Buying digital assets with your card essentials

In this article:

- What is the Buy with Card feature

- How do I buy crypto with my card

- Crypto cashback on card purchases

- Card purchase fees – Buy with Card & Apple/Google Pay

- Card purchase limits – Buy with Card

- Card purchase limits – Apple/Google Pay

- How do I link my card

- How can I rename my linked card

- What happens if my card expires

- Supported countries – Buy with Card

- Supported countries – Apple/Google Pay

- How do I set up Recurring Buys

- Important notes

1. What is the Buy with Card feature

Nexo’s Buy with Card feature allows you to buy digital assets on the Nexo Exchange using your debit or credit card issued by Visa or Mastercard.

You can also buy crypto with a debit/credit card saved in your Apple or Google Wallet. To check if this functionality is available in your region, please visit this section.

Key points:

- You can pay with a debit/credit card in any currency. However, if this currency is different from USD, GBP, or EUR, the purchase amount will be converted into one of Nexo’s three available settlement currencies of your choice (USD, GBP, or EUR).

- Once you select a credit/debit card as your payment method, the purchases will be charged to this card in the selected Pay With currency. Your bank may charge a conversion fee, depending on their exchange policies and rates.

- To use Nexo’s Buy with Card feature, you must pass the Identity Verification process and reside in a supported country. You can also check the countries where Apple/Google Pay is available.

- You must hold a valid Visa or Mastercard in the same legal name as your Nexo account for your purchases to be processed.

- Withdrawals to cards are supported for EURx and GBPx. You can learn more in this article.

- The first asset purchase with a credit/debit card performed within 24 hours of completing Identity verification will place a 24-hour cool-off period for crypto withdrawals on your account. Subsequent operations of that type will not reset the cool-off period.

- Residents of EEA countries cannot purchase USDT, DAI, TUSD, USDP, and PAXG with a credit/debit card.

- Your card details are processed via a third-party provider.

2. How do I buy crypto with my card

You can find step-by-step instructions on how to buy crypto with credit/debit card on the Nexo Exchange in this article.

3. Crypto cashback on card purchases

The Buy with Card feature offers 0.1% to 0.5% crypto cashback on eligible crypto purchases made with your card, depending on your Loyalty tier.

Crypto cashback is available in the Silver, Gold, or Platinum Loyalty tiers and is paid out in the asset you purchase. You can find more information about the crypto cashback specifics in this article.

4. Card purchase fees – Buy with Card & Apple/Google Pay

- A card processing fee will be applied to the Pay With amount:

- 1.99% for EEA countries

- 3.49% for non-EEA countries

The minimum card processing fee is $0.99, and it is visible on the Preview order screen before you complete the purchase. The Spend amount indicated on that screen is the exact amount that Nexo will charge to your card, and it includes the card processing fee.

- For card currencies other than USD, GBP, and EUR, an additional conversion fee ranging from 0.9% to 3.1% will be applied to the Receive amount by a third-party service provider.

Important: Your card issuer may charge additional fees for online card purchases and currency conversion. These fees are independent of Nexo’s fee and are outside of Nexo’s control.

5. Card purchase limits – Buy with Card

| Minimum transaction | 10 USD |

| Maximum transaction | 25,000 USD |

| Daily | 25,000 USD (on a 24-hour rolling basis) |

| Monthly | 750,000 USD (on a 30-day rolling basis) |

Important: The above limit values include the fees.

6. Card purchase limits – Apple/Google Pay

| Minimum transaction | 10 USD |

| Maximum transaction | Platinum -> 15,000 USD/EUR/GBP Gold -> 5,000 USD/EUR/GBP Base & Silver -> 2,000 USD/EUR/GBP |

| Daily | 15,000 USD (on a 24-hour rolling basis) |

| Monthly | 450,000 USD (on a 30-day rolling basis) |

Important: The above limit values include the fees.

7. How do I link my card

If you have not linked your debit/credit card to your Nexo account yet, you will need to do so before making a purchase. Please check this article to see how you can verify and save your card details for future crypto purchases.

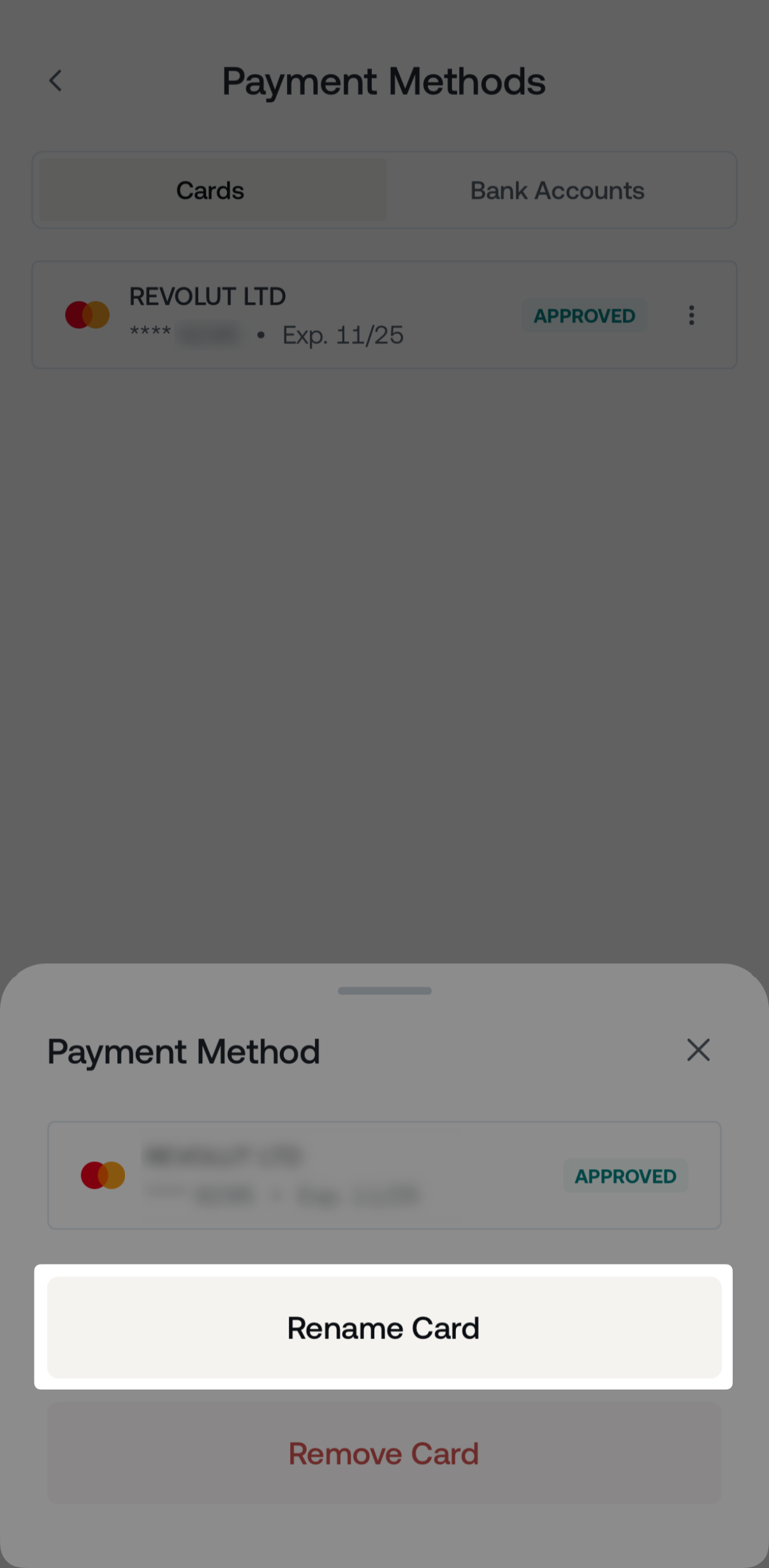

8. How can I rename my linked card

By default, any card linked to your Nexo account will be labeled by the name of the bank that issued it. You can rename your cards anytime to distinguish between them and save time when making transactions.

To rename a card, locate the desired card from the Payment Methods section of the My Profile menu and tap Rename Card (App) or click the Rename button (web platform), respectively.

9. What happens if my card expires

When your card enters its final month before expiry, an Expires soon reminder will be displayed under it whenever you initiate a purchase. Also, an automated email and push notification will be sent out 15 days before your card’s expiration date.

Once your card expires, it will be automatically marked as Expired and greyed out in the Payment methods section. Expired cards can no longer be used for card top-ups and withdrawals.

Important: When a credit/debit card expires, any Recurring Purchases associated with it will also be canceled.

10. Supported countries – Buy with Card

Here is a list of the jurisdictions in which you can buy crypto with a credit/debit card:

European Economic Area (EEA), Åland Islands, Albania, Algeria, Andorra, Angola, Anguilla, Antarctica, Antigua and Barbuda, Argentina, Armenia, Aruba, Azerbaijan, Bahamas (the), Bahrain, Barbados, Belize, Benin, Bermuda, Bhutan, Bolivia (Plurinational State of), Bonaire, Sint Eustatius and Saba, Bosnia and Herzegovina, Botswana, Bouvet Island, Brazil, British Indian Ocean Territory (the), Brunei Darussalam, Burkina Faso, Cabo Verde, Cambodia, Cameroon, Cayman Islands (the), Chad, Chile, China, Christmas Island, Cocos (Keeling) Islands (the), Colombia, Comoros (the), Congo (the Democratic Republic of the), Congo (the), Cook Islands (the), Costa Rica, Côte d’Ivoire, Curaçao, Djibouti, Dominica, Dominican Republic (the), Ecuador, Egypt, El Salvador, Equatorial Guinea, Eswatini, Ethiopia, Falkland Islands (the) [Malvinas], Faroe Islands (the), Fiji, French Guiana, French Polynesia, French Southern Territories (the), Gabon, Gambia (the), Georgia, Ghana, Gibraltar, Greenland, Grenada, Guadeloupe, Guatemala, Guernsey, Guinea, Guinea-Bissau, Guyana, Haiti, Heard Island and McDonald Islands, Holy See (the), Honduras, Hong Kong, India, Indonesia, Isle of Man, Israel, Jamaica, Jersey, Jordan, Kazakhstan, Kenya, Kiribati, Kosovo, Kuwait, Kyrgyzstan, Lao People’s Democratic Republic (the), Lebanon, Lesotho, Liberia, Macao, Madagascar, Malawi, Malaysia, Maldives, Mali, Marshall Islands (the), Martinique, Mauritania, Mauritius, Mayotte, Mexico, Moldova (the Republic of), Monaco, Mongolia, Montenegro, Montserrat, Mozambique, Namibia, Nauru, Nepal, New Caledonia, New Zealand, Nicaragua, Niger (the), Nigeria, Niue, Norfolk Island, Oman, Pakistan, Palau, Palestine (State of), Panama, Papua New Guinea, Paraguay, Peru, Philippines (the), Pitcairn, Qatar, Republic of North Macedonia, Réunion, Rwanda, Saint Barthélemy, Saint Helena, Ascension and Tristan da Cunha, Saint Kitts and Nevis, Saint Lucia, Saint Martin (French part), Saint Pierre and Miquelon, Saint Vincent and the Grenadines, Samoa, San Marino, Sao Tome and Principe, Saudi Arabia, Senegal, Serbia, Seychelles, Sierra Leone, Singapore, Sint Maarten (Dutch part), Solomon Islands, South Africa, South Georgia and the South Sandwich Islands, Sri Lanka, Suriname, Svalbard and Jan Mayen, Switzerland, Taiwan (Province of China), Tajikistan, Tanzania (United Republic of), Thailand, Timor-Leste, Togo, Tokelau, Tonga, Trinidad and Tobago, Tunis, Turkey, Turkmenistan, Turks and Caicos Islands (the), Tuvalu, Uganda, Ukraine, United Arab Emirates (the), United Kingdom, Uruguay, Uzbekistan, Vanuatu, Vietnam, Virgin Islands (British), Wallis and Futuna, Western Sahara, Zambia.

11. Supported countries – Apple/Google Pay

The feature is available in all countries supported by Apple Pay and Google Pay, where Nexo’s Buy with Card service is offered (listed above).

12. How do I set up Recurring Buys

Can I buy crypto with a debit/credit card on a recurring basis? Yes, with Nexo’s Buy feature, you can set a daily, weekly, bi-weekly, or monthly frequency for your purchases.

By distributing purchases over time and acquiring an asset gradually (instead of buying large quantities at once), you may reduce the impact of short-term price fluctuations. Please check this article for step-by-step instructions.

13. Important notes

- Topping up EURx, GBPx, and USDx with a card, trading pairs including EURx/GBPx/USDx, buying crypto with a card, and the Nexo Booster are unavailable to clients residing in Australia.

- The Buy with Card service is enabled by Nexo Services UAB, which partners with third-party payment providers for the purpose of this functionality.

- Topping up EURx, GBPx, and USDx, and buying crypto with cards issued by Nexo banks is unavailable.

- Topping up EURx, GBPx, and USDx with a card is not subject to crypto cashback if the card currency is the same as the acquired currency: EUR/EURx, GBP/GBPx, USD/USDx.