Nexo Loans – FAQ

In this article:

1. What is the minimum and maximum fiat currency equivalent I can borrow in digital assets

2. What currencies are available for loan withdrawal

3. How long does it take to get approved for a Nexo loan

4. Do you perform credit checks and will a Nexo loan affect my credit score

5. How quickly will I receive the funds

6. What is the interest rate on my Nexo loan

7. How can I get a discount on the interest rate

8. Do Nexo loans have a maturity date

9. What are the specifics of my Nexo loan

10. Can I take out more than one Nexo loan at a time

11. Am I the owner of the collateral used to back my Nexo loan

12. Collateralization of Nexo crypto loans

13. Do I have to pay tax on my Nexo loan or the crypto used as collateral

14. How is Nexo different from margin lending

15. Important notes

1. What is the minimum and maximum fiat currency equivalent I can borrow in digital assets

The minimum loan amount you can withdraw is:

- 50 USD in stablecoins (USDT, USDC)

- 500 USD for bank transfers

The maximum loan amount is 2,000,000 USD per day.

2. What currencies are available for loan withdrawal

You can withdraw a Nexo loan in digital assets and receive the fiat currency equivalent via bank transfer. Alternatively, you can request a loan in stablecoins (USDT* or USDC). The borrowed amount is added to your Savings Wallet, where you can exchange it for another cryptocurrency or FIATx if you wish. Regardless of the selected loan withdrawal currency, the total outstanding loan is displayed in USD on the Credit Line Repayment screen.

*Loans in USDT are unavailable for residents of EEA countries.

3. How long does it take to get approved for a Nexo loan

Nexo crypto-backed loans are usually approved automatically, but due to KYC, AML, and other security requirements, it may take us up to 1 business day to approve your loan in some cases.

4. Do you perform credit checks and will a Nexo loan affect my credit score

One of the benefits of Nexo loans is the absence of credit checks. Furthermore, your loan data is not reported to credit agencies, meaning that your credit score will not be affected in any way.

5. How quickly will I receive the funds

The processing time of Nexo loans depends on the loan currency you select and the transfer type:

Bank transfers:

- Local transfer: Same/next business day

- International transfer: 1 to 5 business days

Stablecoins (USDT, USDC):

- Up to a few minutes to see the borrowed funds in your Savings Wallet.

Note: Nexo’s partner processes bank transfers on business days only.

6. What is the interest rate on my Nexo loan

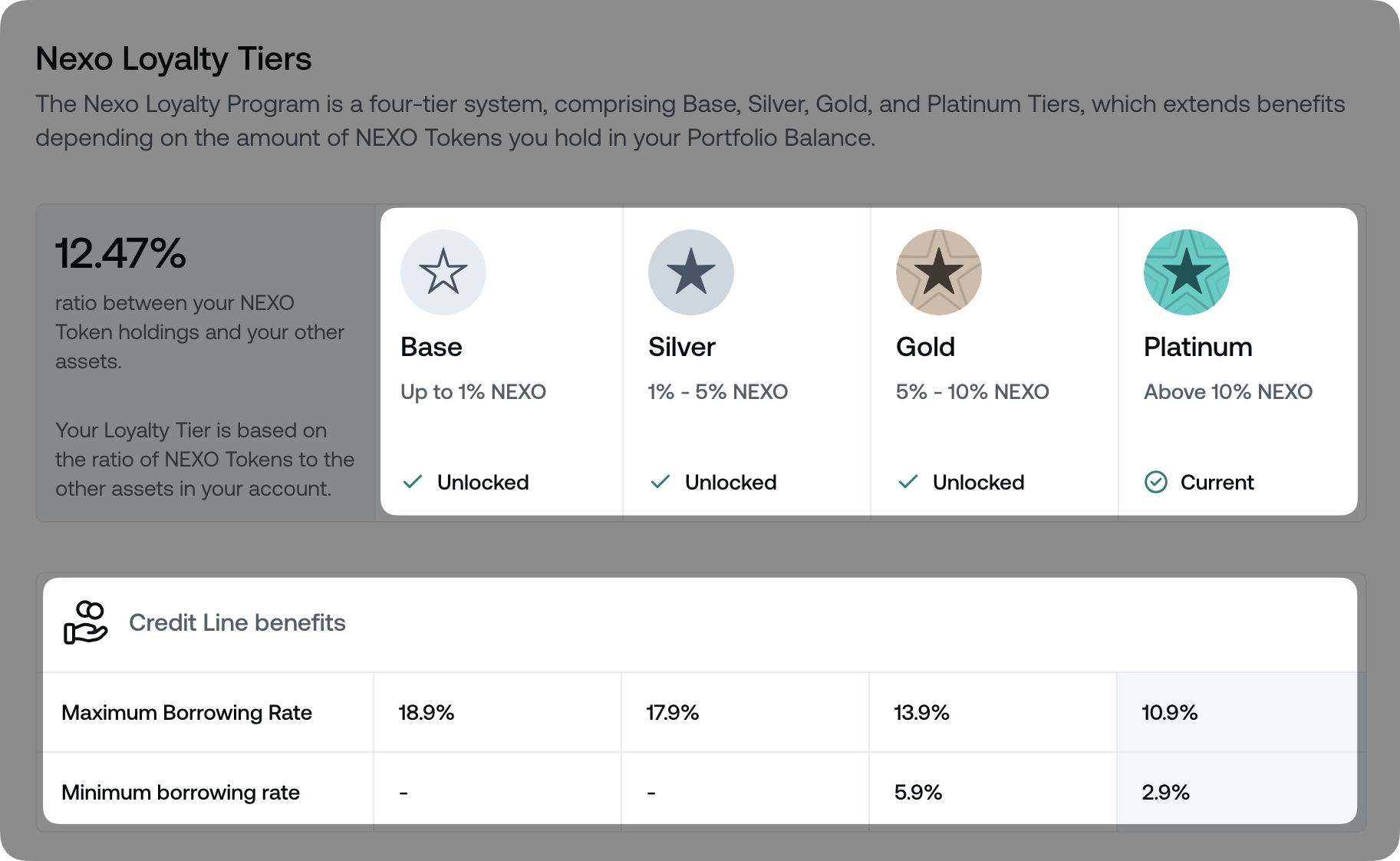

The loan interest rate is based on your Loyalty tier* and portfolio balance. Your Loyalty tier, in turn, is determined by the proportion of NEXO Tokens relative to the rest of your portfolio. Keep in mind the loan interest rate dynamically changes if your Loyalty tier shifts while you have an outstanding loan.

Below, Nexo provides a detailed overview of the loan interest rates applicable to each scenario.

Portfolio balance below $5,000 (regardless of NEXO Tokens ratio) – 18.9%

Portfolio balance above $5,000 (Loyalty Program unlocked):

- Base (No NEXO Tokens) – 18.9%.

- Silver (At least 1% NEXO Tokens against the rest of your portfolio) – 17.9%.

- Gold (At least 5% NEXO Tokens against the rest of your portfolio) – 13.9%.

- Platinum (At least 10% NEXO Tokens against the rest of your portfolio) – 10.9%

* You need to maintain a portfolio balance of at least $5,000 in value to access Nexo’s loyalty Program and take advantage of lower interest rates on your loan. You can learn more in this article.

Example: To illustrate how Nexo loan interest works, let’s explore the following example in which you fall into the Platinum Loyalty Tier associated with a 10.9% annual interest rate:

Day 1: You borrow 00,000 from Nexo’s Credit Line.

Day 2: Daily interest in the amount of $29.86 is accrued. Your overall Nexo loan becomes 00,000 (principal) + $29.86 (daily interest day 2) = 00,029.86.

Day 3: Daily interest in the amount of $29.92 is accrued. Your overall Nexo loan becomes 00,000 (principal) + $29.86 (daily interest day 2) + $29.92 (daily interest day 3) = 00,059.78.

As you can see, the loan interest is calculated day by day, reflecting your Loyalty Tier. To demonstrate this, let us assume that on Day 4, you are in the Gold Loyalty Tier, where your annual interest rate is 13.9%:

Day 4: Daily interest in the amount of $38.61 is accrued. Your overall Nexo loan becomes 00,000 (principal) + $29.86 (daily interest day 2) + $29.92 (daily interest day 3) + $39.36 (daily interest day 4) = 00,099.14.

7. How can I get a discount on the interest rate

Thanks to our Low-Cost Credit Lines, you can benefit from reduced annual loan rates in the Platinum and Gold Loyalty tiers*, respectively, as long as the loan-to-value (LTV) ratio in your Credit Line Wallet remains below 20%.

*You must maintain a portfolio balance of at least $5,000 in value to access our Loyalty Program with its perks, including getting a discount on the loan interest rate.

Platinum:

- LTV below 20%: 2.9%

- LTV above 20%: 10.9%

Gold:

- LTV below 20%: 5.9%

- LTV above 20%: 13.9%

Example:

Value of NEXO: 1,000 USD.

Total Portfolio Value, excluding NEXO: 10,000 USD.

Ratio of NEXO vs Rest of the Assets: 1,000 USD / 10,000 USD * 100 = 10%.

Loyalty Tier: Platinum.

Outstanding Loan: 500 USD.

Total Collateral Value in the Credit Line Wallet: 4,500 USD.

Credit Line Wallet LTV: 500 USD / 4,500 USD * 100 = 11%.

Your Credit Line wallet LTV is below 20%, and you are in the Platinum tier, so your loan rate is 2.9%.

8. Do Nexo loans have a maturity date

The standard maturity of a Nexo loan is one year. However, if you do not repay it by then, the loan will be automatically extended for another year (the number of such extensions shall be unlimited). Please note that the maturity date is reset every time you take out a new loan.

9. What are the specifics of my Nexo loan

There are no fixed monthly or quarterly payments. You can follow a repayment schedule that is most suitable for you and repay your loan partially or in full at your convenience.

A compound interest rate, determined by your Loyalty tier and your Portfolio Balance, is applied to the funds you withdraw from your Credit Line. To learn more about Nexo’s loan rates, click here.

Note: In case you repay your Nexo loan within 45 days of the last withdrawal, the standard annual interest rate of 18.9% will be applied to the repaid amount for the remainder of the 45-day period, regardless of your current Loyalty Level. This information is also available on the Credit Line Repayment screen:

![]()

10. Can I take out more than one Nexo loan at a time

You can withdraw from your Available Credit Line as many times as you like, as long as you have enough collateral in your account to back the Nexo loan. When you request a new loan, crypto assets may be automatically transferred from the Savings Wallet to the Credit Line Wallet if the collateral in your Credit Line Wallet is insufficient to support the loan.

11. Am I the owner of the collateral used to back my Nexo loan

Per the Nexo Crypto Credit General Terms and Conditions (Art. IV.5): Unless prohibited by any Applicable Law, by virtue of this Agreement, Nexo acquires the ownership title and all attendant rights of ownership of the Collateral while the Nexo Crypto Credit is outstanding.

12. Collateralization of Nexo crypto loans

Nexo requires that all crypto loans be over-collateralized by crypto assets. Click here to learn more about our Information Security and Custodial Arrangements.

13. Do I have to pay tax on my Nexo loan or the crypto used as collateral

You may generally be required to pay a tax on your gain when, for instance, you sell an asset for a profit. Additionally, depending on your jurisdiction and the nature of the asset, borrowing against it might carry tax advantages compared to selling.

When considering any tax, financial, and accounting obligations, such reporting remains solely your responsibility as an individual customer. Nexo and its affiliates do not provide tax, legal, or accounting advice.

This article is not intended to provide such and should not be relied upon for tax, legal, and accounting advice. You should always consult your tax, legal, and accounting advisors before engaging in any transaction.

14. How is Nexo different from margin lending

Unlike margin trading, where the borrowed funds serve as collateral, you can use your Nexo crypto-backed loan for whatever purpose you like without having to lock the newly borrowed funds as collateral.

15. Important notes

- Interest is added to your outstanding balance daily at 00:00 UTC.

- The interest applied to loans is compound, i.e., it is calculated on both the initial principal and the accumulated interest.

- The minimum interest charge is 0.01 USD.

- Additional interest generated by making an early repayment is being added to your outstanding loan balance and, as such, cannot be repaid using NEXO tokens.

- Only SWIFT transfers are supported for loan withdrawals in USD.