Low-Cost Credit Lines – Explained

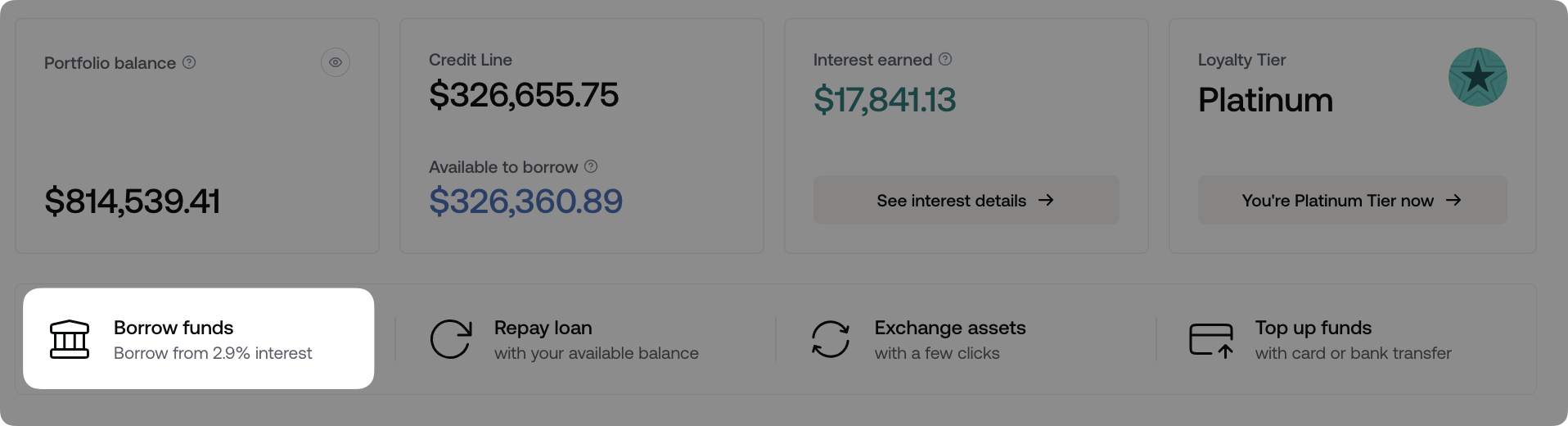

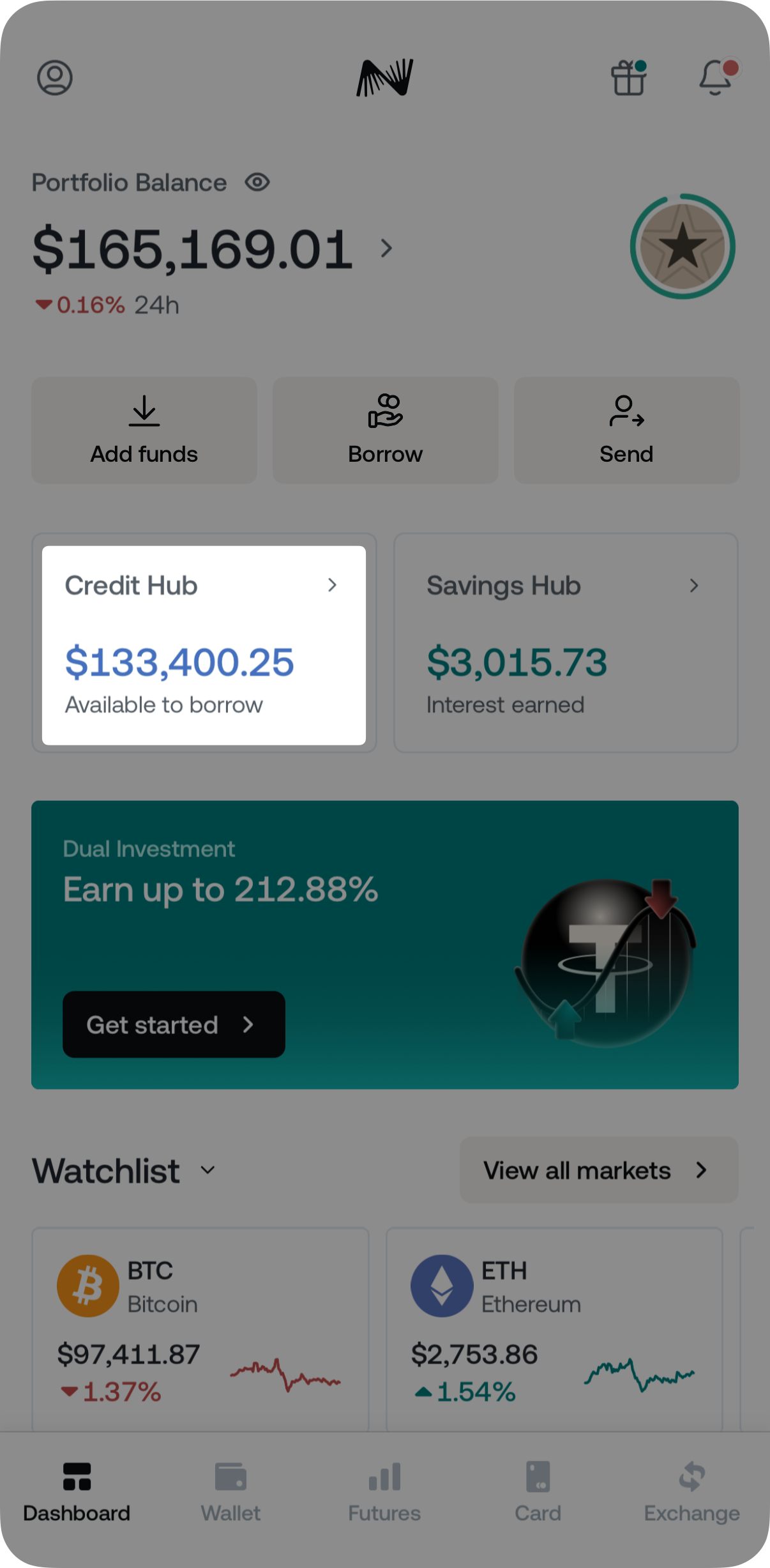

What are Nexo Low-Cost Credit Lines? Nexo offers Low-Cost Credit Lines to Gold and Platinum Loyalty Tier clients. Interest rates are as low as 2.9% for Platinum and 5.9% for Gold, provided the Credit Line Wallet Loan-to-Value (LTV) ratio stays below 20%.

- Borrowing rates by Loyalty Tier

- Steps to borrow at reduced interest rates

- Low-Interest Borrowing feature

- Calculating your Credit Line Wallet LTV

- Loan withdrawal limits

- Automatic rate adjustment

- Important notes

1. Borrowing rates by Loyalty Tier

Platinum:

-

Credit Line Wallet LTV below 20%: 2.9%

-

Credit Line Wallet LTV above 20%: 10.9%

-

Credit Line Wallet LTV below 20%: 5.9%

-

Credit Line Wallet LTV above 20%: 13.9%

2. Steps to borrow at reduced interest rates

Unlock the Loyalty Program: Maintain a portfolio balance of at least $5,000 in value to access our Loyalty Program.

Upgrade Loyalty Tier: Ensure the ratio of NEXO Tokens against the rest of your portfolio is at least 5% for Gold and 10% for Platinum.

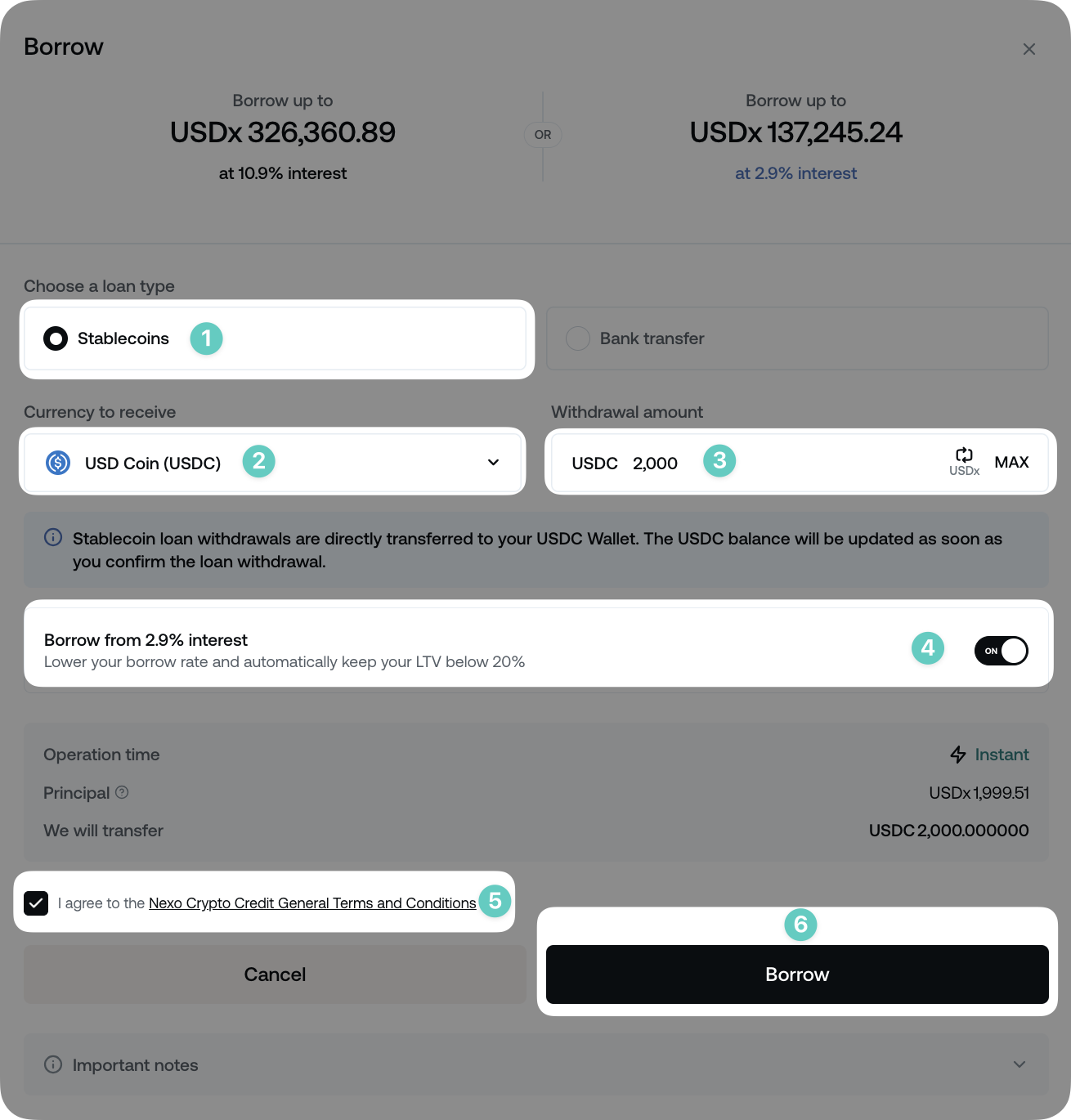

Initiate loan:

- Click Borrow Funds on your Dashboard.

- Choose the loan type, loan currency, and enter the withdrawal amount.

- Enable the Borrow from 2.9% / 5.9% interest toggle. The system will automatically adjust your collateral to keep your Credit Line Wallet LTV below 20%.

- Agree to the Nexo Crypto Credit General Terms and Conditions and click Borrow.

Note: The toggle will only be visible if you have access to the Loyalty Program and your digital assets are sufficient to lower the Credit Line Wallet LTV below 20% based on the requested loan amount. You can utilize the full lineup of supported cryptocurrencies to achieve these rates.

Tip: If your Nexo loan is backed only by assets whose permitted LTV is below the 20% threshold (e.g., the NEXO Token), you will automatically benefit from 5.9% or 2.9% borrowing rates in the Gold and Platinum Loyalty Тiers.

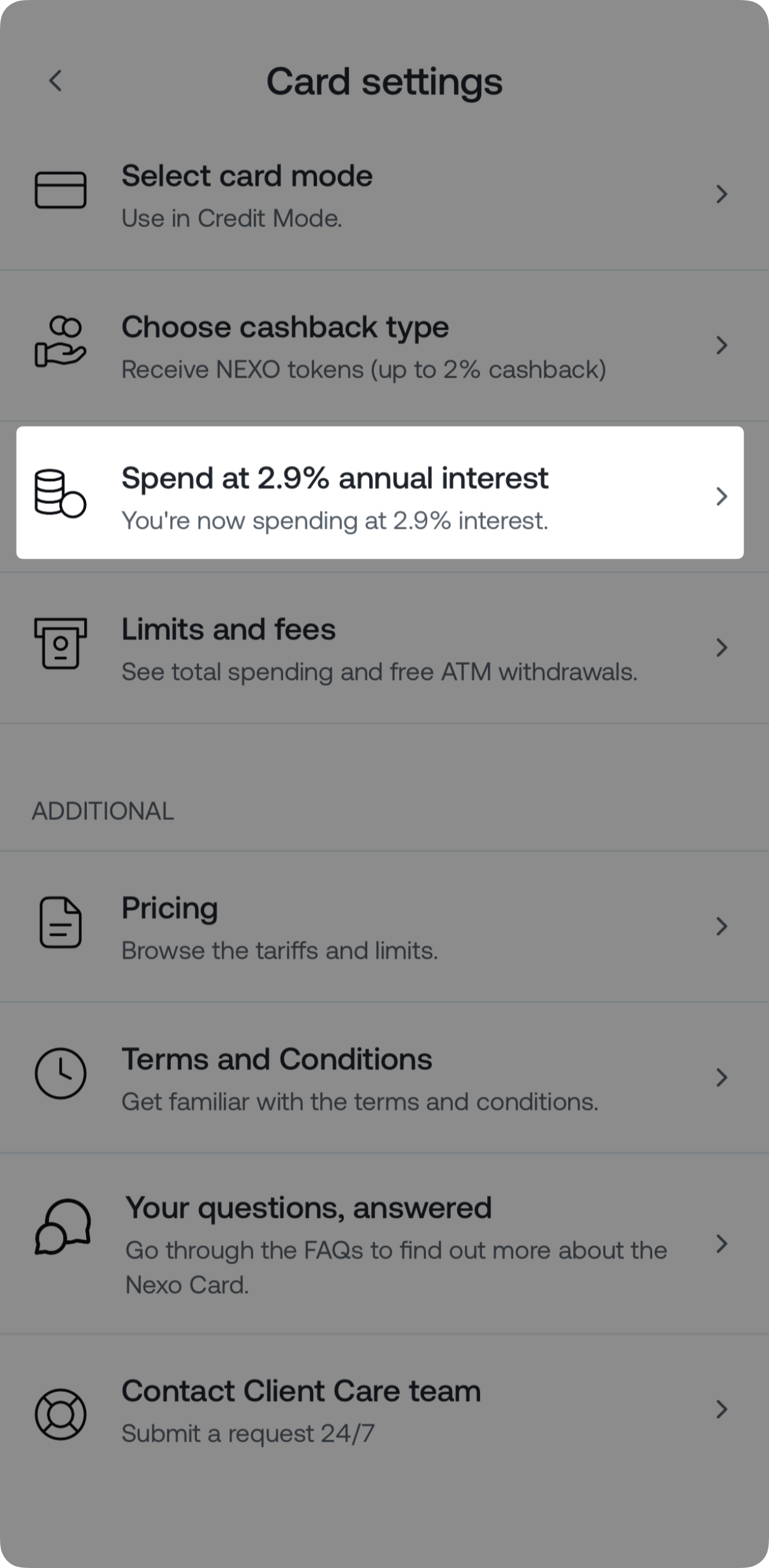

Nexo Card Purchases:

- To enjoy 2.9% or 5.9% rates when making purchases with the Nexo Card, enable the Spend at 2.9% / 5.9% annual interest option from the Card Settings menu in the Card tab on the mobile app.

- Once enabled, sufficient collateral will automatically be transferred to your Credit Line Wallet to keep your LTV below 20%, assuming you have enough assets in your account.

3. Low-Interest Borrowing feature

Functionality: This feature is automatically activated when you withdraw a Low-Cost loan. It prompts the system to monitor your Credit Line Wallet LTV and take action if it exceeds 20%. In such cases, the required collateral value is automatically transferred from your Savings Wallet (Flexible Savings balance only) to your Credit Line Wallet to maintain its LTV below 20%.

Requirements: This feature is available only for Gold or Platinum Loyalty Tier* clients.

*You must maintain a portfolio balance of at least $5,000 in value to access our Loyalty Program.

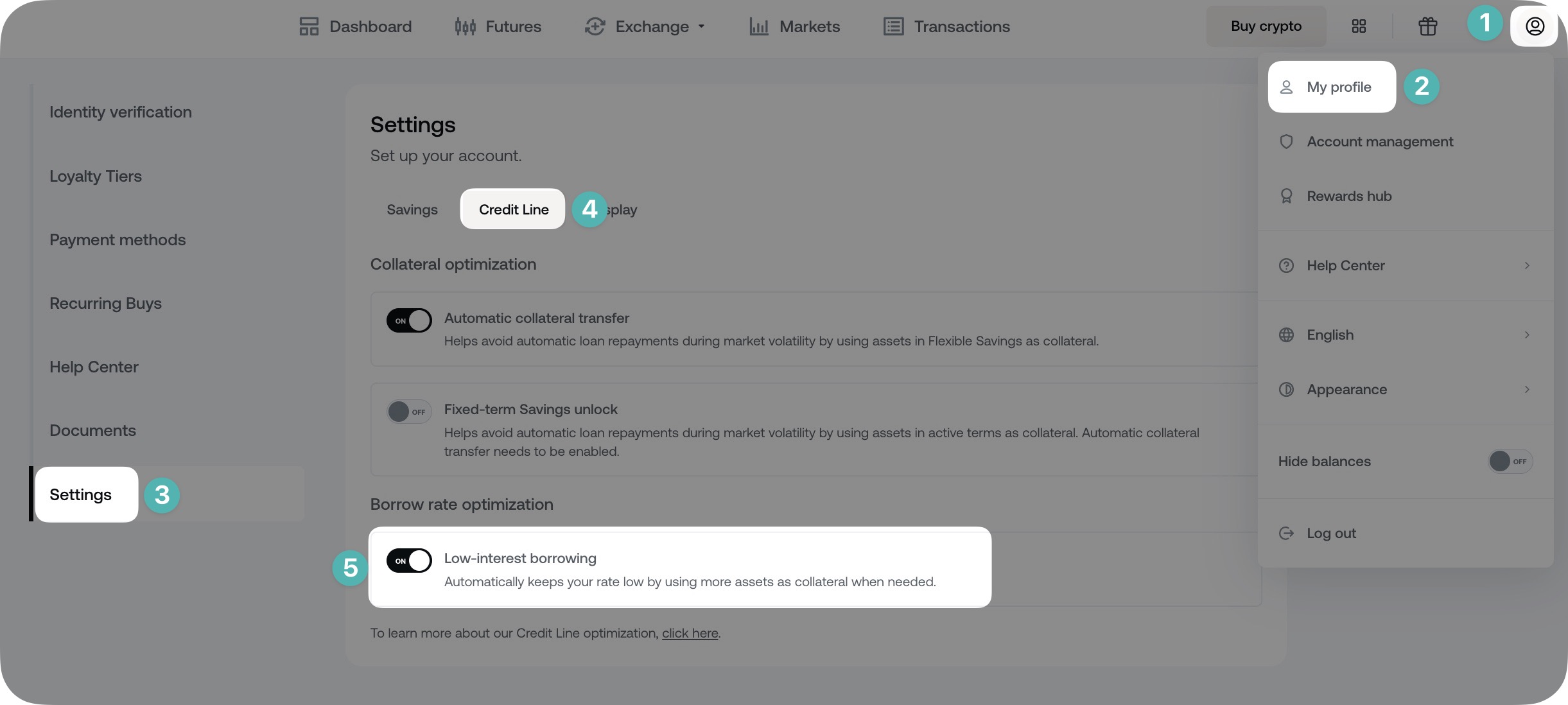

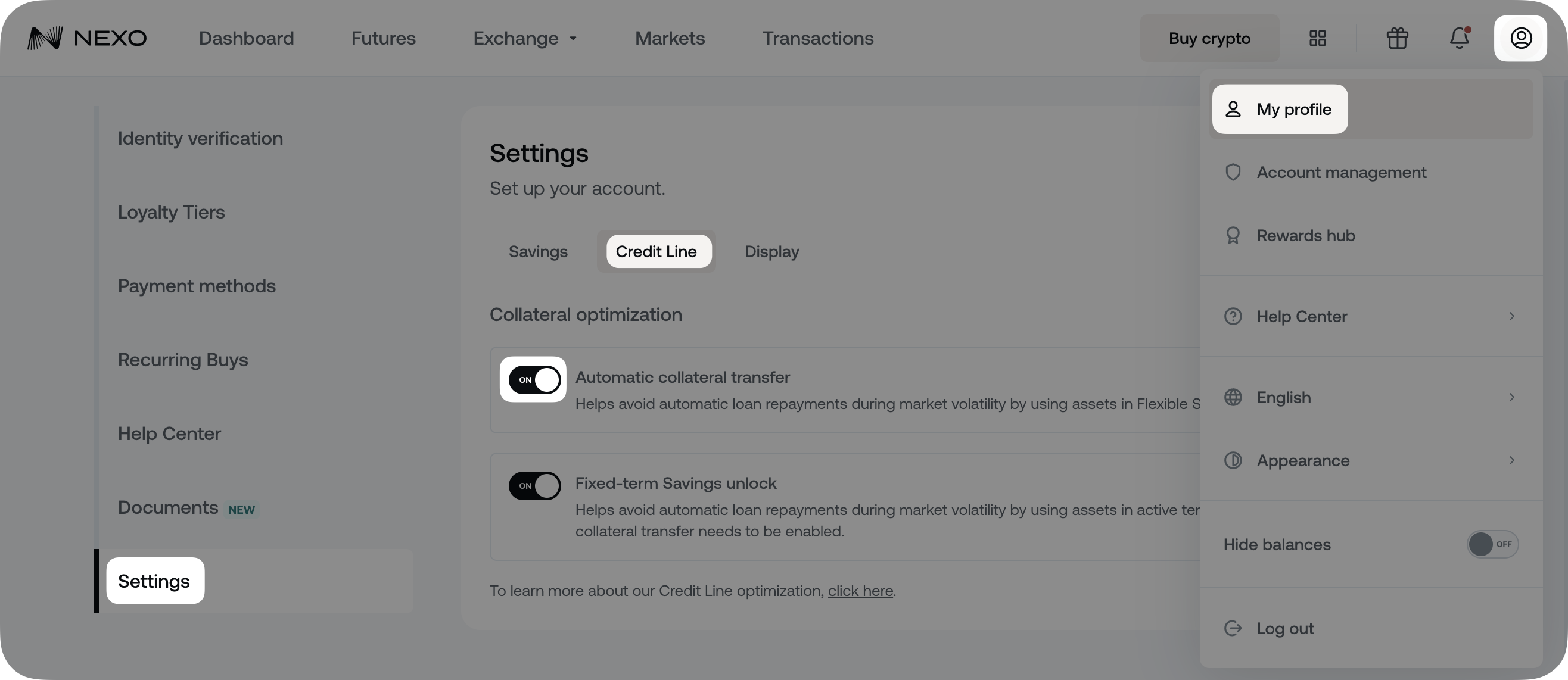

How to manage the Low-interest borrowing feature

- Mobile App: Navigate to My profile > App settings > Credit Line optimization and use the Low-interest borrowing toggle.

- Web Platform: Go to My Profile > Settings > Credit Line, scroll down to Borrow rate optimization, and use the Low-interest borrowing toggle.

Notes to consider:

- Taking out a loan with the Borrow at 2.9% / 5.9% interest toggle ON will automatically enable the Low-Interest Borrowing and the Automatic Collateral Transfer features, even if they were previously OFF. If you’d like to deactivate these settings after borrowing, you can do so manually from the Settings section.

- The Low-Interest Borrowing feature can be manually activated only if Automatic Collateral Transfer is also activated.

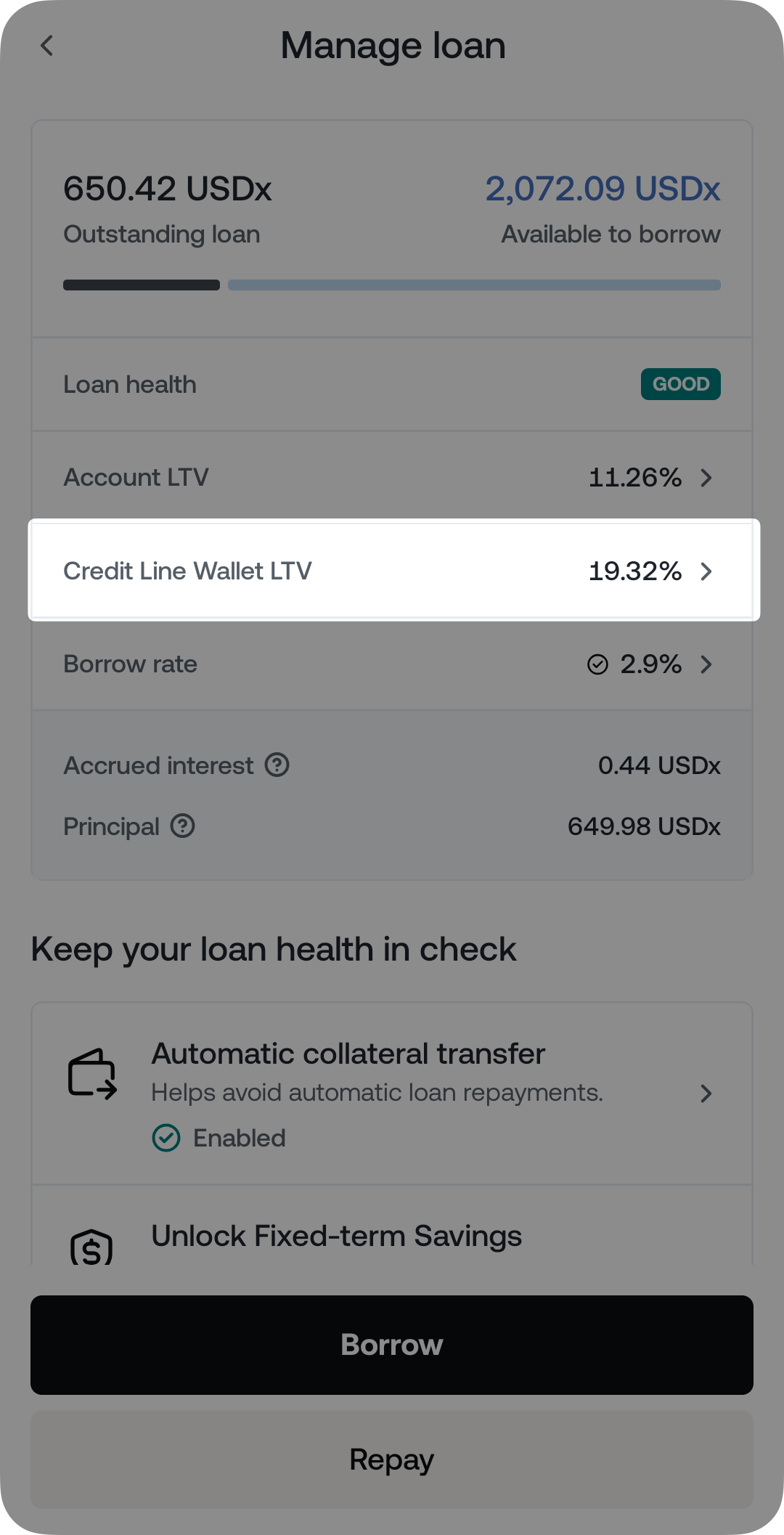

4. Calculating your Credit Line Wallet LTV

Via the mobile app

1. Tap Credit Hub > Outstanding loan. The Credit Line Wallet LTV is displayed on the screen.

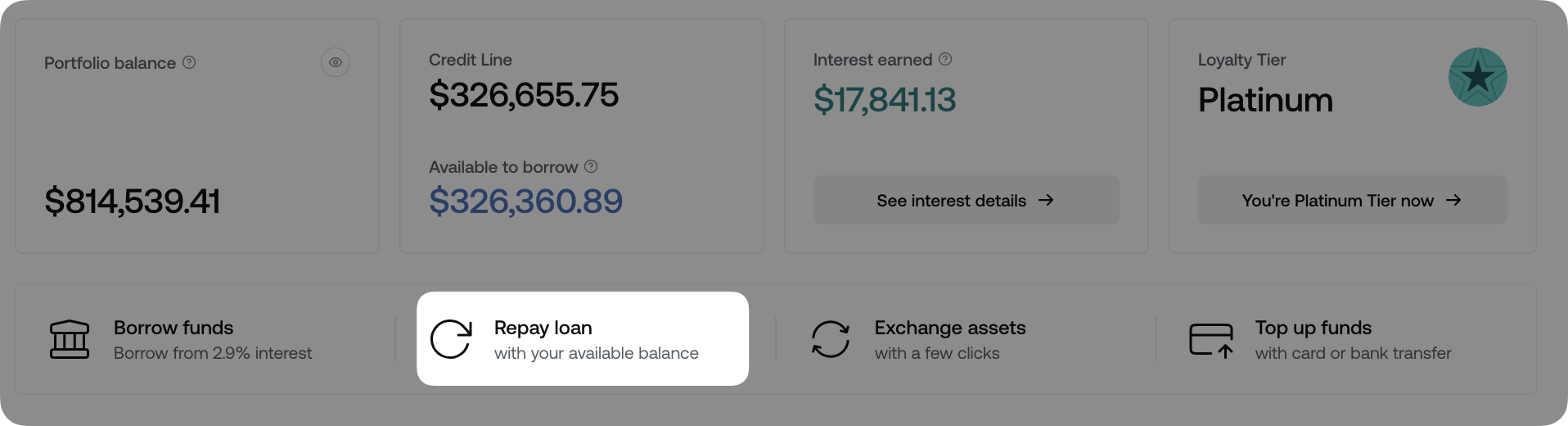

Via the web platform

1. Go to My profile > Settings > Credit Line section, and disable the Automatic collateral transfer toggle.

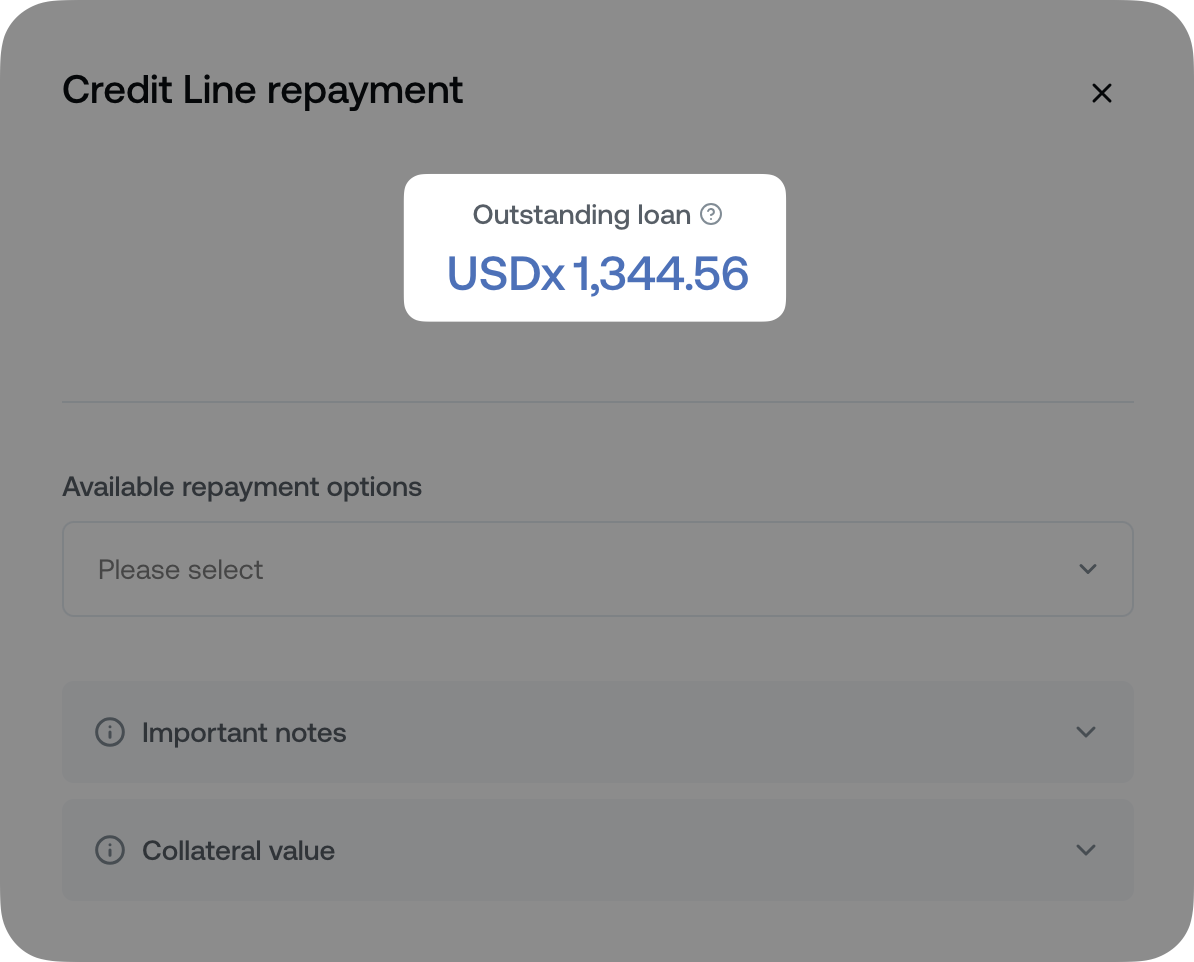

2. Select Repay Loan on your Dashboard.

Check your Outstanding loan on the Credit Line repayment screen.

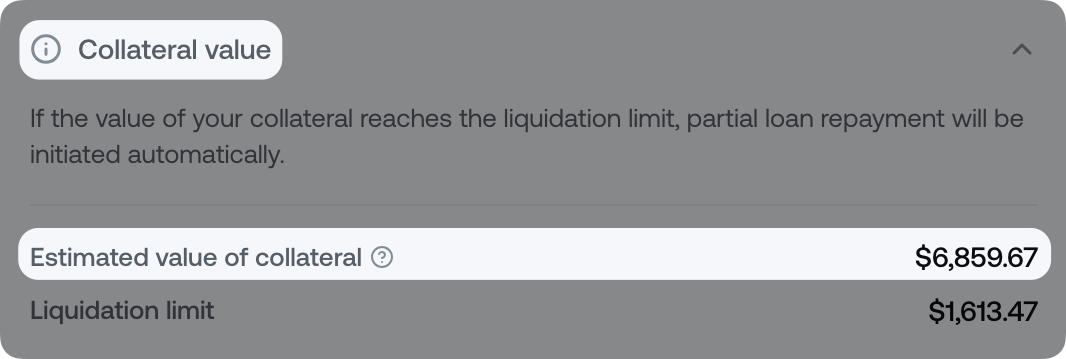

3. Expand the Collateral value section and navigate to Estimated value of collateral. This section displays the current dollar value of the collateral held in your Credit Line Wallet as long as Automatic collateral transfer is disabled.

4. Divide the outstanding loan by the Estimated value of collateral amount to find your Credit Line Wallet LTV.

After performing your calculations, we strongly suggest you re-enable the Automatic collateral transfer option to remain flexible during turbulent market conditions.

Important:

- If the Credit Line Wallet LTV exceeds 20%, you will be prompted to bring it under 20% by transferring additional assets from your Savings Wallet.

- In case the assets in your Savings Wallet are not sufficient to bring the Credit Line Wallet LTV under 20%, you will be prompted to top up more crypto.

5. Loan withdrawal limits

The amount you can borrow ranges from $50 to $2M. For more information, visit this article.

6. Automatic rate adjustment

Borrow interest rates automatically adjust based on the Credit Line Wallet LTV and the Loyalty Tier.

Example: Suppose your Loyalty Tier is Gold or Platinum, and you’re using 0,000 worth of BTC to back a $5,000 loan, meaning your Credit Line Wallet LTV is 50% (above 20%), and your interest rate is standard (13.9% or 10.9%). If you repay $4,000, reducing your loan to ,000 while keeping the same 0,000 worth of BTC as collateral, your LTV drops to 10% (below 20%). The system will automatically apply the Low-Cost rates (5.9% or 2.9%).

7. Important notes

- If you repay your loan within 45 days of the last loan withdrawal, Additional Interest at the standard annual rate of 18.9% (regardless of your current Loyalty Tier) will be applied to the Repayment Amount for the remainder of the 45-day period. This information is also available on the Credit Line Repayment screen.

- Example: If it has been 20 days since your last loan withdrawal, and you make a repayment, the repaid amount will be subject to additional interest for the remaining 25 days out of the 45-day period (45 – 20 = 25) at an 18.9% annual interest rate.

- Early repayment interest is added to the outstanding loan balance and cannot be repaid with NEXO Tokens.

- The interest applied to loans is compound, i.e., it is calculated on both the initial principal and the accumulated interest.