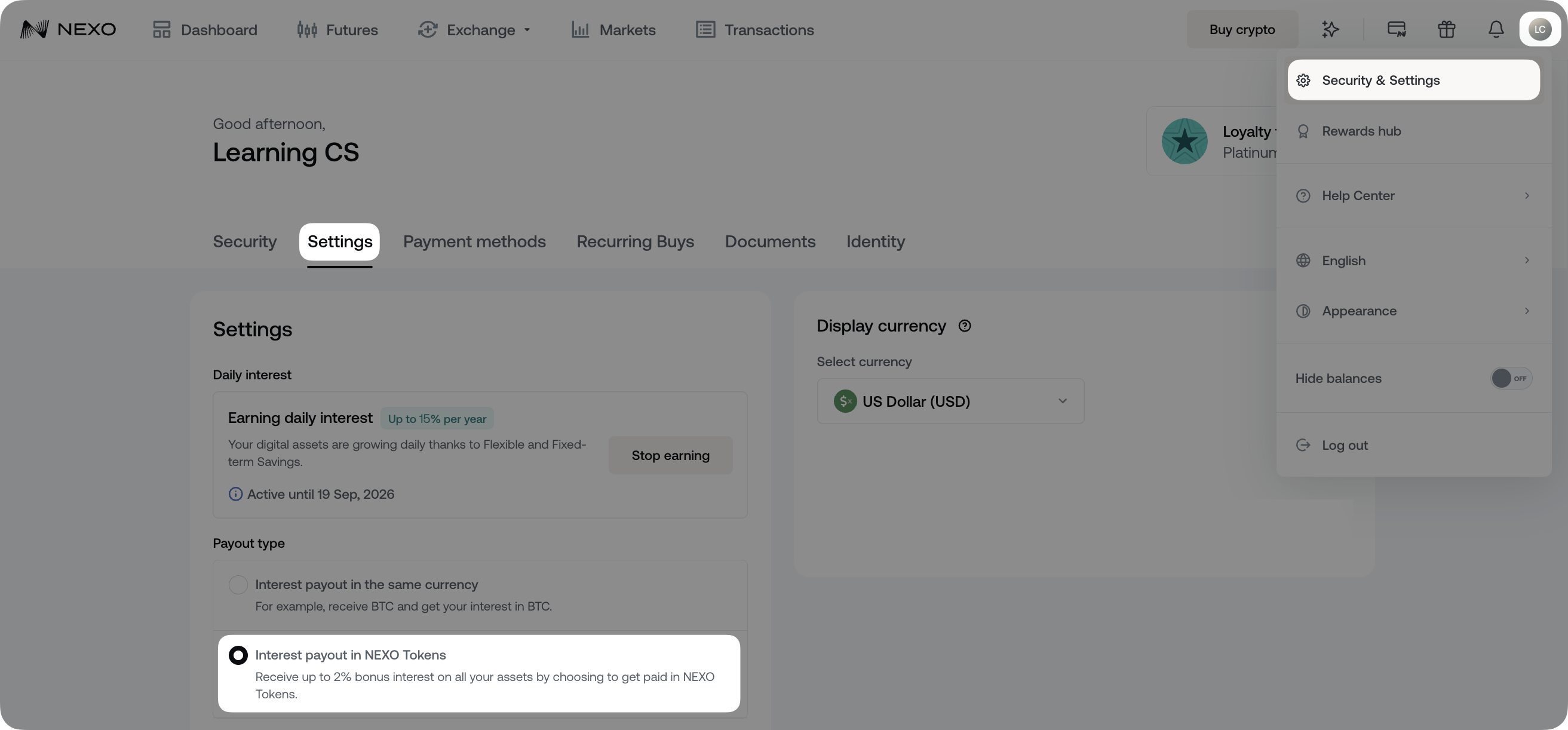

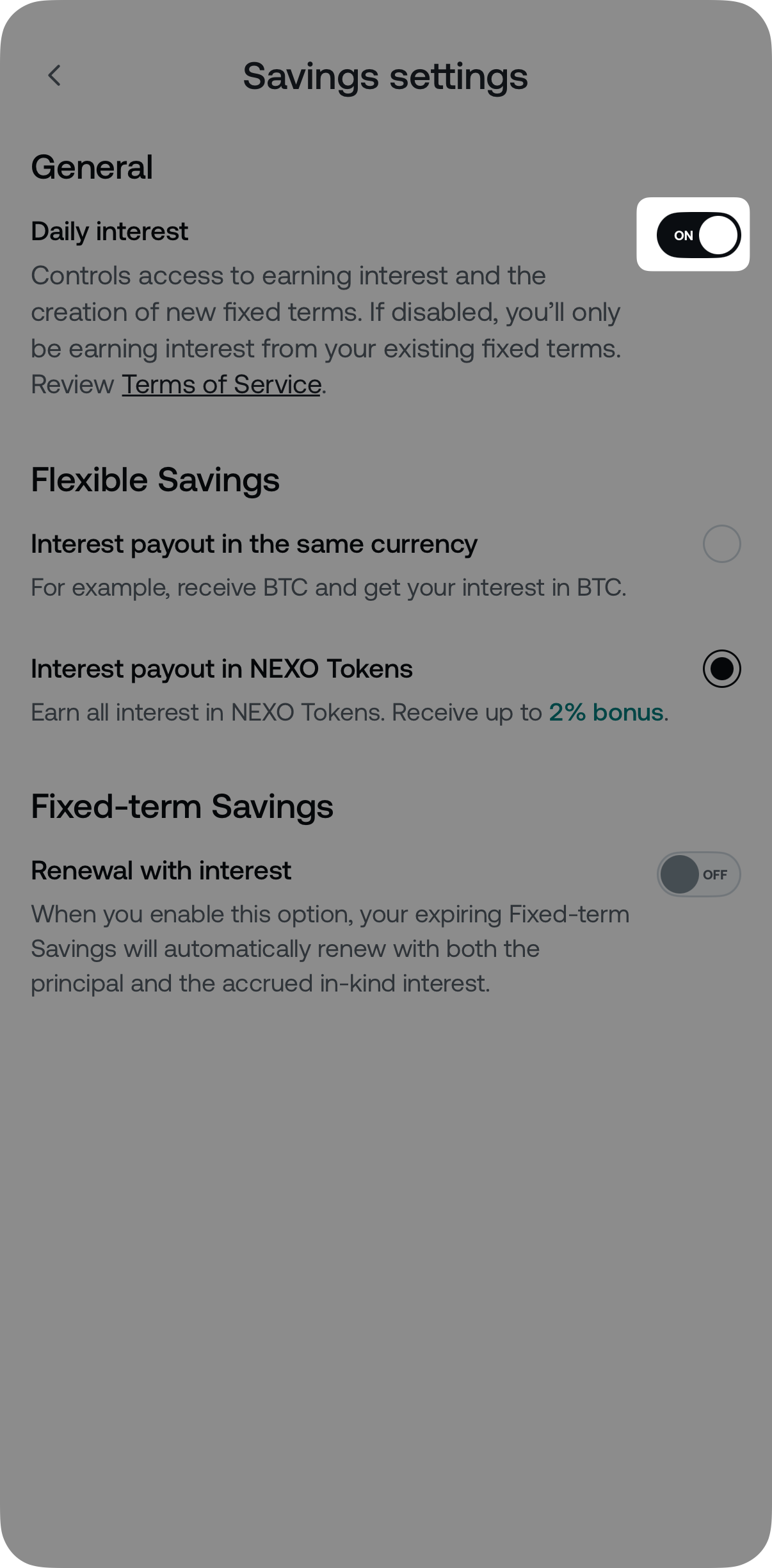

When choosing to earn in NEXO Tokens, you receive between a 0.25% and 2% bonus interest rate, depending on your Loyalty Tier. To activate the option, follow these steps:

- Log in to your Nexo account.

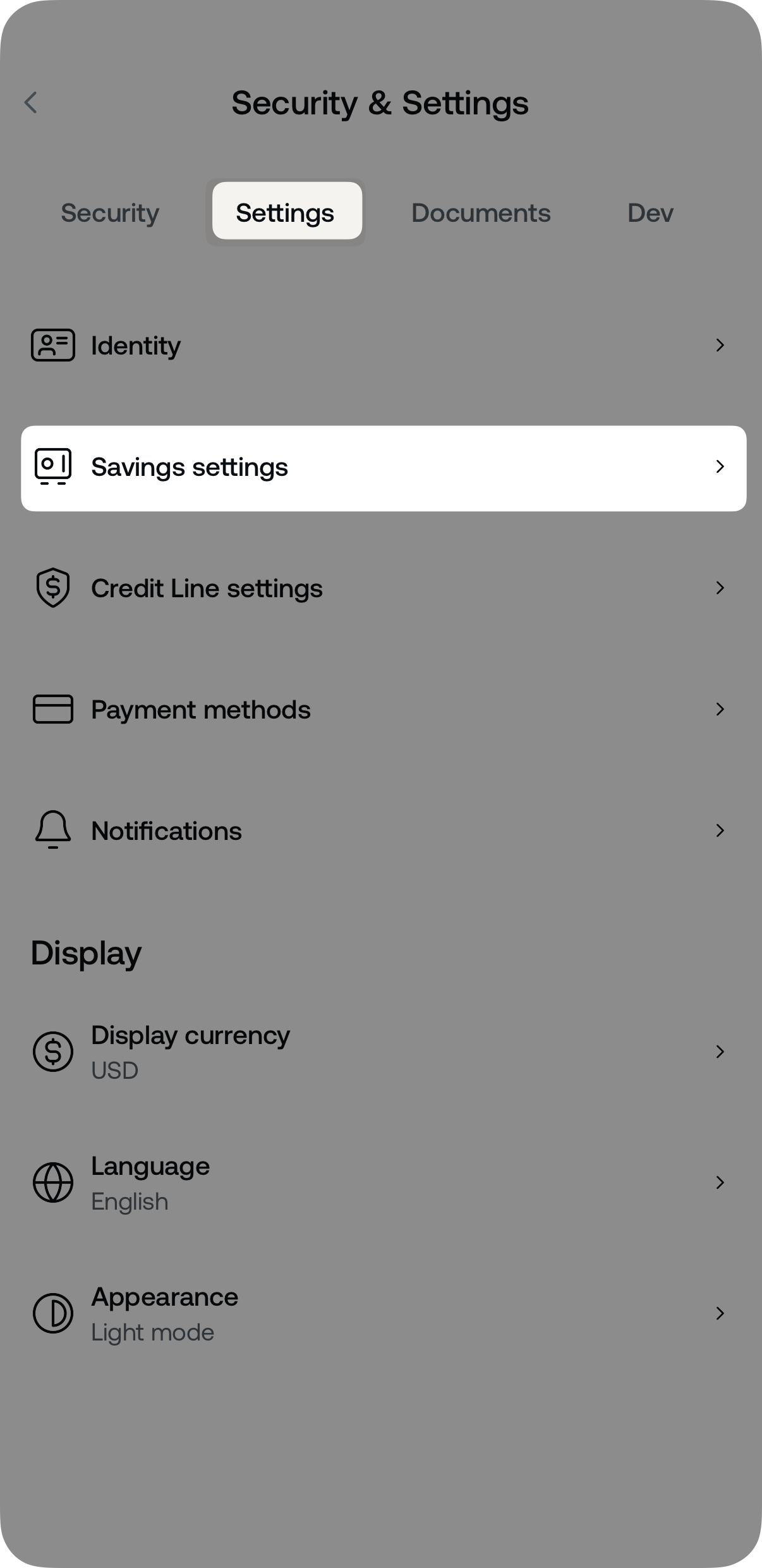

- Navigate to your Profile icon > Security & Settings > Settings.

- Select Interest payout in NEXO tokens in the Payout type section.

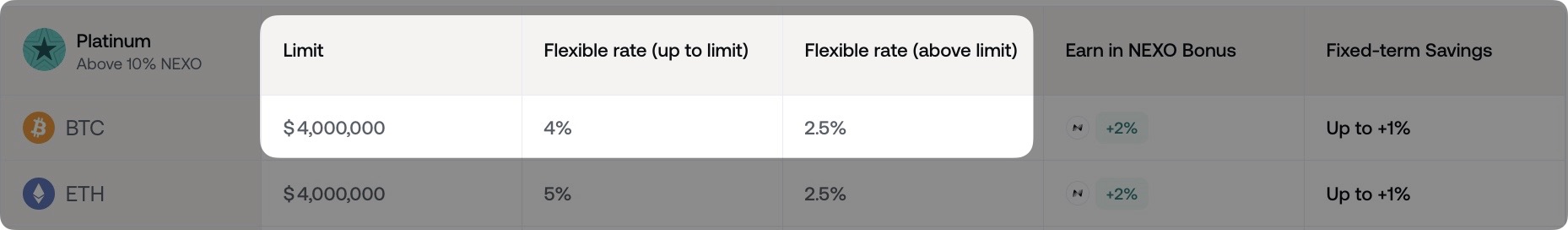

8. What are the balance limits

Balance limits are thresholds that affect how much interest you earn on certain assets – BTC, ETH, XRP, PAXG, and LINK. Any amount below the limit earns at a regular rate (up to limit), whereas any amount above the limit earns at a lower rate (above limit).

These limits apply per asset, not across your entire portfolio, and vary depending on your Loyalty Tier. For specifics, visit My Profile > Loyalty Tiers > Breakdown of savings rates:

Example: If your Loyalty Tier is Platinum and you have $5M USD worth of BTC in Flexible Savings, you earn 4% per year on the first $4M and 2.5% per year on the remaining M.

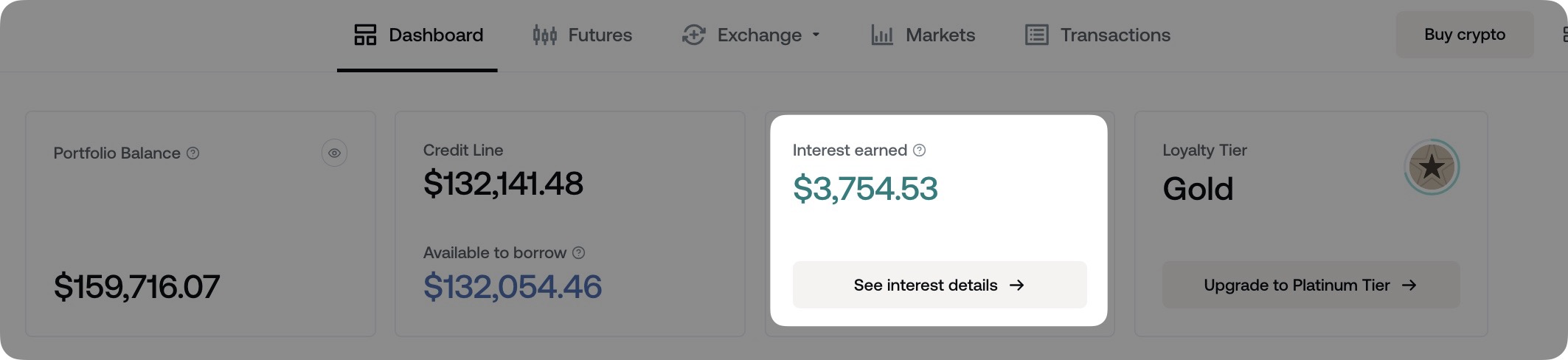

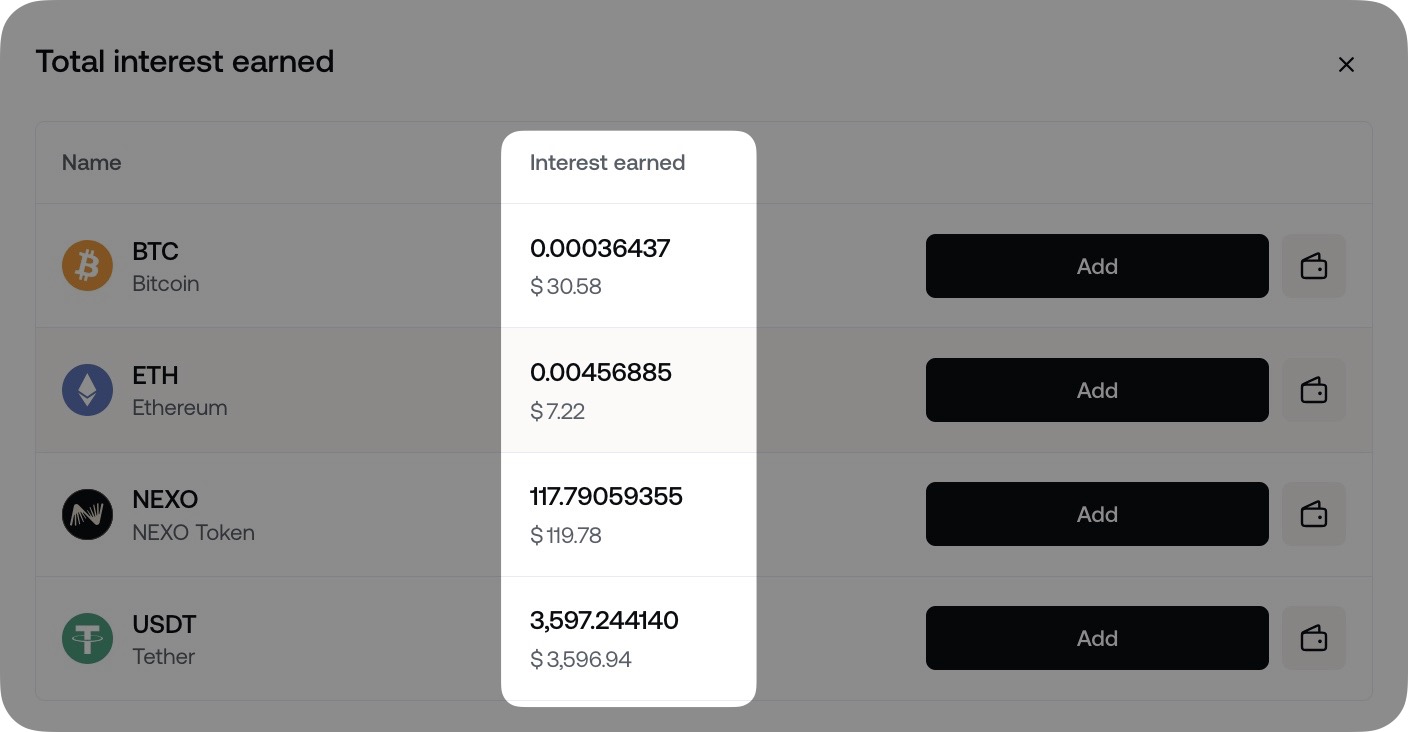

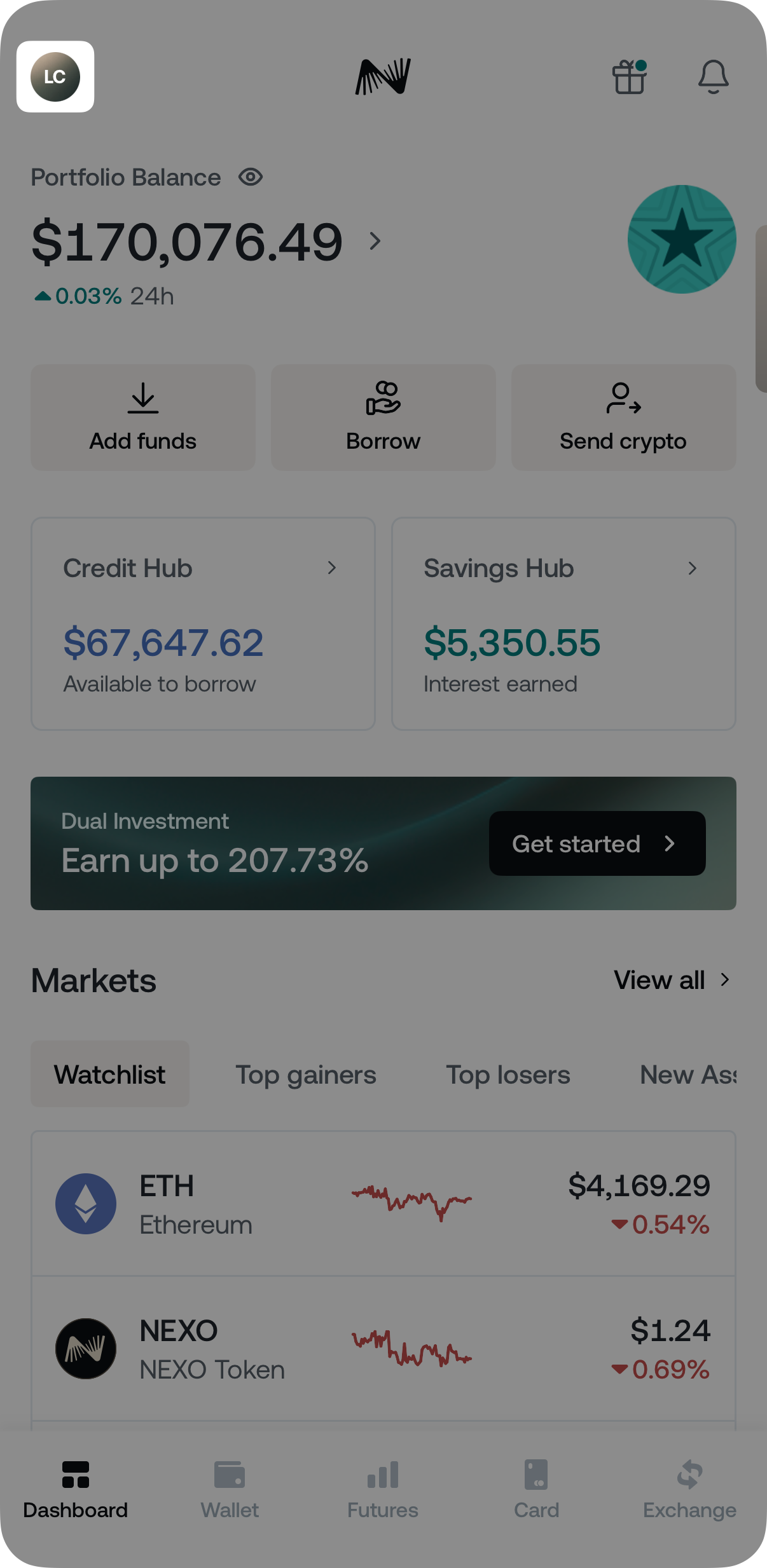

9. How to check the earned interest

You can see the interest accumulated on your savings balances via:

- The Interest Earned section on your Dashboard:

- By clicking See Interest Details, you can access detailed information about all the crypto assets and the interest you have earned on them so far:

- Checking the weekly emails Nexo sends, which provide details on the interest accumulated over the past seven days. The total amount earned will be displayed in US dollars (USD) for comparison purposes.

10. How to opt out of earning interest

- You can opt out of earning interest on your assets at any time.

- Once you opt out, you cannot create or renew fixed terms. However, any active terms will continue to earn interest at the applicable rate until they reach maturity.

- When you opt out, your daily interest payouts will be discontinued on the following day.

Example: If you opt out on March 1st (before 23:59:59 UTC), you won’t receive interest on March 2nd.

Here are the steps to opt out of receiving interest on your assets:

1. Tap the Profile icon in the top left corner of your screen and choose Security & Settings.

2. Select Settings > Savings settings.

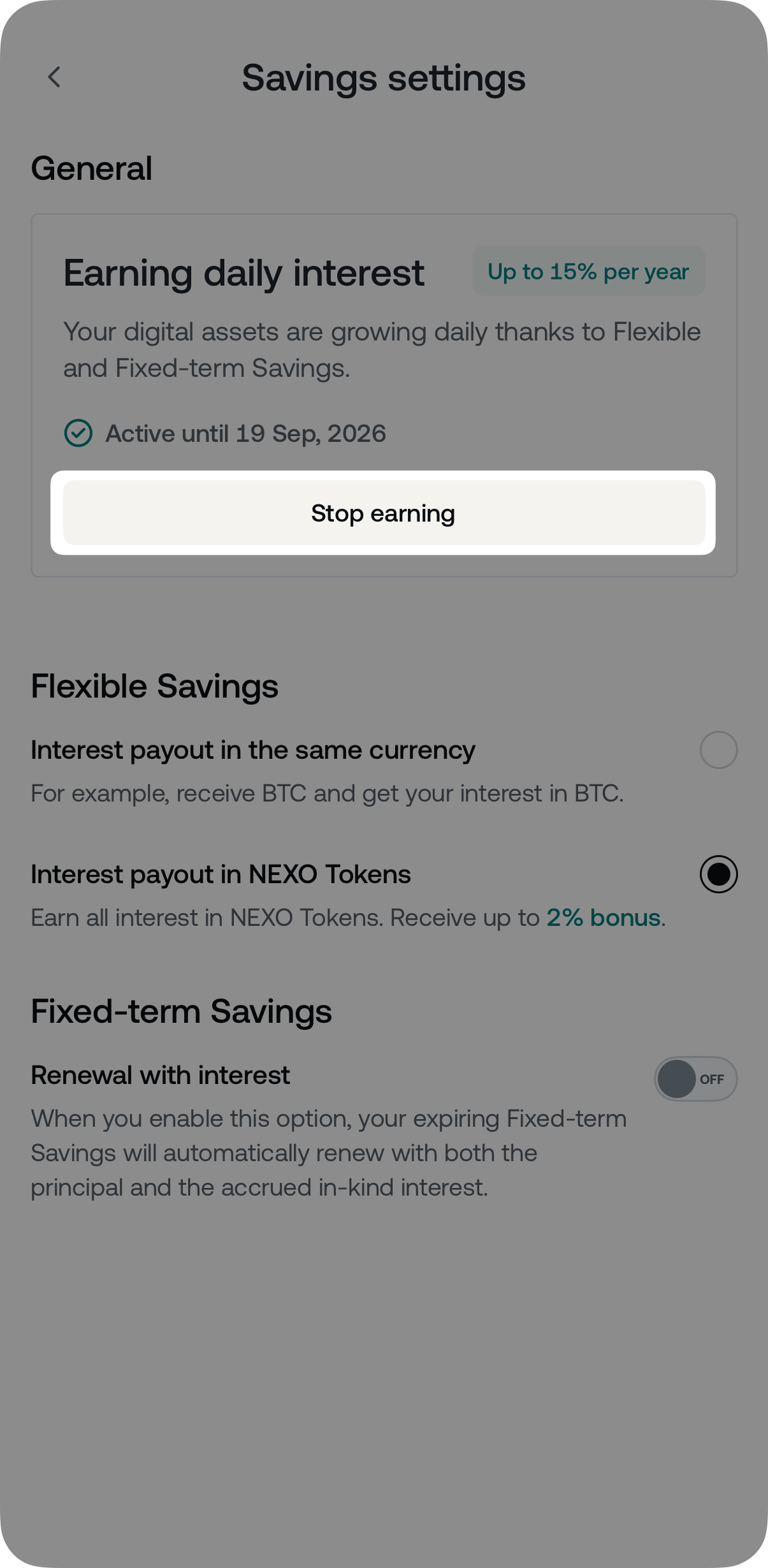

3. Disable the Earn daily interest toggle in the Daily Interest section.

Depending on your country of residence, you may need to press the Stop earning button instead, located in the Earning daily interest section.

Note: If using the web platform, you can opt out of receiving interest by navigating to My Profile > Security & Settings > Settings > Daily interest.

11. FAQ

- Q: Can I withdraw my assets from Flexible Savings at any time?

- A: Yes, Flexible Savings allows you to withdraw your assets at any time without penalties, providing you with full access to your funds whenever needed.

- Q: What factors influence the interest rates I receive?

- A: Interest rates depend on several factors, including your Loyalty tier, the specific asset, your choice between Flexible or Fixed-term Savings, and your preferred payout method (in-kind or in NEXO Tokens). Detailed information on current interest rates is available in the Breakdown of savings rates section of your Nexo account.

- Q: What is the difference between simple and compound interest?

- A: Simple interest is calculated only on the principal amount, excluding any accumulated interest. On the other hand, compound interest is calculated on both the initial principal and the accumulated interest, effectively increasing the total amount of interest you earn over time. In summary, simple interest is straightforward and only grows linearly, while compound interest can increase exponentially over time, as the interest earned on previous days adds to the base (principal) on which future interest is calculated.

- Q: How can I optimize the interest earned on my digital assets?

- A: To optimize your interest earnings, consider upgrading your Loyalty tier by holding more NEXO Tokens, opting to receive interest payouts in NEXO Tokens, and exploring Fixed-term Savings options, which offer higher interest rates for locking your assets for a predetermined period.